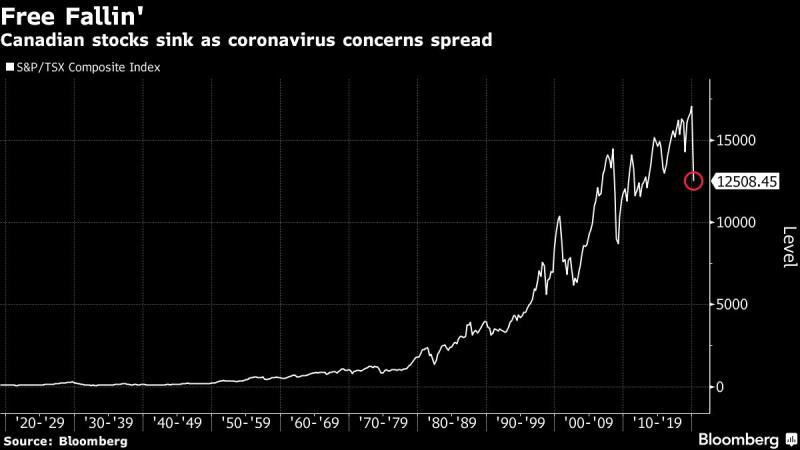

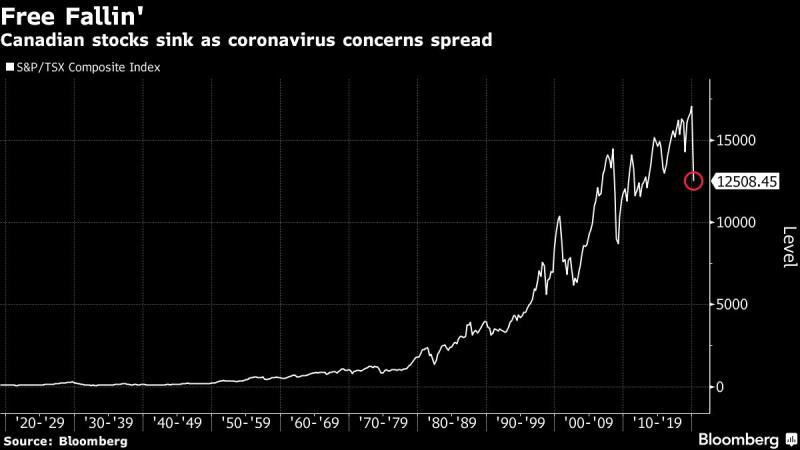

Investors Flee Canada’s Stock Market on Worst Day in 80 Years

(Bloomberg) --Canadian stocks suffered a stunning 12% drop, the largest in eight decades, as investors size up the likelihood of a global recession because of the coronavirus pandemic.

Investors Flee Canada’s Stock Market on Worst Day in 80 Years

Investors Flee Canada’s Stock Market on Worst Day in 80 Years

The S&P/TSX Composite Index had its biggest one-day decline since May 1940, according to data compiled by Bloomberg. The 230 companies in the benchmark collectively lost at least C$265 billion ($190 billion) in market value. Trading on the Toronto Stock Exchange was halted minutes after the market opened as a wave of selling tripped the circuit-breaker rule.

The spread of a global pandemic that has killed more than 4,700 people has shocked financial markets and forced policy makers into emergency measures. The Federal Reserve said it is prepared to inject a total of $5 trillion into funding markets over the next month.

The Bank of Canada also took steps to smooth the flow of credit. Late Thursday afternoon, the central bank said it will broaden the scope of a government bond buyback program and temporarily add repo operations with terms of six and 12 months “to proactively support interbank funding.”

In equity markets, the selling was indiscriminate. One of the country’s largest pipeline operators, TC Energy Corp., saw its market cap fall almost C$13 billion. Shares of the Calgary-based company fell 22%, the most since 1984. Only one stock in the composite went up: auto parts maker Linamar Corp.

“We’ve had a bull market which had to result in some relief at some point,” said Michael Smedley, chief investment officer at Morgan Meighen & Associates. “The situation at the moment is still for me ‘sitting on your hands’ rather than ‘catching the knife.’”

A growing number of economists believe Canada is on the brink of recession as the economy takes a double hit from the coronavirus and tanking oil prices, ramping up pressure on Prime Minister Justin Trudeau’s government to come up with a sizable fiscal stimulus package. In the meantime, investors were left perplexed.

“The most important thing right now is to focus on liquidity, focus on safe yields and non-cyclical parts of market,” including Canadian banks, David Rosenberg, founder of Rosenberg Research and Associates Inc., said in a phone interview. He’s “nibbling back into the market” and advising clients to look for stocks where dividends are safe.

Rosenberg, the former North American chief economist for Merrill Lynch who has been forecasting a recession, thinks one has already begun in Canada and the U.S. “This is an absolutely horrible situation, at every level,” he said.

Don’t bank on a quick bounce, said one analyst at Canadian Imperial Bank of Commerce. “The caveat here is that we do not believe there is a V-shape recovery given the magnitude of the recent technical damage in market internals,” the bank’s technical analyst Sid Mokhtari said in a note to clients.

Oil is headed for the biggest weekly decline since 2008 after Saudi Arabia set off a price war over the weekend and President Donald Trump said the U.S. would restrict travel from Europe for the next 30 days in an attempt to contain the coronavirus, pummeling fuel demand.

Trudeau himself is in self-isolation and working from home while his wife awaits the results of a Covid-19 test. Sophie Gregoire Trudeau had been exhibiting flu-like symptoms after recently returning from a speaking engagement in London, the prime minister’s office said in a statement. While her symptoms have subsided, she’s self-isolating at home as she awaits the test results.

The prime minister isn’t exhibiting any symptoms.

Meanwhile, provincial governments took further steps to try to slow the coronavirus outbreak. Quebec asked residents to quarantine themselves after any foreign trip and made a 14-day self-isolation mandatory for government workers. Ontario said public schools will close through April 5 and Alberta urged the cancellation of all gatherings of more than 250 people.

(Updates with additional details on market drop, government and central bank response, and new chart)

No comments:

Post a Comment