SOCIALIST PERU

Copper price down again despite fears of supply disruption at Las BambasMINING.COM Staff Writer | August 17, 2021

Members of the Nueva Fuerabamba community at a town hall held at Las Bambas.

Photo by the Ministers Cabinet of Peru.

The copper price edged lower on Wednesday despite fears of supply disruption at Las Bambas mine in Peru amid ongoing labour strikes in top producer Chile.

Copper for delivery in September fell 2% from Tuesday’s settlement price, touching $4.12 per pound ($9,064 per tonne) on the Comex market in New York.

The most-traded September copper contract on the Shanghai Futures Exchange fell 1.1% to 69,020 yuan ($10,650.08) a tonne, tracking overnight losses in London.

Click here for an interactive chart of copper prices

Residents near MMG’s Las Bambas mine have blocked a road used to transport the metal after a two-week truce, community leaders said on Tuesday.

Last month, a four-day-long blockade disrupted operations of the mine, which produces about 400,000 tonnes of copper a year.

Strikes began last week at the Caserones and Andina mines in Chile while Teck suspended Highland Valley operations in Canada due to wildfire risk.

Despite the supply risk, the copper price has been weighed down by possible policy tightening in some major economies and rising global coronavirus cases, which could drag on recovery.

Top consumer China announced this week that its refined copper imports fell for the fourth straight month in July, adding to the sense of lost momentum.

New government

Peru’s new socialist government said this week it is working with the mining industry on a new approach to community relations to unlock more of the country’s mineral wealth.

“All companies are happy, so far,” Minister of Energy and Mines Ivan Merino said in an interview Saturday.

“We all agree that all projects must be given a new social face, that we need a new pact.”

The minister’s conciliatory and pragmatic tone may further ease fears stoked by talk in the election campaign of greater state intervention in natural resources that would stifle investment and future output.

Tense relations between mining projects and often isolated rural communities combined with slow permitting have hampered progress in the industry.

Mining comprises 60% of exports from Peru, primarily for the Chinese market.

(With files from Reuters and Bloomberg)

The copper price edged lower on Wednesday despite fears of supply disruption at Las Bambas mine in Peru amid ongoing labour strikes in top producer Chile.

Copper for delivery in September fell 2% from Tuesday’s settlement price, touching $4.12 per pound ($9,064 per tonne) on the Comex market in New York.

The most-traded September copper contract on the Shanghai Futures Exchange fell 1.1% to 69,020 yuan ($10,650.08) a tonne, tracking overnight losses in London.

Click here for an interactive chart of copper prices

Residents near MMG’s Las Bambas mine have blocked a road used to transport the metal after a two-week truce, community leaders said on Tuesday.

Last month, a four-day-long blockade disrupted operations of the mine, which produces about 400,000 tonnes of copper a year.

Strikes began last week at the Caserones and Andina mines in Chile while Teck suspended Highland Valley operations in Canada due to wildfire risk.

Despite the supply risk, the copper price has been weighed down by possible policy tightening in some major economies and rising global coronavirus cases, which could drag on recovery.

Top consumer China announced this week that its refined copper imports fell for the fourth straight month in July, adding to the sense of lost momentum.

New government

Peru’s new socialist government said this week it is working with the mining industry on a new approach to community relations to unlock more of the country’s mineral wealth.

“All companies are happy, so far,” Minister of Energy and Mines Ivan Merino said in an interview Saturday.

“We all agree that all projects must be given a new social face, that we need a new pact.”

The minister’s conciliatory and pragmatic tone may further ease fears stoked by talk in the election campaign of greater state intervention in natural resources that would stifle investment and future output.

Tense relations between mining projects and often isolated rural communities combined with slow permitting have hampered progress in the industry.

Mining comprises 60% of exports from Peru, primarily for the Chinese market.

(With files from Reuters and Bloomberg)

Peru calms interventionist fears with plan to tap copper riches

Bloomberg News | August 16, 2021 |

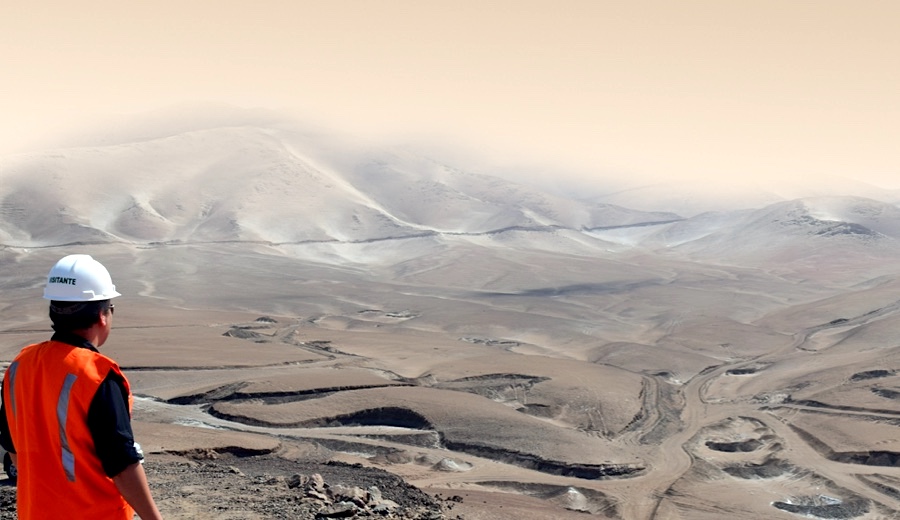

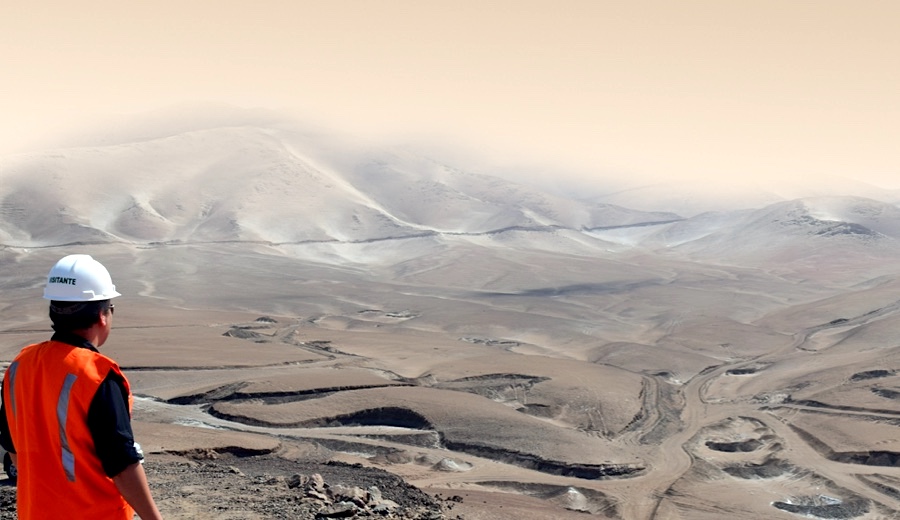

Tia Maria mine. (Image courtesy of Southern Copper Corp.)

Peru’s new socialist government is working with the mining industry on a new approach to community relations and red tape to unlock more of the country’s huge mineral wealth.

“All companies are happy, so far,” Minister of Energy and Mines Ivan Merino said in an interview Saturday. “We all agree that all projects must be given a new social face, that we need a new pact.”

The minister’s conciliatory and pragmatic tone may further ease fears stoked by talk in the election campaign of greater state intervention in natural resources that would stifle investment and future output. Peru is the top copper producer after Chile and the market is relying on the Andean nation developing more of its giant deposits to meet surging demand in the shift toward clean energy.

Tense relations between mining projects and often isolated rural communities combined with slow permitting have hampered progress in the industry.

Of 60 mining projects in different stages, the government intends to focus first on those that are close to starting and freeing up those that are trapped in red tape.

“We recognize that the state has not been present, that the best way forward is direct, with information exchange, so that there are no distortions,” Merino said.

Asked about Southern Copper Corp.’s Tia Maria initiative, Merina said his job was to deliver the program of President Pedro Castillo, who has said he opposed that project.

AT SOME STAGE, THE PERUVIAN STATE COULD PLAY A MORE ACTIVE ROLE IN STRATEGIC SECTORS AND MAY EVEN BE A SHAREHOLDER IN SOME PROJECTS

“The president has already said it: projects with social profitability go, those that do not have social profitability simply do not,” Merino said.

There are deposits in Peru that are richer and bigger, with the region between Apurimac and Cuzco containing enough mineral to match Chile’s production, he said.

Castillo’s administration is studying a proposal to lift taxes and leave more of the mining windfall in the country, although that still needs to go through different government departments and an opposition-led congress.

The message to companies is that the mining ministry will ensure clear rules and act as mediator and facilitator to streamline “this bureaucratic tangle,” he said. “What we are going to do is promote the industry so that things are done well and we are not an obstacle.”

At some stage, the Peruvian state could play a more active role in strategic sectors and may even be a shareholder in some projects, he said, but the priority is bring order to processes and requests that languish for more than a year.

Regarding the Camisea gas fields, which Castillo vowed to nationalize during the campaign, the government is looking into whether its perceptions are supported by data.

“First there must be more gas, for there to be more gas there must be greater reserves and for there to be greater reserves, there must be more exploration,” the minister said.

The government has received expressions of confidence as it holds talks with commodity industry leaders. A sign of the trust is that some companies have just paid back taxes.

“We are not into ideological issues,” he said. “We are generating consensus.”

(By María Cervantes)

Bloomberg News | August 16, 2021 |

Tia Maria mine. (Image courtesy of Southern Copper Corp.)

Peru’s new socialist government is working with the mining industry on a new approach to community relations and red tape to unlock more of the country’s huge mineral wealth.

“All companies are happy, so far,” Minister of Energy and Mines Ivan Merino said in an interview Saturday. “We all agree that all projects must be given a new social face, that we need a new pact.”

The minister’s conciliatory and pragmatic tone may further ease fears stoked by talk in the election campaign of greater state intervention in natural resources that would stifle investment and future output. Peru is the top copper producer after Chile and the market is relying on the Andean nation developing more of its giant deposits to meet surging demand in the shift toward clean energy.

Tense relations between mining projects and often isolated rural communities combined with slow permitting have hampered progress in the industry.

Of 60 mining projects in different stages, the government intends to focus first on those that are close to starting and freeing up those that are trapped in red tape.

“We recognize that the state has not been present, that the best way forward is direct, with information exchange, so that there are no distortions,” Merino said.

Asked about Southern Copper Corp.’s Tia Maria initiative, Merina said his job was to deliver the program of President Pedro Castillo, who has said he opposed that project.

AT SOME STAGE, THE PERUVIAN STATE COULD PLAY A MORE ACTIVE ROLE IN STRATEGIC SECTORS AND MAY EVEN BE A SHAREHOLDER IN SOME PROJECTS

“The president has already said it: projects with social profitability go, those that do not have social profitability simply do not,” Merino said.

There are deposits in Peru that are richer and bigger, with the region between Apurimac and Cuzco containing enough mineral to match Chile’s production, he said.

Castillo’s administration is studying a proposal to lift taxes and leave more of the mining windfall in the country, although that still needs to go through different government departments and an opposition-led congress.

The message to companies is that the mining ministry will ensure clear rules and act as mediator and facilitator to streamline “this bureaucratic tangle,” he said. “What we are going to do is promote the industry so that things are done well and we are not an obstacle.”

At some stage, the Peruvian state could play a more active role in strategic sectors and may even be a shareholder in some projects, he said, but the priority is bring order to processes and requests that languish for more than a year.

Regarding the Camisea gas fields, which Castillo vowed to nationalize during the campaign, the government is looking into whether its perceptions are supported by data.

“First there must be more gas, for there to be more gas there must be greater reserves and for there to be greater reserves, there must be more exploration,” the minister said.

The government has received expressions of confidence as it holds talks with commodity industry leaders. A sign of the trust is that some companies have just paid back taxes.

“We are not into ideological issues,” he said. “We are generating consensus.”

(By María Cervantes)

No comments:

Post a Comment