LONG READ

Photograph by Spencer Lowell

BY ARYN BAKER

SEPTEMBER 7, 2021

Scattered three miles deep along the floor of the central Pacific are trillions of black, misshapen nuggets that may just be the solution to an impending energy crisis. Similar in size and appearance to partially burned charcoal briquettes, the nuggets are called polymetallic nodules, and are an amalgamation of nickel, cobalt, manganese and other rare earth metals, formed through a complex biochemical process in which shark teeth and fish bones are encased by minerals accreted out of ocean waters over millions of years.

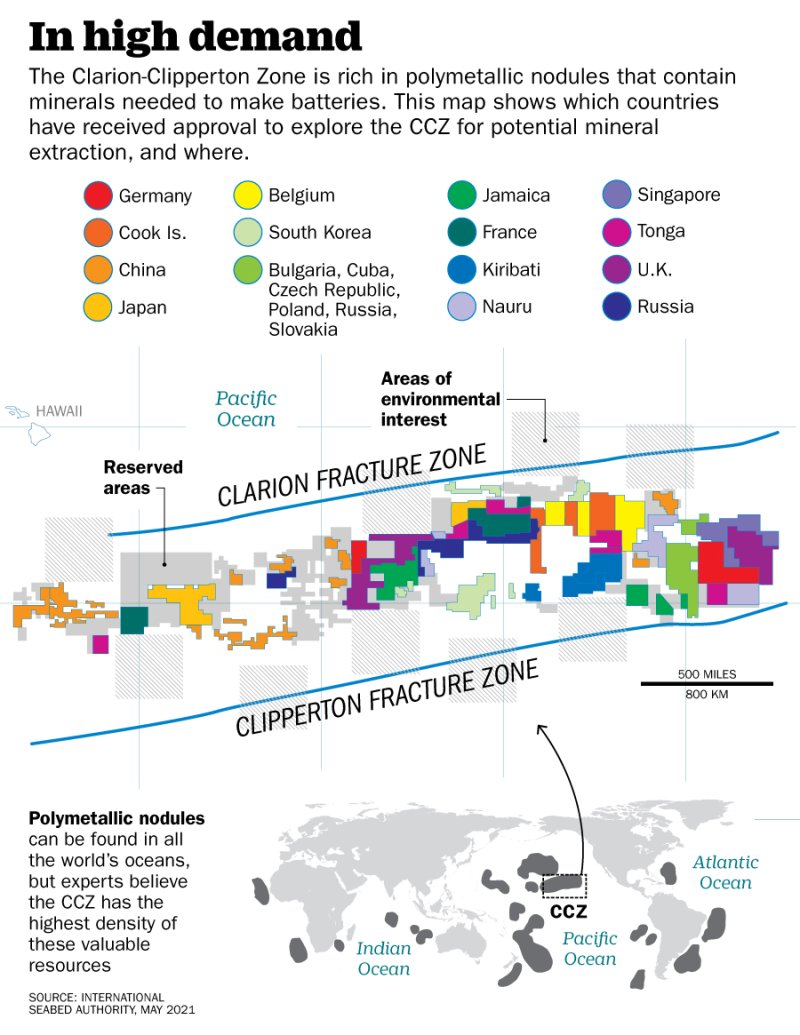

Marine biologists say they are part of one of the least-understood environments on earth, holding, if not the secret to life on this planet, at least something equally fundamental to the health of its oceans. Gerard Barron, the Australian CEO of seabed-mining company the Metals Company, calls them something else: “a battery in a rock,” and “the easiest way to solve climate change.” The nodules, which are strewn across the 4.5 million-sq-km (1.7 million-sq-mi.) swath of international ocean between Hawaii and Mexico known as the Clarion-Clipperton Zone (CCZ), contain significant amounts of the metals needed to make the batteries that power our laptops, phones and electric cars. Barron estimates that there is enough cobalt and nickel in those nuggets to power 4.8 billion electric vehicles—more than twice the number of vehicles on the road today, worldwide. Mining them, he says, would be as simple as vacuuming golf balls off a putting green.

At the bottom of the Pacific Ocean lies a solution to the imminent battery shortage...at a great potential cost to biodiversity and life on earth.

Spencer Lowell for TIME

But conservationists say doing so could unleash a cascade effect worse than the current trajectory of climate change. Oceans are a vital carbon sink, absorbing up to a quarter of global carbon emissions a year. The process of extracting the nodules is unlikely to disrupt that ability on its own, but the very nature of the world’s oceans—largely contiguous, with a system of currents that circumnavigate the globe—means that what happens in one area could have unforeseen impacts on the other side of the planet. “If this goes wrong, it could trigger a series of unintended consequences that messes with ocean stability, ultimately affecting life everywhere on earth,” says Pippa Howard, director of the biodiversity-conservation organization Fauna and Flora International. The nodules are a core part of a biome roughly the size of the Amazon rain forest, she notes. “They’ve got living ecosystems on them. Taking those nodules and then using them to make batteries is like making cement out of coral reefs.”

The debate over the ethics of mining the earth’s last untouched frontier is growing in both intensity and consequence. It pits biologist against geologist, conservationist against environmentalist, and manufacturer against supplier in a world grappling with a paradox—one that will define our path to a future free of fossil fuels: sustainable energy that will run cleaner but also require metals and resources whose extraction will both contribute to global warming and impact biodiversity. So as nations commit to lower greenhouse-gas emissions, the conflict is no longer between fossil-fuel firms and clean-energy proponents, but rather over what ecosystems we are willing to sacrifice in the process.

History is littered with stories of well-intended environmental interventions that have gone catastrophically wrong; for example, South American cane toads introduced into Australia in the 1930s first failed to control beetles attacking sugarcane, then spread unchecked across the continent, poisoning wildlife and pets.

Nevertheless, a radical embrace of electric vehicles will be necessary to limit global warming to less than 1.5°C above preindustrial levels, the goal of the Paris Agreement. But according to a May 2021 report by the International Energy Agency (IEA)—the Paris-based intergovernmental organization that helps shape global energy policies—the world isn’t mining enough of the minerals needed to make the batteries that will power that clean-energy future. Demand for the metals in electric vehicles alone could grow by more than 30 times from 2020 to 2040, say the report’s authors. “If supply chains can’t meet skyrocketing demand, mineral shortages could mean clean-energy shortages,” the report argues. Fears of such shortages have countries and companies racing to secure the supplies needed for the coming energy transition.

By most assessments, existing mines on land could supply the needed minerals. But after decades of exploitation, the quality of the ore is going down while the energy required to quarry and refine it is going up. Meanwhile, the efforts to extract cobalt, which is mined almost exclusively in the Democratic Republic of Congo, are dogged by persistent accounts of human-rights and environmental abuses. According to deep-ocean-mining proponents, the seabed nodules could provide most of the minerals the world needs, with minimal impact. “The biggest risk to the ocean right now is global warming,” says Kris Van Nijen, managing director of the Belgium-based deep-sea-mining company Global Sea Mineral Resources (GSR). “And the solution can be found on the seafloor, where there is a single deposit that provides the minerals we need for clean-energy infrastructure.” GSR has already trialed a 12-m-long, 25-ton nodule-sucking robot that zigzags across the ocean floor on caterpillar tracks, kind of like a giant underwater Roomba. They dubbed their prototype “Patania,” after the world’s fastest caterpillar.

Commercial mining is not yet permitted in international waters. The International Seabed Authority (ISA), the U.N. body tasked with managing seafloor resources, is still deliberating how, and under what conditions, mining should be allowed to proceed. A few private companies, including GSR and Barron’s Metals Company, have scooped up a couple of dozen metric tons of the nodules on exploratory missions, and are now pressuring the ISA to approve commercial operations. Barron is already telling potential investors that he expects to be harvesting nodules by 2024. GSR says that by the time they are up and running, they will be able to collect up to 3 million tons a year with just two of their mining robots.

The deployment of Patania II, GSR’s 25-metric-ton nodule-collecting robot.

Courtesy GSR

Not everyone is on board. Scientists, conservationists, the European Parliament and some national governments are calling for a moratorium on deep-sea mining until its ecological consequences can be better understood. The ocean environment is already under threat from climate change, overfishing, industrial pollution and plastic debris, they argue; added stresses from heavy machinery and habitat destruction could tip it over the edge. Three miles below the ocean’s surface, the deep seafloor boasts some of the most biologically diverse ecosystems on the planet; the perpetual darkness, intense cold and strong pressures foster unique life-forms rarely seen elsewhere, such as a newly discovered ghostly white octopus dubbed “Casper” and an armored snail that researchers believe doesn’t need to eat to survive.

The region may look lifeless, but it is home to thousands of species of tiny invertebrates fundamental to the ocean food web, says deep-ocean marine biologist Diva Amon, whose work is focused on the CCZ. The nodules themselves host microbial life forms that scientists are just starting to investigate—they play an important but poorly understood role in the nodules’ formation that may be vital for a wider comprehension of how ocean processes work. Removing them would be akin to yanking a couple of wires out of the back of your computer just because you don’t know what they’re for. “A lot of the life in the CCZ is very small, but that doesn’t mean it’s unimportant,” says Amon. “Think about our world without insects. It would collapse.”

The little data available suggests that deep-sea mining could have long-term and potentially devastating impacts on marine life. For example, in 1989, scientists simulated deep-sea mining in an area similar to the CCZ, and in those simulations, marine life never recovered, according to a recent study published in the journal Scientific Reports. Plough tracks remain etched on the seafloor 30 years later, while populations of sponges, soft corals and sea anemones have yet to return. If the results of the experiment were extrapolated to the CCZ, the authors concluded, “the impacts of polymetallic-nodule mining there may be greater than expected and could potentially lead to an irreversible loss of some ecosystem functions, especially in directly disturbed areas.”

That said, it’s a hard call, says Amon. “We want to transition to a green economy. But should that mean destroying a potentially huge part of the ocean? I don’t know.”

In June, more than 400 marine scientists and policy experts from 44 countries signed a petition stating that the ISA should not make any decisions about deep-sea mining until scientists have a better understanding of what is at stake and all possible risks are understood. The ISA requires permit holders to undertake three years of environmental-impact assessments before it will grant a commercial license, but given the slow-moving nature of the deep sea, scientists say it would be impossible to understand the impacts in such a short time. Nor is it clear on what grounds, exactly, the ISA will evaluate the results of such studies.

A few days later, the debate grew even more heated as the tiny Pacific island nation of Nauru, the ISA member sponsoring Barron’s company in a mining application, announced it wanted to start mining efforts, triggering the ISA’s “two-year rule,” a clause that allows member states to notify the organization of their intention to start deep-sea mining, even if the regulations governing mining have not yet been formalized.

A team aboard The Metals Company exploration vessel conducting a survey for species in the CCZ using a remotely operated vehicle.

Courtesy The Metals Company

It also triggered international uproar. “Deep-sea-mining companies are peddling a fantasy of untold profits and minimal risks,” says Louisa Casson of Greenpeace’s Protect the Oceans campaign. “Governments who claim to want to protect the oceans simply cannot allow these reckless companies to rush headlong into a race to the bottom, where little-known ecosystems will be ploughed up for profit and the risks and liabilities will be pushed onto small island nations.” Barron, who has invested millions of dollars in preliminary environmental-impact assessments, describes the abyssal plain where the nodules are located as a “lifeless desert” where the impact of mining is likely to be minimal, if felt at all. “I think we are overthinking this. There is a reason why they are full of battery metals. It’s so we can make batteries,” he says.

If you were to discover a cobalt seam in your backyard, the revenue would, in most cases, belong to you or your government. But much of the world’s known deep-sea metal deposits lies under international waters, which means it belongs to the world.

First discovered in the Arctic Ocean in 1868, polymetallic nodules can be found in almost all oceans, but are concentrated in the CCZ. They were widely regarded as geologic curiosities until the 1960s and ’70s, when several multinational mining consortiums started exploring the potential of the CCZ, with mixed results. Despite an estimated yield of 21 billion tons of nodules, commercial interest in mining the CCZ waned, largely because of high extraction costs and the relative abundance of existing sources of the same metals—particularly nickel—on land. Recognizing that the nodules, along with other potentially lucrative seabed mineral deposits in international waters, should be treated as a “common heritage of mankind,” the U.N. established the ISA in 1994, under the U.N. Convention on the Law of the Sea (UNCLOS). The 168-member-country bureaucracy was tasked with organizing, regulating and controlling all mineral-related activities in the international seabed area “for the benefit of mankind as a whole,” with proceeds shared among those who developed the resources and the rest of the international community.

The treaty gives the ISA two almost mutually exclusive mandates, says Aline Jaeckel, a specialist on international seabed-mining law at Potsdam University’s Institute for Advanced Sustainability Studies (IASS) in Germany: one to administer the mineral resources for the good of mankind, and the other to protect the marine environment from any harm from mining. “They are almost impossible to comply with because any mining will have environmental consequences. There is no way around that. So the question then becomes, How much harm is acceptable?”

Those conflicting mandates may explain why the ISA has yet to issue a single commercial mining permit—and why, in its nearly three decades of existence, it hasn’t even agreed on mining regulations, let alone how revenue from the globally owned resource should be distributed. So far, the ISA has awarded 18 exploration contracts in the CCZ to contractors representing China, Russia and the U.K., along with several other European, Asian and island nation-states. The U.S., which has not yet ratified UNCLOS, tacitly abides by it but has not sought any mining contracts. Once the mining regulations are formally established, exploration-contract holders can apply for commercial-mining permits.

According to the ISA’s mandate, mining revenue from those concessions should be equitably shared among members. Yet industry watchers expect that the organization will establish a royalty fee somewhere from 2% to 6% when it next meets in Kingston, Jamaica. A meeting scheduled to take place in July was postponed indefinitely because of the pandemic. In 2019, a group of 47 ISA members from Africa calculated that the proposed payment regime could lead to a return to member nations of less than $100,000 a year per country, hardly enough to “foster healthy development of the world economy,” as stipulated by the UNCLOS directive to the ISA.

The final amounts could be even less, especially if the ISA establishes more stringent environmental protections, which would require consistent monitoring, an expensive undertaking when it has to happen thousands of miles from port and three miles deep. “The more money put into monitoring, the less gets distributed to the developing states,” says Pradeep Singh, a research associate at IASS in Germany who focuses on seabed-mining issues, and who frequently attends ISA meetings as a consultant for member nations. Apart from a small number of private contractors and supporting states who could potentially receive a windfall, he says, few others would benefit.

Any member nation can sponsor a contract application, but developing nations are given preferential access to concessions with proven deposits, a practice meant to level the playing field. Most sponsoring countries work with their own government-run mining contractors. Nauru partnered with the Metals Company, giving the Canada-based startup preferential access to a 75,000-sq-km area rich in nodules. The details of the Metals Company’s agreement with the government of Nauru are not public, but according to the company’s regulatory filing with the SEC in advance of its pending public listing, the startup estimates that it will earn $95 billion over 23 years of production, of which it will pay 7.6% in royalties to Nauru and the ISA. The rest, presumably, goes to the investors that Barron is now courting.

Singh suspects that Nauru’s recent triggering of the two-year countdown to mining activity was directly linked to the Metals Company’s desire to create investor hype ahead of the listing. Either way, Barron has managed to crown what is at its core an expensive, untested and risky underwater-mining operation with a green halo, promising a surefire—and lucrative, at least for investors—shortcut for saving the planet.

A self-styled maverick with the requisite long hair, beard and leather jacket, Barron professes to be shocked that conservation groups have not wholeheartedly embraced his plan to mine the ocean for the battery metals that will help replace fossil fuels. The alternative, he says, is to keep plundering terrestrial mines with all their devastating environmental and social consequences: biodiversity loss, habitat destruction, contaminated waterways, displaced Indigenous groups and labor exploitation. “If we started mining over again, knowing what we know now, surely we would carry out extractive industries in parts of the planet where there was least life,” he tells TIME via video call. “We wouldn’t go to the rain forest. We would go to the deserts. That’s what we have here in the CCZ: the most desert-like place on the planet. It just happens to be covered by 4,000 m of water.”

A Metals Company core-sample collector shown at a harbor in San Diego on June 8, after returning from a deep-sea-mining mission.

Spencer Lowell for TIME

Core samples from a deep-sea-mining mission.

Spencer Lowell for TIME

Even if seabed mining were able to provide metals in sufficient quantities to feed growing demand for electric vehicles, it’s unlikely that terrestrial mining would come to an end. If anything, demand for the metals would increase, as manufacturers engineer based on the availability of more plentiful supplies. Nor would ocean mining necessarily be immune from the oversight problems that plague land extraction. Fishing on the high seas, for example, is highly regulated on paper, but enforcement is weak because of the difficulty and high costs of policing nearly 100 million square nautical miles of open ocean, leading to rampant abuse.

Nor is it certain that cobalt mining will even be all that important in car-battery technology going forward. To start, there are efforts among many battery manufacturers, Tesla among them, to recycle cobalt (among other elements) from spent batteries. More long-term, manufacturers have already started the shift to alternatives. Lithium-iron-phosphate options—which are jokingly referred to as rust-and-fertilizer batteries in the industry for the everyday ubiquity of their core ingredients—may have a lower energy density than cobalt versions, but engineers are willing to work around those limitations in order to reduce their dependence on imports, says Gavin Harper, a battery metals Ph.D. and research fellow at Birmingham University’s Energy Institute. “They won’t give you the extreme performance [of cobalt battery formulations], but they will give you a more than adequate performance that will meet a lot of people’s needs, without the baggage that comes with [cobalt] chemistries.” Many Chinese EV manufacturers have already made the switch, and Tesla announced in September 2020 that the batteries in its Model S will soon be cobalt-free. Even the IEA in its report noted that EV-battery manufacturers are shifting away from cobalt-rich chemistries in favor of those using cheaper, more readily available materials. “My concern is that we start mining the ocean for cobalt because it is profitable now, but once we move to next-gen batteries and more efficient recycling, we will have done irreversible damage for just a few years of profit,” says Harper.

The polymetallic nodules do contain other valuable minerals, such as nickel and trace amounts of rare earth, that could make mining them worthwhile, says Frances Wall, the principal investigator for the U.K.’s Research and Innovation Interdisciplinary Circular Economy Centre for Technology Metals. But if the nodules aren’t needed for power storage, “it just takes away that magic headline that you are mining the ocean for batteries. And without that, companies might find it harder to raise investment.” Without its green halo, the Metals Company becomes just another mining company hawking unproven riches at considerable risk.

Nor is mining in the deep sea exclusively about minerals. It’s also about access and market share. China, which holds three exploration permits in the CCZ (Russia and the U.K. each have two; every other nation that has any has one), invested early in developing deep-sea-mining machinery and is considered to be a world leader in submersible technology. After a tour of a Chinese submersible-mining-tech factory in 2017, Singh, the deep-sea-mining law expert from IASS, was convinced that the country would be the first to dive in. Instead, it seems to be holding back, he says, because leaders there appear unconvinced that nodule mining is commercially viable. As the world’s top manufacturer of solar panels, turbine parts, EV batteries and all manner of electronics, China is also unsurprisingly the world’s top importer of cobalt, buying some 95,000 metric tons annually, mainly from Congo. As long as supplies remain stable, China will have less interest in aggressively exploring seabed mining. Unless, of course, opening up a new seabed source threatens its dominance in the cobalt-refining business. “If someone is going to be at the front of the line with a cobalt supply that could compete, or threaten their position, then China is going to come quickly, and maybe even cut the line,” says Singh.

Meanwhile, China has focused investment on mining in the technologically challenging—and highly controversial—hydrothermal vent deposits of the deep sea, where it holds two additional exploration permits with the ISA. “China wants to do the stuff that nobody else has got access to yet,” says Jessica Aldred, editor of the Oceans special project at China Dialogue Trust, an independent nonprofit organization promoting environmental awareness in China.

Amon, the deep-sea marine biologist, has been going to the CCZ since 2013. Each time she returns from a research expedition, it is with a deeper understanding of the complex interactions between the creatures that live at inhospitable depths and the environment that supports them. Her research has shown that those relationships affect neighboring ecosystems as well, impacting biodiversity, feeding patterns and carbon sequestration in ways that scientists have yet to grasp. It has also shown her how much more there is to learn. Barron speaks of “plucking” nodules off the seafloor, but the mining robots work more like vacuums, sucking the nodules up along with a layer of sediment approximately 4 in. deep. Amon describes it as not just clear-cutting a forest but digging up the top 10 ft. of soil as well. She also worries that plumes of disturbed sediment could drift with ocean currents, smothering habitats miles away with unknown consequences.

A polymetallic nodule, an amalgamation of nickel, cobalt, manganese and other rare earth metals, formed through a complex biochemical process.

Spencer Lowell for TIME

Barron, who has already spent $3 million and committed a further $72 million to deep-sea research, says that preliminary findings show no such impacts. Amon argues that there hasn’t been enough time to know for sure. “No one is saying never,” she says about mining in the deep sea. “Just not yet. By rushing in, we risk losing parts of the planet and species before we know them, and not just before we know them but before we understand them and before we value them.”

Companies are starting to heed scientists’ call for a moratorium on exploration activities. In March, BMW and Volvo joined other businesses in a joint statement to say that they would not buy any metals produced from deep-sea mining before the environmental risks are “comprehensively understood.” Even the World Bank warned of the risk of “irreversible damage to the environment and harm to the public” from seabed mining, and urged caution. The mining companies argue that the ISA’s existing research requirements are sufficient. “No commercial licences will be granted by the ISA without a full environmental-impact assessment. If the science shows the deep seabed has no advantages over the alternatives, there will be no seabed-minerals industry,” says Van Nijen, of GSR. He points out that putting a stop to exploration could even be counterproductive. Both GSR and the Metals Company have already invested tens of millions in deep-seabed research. “A moratorium would put a halt to all that,” says Van Nijen. “[Stopping] exploration takes whatever certainty there is for the industry away, which means investment will disappear, which means that research isn’t funded, which means in 10 years’ time, we are in a similar boat as we are today, without a significant advance in knowledge.”

Barron may dismiss the bottom of the CCZ as a barren wasteland, but his scientists think differently. When the Maersk Launcher pulled into San Diego’s port on June 8, after a six-week research expedition to the CCZ sponsored by the Metals Company, the top deck was bustling with 21 marine scientists from eight universities packing up seafloor samples to take back to their labs for further analysis. Lead scientist Claire Dalgleish, a marine biologist working with the Seattle-based marine-consulting service Gravity Marine, peered into a box containing a 20-sq.-in. section of nodule-studded sediment that had been stamped out of the seabed with the underwater equivalent of a giant cookie cutter. Pointing with her finger, she identified several species of sea life all but invisible to the naked eye: bryozoans, algae, xenophyophores, miniscule sponges and a delicate fanlike creature called a chiton. “Initially you might look at this and think there’s nothing there,” Dalgleish says, “but there’s actually a fair amount of life. It’s just a really small scale.”

The Metals Company’s exploratory vessel, the Maersk Launcher, conducting environmental studies in the CCZ.

Courtesy The Metals Company

None of the scientists on board are ready to say what kind of impact, if any, mining will have. An assessment like that will take years of research, says principal investigator Andrew Sweetman, a marine scientist at Edinburgh’s Heriot-Watt University. This is his eighth trip to the CCZ in the past decade, and on each expedition he has discovered something new: “It’s kind of like being the only person on a planet for the first time. It comes with an enormous amount of responsibility to work out exactly what’s going on. But that’s why we’re out here.” Sweetman doesn’t want to get sucked into the controversies over deep-sea mining, but he does agree that without mining interest, research like his wouldn’t be happening much at all. “With all the investment that the mining companies are putting into the Clarion-Clipperton Zone, it’s probably going to be one of the most well-studied areas on the planet by the time we’re finished,” he says.

Whether or not that research will open the deep sea to mining, he doesn’t know. What he does know is that in the drive to save the planet from human-induced global warming, there will have to be trade-offs. “I’m not for mining, and I’m not against it. We all have to look in the mirror and realize that in order to get electric cars or a new cell phone or a new computer, tons and tons of rock will have to be extracted from either the ocean or the land,” he says. “All I’m trying to do is get the best environmental data so that if mining does go ahead, we know with a good level of confidence what’s potentially going to be damaged, and what the effects are going to be. And then it’s up to society to make the decision to go ahead.”

—With reporting by Charlie Campbell/Beijing and Corinne Purtill/San Diego

This appears in the September 13, 2021 issue of TIME.

No comments:

Post a Comment