Bloomberg News | August 24, 2021 |

Miller Technology’s Relay electric vehicle. Credit: Miller

BHP Group and Mitsubishi Corp. will deploy electric pickup trucks and fast-charging units at an Australian coal mine to test technology that could aid the challenging task of cutting the sector’s greenhouse gas emissions.

The BHP Mitsubishi Alliance joint venture, Australia’s top coal producer, will initially use two of Canadian firm Miller Technology Inc.’s Relay trucks to transport workers at the Broadmeadow mine in Queensland. The vehicles — which can be juiced up in about 20 minutes for a 10-hour shift — will be backed by Tritium Pty Ltd. chargers that are adapted for use in harsh mining environments.

Miners are beginning to test out options to replace their vast diesel-powered fleets, including pickups and excavators, with zero-emissions alternatives, a step that could assist in curbing the industry’s sprawling climate footprint. Fortescue Metals Group Ltd. is adding hydrogen fuel-cell buses, while BHP, Vale SA and Rio Tinto Group have challenged suppliers to speed up development of large electric haul trucks.

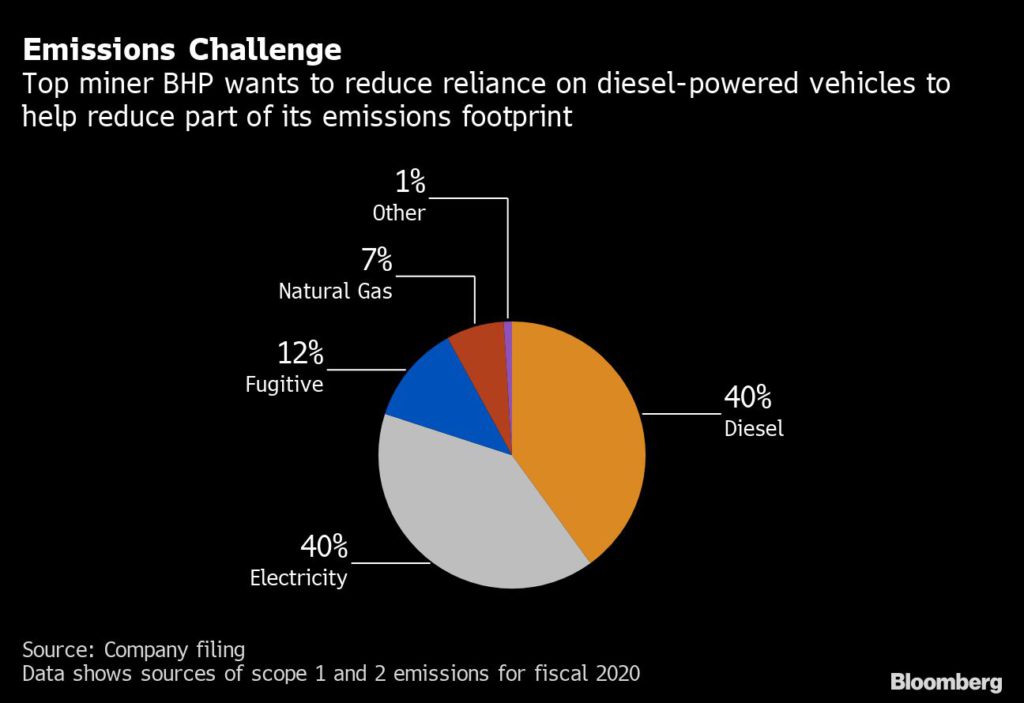

Eliminating all combustion-engine vehicles at mines would require major investment and only tackle a portion of their pollution. Use of diesel, including by mining equipment, accounts for about 40% of BHP’s so-called scope 1 and 2 greenhouse gas emissions, the company said in its most recent annual climate report.

“The new electric transporters are a major step toward safer and more sustainable underground mining,” BMA President James Palmer said in a statement. The Relay trucks will replace diesel vehicles at the mine, and BMA plans a broader fleet replacement program that will eventually retire its entire diesel fleet.

Brisbane-based charger manufacturer Tritium, which in May reached an agreement to go public via a merger with a special purpose acquisition company, sees further opportunities to supply charging equipment to miners.

The industry will need “charging technology that is sealed to protect against sediment, dust and moisture, and rated to operate in harsh conditions,” Jane Hunter, Tritium’s chief executive officer, said in a statement.

BHP is seeking to lower greenhouse gas emissions from its own operations — a small fraction of the total — by almost a third by 2030 and to zero by 2050. The company last week agreed to split off its oil and gas unit to accelerate a retreat from fossil fuels, and is working with customers to reduce emissions.

(By James Thornhill)

BHP risks two notch downgrade on oil asset sale

Reuters | August 24, 2021 |

Credit: BHP

BHP Group is at risk of a two notch downgrade that would provoke its lowest ever credit rating as the sale of its petroleum business raises the miner’s dependence on its major business of iron ore, S&P Global said on Tuesday.

BHP has agreed to hive off its petroleum business to Woodside Petroleum Ltd in a nil-premium merger, in return for new Woodside shares which will go to BHP shareholders, who will own 48% of the enlarged group.

The sale will reduce BHP’s portfolio diversity and will raise its dependency on a single asset, the agency noted.

S&P Global said it was placing ‘A’ long- and ‘A-1’ short-term ratings on BHP, as well as the ‘A’ issue rating on the group’s senior unsecured notes on CreditWatch with negative implications.

That means BHP’s rating could fall to BBB+, which would be its lowest since it was first rated in 1995.

“The CreditWatch placement indicates that we could lower our ratings on BHP by up to two notches in the coming months, based on our updated review of the strength of the group’s business risk profile, if the divestment of its petroleum assets takes place as proposed,” it said in a note.

(By Melanie Burton; Editing by Krishna Chandra Eluri and Jacqueline Wong)

No comments:

Post a Comment