Anuradha Raghu, Bloomberg News

A harvested palm oil fruit bunch sits on the ground at the IOI Corp. Gomali palm oil estate in Gemas, Johor, Malaysia, on Wednesday, June 10, 2020.

Palm oil stockpiles in Malaysia posted a surprise drop as of end-May as production in the world's second-largest grower eased for the first time in four months. Photographer: Joshua Paul/Bloomberg , Bloomberg

(Bloomberg) -- Palm oil is once again in the news after the U.S. blocked imports from one of the world’s top producers, a move that may restrict access for the edible oil and undermine the industry’s efforts to clean up its image.

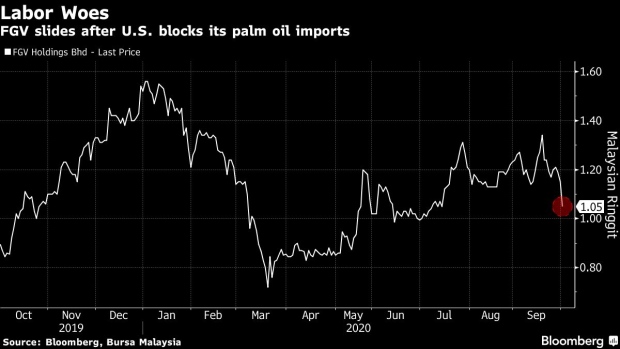

The U.S. Customs and Border Protection will detain shipments of palm oil and palm-based products made by FGV Holdings Bhd. on indications that the company uses forced labor. While North America only accounts for about 5% of the company’s sales, analysts say it could encourage other countries to follow the U.S. in launching their own investigations.

“This could potentially lead some countries to look into the issue of labor practice in FGV, and the industry,” said Ivy Ng, head of research at CGS-CIMB in Kuala Lumpur. While the allegations aren’t new, consumers may want to re-assess purchases and get suppliers’ assurance on fair labor standards, she said.

Malaysia-listed FGV sank 8.7% on Thursday, the biggest one-day slide since March, even as the company said it had taken steps to fix the issue and clear its name with the U.S. customs.

Labor Practices

This isn’t the first time palm oil has been the target of bans. In 2018, U.K. supermarket chain Iceland Foods Ltd. launched a campaign against using the oil over deforestation practices, while the EU has also sought to curb shipments for biofuel use on concerns over its sustainability. The latest blow comes as Malaysia, the world’s second-largest producer, grapples with a chronic worker shortage after the pandemic restricted travel.

While the U.S. order hasn’t impacted palm oil futures, “reputation-wise it’s a big blow” to FGV, said Sathia Varqa, owner of Palm Oil Analytics in Singapore. “The U.S makes up 2% to 3% of Malaysia’s annual exports, but it’s an important market given the large economy and the prospect for growth.”

(Closes FGV’s shares in fourth paragraph)

©2020 Bloomberg L.P.

No comments:

Post a Comment