New York Skies Set to Darken Again With Smoke From Canada Wildfires

Brian K. Sullivan and Laura Nahmias

Tue, June 27, 2023

(Bloomberg) -- Smoke from Canadian wildfires will obscure the skies in New York and across the Mid-Atlantic starting Wednesday, just weeks after the blazes blanketed the region in a polluted haze.

Air quality could reach unhealthy levels in western and central New York Wednesday into Thursday, Governor Kathy Hochul said in a tweet. Alerts have already been posted for the area, including Buffalo, Ithaca, Syracuse and Binghamton, according to the National Weather Service.

While the potential intensity of the pollution wasn’t clear yet, Hochul said the smoke would start affecting New York City by Thursday.

“We’re expecting smoke and haze to come all across the state,” Hochul said in a press conference.

The state Department of Environmental Conservation said in a tweet that New Yorkers should be prepared for “possible elevated levels of fine particulate pollution caused by smoke on Wednesday June 28th.”

New York City and the Northeast had some of the worst air quality in the world earlier this month when smoke from Quebec forest fires swirled south, turning the skies over Manhattan an apocalyptic orange. The smog triggered flight delays and led to the cancellation of outdoor events.

“If you want to know the effects of climate change, you’re going to feel it tomorrow in real time,” Hochul said. “We are truly the first generation to feel the real effects of climate change, and we’re also the last generation to do anything meaningful about it.”

The smoke is currently bringing unhealthy air conditions to Chicago and other areas of the Midwest, according to AirNow.gov.

“It’s pretty bad in Chicago,” said Bryan Jackson, a forecaster with the US Weather Prediction Center. The city’s mayor, Brandon Johnson, said residents should consider wearing masks and limit outdoor activity.

A weather pattern that’s bringing thunderstorms and showers across the Northeast will move out of the region, causing winds to blow from north to south in coming days, Jackson said. This flow could channel the smoke from Canada’s fires south.

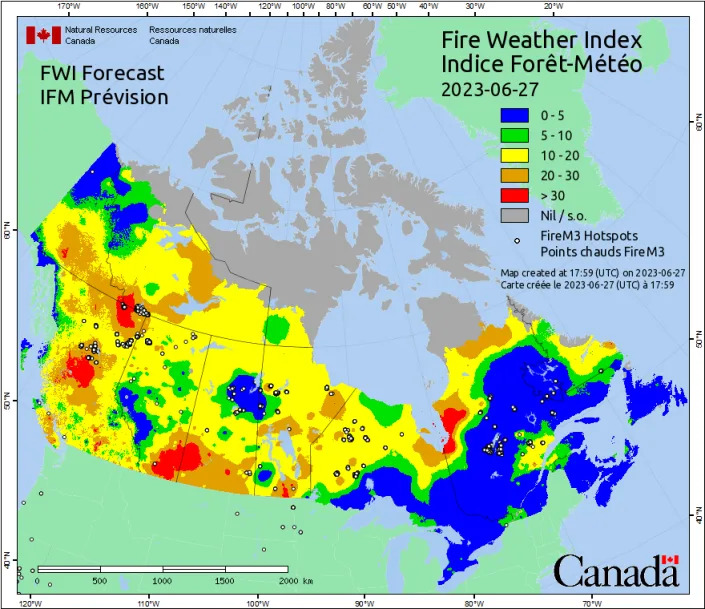

Large parts of Canada from coast to coast have been burning for weeks. Currently 257 fires were burning out of control across the country, according to the Canadian Interagency Forest Fire Centre.

Smoke from Canada’s wildfires has reached Europe. Will it affect air quality?

Rebecca Ann Hughes

Tue, 27 June 2023

Canada is currently experiencing the worst wildfire season on record.

At least 75,000,00 hectares across the country have already burnt and there are still several months of peak wildfire season to come.

After covering the east coast of North America, clouds of smoke from the blazes have now drifted across the Atlantic to Europe.

Here’s how the smog has travelled and the effects it could have on the continent.

Smoke from Canadian wildfires has reached Europe

On Monday 26 June, smoke from Canada’s raging wildfires could be seen across western Europe using satellite imagery, the UK Met Office reports.

The smog travelled across the Atlantic Ocean via the jet stream - a fast flowing air current in the Earth’s atmosphere.

At the beginning of June, the smoke reached Norway and on Monday, it also arrived in the UK.

For the remainder of the week, the smoke will remain in the upper levels of the atmosphere over Europe, forecasts predict.

As the smoke enters the atmosphere at high altitudes, it is able to linger for longer and travel long distances.

Will the Canada wildfire smoke affect air quality in Europe?

Earlier this month, the wildfire smoke enveloped New York City in a hazardous orange haze.

Residents were advised to remain indoors as much as possible.

“This is detrimental to people’s health,” New York Governor Kathy Hochul warned.

But in Europe, the effects will not be the same. The smoke will not lead to any significant worsening of air quality for residents as it will remain in the upper layers of the atmosphere.

It could, however, lead to some picturesque scenes in our skies.

“Whilst the smoke is high up in the atmosphere, it may make for some vivid sunrises and sunsets in the next few days,” the Met Office wrote on Twitter.

Canada wildfires are the worst on record

In Canada, the blazes continue to rage across multiple provinces. On 26 June, there were 27 new wildfires, according to the National Fire Situation Report.

While air quality in Europe has not been affected, many areas of North America are seeing dangerous conditions.

In Ottawa, Canada’s capital city, the air quality was deemed as “high risk” over the weekend.

Residents experienced a slight reprieve on Monday thanks to stormy weather and wind changes, but the smoke is likely to return later in the week.

Air quality warnings have also been issued in the US including in Wisconsin, Michigan, and Indiana.

“We’re seeing more and more of these fires because of climate change,” tweeted Canada’s prime minister Justin Trudeau.

Canada travel warning: Everything you need to know about travelling during wildfires

Canada fires: Millions breathing hazardous air as smoke spreads south into US

“These fires are affecting everyday routines, lives and livelihoods, and our air quality. We’ll keep working - here at home and with partners around the world - to tackle climate change and address its impacts.”

Direct links between the wildfires in Canada this month and climate change have not been confirmed by scientists. But in general, the climate crisis is provoking more fire-inducing conditions.

A 2021 report from the Intergovernmental Panel on Climate Change (IPCC) found that dry, windy and hot weather conditions, which increase the chances of fire taking hold, will become more common in some places, including Atlantic Canada and the US, as climate change worsens.