PUBLISHED TUE, NOV 9 2021

Anmar Frangoul

KEY POINTS

While there is excitement about the potential of green hydrogen in some quarters, the sector also faces challenges.

In October, the CEO of Siemens Energy told CNBC there was “no commercial case” for it at this moment in time.

FREDRIK HAGEN | AFP | Getty Images

Norsk Hydro and fossil fuel giant Shell are to look into the potential of joint projects focused on green hydrogen production.

In an announcement Tuesday, Norway’s Hydro said a memorandum of understanding had been signed between the two parties.

Under the deal, Shell and Hydro’s green hydrogen business, Hydro Havrand, will focus on the joint generation and supply of hydrogen “produced from renewable electricity in hubs centered around Hydro and Shell’s own business, and where they see strong potential for scaling production for customers in heavy industry and transport.”

From sites in Europe, the initial aim is to find opportunities for the production and supply of renewable hydrogen for their own operations alongside the wider market. “The intention is to expand into additional regions and locations over time,” Hydro said.

Hydrogen can be produced in a number of ways. One method includes using electrolysis, with an electric current splitting water into oxygen and hydrogen.

If the electricity used in this process comes from a renewable source such as wind or solar then some call it green or renewable hydrogen.

More from CNBC Climate:

Tom Steyer’s life changed when he revisited an Alaska glacier and saw how much it had melted

Glacial lake outburst floods: How a lesser-known climate phenomenon threatens from above

Bill Gates doubts goal of limiting global warming to 1.5 degrees is achievable

While there is excitement about the potential of green hydrogen in some quarters, it remains expensive to produce. Currently, the vast majority of hydrogen generation is based on fossil fuels.

Shell is itself a major player in oil and gas, but says it wants to become a net-zero emissions energy firm by 2050.

In February, the business confirmed its total oil production had peaked in 2019 and said it expected its total carbon emissions to have peaked in 2018, at 1.7 metric gigatons per year.

In a landmark ruling earlier this year, a Dutch court ordered Shell to take much more aggressive action to drive down its carbon emissions and reduce them by 45% by 2030 from 2019 levels.

The verdict was thought to be the first time in history a company has been legally obliged to align its policies with the 2015 Paris Agreement. Shell is appealing the ruling, a move that has been sharply criticized by climate activists.

Hopes for hydrogen

In recent years, a number of major companies have announced projects related to green hydrogen. It was recently announced that a deal related to the supply and distribution of green hydrogen in the U.K. had been struck.

In an statement, Australia-headquartered Fortescue Future Industries said it would become the U.K.’s largest supplier of green hydrogen after signing a memorandum of understanding with construction equipment firm JCB and Ryze Hydrogen.

Fortescue described it as a “multi-billion-pound deal” but did not reveal exact figures.

In October, the CEO of Siemens Energy spoke of the issues he felt were facing the green hydrogen sector, telling CNBC that there was “no commercial case” for it at this moment in time.

In comments made during a discussion at CNBC’s Sustainable Future Forum, Christian Bruch outlined several areas that would need attention in order for green hydrogen to gain momentum.

“We need to define boundary conditions which make this technology and these cases commercially viable,” Bruch, who was speaking to CNBC’s Steve Sedgwick, said.

“And we need an environment, obviously, of cheap electricity and in this regard, abundant renewable energy available to do this.” This was not there yet, he argued.

—CNBC’s Sam Meredith and Chloe Taylor contributed to this article.

Baker Hughes invests in 'turquoise' hydrogen production

The US technology giant will have a 20% stake in growth-stage company Ekona Power

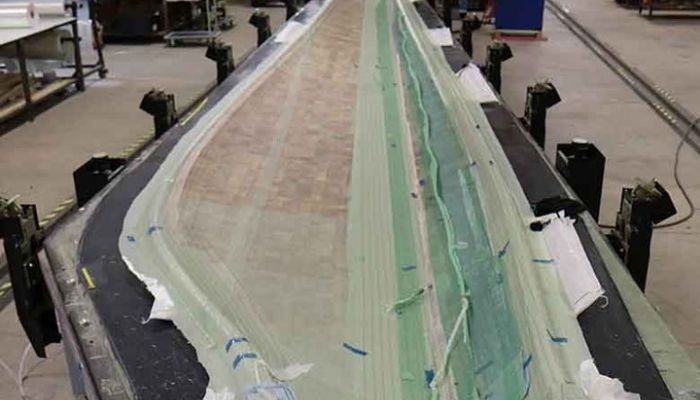

Turquoise hydrogen: Baker Hughes is working with Vancouver-based Ekona Power

9 November 2021

By Naomi Klinge in Houston

Baker Hughes announced Tuesday it has invested in Vancouver-based, growth stage company Ekona Power, which is developing turquoise hydrogen production technology.

The investment gives Baker Hughes a 20% stake in Ekona and enhances the Houston-based technology giant’s hydrogen and decarbonisation portfolio.

“Ekona Power’s methane pyrolysis platform for the production of cleaner and lower cost turquoise hydrogen builds on our growing and diverse portfolio of decarbonization technologies, including blue and green hydrogen, CCUS and emissions management solutions,” said Rod Christie, executive vice president of Turbomachinery & Process Solutions at Baker Hughes.

“Through the adoption of this technology, the industry can leverage existing and abundant natural gas reserves to produce lower carbon hydrogen and accelerate its use across the energy value chain.”

Turquoise hydrogen is produced from methane using pyrolysis, a combustion process that results in hydrogen and solid carbon. The process is meant to greatly reduce carbon dioxide emissions compared to traditional steam methane reforming processes.

The solid carbon by-product has potential for a variety of uses, including in applications that involve graphite, carbon fibre, carbon nanotubes, and other derivatives, and can be used in sectors like construction, transportation, and agriculture.

Baker Hughes says Hurricane Ida impacted Q3 revenuesRead more

In a recent report Kenneth Medlock and Rachel Meidl from Rice University’s Baker Institute said the classification of the solid carbon will determine how it is regulated and used. Different pyrolysis processes will yield different types of carbon by-product, which can cause barriers to the stabilisation of the sector.

While many companies have the goal to scale up various types of hydrogen production, a solid carbon by-product can increase the value of hydrogen production from pyrolysis if there is demand for it.

“The value proposition of methane pyrolysis relies on the availability of sufficiently large markets that can absorb the solid carbon output that will result from the scale-up of turquoise hydrogen production,” the report said.

Baker Hughes and Ekona will work to scale up their pyrolysis technology with pilot projects and utilising Baker Hughes’ turbomachinery portfolio.

“Our innovative technology has the potential to produce hydrogen at costs on par with conventional steam methane reformers, while drastically reducing greenhouse gas emissions," said Chris Reid, chief executive officer of Ekona Power. "In addition, our solution isn’t reliant on CO2 sequestration, so it has the potential to be quickly and broadly deployed across various industries and market regions.” (Copyright)

Read more

"No shortage of geothermal - challenge is bringing it to market": Baker Hughes executive

io consulting: pendulum's swing towards clean energy faces challenges

French trio TotalEnergies, Air Liquide and Vinci to create $1.7 billion hydrogen fund

Investment will advance development of a novel methane pyrolysis technology platform to produce cleaner and lower cost turquoise hydrogen

Compared to the traditional steam methane reforming process used for producing industrial scale hydrogen,

Technology applicable for multiple markets including refineries, ammonia or chemical plants, as well as natural gas transmission and distribution companies looking to reduce their GHG emissions footprint

November 09, 2021 08:00 AM Eastern Standard Time

HOUSTON & VANCOUVER, British Columbia--(BUSINESS WIRE)--Baker Hughes (NYSE: BKR), an energy technology company, has announced an investment in Ekona Power Inc., a growth stage company developing novel turquoise hydrogen production technology. Through its investment, Baker Hughes will enhance its broader hydrogen and natural gas decarbonization solutions portfolio, further contributing to the energy transition.

“This important investment from Baker Hughes who is an established global player is a key step to commercializing our technology.”Tweet this

Turquoise hydrogen is made from methane using pyrolysis, also known as splitting, or cracking. Ekona’s methane pyrolysis solution uses combustion and high-speed gas dynamics in a reactor to separate feedstock methane into hydrogen and solid carbon, drastically reducing carbon dioxide emissions versus the traditional and prevalent steam methane reforming process. The innovative solution is designed to easily integrate with standard equipment for natural gas and hydrogen applications including carbon separation and hydrogen purification, thus simplifying industrial process integration.

The two companies will join efforts to accelerate the scale up and industrialization of the technology by identifying suitable pilot projects and leveraging Baker Hughes’ leading turbomachinery portfolio as well as established technical expertise in providing modular and scalable solutions for global hydrogen and natural gas projects.

“This strategic investment further demonstrates our commitment to advancing new energy frontiers by accelerating the pace at which novel technologies are being brought to market,” said Rod Christie, executive vice president of Turbomachinery & Process Solutions at Baker Hughes. “Ekona Power’s methane pyrolysis platform for the production of cleaner and lower cost turquoise hydrogen builds on our growing and diverse portfolio of decarbonization technologies, including blue and green hydrogen, CCUS and emissions management solutions. Through the adoption of this technology, the industry can leverage existing and abundant natural gas reserves to produce lower carbon hydrogen and accelerate its use across the energy value chain.”

“At Ekona, we are deeply committed to delivering cleaner energy solutions that cost-effectively address industry pain points. Our innovative technology has the potential to produce hydrogen at costs on par with conventional steam methane reformers, while drastically reducing greenhouse gas emissions. In addition, our solution isn’t reliant on CO2 sequestration, so it has the potential to be quickly and broadly deployed across various industries and market regions,” Chris Reid, chief executive officer of Ekona Power Inc. “This important investment from Baker Hughes who is an established global player is a key step to commercializing our technology.”

Baker Hughes will take an approximately 20% stake in Ekona to help advance new project development and commercialization. Baker Hughes will also assume a seat on Ekona’s Board of Directors. Fort Capital Partners acted as advisors to Ekona Power. Along with lead investor Baker Hughes, Ekona has been supported by numerous Canadian Federal and Provincial partners, including the BC Innovative Clean Energy (ICE) Fund, National Research Council (NRC), Natural Resources Canada (NRCan) Breakthrough Energy Solutions Canada (BESC) Program, Emissions Reduction Alberta (ERA), the Natural Gas Innovation Fund (NGIF) and Pacific Economic Development Canada. In addition, BDC Capital’s Cleantech Practice invested in 2020 to help fund Ekona’s technology development program.

About Baker Hughes:

Baker Hughes (NYSE: BKR) is an energy technology company that provides solutions for energy and industrial customers worldwide. Built on a century of experience and with operations in over 120 countries, our innovative technologies and services are taking energy forward – making it safer, cleaner and more efficient for people and the planet. Visit us at bakerhughes.com.

About Ekona Power Inc.

Ekona is a Vancouver-based venture established by Evok Innovations and Innovative Breakthrough Energy Technologies. Ekona is developing a revolutionary technology that transforms the way we produce clean hydrogen. Our solution is an innovative and low-cost methane pyrolysis platform that converts natural gas into hydrogen and solid carbon, virtually eliminating greenhouse gas emissions. Visit us at ekonapower.com