Reuters | August 24, 2021 |

Borneo Island (Image credit: Needpix)

Australia’s Fortescue Metals Group and China’s Tsingshan Holding Group could invest billions of dollars to build an industrial estate for metal smelting near a planned hydropower plant on Borneo island, an Indonesian minister said.

The companies have been in talks since early this year about the project and minister of maritime affairs and investment, Luhut Pandjaitan, has said smelting of iron, nickel and copper ores at the estate could start as early as 2023.

Fortescue could invest $12 billion, while Tsingshan has the “potential” to pump in $30 billion, a slide displayed by Luhut during a presentation on Tuesday showed.

“Total investment, there will be $100 billion, including the dam, and it will be completed in 10 years,” the minister said, adding that groundbreaking was planned for October.

TSINGSHAN ALREADY HAS LARGE INVESTMENTS IN INDONESIA RANGING FROM INDUSTRIAL PARKS TO STAINLESS STEEL PROCESSING

Last September, a Fortescue subsidiary, Fortescue Future Industries (FFI), signed an agreement to conduct feasibility studies into the utilisation of Indonesia’s hydropower and geothermal resources for industrial operations, for potential domestic supply and exports, FFI’s chief executive Julie Shuttleworth said in email in March.

FFI has been announcing ambitious global green energy plans, mostly via green hydrogen. It plans to fund the majority of its projects off its balance sheet, investing about $1 billion a year of its own money.

“FFI is already conducting studies on potential projects in Kalimantan, and we look forward to continuing our positive engagement with local stakeholders,” FFI’s Shuttleworth told Reuters on Wednesday.

Tsingshan already has large investments in Indonesia ranging from industrial parks to stainless steel processing. A spokesman did not respond to a request by Reuters for comments.

Top nickel producer Indonesia has ambitious plans to start processing its rich supplies of nickel laterite ore used in lithium batteries and eventually become a global hub for producing and exporting electric vehicles (EV).

Miners and EV companies alike are keen to ensure that the supply chains of their batteries are green compliant, and are hesitant to invest in projects powered by coal, which nickel smelters usually rely on in Indonesia.

The new metal smelting estate will be located near the 11,000 megawatt Kayan hydropower project in North Kalimantan province, on Indonesia’s side of Borneo island.

(By Bernadette Christina Munthe, Melanie Burton, Tom Daly and Fathin Ungku; Editing by Ed Davies)

MINING.com Editor | August 24, 2021 |

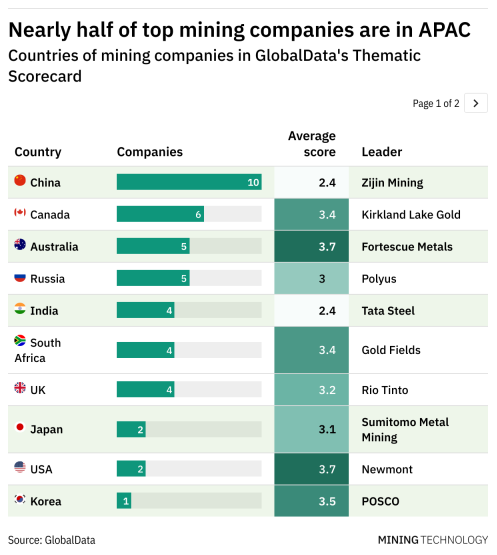

Fortescue Metals leads an Australia-heavy Top 10 based on GlobalData research.

Fortescue Metals leads in an Australia-heavy Top 10 listing of companies based on leadership in 10 areas that matter the most to the mining sector, GlobalData reports.

The company, the fourth biggest iron ore producer globally, is the mining company best positioned to take advantage of future disruption in the industry, according to GlobalData analysts.

ON A SCALE OF ONE TO FIVE, AUSTRALIAN COMPANIES RECEIVED AN AVERAGE SCORE OF 3.7, WITH FORTESCUE LEADING THE COUNTRY’S SCORECARD WITH 4.5

The scores are based on overall technology, macroeconomic and sector-specific leadership in the ten key thematic areas developed by GlobalData.

Fortescue Metals is followed by several gold mining firms – US-based Newmont, Russia-based Polyus, South Africa’s Gold Fields, Australia’s Newcrest Mining and Canada’s Kirkland Lake Gold.

Click here to view an interactive chart comparing company ratings across the 10 themes in question.

South African Gold Fields was also highly ranked in GlobalData’s thematic scorecard, announcing new digitizing mines and renewable power operations projects.

On a scale of one to five, Australian companies received an average score of 3.7, with Fortescue leading the country’s scorecard with 4.5.

Australia also has one of the highest representations among top mining companies, being home to five out of 50 of the companies in the GlobalData analysis, only behind China and Canada. However, this number doesn’t include multinational corporations such as Anglo-Australian Rio Tinto or companies that have significant operations in Australia, such as AngloGold Ashanti.

Overall, 44% of the top companies in the GlobalData thematic scorecard are from the Asia-Pacific region, including China.

In the case of Australia, where the five companies on the list shone brightest was the workplace safety theme, scoring an average of 4.4 out of five. Commodity markets and ESG, climate change, and capital raising were also among the most promising themes for Australian companies, while investment in lithium-ion batteries was below the scorecard average.

Companies based in other countries had their own strengths and weaknesses: Chinese corporations, for example, perform well on capital raising but poorly when it comes to climate change, while British companies are more ambitious when it comes to climate change and score well on commodity markets.

For the latter, Rio Tinto, for example, has benefited from the steep rise in iron ore prices over the last 12 months, and is looking to build its position in copper. The successful development of the Jadar project in Serbia would also improve its position in lithium-ion battery theme.

These scores are based on overall technology, macroeconomic and sector-specific leadership in 10 of the key themes that matter most to the mining industry and are generated by GlobalData analysts’ assessments.

No comments:

Post a Comment