Ayelet Sheffey

Mon, May 2, 2022,

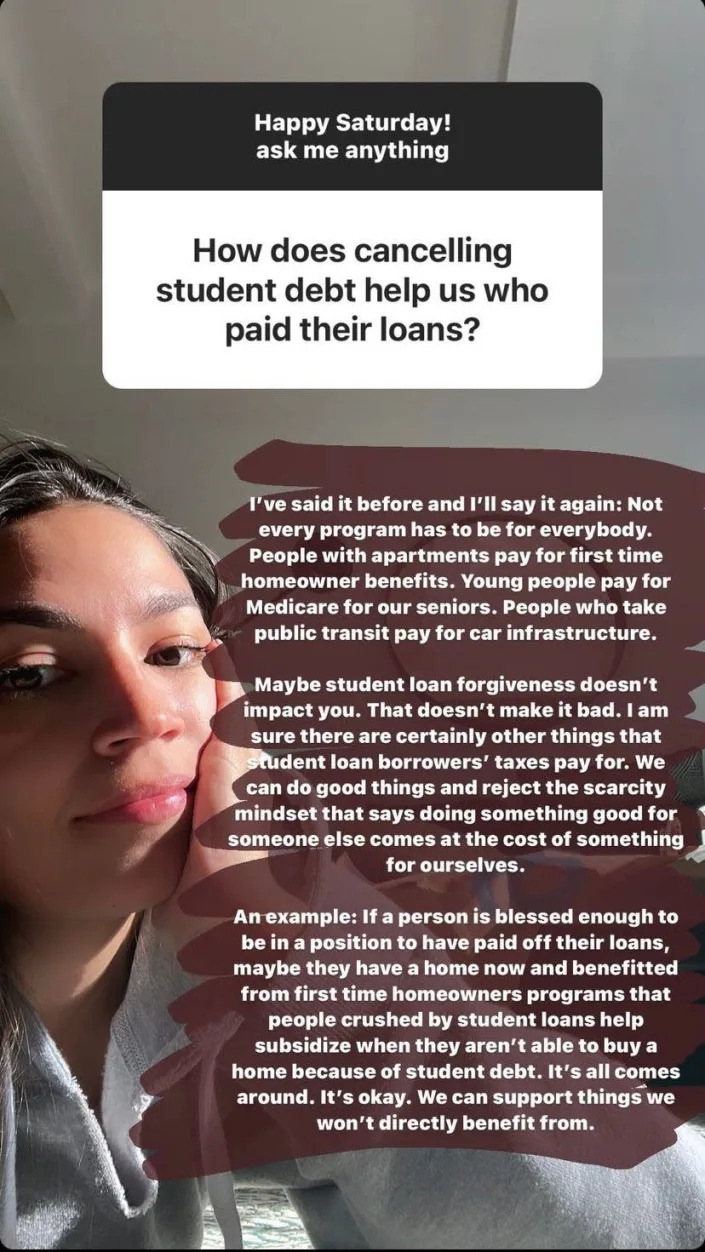

AOC said student-loan forgiveness is good, even for those who have already paid off their loans.

Biden is getting closer to acting on debt relief, saying a decision will be made in the coming weeks.

He told reporters he isn't considering $50,000 in forgiveness — an amount progressives have pushed for.

New York Rep. Alexandria Ocasio Cortez says student-loan forgiveness is good for everyone — even those who already paid off their debt.

"Maybe student loan forgiveness doesn't impact you," Ocasio-Cortez wrote in an Instagram story, in response to a question on the benefits of debt cancellation for those who already paid off their loans. "That doesn't make it bad. I am sure there are certainly other things that student loan borrowers' taxes pay for. We can do good things and reject the scarcity mindset that says doing something good for someone else comes at the cost of something for ourselves."

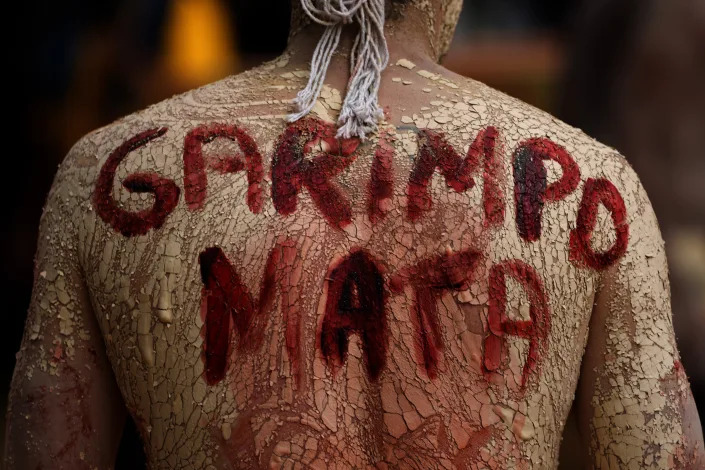

AOC responds to a question on student-loan forgiveness on Instagram.Rep. Alexandria Ocasio-Cortez

"It all comes around," she added. "It's okay. We can support things we won't directly benefit from."

The student-loan forgiveness conversation is picking up steam after President Joe Biden told reporters last week a decision on relief will be made "in the next couple of weeks." While he said he is not considering canceling $50,000 in student debt for every federal borrower — an amount many progressives have been pushing for — a number of reports have suggested the president is considering at least $10,000 in relief that will likely be tied to income limits, and it will be implemented before the pause on payments expires after August 31.

I'm a 34-year-old who has never had a credit card — and it's the worst financial decision I've made in my life

He avoided credit cards to stay out of debt, but it still hurt his credit score.

While broad loan forgiveness is something many Democrats would like to see carried out, Ocasio-Cortez told the Washington Post she has concerns with subjecting the relief to income thresholds.

"I don't believe in a cutoff, especially for so many of the front-line workers who are drowning in debt and would likely be excluded from relief," Ocasio-Cortez said. "Canceling $50,000 in debt is where you really make a dent in inequality and the racial wealth gap. $10,000 isn't."

Republican lawmakers feel differently. Since the news came out that the president is considering canceling some amount of student debt this summer, many of them slammed the possibility of broad relief. Arkansas Sen. Tom Cotton, for example, wrote about the cost to taxpayers forgiving debt would have on Twitter: "Why should those who didn't go to college or responsibly paid their loans be responsible for $13,000 in new debt?"

Utah Sen. Mitt Romney said broad relief would be a "bribe" to voters — an attempt by Democrats to win the midterm elections. Maine Sen. Susan Collins previously told Insider student-loan forgiveness is "not fair" to those who have already repaid their debt and argued people with higher incomes shouldn't qualify for the broad relief Biden is considering.

But most Democrats want to see Biden enact broad student-loan relief for everyone, free of thresholds.

"Instead of continuously extending the pause under pressure," New York Rep. Jamaal Bowman recently tweeted, "he needs to cancel all student loan debt."

'A slap in the face':

Some Americans are mad over

potential student loan forgiveness

As the president weighs broad student loan forgiveness, some Americans expressing frustration over a policy they see as unfair.

"While some may view this debt forgiveness as a slap in the face to people who were responsible and paid off their student loans, this is a bigger slap in the face to those Americans who never went to college," Will Bach, a financial advisor based in Ohio, told Yahoo Finance.

Research has shown that a college degree generally boosts an individual's earnings over their lifetime. And given that any broad-based forgiveness would cost tens of billions of dollars, all taxpayers — not just by those who have a college degree — would be contributing to the cost of cancellation.

"How can we honestly ask people who did not go to college to subsidize the lives of those who did decide to go to college?" Bach added. "To my knowledge, everyone with student loans voluntarily took them. Every instance of a student loan was a voluntary choice that person made."

Some right-leaning academics, including Andrew Gillen of the Texas Public Policy Foundation, argue that there are a variety of problems with cancelling student loan debt. These include the overall cost and the fact that forgiveness does not directly address the core issue of rising college costs.

Cancelling $10,000 or $50,000 across the board is "really badly targeted," Gillen said in an interview with Yahoo Finance.

"There there are people who are struggling to repay their debt, and we've got an existing set of solutions — and those solutions aren't working," he acknowledged, such as the massive failure of the income-driven repayment system. At the same time, he added, any broad-based forgiveness would be like saying that "a handful of people that are struggling here, [so] let's get rid of the debt for everybody."

An income cap on who qualified for any loan forgiveness would be a "no brainer," Gillen added, because it would help target the relief towards lower-income struggling debtors.

Biden is reportedly considering capping forgiveness to those who earned less than $125,000 or $150,000 as individual filers the previous year, The Washington Post reported recently. For couples filing jointly, the cap would be around $250,000 or $300,000.

"The other thing that would also be a no-brainer is having different criteria for graduate loans than you do for undergraduate loans," Gillen said, "because we really do restrict how much you can borrow at the undergraduate level ... whereas at graduate level, because those students can borrow virtually without limit."

The proposal "is nothing more than a welfare program for the upper class," Bach said. "The people who have responsibly saved and paid for college will not benefit from this at all."

Bach, who worked as a police officer for five years after college, added that he took on student loans to pay for his MBA in finance and paid it off within a few years of graduating. He currently is a certified financial planner and financial adviser.

Critics ignore the privilege that allowed them to be debt-free: academic

Advocates pushed back against critics of Biden's plans to cancel debt.

“I'm sorry we weren’t able to win cancel student debt sooner," Melissa Byrne, a political organizer and an activist pushing for student debt cancellation, told Yahoo Finance. "I'm sorry that political operatives in the '70s and the '80s caved to Ronald Reagan and let folks defund higher education. ... But I'm not sorry we’re about to hopefully get a win now."

Louise Seamster, a sociologist at the University of Iowa, told Yahoo Finance that the group pushing back against cancellation is not a large one and asked them to put themselves in student debtors' shoes.

"As a sociologist, my work involves teaching students to consider how their own experiences are shaped by larger forces," Seamster said in an email to Yahoo Finance. "As such, I would encourage people who have been lucky enough to pay down their debt to reflect on what factors allowed them to pay down their debt: maybe attending school when public education was actually affordable; the support of a partner or family; or graduating into a favorable economy."

She added that critics "might have made career choices that prioritized income, but I hope they think what our society would look like if everyone had made those same choices and who would be educating their children or providing them medical care."

Some studies have shown that women and people of color take on more debt to go to college compared to their white male peers. Rep. Ayanna Pressley (D-MA) has repeatedly argued that student loan forgiveness is "a matter of racial and economic justice" given the disproportionate burden on borrowers of color.

"Canceling student debt is one of the most powerful ways to address racial and economic equity issues," a recent letter from prominent Democrats, including Pressley, asserted to the president. "The student loan system mirrors many of the inequalities that plague American society and widens the racial wealth gap. Black students in particular borrow more to attend college, borrow more often while they are in school, and have a harder time paying their debt off than their white peers."

Seamster added that if Americans still feel like cancellation of debt is unfair, "I invite them to join the movement for free college to make the same public higher education benefits available to all and make student debt itself unnecessary."

Bach said he doubted that forgiving debt would help the economy, and that it was an opportunity for Democrats to gain clout with voters.

"I don't think there is any evidence that this is going to help with the U.S. economy or student debt holders," he said. "This is simply a Hail Mary for President Biden who has just hit a 40% approval rating with the younger population."

The political benefit seems to be one thing both sides agree on: In a recent interview with Yahoo Finance, Pressley stated that "Democrats win when we deliver, and we have to deliver in ways that are impactful, tangible and transformative, like canceling student debt. This is good policy. And it is also good politics."

Aarthi is a reporter for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Student debt can impair your

cardiovascular health into middle age

Individuals with student loan debt into early middle age have a higher risk of cardiovascular illness, plus undermining the usual health benefits of a post-secondary education, researchers report in the American Journal of Preventive Medicine

Peer-Reviewed PublicationAnn Arbor, May 3, 2022 – Adults who failed to pay down student debt, or took on new educational debt, between young adulthood and early mid-life face an elevated risk of cardiovascular illness, researchers report in the American Journal of Preventive Medicine, published by Elsevier. Adults who repaid their student debt had better or equivalent health than individuals who never faced student debt, suggesting that relieving the burden of student debt could improve population health.

“As the cost of college has increased, students and their families have taken on more debt to get to and stay in college. Consequently, student debt is a massive financial burden to so many in the United States, and yet we know little about the potential long-term health consequences of this debt. Previous research showed that, in the short term, student debt burdens were associated with self-reported health and mental health, so we were interested in understanding whether student debt was associated with cardiovascular illness among adults in early mid-life,” explained lead investigator Adam M. Lippert, PhD, Department of Sociology, University of Colorado Denver, Denver, CO, USA.

The study utilized data from the National Longitudinal Study of Adolescent to Adult Health (Add Health), a panel study of 20,745 adolescents in Grades 7 to 12 first interviewed during the 1994-1995 school year. Four subsequent waves of data were collected, including Wave 3, when the respondents were aged 18-26 and Wave 5, when respondents were aged 22-44. Wave 5 respondents were invited to in-home medical exams.

Researchers assessed biological measures of cardiovascular health of 4,193 qualifying respondents using the 30-year Framingham cardiovascular disease (CVD) risk score, which considers sex, age, blood pressure, antihypertensive treatment, smoking status, diabetes diagnosis, and body mass index to measure the likelihood of a cardiovascular illness over the next 30 years of life. They also looked at levels of C-reactive protein (CRP), a biomarker of chronic or systemic inflammation.

The investigators classified student debt according to the following categories: never had student debt; paid off debt between Waves 3 and 5; took on debt between waves; and consistently in debt. Models were adjusted for respondent household and family characteristics including education, income, and other demographics.

The researchers found that more than one third of respondents (37%) did not report student debt in either wave, while 12% had paid off their loans; 28% took on student debt; and 24% consistently had debt. Respondents who consistently had debt or took on debt had higher CVD risk scores than individuals who had never been in debt and those who paid off their debt. Interestingly, respondents who paid off debt had significantly lower CVD risk scores than those never in debt. They found clinically significant CRP value estimates for those who took on new debt or were consistently in debt between young adulthood and early mid-life, estimates that exceeded their counterparts who never had debt or paid it off. Race/ethnicity had no impact on the results.

Supplemental analyses suggested that, on balance, degree completion provides health benefits even to those with student debt, although these benefits were diminished relative to non-debtors. Dr. Lippert observed that these findings underscore the potential population health implications of transitioning to debt-financed education in the US. Though the empirical evidence is clear on the economic and health returns from a college degree, these advantages come at a cost for borrowers.

“Our study respondents came of age and went to college at a time when student debt was rapidly rising with an average debt of around $25,000 for four-year college graduates. It’s risen more since then, leaving young cohorts with more student debt than any before them,” Dr. Lippert said. “Unless something is done to reduce the costs of going to college and forgive outstanding debts, the health consequences of climbing student loan debt are likely to grow.”

JOURNAL

American Journal of Preventive Medicine

METHOD OF RESEARCH

Data/statistical analysis

SUBJECT OF RESEARCH

People

ARTICLE TITLE

Student Debt and Cardiovascular Disease Risk Among U.S. Adults in Early Mid-Life

ARTICLE PUBLICATION DATE

3-May-2022