Prem Sikka

The government is continuing with Tory policies which would deepen despair and push more people into the arms of right-wing extremists.

Next week, the UK parliament returns from its summer recess for a two-week session. The Labour government is likely to face considerable scrutiny of policies which have curtailed its post-election honeymoon.

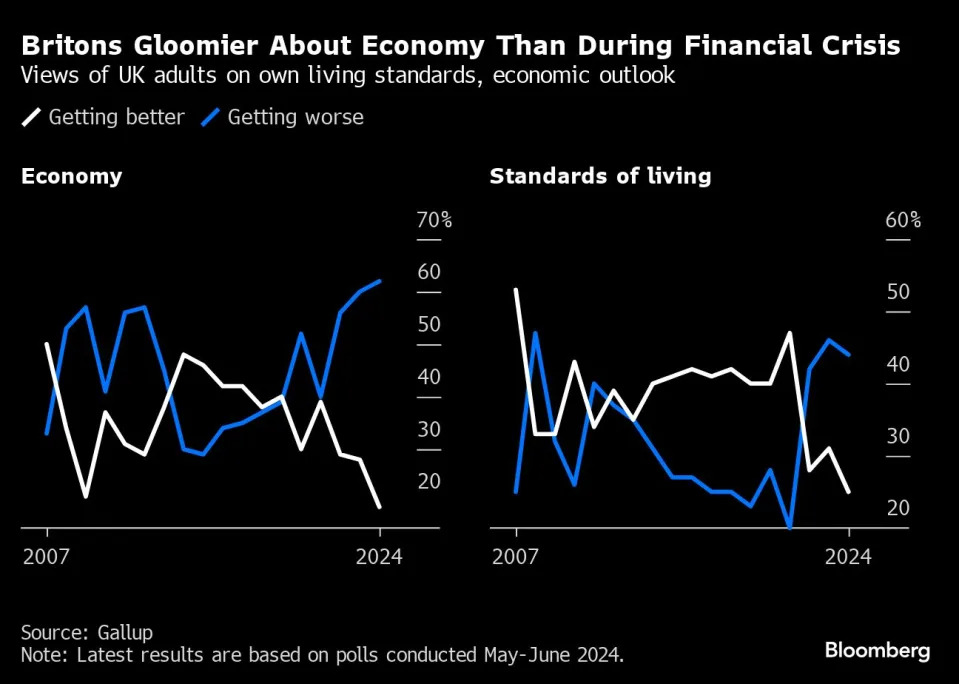

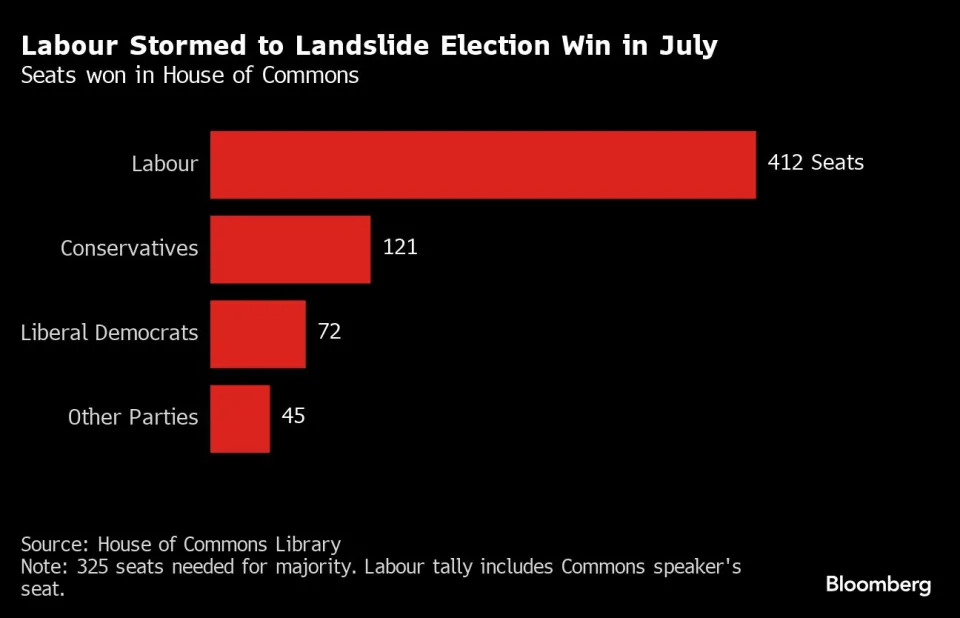

After 14 years of Conservative rule, erosion of household incomes and public services, Labour won the July 2024 election with a promise of ‘change’ though its election manifesto was light on policy details. Whilst it is too early to reach any definitive conclusions, the concern is that the government is continuing with Tory policies which would deepen despair and push more people into the arms of right-wing extremists.

The early sign of continuing with Tory policies is the retention of the two-child benefit cap, introduced by the Conservative government in 2017. It denies child allowances in universal credit and tax credits worth up to £3,455 per year to third or subsequent children born after April 2017. 450,000 households and 1.6m children are affected by the cap. Some 4.3m children, 30% of all children, live in poverty. Abolishing the cap would cost the government between £2.5bn and £3.6bn in 2024/25. Just £1.7bn would lift 300,000 children out of poverty and reduce poverty for another 700,000 children. This would increase family income and stimulate the local economy too. The government was not persuaded and saw off a rebellion in its own ranks by withdrawing the whip from seven Labour MPs.

The government added fuel to anger by abolishing the universal right for pensioners to receive winter fuel payment (WFP) and deprive 10m of payment of between £100 and £300 to cover higher heating costs in winter. The average state pension is between £9,000 and £9.500 a year, which is less than 50% of the national minimum wage. It is the main or the only source of income for most retirees. Nearly 1.4m pensioners receive mean-tested pension credit, worth £3,900 a year. Some 880,000 eligible pensioners do not claim it because they can’t negotiate the regulatory maze, or lack access to computers. Last year £2.2bn went unclaimed.

Despite benefits and the triple-lock, 2.2m UK retirees live in poverty, 2.5m skip meals and 1.3m are at risk of undernourishment. Last winter, despite WFP there were 5,000 excess pensioner deaths as pensioners could not afford to eat and heat. Each year, around 68,000 senior citizens die in poverty.

This abolition of universal WFP was not in Labour’s election manifesto. It was not preceded by any public consultation or warning and no impact assessment has been produced. “The Social Fund Winter Fuel Payment Regulations 2024” which abolishes the universal right is being introduced as a Statutory Instrument and is expected to come into force on 16thSeptember. The new policy is to means-test the WFP and only pensioners with annual income below £11,336 would be receive it if they can fill a 22 page form and answer 243 questions. Two million more pensioners could be pushed into poverty.

The government claims that the new policy would save £1.4bn a year. Such savings are insignificant as the government is expected to spend some £1,226bn in 2024-25. The £1.4bn saving is doubtful as no mention is made of the costs associated with means-testing and dispute resolution. Due to cold and sickness, more pensioners would need hospital admissions and would increase the cost of healthcare. With erosion of incomes, pensioners would spend less and that would damage the local economies. In any case, successful claim of additional pension credits and related benefits by 880,000 pensioners could cost up to £4bn and wipe out the £1.4bn alleged saving.

The government had a number of policy alternatives. For example, it could have introduced a taper, added WFP to total income so that richer pensioners would pay income tax on it and taxed the rich to raise revenues to retain universal WFP. It ignored all alternatives. The loss of up to £300 of WFP comes at a time when household energy bills are set to rise by 10% or around £150 from October. Since March 2021, tax exempt personal allowance has been frozen at £12,570 a year, and pensioners with modest additional incomes are being hit with income tax. Since 2020-21, the number of pensioners paying income tax has creased by over than 2m, from 6.47mn to 8.51m.

It isn’t just pensioners; low income families are also suffering from high energy bills, and cost-of-living crisis, and deserve support. Some 17.8m adults have annual income of less than £12,570. Despite social security benefits 12m people live in poverty. In England alone, some 13% of households (3.17m) live in fuel poverty. A root cause of this is low wages and corporate profiteering. Last year British Gas announced a ten-fold increase in its profits. BP and Shell have made record profits. Since the pandemic, electricity generation companies have increased their profit margins by 198%. The government’s refusal to tackle profiteering will inevitably erode living standards and cause public disenchantment.

Water is another disaster looming and the government is content to leave this monopoly in private hands, just like Conservatives. Despite inflation-busting hikes in customer bills water companies have a long history of under investing, dumping raw sewage in rivers and seas and not plugging water leaks. Since privatisation in 1989, companies have paid more than £85bn in dividends mostly financed by borrowing of more than £60bn. Now they are struggling to service debt and make the required investment. This week Thames water, the UK’s largest water company, with a debt pile of £18bn urged the regulator to hike household bills by 59% or £228 a year. The companies leading shareholders consider their investment to be almost worthless. Its debt is rated as junk.

Public ownership of water industry is widely supported by the public but that is not what the government wants to do. Instead it has offered some gimmicks such as tighter rules to stop polluters from using four-star ratings to justify high CEO pay. In response to my question in parliament, the Minister ruled out nationalisation by claiming that “It would cost billions of pounds”. When asked to share the government’s calculations, the Minister referred me to a 2018 report by Social Market Foundation, a right-wing think-tank, which estimated the cost of water nationalisation to be £90bn. This included £41-44bn for equity. This report is described by a former government adviser as having “virtually no intellectual substance and the [£90bn] figure was wrong”. He added that the process of renationalisation itself would be “relatively easy, as with the revenues from the water bills, the government would have sufficient income to pay for the assets it acquired”. Of course, no government would buy the debt for £46bn.

The minister provided no reference to any government calculation, alternative source of data or anything more recent. For example, in 2019 Moody’s, a rating agency, considered shareholder equity in water companies to be worth only £14.5bn. Since then, if the state of Thames Water is anything to go by, water company shares have become worthless and debtholders are facing major losses. The government is continuing with Conservative policies, by obfuscation.

Elsewhere, the government is committed to further deregulating the finance industry and reducing capital adequacy requirements. It is seduced by claims that this would somehow release £100bn for investment. It is mistaken. There is no pot of gold sitting in boardrooms that can be emptied. The money is held in assets and capital buffers which would need to be liquidated and would inevitably affect resilience of the industry with deadly consequences. The government is also rolling-back on its commitment to protect workers’ rights which could reduce job insecurity. Chancellor Rachel Reeves has promised employers that government will ‘co-design’ reforms with business.

This week, the public backlash persuaded the Prime Minister to make a statement which remained light on policy details, and there is little relief from Tory policies. The government is planning to raise taxes and cut spending in October budget though the Prime Minister promised that “those with the broadest shoulders should bear the heavier burden”. That hasn’t been evident so far from policies on children and pensioners.

The government is committed to economic growth but it is hard to see how that can be achieved without increasing disposable income of the masses and direct state investment in infrastructure and new industries. The government has boxed itself into a corner with its pre-election pledges of not increasing taxes on the rich and additional borrowing. Such promises are not sustainable. The government must abandon Tory policies and give people hope or risk social disorder and pushing more people into the arms of right-wing extremists.