Full-time minimum wage workers cannot afford a 2-bedroom rental anywhere in the US

Published Wed, Jun 26 201

Alicia Adamczyk@ALICIAADAMCZYK

Twenty/20

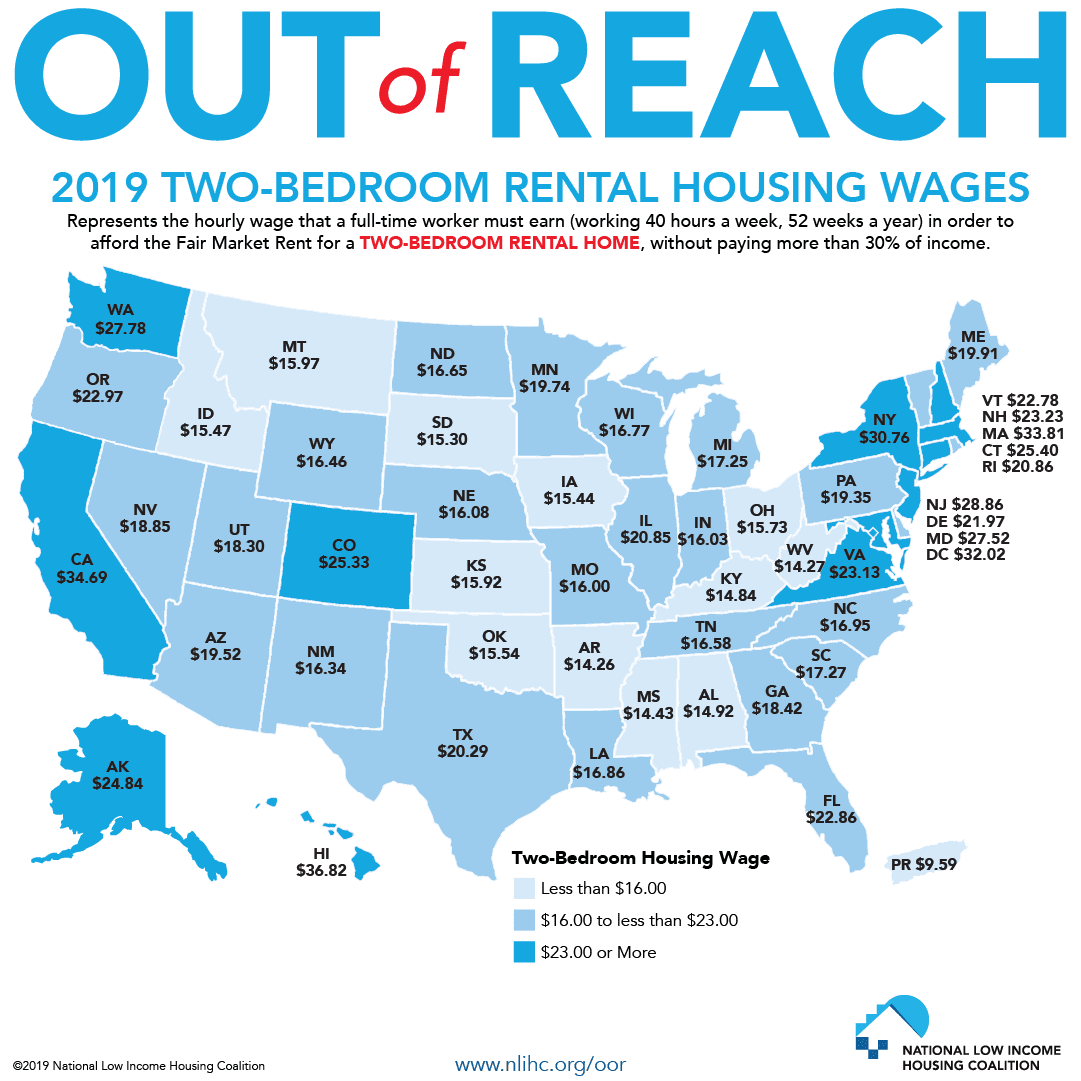

New York, San Francisco and Washington D.C. are often spotlighted for their astronomical housing prices. But a new report finds that it’s not just the coasts that are facing an affordability crisis: A full-time worker earning the federal minimum wage of $7.25 per hour cannot rent an affordable two-bedroom apartment anywhere in the country, where affordable is defined as comprising up to 30% of a renter’s budget.

That’s according to the National Low Income Housing Coalition’s 30th annual Out of Reach report, which finds that a nationwide affordable housing shortage, wage stagnation and racial inequities have left a growing number of people unable to find a place to live that’s reasonably within their budget.

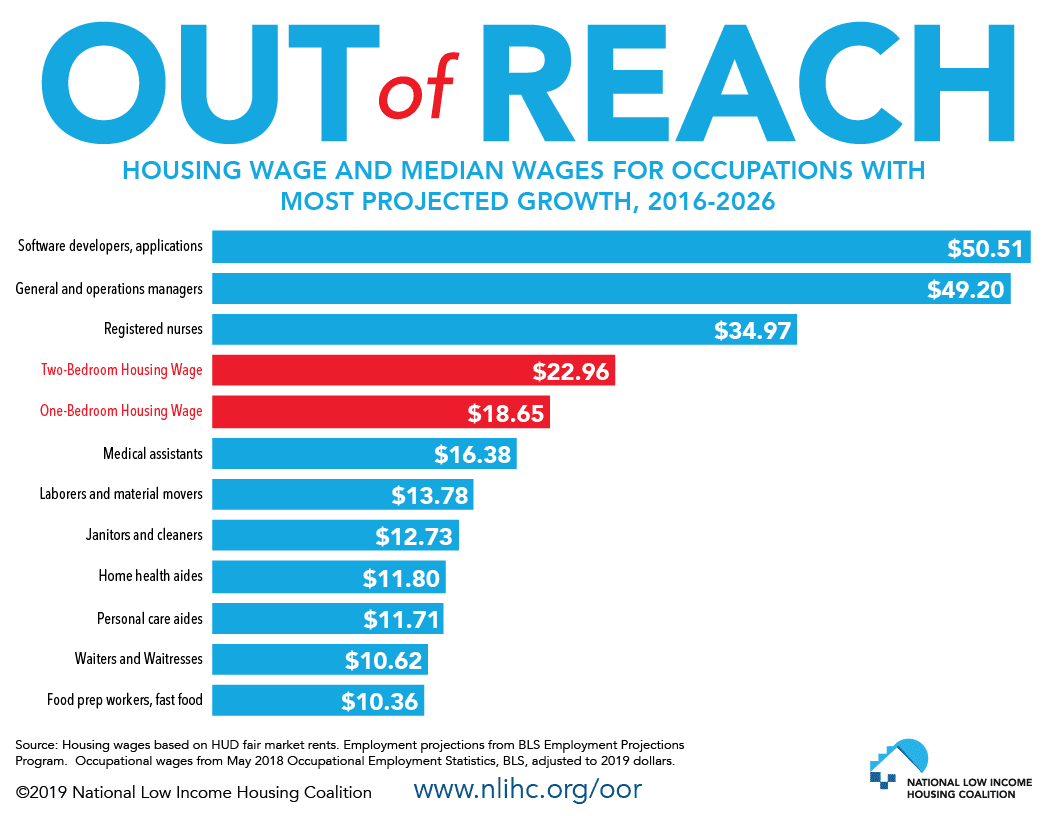

NLIHC’s report calculates a “housing wage” that estimates how much a full-time worker must make in order to afford a fair market rental without spending more than 30% of his or her income. For 2019, the housing wage is $22.96 for a two-bedroom rental, and $18.65 for a one-bedroom.

Twenty/20

New York, San Francisco and Washington D.C. are often spotlighted for their astronomical housing prices. But a new report finds that it’s not just the coasts that are facing an affordability crisis: A full-time worker earning the federal minimum wage of $7.25 per hour cannot rent an affordable two-bedroom apartment anywhere in the country, where affordable is defined as comprising up to 30% of a renter’s budget.

That’s according to the National Low Income Housing Coalition’s 30th annual Out of Reach report, which finds that a nationwide affordable housing shortage, wage stagnation and racial inequities have left a growing number of people unable to find a place to live that’s reasonably within their budget.

NLIHC’s report calculates a “housing wage” that estimates how much a full-time worker must make in order to afford a fair market rental without spending more than 30% of his or her income. For 2019, the housing wage is $22.96 for a two-bedroom rental, and $18.65 for a one-bedroom.

Click to enlarge

The means someone earning the federal minimum wage would have to work more than three full-time jobs — 127 hours per week — to afford a two-bedroom rental, and 103 hours for a one-bedroom.

Presidential candidate Bernie Sanders called the housing situation a “national disgrace.”

A minimum wage increase alone won’t fix the crisis

The report notes that it will take more than just an increase in the minimum wage to rectify the situation. More than 40 cities and states have instituted higher minimum wages than the federal minimum of $7.25, but the highest tops out at $12 per hour — far less than the housing wage calculated by NLIHC.

Even the national average renter’s income of $17.57 per hour, as calculated by NLIHC, is too little to afford a modest two-bedroom. Someone earning $17.57 per hour, in fact, would be able to find an affordable two-bedroom apartment in just 10% of U.S. counties.

Financial experts routinely recommend that people spend no more than 30% of their income on housing, but the report drives home just how hard this is to do for a wide swath of workers in the U.S. today. Not only are many Americans not earning enough to afford a “modest” rental, but a lack of reasonably-priced housing options is another culprit: NLIHC calculates there is a shortage of 7 million affordable rental homes nationally.

The organization expects the situation to get worse in the coming years. Most of the industries forecasted to see the most growth over the next decade, including home health aides and food prep workers, boast median wages that are less than the one-bedroom and two-bedroom housing wage figures detailed above.

Click to enlarge

The report calls for increased funding to certain federal housing programs, such as the Low-Income Housing Tax Credit, and advocates for a renters tax credit based on the difference between 30% of a tenant’s household income and their rental costs.

---30---

No comments:

Post a Comment