PUBLISHED TUE, MAR 17 2020 Huileng Tan@HUILENG_TAN

KEY POINTS

On Sunday, the Fed slashed interest rates to near-zero and announced a $750 billion asset-purchasing program to shelter the economy from the impact of the virus.

KEY POINTS

On Sunday, the Fed slashed interest rates to near-zero and announced a $750 billion asset-purchasing program to shelter the economy from the impact of the virus.

“This is a different kind of crisis than normal crises. It’s just not a problem of aggregate demand,” said Joseph Stiglitz, former chief economist at the World Bank.

The spread of the coronavirus disease, formally known as COVID-19, has disrupted the global economy and supply chains as countries implement strict border controls, massive city-wide lockdowns and quarantines in order to contain the virus.

Aggressive policy action by the Federal Reserve is “obviously not” enough to help the U.S. avert a downturn caused by the coronavirus outbreak, said Joseph Stiglitz, a Nobel laureate in economics.

“Given the nature of the uncertainties, given the nature of the collapsing incomes of so many people, it can help stabilize financial markets at best and it’s clear that it didn’t do that,” Stiglitz told CNBC on Tuesday.

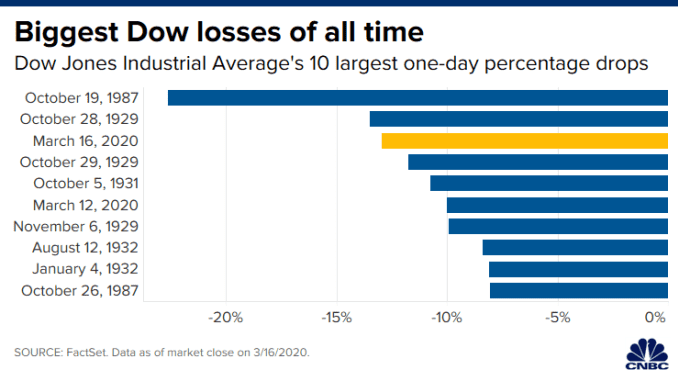

On Sunday, the Fed slashed interest rates to near-zero and announced a $750 billion asset-purchasing program to shelter the economy from the impact of the virus. Despite that, the markets crashed Monday — with the Dow suffering its worst day since the “Black Monday” market crash in 1987 and its third-worst day ever.

While the situation might have been worse without the Fed’s moves, “clearly it didn’t stabilize the stock markets,” said Stiglitz, who is a former chief economist at the World Bank.

The problem is that “this is a different kind of crisis than normal crises. It’s just not a problem of aggregate demand,” he said.

“Because of the disease, people are shutting down their businesses. In the United States, restaurants in New York City have been closed,” said Stiglitz. “More demand is not going to save that particular problem.”

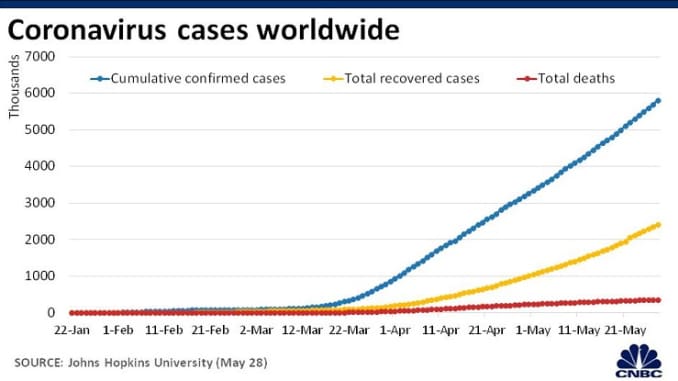

The spread of the coronavirus disease, formally known as COVID-19, has disrupted the global economy and supply chains as countries implement strict border controls, massive city-wide lockdowns and quarantines in order to contain the virus.

There are now at least 168,019 cases of the coronavirus worldwide, according to data from the World Health Organization. At least 6,610 have died from the disease.

Even though financial institutions have assured that their positions are strong amid the market rout, Stiglitz said no bank would be spared from the impact of a major economic downturn even if it is adequately capitalized.

“People wouldn’t be able to repay their loans, people wouldn’t be taking out new loans, businesses wouldn’t be taking out new loans. The business model of banks is very sensitive to the business cycle,” he said.

Give help to targeted segments

Stiglitz advocated for targeted assistance to help people and sectors weather the public health emergency.

“It is clearly a case where targeted fiscal policy is what is needed. It’s been true for a long while that monetary policies has had only have limited efficacy,” said the Columbia University professor, who is also chief economist at the Roosevelt Institute.

The support should focus on those who will be “facing enormous stress,” strengthening the capacity of the healthcare system and encouraging people to not interact, as well as get tested and not show up at work if they are sick, said Stiglitz.

“We are going to need to get large amounts of money — you might call it ‘helicopter money’ — to those people who are going to be under enormous stress,” he said, citing the example of Hong Kong, which announced a 10,000 Hong Kong dollar ($1,287) cash payout to all permanent residents above 18 years old.

In fact, large government spending in today’s pressing circumstances while paying no attention to deficit “is correct,” he said.

“The deficit is something that we will have to deal with in the future. When we went to World War II, we didn’t ask ‘could we afford it,’” said Stiglitz. “We spent the money as we needed it.”

“We had to make sure that we weren’t overspending in the sense that we had inflation. We had to manage the economy.”

WATCH NOW VIDEO 02:55

Trump had ‘no idea’ about the seriousness of coronavirus crisis: Stiglitz

Trump had ‘no idea’ about the seriousness of coronavirus crisis: Stiglitz

No comments:

Post a Comment