Inter Pipeline hopes to find petrochemical partner in the first half of 2021

Dan Healing, The Canadian Press

Nov 13, 2020

CALGARY -- Inter Pipeline says it hopes to conclude its search for a partner in its $4-billion petrochemical project now under construction near Edmonton in the first half of next year.

"We continue to advance the process to secure a partner for a material interest in the Heartland Petrochemical Complex," said CEO Christian Bayle on a conference call on Friday.

"We expect that work ... will take into next year to conclude the process; however, there's no assurance a transaction will be completed."

Analysts pointed out the quest for a partner had previously been expected to wrap up by early 2021, although Bayle said there's little significance to the change in wording.

Inter has been looking for a partner since late 2019 to share the cost of the project which has increased from the original estimate of about $3.5 billion.

The Calgary-based company concluded a deal to sell a majority of its European bulk liquid storage business to the CLH Group for $715 million earlier this week and Bayle said those proceeds, along with available credit lines, will help the company go ahead with funding the remaining $1.1 billion needed for the petrochemical project on its own if necessary.

Bayle praised the Alberta government's petrochemical incentive program announced at the end of October which offers grants worth 12 per cent of eligible capital costs once a project is up and running.

Inter received $200 million in royalty credits in connection with the Heartland project in 2016 under the previous NDP government's incentive program and Bayle said his understanding is that those credits can be converted to cash payments under the new program when the complex is in service in early 2022.

He wouldn't say if the program will encourage the company to build more projects.

Inter plans to eventually sell its remaining eight storage terminals in Sweden and Denmark, Bayle said, adding those assets aren't being marketed yet.

Inter reported third quarter net income of $38.7 million on revenue of $633 million, versus income of $79.9 million on revenue of $591 million in the same period last year.

Analysts polled by Refinitiv expected net income of $75.6 million on revenue of $555.5 million.

During the quarter, oil sands pipeline volumes fell to 1.06 million barrels per day from 1.18 million bpd in the year-earlier period.

Inter was forced to shut down part of its Polaris pipeline system for about two weeks after a leak was detected just east of the Fort McMurray airport in northern Alberta at the end of August.

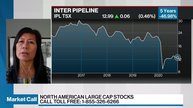

Inter shares fell by as much as 85 cents or 6.4 per cent to $12.40 in Toronto on Friday.

Nov 13, 2020

CALGARY -- Inter Pipeline says it hopes to conclude its search for a partner in its $4-billion petrochemical project now under construction near Edmonton in the first half of next year.

"We continue to advance the process to secure a partner for a material interest in the Heartland Petrochemical Complex," said CEO Christian Bayle on a conference call on Friday.

"We expect that work ... will take into next year to conclude the process; however, there's no assurance a transaction will be completed."

Analysts pointed out the quest for a partner had previously been expected to wrap up by early 2021, although Bayle said there's little significance to the change in wording.

Inter has been looking for a partner since late 2019 to share the cost of the project which has increased from the original estimate of about $3.5 billion.

The Calgary-based company concluded a deal to sell a majority of its European bulk liquid storage business to the CLH Group for $715 million earlier this week and Bayle said those proceeds, along with available credit lines, will help the company go ahead with funding the remaining $1.1 billion needed for the petrochemical project on its own if necessary.

Bayle praised the Alberta government's petrochemical incentive program announced at the end of October which offers grants worth 12 per cent of eligible capital costs once a project is up and running.

Inter received $200 million in royalty credits in connection with the Heartland project in 2016 under the previous NDP government's incentive program and Bayle said his understanding is that those credits can be converted to cash payments under the new program when the complex is in service in early 2022.

He wouldn't say if the program will encourage the company to build more projects.

Inter plans to eventually sell its remaining eight storage terminals in Sweden and Denmark, Bayle said, adding those assets aren't being marketed yet.

Inter reported third quarter net income of $38.7 million on revenue of $633 million, versus income of $79.9 million on revenue of $591 million in the same period last year.

Analysts polled by Refinitiv expected net income of $75.6 million on revenue of $555.5 million.

During the quarter, oil sands pipeline volumes fell to 1.06 million barrels per day from 1.18 million bpd in the year-earlier period.

Inter was forced to shut down part of its Polaris pipeline system for about two weeks after a leak was detected just east of the Fort McMurray airport in northern Alberta at the end of August.

Inter shares fell by as much as 85 cents or 6.4 per cent to $12.40 in Toronto on Friday.

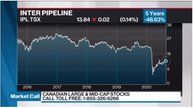

Market Call Christine Poole discusses Inter Pipeline

Christine Poole, CEO and managing director at GlobeInvest Capital Management discusses Inter Pipeline.

Now Showing

No comments:

Post a Comment