PUBLISHED THU, AUG 19 2021

Sam Meredith@SMEREDITH19

KEY POINTS

Australian thermal coal at Newcastle Port, the benchmark for the vast Asian market, has climbed 106% this year to more than $166 per metric ton, according to the latest weekly assessment by commodity price provider Argus.

The Newcastle weekly index, which stood at a 2020 low of $46.18 in early September, now appears to be closing in on an all-time high of $195.20 from July 2008.

The resurgence of thermal coal, which is burned to generate electricity, raises serious questions about the so-called “energy transition.”

A freight train transports coal from the Gunnedah Coal Handling and Prepararation Plant, operated by Whitehaven Coal Ltd., in Gunnedah, New South Wales, Australia, on Tuesday, Oct. 13, 2020.

David Gray | Bloomberg | Getty Images

LONDON — Soaring electricity demand, infrastructure woes and a surge in global gas prices have triggered an extraordinary rally for the world’s least liked commodity.

Australian thermal coal at Newcastle Port, the benchmark for the vast Asian market, has climbed 106% this year to more than $166 per metric ton, according to the latest weekly assessment by commodity price provider Argus.

The Newcastle weekly index, which stood at a 2020 low of $46.18 in early September, now appears to be closing in on an all-time high of $195.20 from July 2008. Its South African equivalent, the Richards Bay index, ended the week through to Aug. 13 at $137.06 per metric ton, up more than 55% this year.

To put thermal coal’s remarkable rally into some context, international benchmark Brent crude is one of few assets to have recorded comparable gains this year. The oil contract is up 33% year-to-date.

The resurgence of thermal coal, which is burned to generate electricity, raises serious questions about the so-called “energy transition.” To be sure, coal is the most carbon-intensive fossil fuel in terms of emissions and therefore the most important target for replacement in the pivot to renewable alternatives.

Yet, as policymakers and business leaders repeatedly tout their commitment to the demands of the deepening climate emergency, many still rely on fossil fuels to keep pace with rising power demand.

It comes shortly after the world’s leading climate scientists delivered their starkest warning yet about the speed and scale of the climate crisis. The Intergovernmental Panel on Climate Change’s landmark report, published Aug. 9, warned a key temperature limit of 1.5 degrees Celsius could be broken in just over a decade without immediate, rapid and large-scale reductions in greenhouse gas emissions.

U.N. Secretary-General, António Guterres, described the report’s findings as a “code red for humanity,” adding that it “must sound a death knell for coal and fossil fuels before they destroy our planet.”

Earlier this year, Guterres pushed for all governments, private companies and local authorities to “end the deadly addiction to coal” by scrapping all future global projects. The move to phase out coal from the electricity sector was “the single most important step” to align with the 1.5-degree goal of the Paris Agreement, he said.

Outlook for thermal coal prices

Yulia Buchneva, director in natural resources at Fitch Ratings, told CNBC that thermal coal remains a key global energy source, noting the commodity still has a more than 35% share in global power generation.

“We expect that the share of coal in energy generation will decline driven by the energy transition agenda, however this will have a rather longer-term impact on the market. In the medium-term demand for coal in emerging markets with less strict environmental agenda, in particular in India, Pakistan, and Vietnam, where coal-fired power dominates generation, is expected to rise,” Buchneva said.

By comparison, Buchneva said that since the U.S. and EU account for only 10% of worldwide demand for coal, an expected contraction in these regions would have a limited impact on the global market.

When asked whether thermal coal prices could push even higher in the coming months, Buchneva replied: “The current high thermal coal prices have decoupled from costs and are therefore not sustainable. We expect that prices will normalize during the remainder of the year.”

Fitch Ratings assumes the price of high energy Australia coal will decline toward $81.

A bucket-wheel reclaimer stands next to a pile of coal at the Port of Newcastle in Newcastle,

New South Wales, Australia, on Monday, Oct. 12, 2020.

David Gray | Bloomberg | Getty Images

Energy analysts cited a variety of reasons for thermal coal’s breakneck rally. These included rebounding power demand in China, Beijing’s informal ban on coal imports from Australia, supply disruptions in Australia, South Africa and Colombia, and rising global gas prices.

For the latter, analysts at Argus said Europe had incurred unseasonably low gas storages, weak liquified natural gas imports and modest pipeline imports from Russia. It has coincided with gas prices rising more sharply than coal and thus led to an increased incentive to burn coal at the expense of gas for power generation.

“Coal as an expensive substitute, especially in Europe given the need to buy pollution offsets via emission futures, is likely to continue into the winter period,” Ole Hansen, head of commodities research at Saxo Bank, told CNBC via email.

“This in response to low gas stock levels both in the US and Europe following a high demand season driven by extreme heat and economic activity,” he continued. “All in all, coal is in demand despite raised focus on climate change.”

Hansen said this was simply due to the lack of supplies from coal’s biggest competitor: natural gas.

Financing coal projects to become more difficult

“I’m reluctant to get into how this is going to continue to play out over the next few months. I think things are fairly fluid in terms of the impact of the virus on various economies and it doesn’t take much of a slowdown for things to really start impacting a commodity like coal,” Seth Feaster, energy data analyst at IEEFA, a non-profit organization, told CNBC via telephone.

“One thing I can say is that prices have been very volatile. And from a U.S. perspective, when coal companies talk about exports being their savior, we find that pretty suspect because volatility makes it very difficult for coal companies to have any kind of long-term plan around thermal coal exports.”

David Gray | Bloomberg | Getty Images

Energy analysts cited a variety of reasons for thermal coal’s breakneck rally. These included rebounding power demand in China, Beijing’s informal ban on coal imports from Australia, supply disruptions in Australia, South Africa and Colombia, and rising global gas prices.

For the latter, analysts at Argus said Europe had incurred unseasonably low gas storages, weak liquified natural gas imports and modest pipeline imports from Russia. It has coincided with gas prices rising more sharply than coal and thus led to an increased incentive to burn coal at the expense of gas for power generation.

“Coal as an expensive substitute, especially in Europe given the need to buy pollution offsets via emission futures, is likely to continue into the winter period,” Ole Hansen, head of commodities research at Saxo Bank, told CNBC via email.

“This in response to low gas stock levels both in the US and Europe following a high demand season driven by extreme heat and economic activity,” he continued. “All in all, coal is in demand despite raised focus on climate change.”

Hansen said this was simply due to the lack of supplies from coal’s biggest competitor: natural gas.

Financing coal projects to become more difficult

“I’m reluctant to get into how this is going to continue to play out over the next few months. I think things are fairly fluid in terms of the impact of the virus on various economies and it doesn’t take much of a slowdown for things to really start impacting a commodity like coal,” Seth Feaster, energy data analyst at IEEFA, a non-profit organization, told CNBC via telephone.

“One thing I can say is that prices have been very volatile. And from a U.S. perspective, when coal companies talk about exports being their savior, we find that pretty suspect because volatility makes it very difficult for coal companies to have any kind of long-term plan around thermal coal exports.”

Smoke and steam rises from the Bayswater coal-powered thermal power station located near the central New South Wales town of Muswellbrook, New South Wales, in Australia.

David Gray | Getty Images News | Getty Images

Feaster said that while some countries appeared hesitant to move away from coal, it is becoming “abundantly clear” that financing for coal projects is drying up. “It is going to be very difficult going forward to fund any kind of new power projects for coal,” he continued.

“I think that that’s really going to become a pariah around the world for anybody to finance coal projects. It is going to become more expensive and more difficult.”

US coal exports on the mend despite mixed long-term outlook

The amount of coal shipped from U.S. shores rose during the second quarter, buoyed by robust demand from international markets, particularly in Asia.

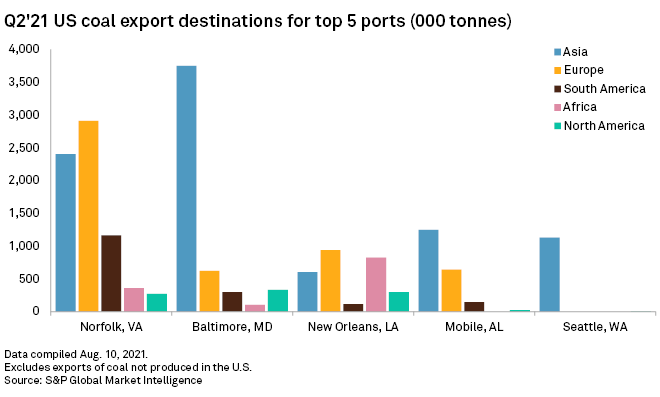

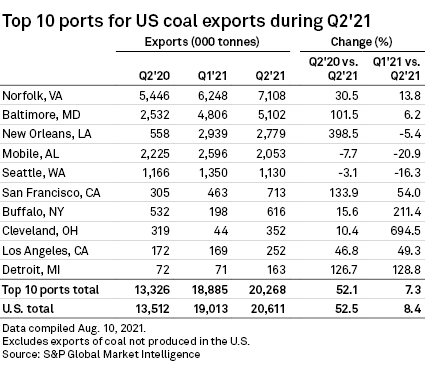

Exports of U.S. coal jumped 52.5% year over year to 20.6 million tonnes in the June quarter from 13.5 million tonnes, according to an S&P Global Market Intelligence analysis.

In 2020, the COVID-19 pandemic caused electricity consumption to tank, decimating demand for U.S. coal. But the economic recovery in 2021, combined with stronger international coal demand, especially from China, has led to a resurgence in coal exports. What is more, low investment in coal over roughly the past decade made it challenging for the industry to keep supply on pace with demand when markets did recover.

"When you put that all together, these factors have created — at least for the time being — a better environment for the U.S. coal industry, particularly Eastern producers that are able to export," said Benjamin Nelson, global lead analyst for coal at Moody's Investors Service.

Of the top 10 U.S. ports analyzed by Market Intelligence, only two recorded year-over-year declines in seaborne shipments: the ports in Mobile, Ala., and Seattle. The remaining eight ports booked increased second-quarter shipments compared to the same quarter of 2020.

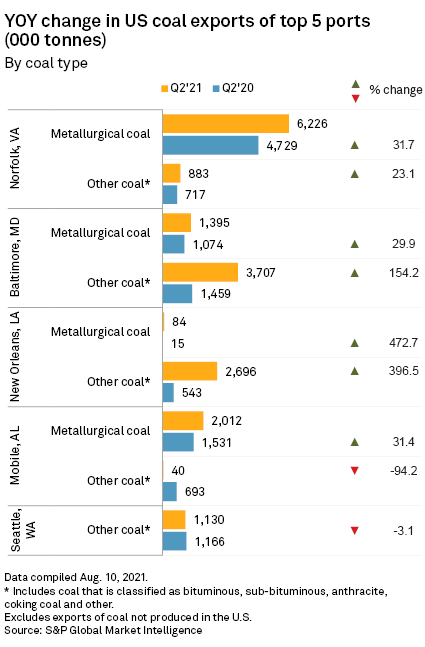

Coal shipments from New Orleans, which exports a significant amount of Illinois Basin coal, surged in the second quarter to 2.8 million tonnes, 398.5% more than in the same quarter in 2020.

"With coal prices up, a lot of Illinois Basin coal production can now be reasonably exported again," Nelson told Market Intelligence. "That helps explain why exports from New Orleans' ports were up so much during the quarter. It's a function of where that coal is coming from and what is going on there."

A significant portion of the country's metallurgical coal, a primary ingredient in steelmaking, departed from Norfolk, Va., during the three-month period. Producers shipped about 6.2 million tonnes of metallurgical coal from Norfolk, a 31.7% increase from the 4.7 million tonnes of metallurgical coal exported during the second quarter of 2020.

Total coal export volumes from Baltimore also jumped during the June quarter, by 101.5% year over year to total 5.1 million tonnes. Producers in Northern and Central Appalachia service ports in Baltimore and Norfolk.

Help from China

As domestic demand for U.S. thermal coal wanes, several major coal operators have their eyes on supplying international markets. Coal companies shipped an average of 12.1 million tonnes of coal from the U.S. during each week of June, about 47% more than in June 2020, according to a Market Intelligence report by analyst Steve Piper.

U.S. coal exports could reach 90 million tons by the end of 2021, an increase of approximately 30% from 2020, according to the U.S. Energy Information Administration's Aug. 10 short-term energy outlook.

"High global steel prices are driving these increases in coal exports, and trade tensions between China and Australia continue to support U.S. thermal coal exports," the report stated.

The U.S. saw a boom in coal demand from China at the end of 2020 after an unofficial ban on Australian coal imports pressured buyers to turn to comparable sources. U.S. exports of coal to China spiked 251.8% year over year in the final three months of 2020.

Pennsylvania-based Consol Energy Inc.'s total coal shipments soared during the second quarter, increasing to 5.9 million tonnes, from 2.3 million tonnes during the year-ago quarter, on the back of strong demand from seaborne markets, according to the company.

"We continue to focus on our strategy of further reducing our exposure to a declining U.S. coal market for power generation with a heightened focus on increasing our industrial business," Consol Energy CEO and President James Brock said during an Aug. 3 earnings call. "We have seen sustained improvements in the seaborne thermal coal market since the end of the third quarter of 2020."

British Columbia-based Teck Resources Ltd. said the favorable price environment for exports of coal to China boosted the company's second-quarter earnings. Of the 6.2 million tonnes of steelmaking coal sold during the June quarter, about 2 million tonnes went to China "at significantly higher prices than FOB Australia prices," the company stated in its earnings report.

"We will continue to prioritize available spot sales volumes to China, which is expected to continue to result in favorable price realization," CEO and President Donald Lindsay said during a July 27 earnings call.

The U.S. thermal coal sector will continue its structural decline in 2022, according to Nelson. Although coal export volumes are likely to grow in 2022, domestic consumption of coal will ultimately fall more than exports will rise.

No comments:

Post a Comment