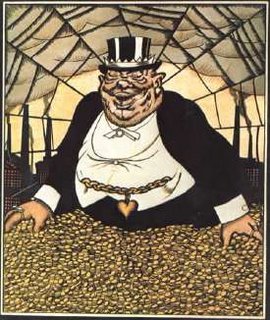

Hmm whats wrong with this picture?

Pfizer to lay off 10000 to cut costs

Pfizer 4Q Profit Soars to $9.45 Billion

Falling rate of profit perhaps? Profit Disfunction?

Impotence-treatment Viagra posted quarterly sales of $450 million, a 5 percent gain, while revenue from allergy drug Zyrtec jumped 14 percent to $374

Of course a falling rate of profit does not mean profits decline it means that it takes more profit, gouged out of the working class, to keep running on the spot.

Labour being variable capital it is always expendable.....

Do the ‘deep roots’ of inflation lie in the falling rate of profit?

TWO apparently contradictory phenomena are manifest simultaneously in the American economic structure today; at least they appear contradictory in the terms by which they are often described – inflation and deflation. A vastly expanded credit system, with its mountains of fictitious capital, has debased the currency almost beyond recognition. Alongside of this, excess capacity of production shows up in idle plants, or partially operating plants, and the resultant large-scale unemployment.

Marx's Analysis of the Falling Rate of Profit on the First Version Of Volume III of Capital

If the ratio of the variable part of capital to the constant part…is large, …this

shows that all the means towards the development of the productivity of labour

have not been employed. …that therefore with a large quantity of labour little is

produced, whereas in the opposite case a (relatively) large amount is produced

with a small amount of labour. The development of fixed capital…is a particular symptom of the development of capitalist production.

Falling Rate of Pricing and Profit Over the Internet

Marx originally described a system-wide falling rate of profit crisis as part of his analysis of advanced capitalism. In Marx's model, the increasing use of machinery with a decreased use of human labor would ultimately so increase total production, that total consumption power would be too low to keep production recycling back into consumption. A great inventory bulge would lead businesses to lay of excess workers and the downward spiral of laid-off workers and decreasing sales would so affect sales, the profits would fall.

Miller-Must The Profit Rate Really Fall?We live in an age in which the horror of a falling rate of profit increasingly permeates the consciousness of growing layers of capitalists throughout the world. While profit rates fluctuate widely from boom to bust, from one country to another, and from one business or branch of industry to another, the feeling that profits are not what they should be, or not what they used to be, grows.

For the capitalists, and the economists who try to serve them, the shifts in profits that occur on the balance sheets of banks and corporations are not, nor can they be, manifestations of an underlying tendency rooted in the basic character of the capitalist mode of production. If a squeeze on profits becomes apparent, any number of immediate or indirect causes can be pointed to: interest rates, taxes, wages, environmental and other regulations, etc. Instead of probing the inner structure of capital, and the laws of its evolution, they are restricted to examining this mulitplicity of conflicting forces that forms the outward appearance of economic relations. As Marx commented about the capitalists and their theoretical spokepersons:

"...it is just as natural for the actual agents of production to feel completely at home in these estranged and irrational forms of capital–interest, land–rent, labor–wages, since these are precisely the forms of illusion in which they move about and find their daily occupation. It is therefore just as natural that vulgar economy, which is no more than a didactic, more or less dogmatic, translation of everyday conceptions of the actual agents of production, and which arranges them in a certain rational order, should see precisely in this trinity, which is devoid of all inner connection, the natural and indubitable lofty basis for its shallow pompousness." (Marx, 1962, p. 809)