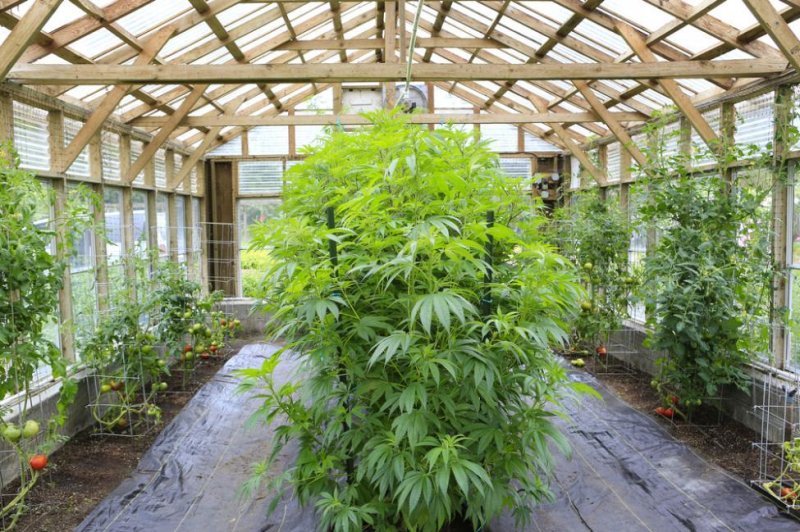

Dispensaries and other marijuana and hemp businesses are having an effect on local real estate in states where the pot is legal. File Photo by Iriana Shiyan/Shutterstock

DENVER, Feb. 26 (UPI) -- Commercial real estate markets across the United States are feeling a positive influence from the cannabis industry as property is bought, sold and leased for medical and recreational marijuana, a new report shows.

Hemp also is making waves in agricultural land sales and industrial real estate, agents say.

There were desert cities no one cared about until cannabis came along, said Ryan George, founder of cannabis real estate listing site 420property.com. "In Palm Springs, Adelanto, Cathedral City, [Calif.,] I personally know people who bought warehouses for $50 a square foot and sold them for $500 a square foot."

Marijuana is illegal at the federal level, which interferes with some aspects of buying, renting and selling real estate. But 23 states have legalized medical pot, and 11 of them, plus Washington, D.C., also allow recreational cannabis sales.

RELATED Products made from hemp-based plastics enter consumer market

Mature markets in states like Oregon, Washington and Colorado appear to have gotten a commercial real estate boost from marijuana, according to a National Association of Realtors report issued this month based on a 2019 survey of commercial brokers.

In states where all forms of marijuana have been legal for more than three years, 42 percent of survey respondents reported an increased demand for commercial warehouse space, and between 20 and 30 percent said they saw an increase in sales of retail properties and land.

But cannabis properties can come with regulatory hassles, said Vince Sliwoski, a Portland, Ore., real estate attorney. Recreational cannabis was approved in Oregon in 2015.

RELATED Colorado university to offer cannabis science degrees

"Title insurance is a huge headache," Sliwoski said. "Buyers often have to use a third-party escrow instead of banks."

Landlords with mortgages run a risk of banks calling in their loans if they are renting to a retail or industrial cannabis tenant.

Hemp doesn't have these issues, Sliwoski said, because marijuana's non-psychoactive cannabis cousin no longer is federally illegal.

RELATED Recreational marijuana now legal in Illinois

A south Oregon sawmill has been repurposed as a hemp extractor facility, and that shows how the region's economy is changing, he said.

"In southern Oregon, the biggest driver of the economy used to be timber, but now hemp is the new big agricultural commodity that people are banking on."

Denver-based Foster, of VIP Commercial real estate, remembers when Colorado legalized medicinal pot in 2008, "just as the entire economy was falling apart."

Many blamed the marijuana industry for higher rents, he said, but cannabis money for warehouses, dispensaries and doctor's offices was welcome. Colorado legalized recreational pot in 2014.

As the industry has matured, landlords are recognizing some pitfalls unique to renting to cannabis businesses.

Respondents from mature cannabis markets in the Realtor association study said the smell was the largest concern for property owners renting to cannabis-related businesses. Other concerns were moisture and mold and theft and fire.

"There are complaints that large warehouses that grow produce a smell that kind of takes over the neighborhood," Foster said. "You smell it on the highway, and it's like 'Welcome to Denver.'"

But even if marijuana initially helped hold up the prices of Colorado warehouse space, it's now too expensive to grow cannabis indoors, Foster said. Growers are turning to greenhouse properties in southern Colorado -- in the poorest areas of the state -- where land is cheaper.

Hemp cannabidiol extractors are moving into prime warehouse space with complicated build-outs including "explosion-proof rooms and air-release vents 150 feet high," Foster said.

"It's like a second gold rush," Denver commercial real estate agent Pete Foster said. "First it was cannabis in 2008 through 2012, and now it's the hemp."

In California, cannabis-friendly municipal ordinances and low tax rates caused a land rush between 2017 and 2018 in the Palm Desert area where the Coachella music festival is hosted, George said. But some investors were burned when they realized the high cost of retrofitting warehouse space to grow cannabis.

Some towns didn't have the electrical capacity to upgrade electricity in warehouses to grow, he said, adding, "Some people lost millions."

The ride has not been as wild in states where medical marijuana has been legalized.

"You need to get it approved by the county and then sometimes by the municipality, too," Miami-based Realtor April Rodriguez said.

Getting into the medical marijuana business is a billionaire's game, she said, with strictly limited state licenses going for $40 million "for the piece of paper -- that's before they even buy the land."

Rodriguez said some landlords want nothing to do with a medical marijuana dispensary, but sometimes change their minds after town hall meetings.

"Most of it is landlord education. They don't know what it is and wonder, are they going to get in trouble?" she said.

For states with no legal cannabis, but growing hemp industries, real estate is trickier, said Harold Jarboe of Tennessee Homegrown hemp in Readyville.

Jarboe, a hemp consultant, and others in former tobacco country, are operating on slim margins after a glut of 2019 supply and a steep drop in prices.

GenCanna, Tennessee's biggest hemp processor, filed for bankruptcy protection, and several others have shut their doors or lost financing, he said.

Jarboe said real estate agents are trying to find an entrance into the agricultural farm market.

"In agricultural areas where farming has been stressed, there's all sorts of warehouses and barns that need no refurbishing for hemp. But this next year, it will be extremely hard, because where will the margin be for the person doing the real estate?"

No comments:

Post a Comment