"Millions of borrowers are still waiting for President Biden to make good on his promise to provide widespread student loan cancellation, and the time to act is now."

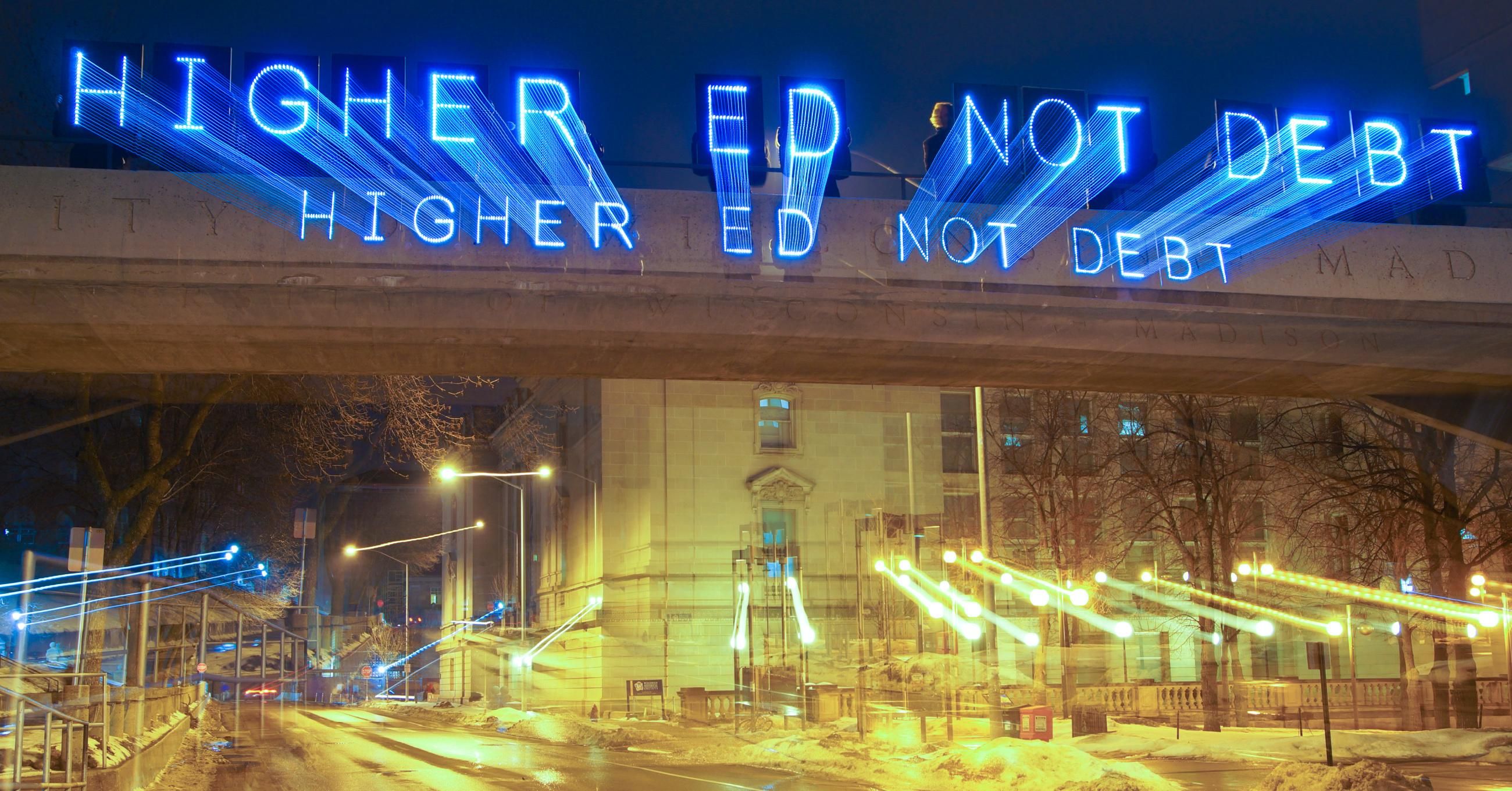

The Biden administration is under pressure from lawmakers and borrowers to provide broader student loan debt relief. (Photo: Joe Brusky/Flickr/cc)

JESSICA CORBETT

Borrowers and their allies renewed calls for the Biden administration to wipe out all federal student debt on Thursday after the U.S. Department of Education announced $1.1 billion in loan forgiveness for 115,000 people who left the now-defunct ITT Technical Institute chain before graduating.

Alexis Goldstein, Open Markets Institute's director of financial policy, called the development "a great step," tweeting that "it's a relief that many scammed former students of ITT Tech will be getting long overdue relief."

"Broad-based student debt cancellation is still needed. And doing so while payments are paused is the right time to do it," added Goldstein, referencing that federal student loan payments are paused through the end of January 2022 due to the ongoing coronavirus pandemic.

Melissa Byrne, a Philadelphia-based progressive political strategist, also responded to the news on Twitter, asking: "Is this like biking with training wheels? Take off the training wheels and #CancelStudentDebt—all of it."

"You can't nickel and dime justice," Byrne also said, warning of moves that leave most borrowers behind.

The Associated Press explained that while "students are usually eligible for loan forgiveness if they attended a college within 120 days of its closure and were unable to complete their degrees," in this case the Education Department is extending that window back to March 31, 2008, several years before ITT Tech closed in 2016.

The department estimates that 43% of the affected ITT Tech borrowers are currently in default.

"For years, ITT hid its true financial state from borrowers while luring many of them into taking out private loans with misleading and unaffordable terms that may have caused borrowers to leave school," U.S. Secretary of Education Miguel Cardona said in a statement Thursday.

"Today's action continues the department's efforts to improve and use its targeted loan relief authorities to deliver meaningful help to student borrowers," he said. "At the same time, the continued cost of addressing the wrongdoing of ITT and other predatory institutions yet again highlights the need for stronger and faster accountability throughout the federal financial aid system."

The administration's latest move brings the total amount of loan cancellation approved since January—when President Joe Biden took office—to $9.5 billion, which has benefited more than 563,000 borrowers, according to the department.

Eileen Connor, director of the Project on Predatory Student Lending at the Legal Services Center of Harvard Law School, welcomed the "good news" but also said that "the exact reasoning used by the department in expanding this look back period also demonstrates why all ITT loans need to be canceled."

Noting that "one of ITT's notorious scam tactics" was talking students into "multiple degrees and a mountain debt," Connor pointed out that it has been five years since the chain shut down in the face of "overwhelming evidence of wrongdoing, yet the department still has not addressed the more than 700,000 borrowers with over $3 billion in fraudulent debt from ITT."

Connor's call for additional action from the Biden administration was echoed by Abby Shafroth, staff attorney with the National Consumer Law Center's Student Loan Borrower Assistance Project.

Shafroth said that though the new relief action "will make a tremendous difference in the lives of the many borrowers who withdrew from ITT once they realized that the school had sold them a bill of goods," it still "left out hundreds of thousands more ITT students who were subject to the same misconduct."

"The department should use its existing authority to cancel all federal student debt taken out to attend ITT," she added. "And the department should not stop there—ITT is hardly the only school that took advantage of the federal student loan system and ITT students are hardly the only borrowers who have suffered from a broken student loan system. Millions of borrowers are still waiting for President Biden to make good on his promise to provide widespread student loan cancellation, and the time to act is now."

Thursday's move came a week after the Biden administration canceled $5.8 billion in federal student debt held by over 300,000 people with severe disabilities—a decision that, as Common Dreams reported, also sparked calls for broader loan forgiveness.

The administration's piecemeal approach to the nation's student debt crisis has led some to ask, as Eric Levitz wrote last week for Intelligencer, "Has Biden abandoned wide-scale student-loan forgiveness?"

Acknowledging the Education Department's ongoing review of the president's authority on the matter, Levitz posited that "blanket loan forgiveness remains possible. But in all likelihood, the Biden presidency will yield only small-bore reforms that deliver relief to specific kinds of borrowers, while most will carry on bearing the burdens of America's inefficient, scam-ridden system of higher education."

Biden, who campaigned on canceling up to $10,000 in student loan debt, has resisted pressure from progressive lawmakers—led by Senate Majority Leader Chuck Schumer (D-N.Y.), Sen. Elizabeth Warren (D-Mass.), and Rep. Ayanna Pressley (D-Mass.)—to make that figure $50,000.

The trio continues to push the president on the issue, with Warren tweeting Thursday morning that "after the 2008 financial crisis, young people were shoved into a weak job market and plunged even deeper into student debt. Many never recovered financially. We must do better this time and #CancelStudentDebt."

U.S. to forgive loans for 100,000 students who went to ITT Tech

Move impacts anyone who attended an ITT school between 2008 and 2016 but didn't graduate

The U.S. Department of Education announced Thursday it will forgive student debt for more than 100,000 borrowers who attended colleges in the now-defunct ITT Technical Institute chain but left before graduating.

In a rarely used move, the agency said it will erase federal loans for borrowers who left the for-profit colleges during an eight-year window before their 2016 closure. During that period, the department said, ITT Tech lied about its financial health and misled students into taking on debt they couldn't repay.

The action will offer $1.1 billion US in loan forgiveness to 115,000 borrowers who attended ITT Tech, which had 130 locations across 38 U.S. states, but did not operate in Canada.

About 43 per cent of those borrowers are in default on their student loans, the department said.

"For years, ITT hid its true financial state from borrowers while luring many of them into taking out private loans with misleading and unaffordable terms that may have caused borrowers to leave school," Education Secretary Miguel Cardona said in a statement.

Students are usually eligible for loan forgiveness if they attended a college within 120 days of its closure and were unable to complete their degrees. But for ITT Tech, the Education Department is extending the window back to March 31, 2008.

That date, the agency said, is when ITT Tech's executives disclosed a scheme to hide the truth about the company's finances after the loss of outside funding. It led ITT Tech to shift more costs to students, the department said, and it prevented the company from making investments to provide a quality education.

ITT Tech shut down in 2016 after being hit with a series of sanctions by the Obama administration.

Under the new action, eligible borrowers will automatically get their loans cleared if they did not attend another college within three years of the school's closure. Those who went to another college but did not earn degrees may be eligible but must apply for discharges, the agency said.

Borrower advocates have been urging the Biden administration to broaden loan relief for students who attended shuttered for-profit colleges. The nonprofit Student Defense applauded the department's move and said the same should be done for students who attended other for-profit chains.

"There are countless others who attended other predatory institutions who are still waiting. We hope the Department will continue to implement our recommendations to make things right for all of them, too," Alex Elson, vice president of Student Defense, said in a statement.

It is the latest in a series of loan discharges targeting specific groups of students. In June, the Biden administration erased more than $500 million in student debt for borrowers who were defrauded by ITT Tech. That decision centred on claims that the company made exaggerating its graduates' success in finding jobs.

Earlier this month, Cardona announced he would automatically forgive student loans for 300,000 Americans with severe disabilities that leave them unable to earn significant incomes.

But the Biden administration also faces growing pressure to pursue wider student debt forgiveness. Some Democrats in Congress are calling for the White House to use executive action to erase $50,000 for all student loan borrowers.

Biden has suggested such action needs to come from Congress, but he has asked the Education and Justice departments to study the topic. Earlier this month, Cardona said that study is still underway.

The Education Department has the authority to extend the window for loan forgiveness in cases of school closures, but the power has not often been used. After the closure of the Corinthian Colleges for-profit chain in 2015, the Obama administration widened the window back to June 20, 2014.

By Katie Lobosco, CNN

Thu August 26, 2021

Washington (CNN)The Department of Education said Thursday that it will cancel $1.1 billion in student loan debt for some students who attended the now-defunct for-profit ITT Technical Institute -- bringing the total amount of loan discharges approved under President Joe Biden to $9.5 billion.

The majority of that debt is held by permanently disabled borrowers who have long been eligible for loan forgiveness but who have not applied. The Department of Education is making the cancellation automatic by using federal data to identify borrowers who qualify. The change will impact 320,000 borrowers, eliminating $5.8 billion in debt starting in September.

Much of the other debt relief will benefit victims of for-profit college fraud, many of whom have been waiting years for the Department of Education to process their forgiveness claims. The most recent action will automatically cancel the debt borrowed by 115,000 students who left ITT Tech without completing their program after March 2008.

About 43% of those borrowers are currently in default on their loans, the Department of Education said. The move was made after a new review of the problems at ITT Tech found that these borrowers attended the school during a period of time when the school misled students into taking out private loans that were allegedly portrayed as grant aid and engaged in widespread misrepresentations about the state of the institution's financial health.

A backlog of defrauded students await relief

"Today's action continues the Department's efforts to improve and use its targeted loan relief authorities to deliver meaningful help to student borrowers," said Education Secretary Miguel Cardona in a statement.

"At the same time, the continued cost of addressing the wrongdoing of ITT and other predatory institutions yet again highlights the need for stronger and faster accountability throughout the federal financial aid system," he added.

There are many borrowers who are eligible for debt relief that could still be waiting, according to Student Defense, a nonprofit group that advocates for students' rights and has been calling on the Department of Education to speed up the process.

"Thanks to Secretary Cardona and President Biden, thousands of former ITT students will finally get the relief they've been owed for far too long. At the same time, there are countless others who attended other predatory institutions who are still waiting," said Student Defense Vice President Alex Elson in a statement.

Democrats push for broader debt cancellation

Key Democratic lawmakers, including Senate Majority Leader Chuck Schumer of New York and Sen. Elizabeth Warren of Massachusetts, are pressuring Biden to go further and broadly cancel up to $50,000 of student loan debt per borrower.

It would be an unprecedented move, but a memo from lawyers at Harvard's Legal Services Center and its Project on Predatory Student Lending says the Department of Education has the power to do so.

Biden, who said during the presidential campaign that he would support canceling $10,000 per borrower, has repeatedly resisted the pressure since taking office, arguing that the government shouldn't forgive debt for people who went to "Harvard and Yale and Penn." As of now, he has directed Cardona to write a memo on the executive branch's legal authorities to cancel debt.

Biden recently extended the pandemic-related pause on federal student loan payments another four months until January 31.

Borrower balances have effectively been frozen for more than a year, with no payments required on federal loans since March 2020. During this time, interest has stopped adding up -- saving the average borrower about $2,000 over the first year -- and collections on defaulted debt have been on hold.

The relief is even more significant for those who work in the public sector and may be eligible for loan forgiveness after 10 years. They are still receiving credit toward those 10 years of required payments as if they had continued to make them during the pandemic, as long as they are still working full time for qualifying employers.

No comments:

Post a Comment