We can create the future we need - but we have to make a start now

Image: Karsten Würth on Unsplash.com

25 Jul 2020

Nicole Systrom Founder, Sutro Energy Group

The World Economic Forum

More on the agenda

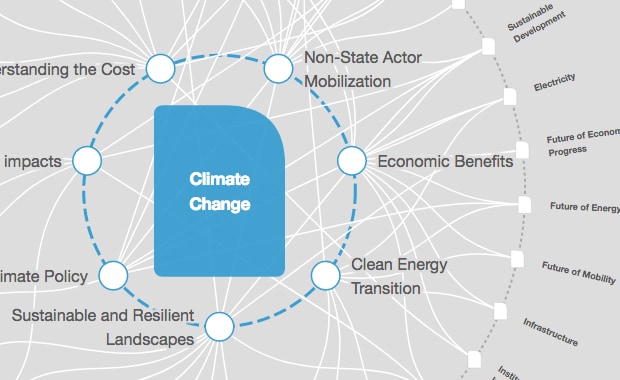

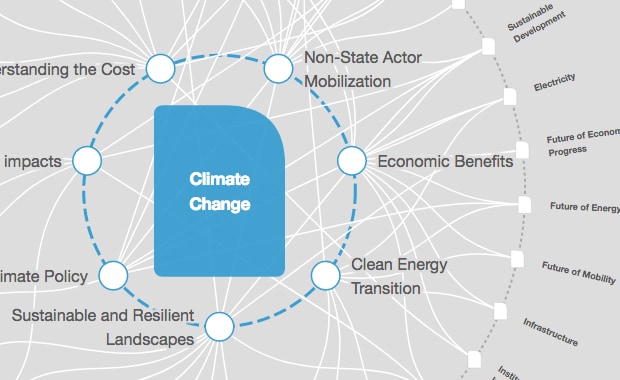

Explore context

Climate Change

Explore the latest strategic trends, research and analysis

The scale of the climate crisis and its potential impacts mean we need a scientific and investment revolution to tackle it.

It's time to tap into the power of science and innovation. Here's a guide.

It’s hard to know its ultimate scale or how long it will take, but over the coming months the world will be watching the urgent efforts of scientists to develop a COVID-19 vaccine. At the same time, engineers and academics will develop technologies and models to help businesses and our economy adapt to this extended period of social distancing, Zoom calls and home schooling. And manufacturers will continue to dedicate some of their factories to the mass production of everything from hand sanitizer to ventilators. It’s clear our capacity for innovation is being tested.

It reminds us that as much as we depend on our leaders in moments of crisis and need – and boy, do we ever – we also depend on the tenacity and insights of scientists, the ingenuity and vision of entrepreneurs, and the resourcefulness and boldness of companies to solve big problems. But we also need investors.

I have spent much of my career trying to facilitate innovations that will help us address another existential threat to our society: climate change. Like COVID-19, this is an area where the scale of the problem is so vast and the repercussions so massive – with huge economic and social justice implications – that we need nothing less than a scientific and investment revolution.

Have you read?

There's no better time for investors to start making healthy returns

Billions for sustainable investments – Germany’s plan for a green recovery

Private sector investors must now step up to quell the COVID-19 crisis

Decarbonizing our entire economy by 2050 will require two things:

1. Massive investments and innovation in areas like electrification, affordable long-term energy storage, and regenerative agriculture.

2. Investors patient enough to allow these investments to pay off.

For those willing to wait 10 to 15 years for returns, there is an opportunity to focus long-term on energy storage and the technology we need to remake transportation systems. Electrifying our vehicle fleet is the single biggest opportunity we have to reduce emissions in the transportation sector, but we’ll need a seismic increase in electricity production in order to shift from oil and gas, and provide equitable access to clean transportation options. This increase in demand for clean power can be met by solar and wind, but will also require long-term seasonal energy storage—batteries that can provide energy when renewables don’t provide enough to keep the lights on.

One prominent company working on long-term seasonal energy storage is Form Energy, which is developing a new type of sulphur-based battery. Form, which is based in the Boston area and is backed by Bill Gates’ Breakthrough Energy Ventures, was founded by Mateo Jaramillo, who launched Tesla’s PowerWall business, and MIT professor Yet-Ming Chiang. Another start-up, Quidnet, is pioneering technology that pumps water to store energy at extremely large capacities.

Game-changing innovations aren’t always about new technologies. A generation ago, in the 1990s, New York began to purchase land in the Catskills watershed. The innovative idea was that by acquiring land upstate to restrain development, they could reduce runoff and pollution to provide clean water to New York City. In this case, better short-term forest management saved taxpayers between $8 billion and $10 billion because they didn’t have to build a filtration plant that would cost millions of dollars a year to operate – allowing the state to sequester carbon, offset greenhouse gases and help communities better adapt to the extreme weather patterns and precipitation changes brought about by climate change.

New investments in clean energy over the past 14 years have flattened

Image: Bloomberg New Energy Finance

At a time when tropical forests are sequestering less carbon dioxide – studies show that by 2035 the Amazon won’t be taking on any new CO2, and that deforestation has been rapidly increasing while the world was distracted by the COVID-19 crisis – investors should be exploring ways to empower local municipalities and indigenous communities to better manage and restore forests, marshland and other natural ecosystems. New financial instruments could provide payoffs in the form of cash raised for local communities, increased biodiversity and climate resiliency.

None of this is to minimize the importance of near-term investments in proven or close-to-proven technologies. Indeed, investing in sustainable infrastructure and all the jobs that will create can be a cornerstone of the world’s economic recovery from the COVID-19 crisis. Everything from building community solar farms to next-generation energy-efficiency retrofits and energy-efficient coatings for windows should be on the table for investors.

So should making electric grids more efficient. While replacing them all will take decades, companies like Siemens and Stem have been developing software that learns from patterns and allows everyone from utility partners to industrial facility managers at universities and corporate campuses across the country to forecast and manage electricity use more efficiently. These, too, are worthy areas of investment.

What's the World Economic Forum doing about the transition to clean energy?

![]()

Show

One major lesson from COVID-19 is that science matters. Sometimes it tells us that we need to make a moonshot investment in, say, decarbonizing energy-intensive industries like cement and steel production. Other times, science points to simpler but equally game-changing steps, such as how crop rotation, managed grazing, and manure and organic fertilizer management could make the agricultural sector carbon-neutral.

But of all the lessons we’ve learned from COVID-19 as we race toward a solution, perhaps the biggest is that we ignored the warning signals instead of preparing. With the climate, let’s make the most of this opportunity. Let’s start that race now and tap the power that innovation has to accelerate change and unlock new and surprising possibilities. And let’s look to scientists, enabled by savvy investors, to lead the way.

Share

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

Written by

Nicole Systrom, Founder, Sutro Energy Group

The views expressed in this article are those of the author alone and not the World Economic Forum.

Explore context

Climate Change

Explore the latest strategic trends, research and analysis

The scale of the climate crisis and its potential impacts mean we need a scientific and investment revolution to tackle it.

There are opportunities for patient investors in areas such as energy storage and electrification.

It's time to tap into the power of science and innovation. Here's a guide.

It’s hard to know its ultimate scale or how long it will take, but over the coming months the world will be watching the urgent efforts of scientists to develop a COVID-19 vaccine. At the same time, engineers and academics will develop technologies and models to help businesses and our economy adapt to this extended period of social distancing, Zoom calls and home schooling. And manufacturers will continue to dedicate some of their factories to the mass production of everything from hand sanitizer to ventilators. It’s clear our capacity for innovation is being tested.

It reminds us that as much as we depend on our leaders in moments of crisis and need – and boy, do we ever – we also depend on the tenacity and insights of scientists, the ingenuity and vision of entrepreneurs, and the resourcefulness and boldness of companies to solve big problems. But we also need investors.

I have spent much of my career trying to facilitate innovations that will help us address another existential threat to our society: climate change. Like COVID-19, this is an area where the scale of the problem is so vast and the repercussions so massive – with huge economic and social justice implications – that we need nothing less than a scientific and investment revolution.

Have you read?

There's no better time for investors to start making healthy returns

Billions for sustainable investments – Germany’s plan for a green recovery

Private sector investors must now step up to quell the COVID-19 crisis

Decarbonizing our entire economy by 2050 will require two things:

1. Massive investments and innovation in areas like electrification, affordable long-term energy storage, and regenerative agriculture.

2. Investors patient enough to allow these investments to pay off.

For those willing to wait 10 to 15 years for returns, there is an opportunity to focus long-term on energy storage and the technology we need to remake transportation systems. Electrifying our vehicle fleet is the single biggest opportunity we have to reduce emissions in the transportation sector, but we’ll need a seismic increase in electricity production in order to shift from oil and gas, and provide equitable access to clean transportation options. This increase in demand for clean power can be met by solar and wind, but will also require long-term seasonal energy storage—batteries that can provide energy when renewables don’t provide enough to keep the lights on.

One prominent company working on long-term seasonal energy storage is Form Energy, which is developing a new type of sulphur-based battery. Form, which is based in the Boston area and is backed by Bill Gates’ Breakthrough Energy Ventures, was founded by Mateo Jaramillo, who launched Tesla’s PowerWall business, and MIT professor Yet-Ming Chiang. Another start-up, Quidnet, is pioneering technology that pumps water to store energy at extremely large capacities.

Game-changing innovations aren’t always about new technologies. A generation ago, in the 1990s, New York began to purchase land in the Catskills watershed. The innovative idea was that by acquiring land upstate to restrain development, they could reduce runoff and pollution to provide clean water to New York City. In this case, better short-term forest management saved taxpayers between $8 billion and $10 billion because they didn’t have to build a filtration plant that would cost millions of dollars a year to operate – allowing the state to sequester carbon, offset greenhouse gases and help communities better adapt to the extreme weather patterns and precipitation changes brought about by climate change.

New investments in clean energy over the past 14 years have flattened

Image: Bloomberg New Energy Finance

At a time when tropical forests are sequestering less carbon dioxide – studies show that by 2035 the Amazon won’t be taking on any new CO2, and that deforestation has been rapidly increasing while the world was distracted by the COVID-19 crisis – investors should be exploring ways to empower local municipalities and indigenous communities to better manage and restore forests, marshland and other natural ecosystems. New financial instruments could provide payoffs in the form of cash raised for local communities, increased biodiversity and climate resiliency.

None of this is to minimize the importance of near-term investments in proven or close-to-proven technologies. Indeed, investing in sustainable infrastructure and all the jobs that will create can be a cornerstone of the world’s economic recovery from the COVID-19 crisis. Everything from building community solar farms to next-generation energy-efficiency retrofits and energy-efficient coatings for windows should be on the table for investors.

So should making electric grids more efficient. While replacing them all will take decades, companies like Siemens and Stem have been developing software that learns from patterns and allows everyone from utility partners to industrial facility managers at universities and corporate campuses across the country to forecast and manage electricity use more efficiently. These, too, are worthy areas of investment.

What's the World Economic Forum doing about the transition to clean energy?

Show

One major lesson from COVID-19 is that science matters. Sometimes it tells us that we need to make a moonshot investment in, say, decarbonizing energy-intensive industries like cement and steel production. Other times, science points to simpler but equally game-changing steps, such as how crop rotation, managed grazing, and manure and organic fertilizer management could make the agricultural sector carbon-neutral.

But of all the lessons we’ve learned from COVID-19 as we race toward a solution, perhaps the biggest is that we ignored the warning signals instead of preparing. With the climate, let’s make the most of this opportunity. Let’s start that race now and tap the power that innovation has to accelerate change and unlock new and surprising possibilities. And let’s look to scientists, enabled by savvy investors, to lead the way.

Share

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

Written by

Nicole Systrom, Founder, Sutro Energy Group

The views expressed in this article are those of the author alone and not the World Economic Forum.

INVESTMENT MUST BE MADE AS SOCIAL CAPITAL REMOVING CAPITAL FROM THE 1% AND INVESTING IT FOR THE GOOD OF ALL, THE COMMONWEALTH

No comments:

Post a Comment