Executives at JPMorgan Chase, FedEx, and others have spoken out publicly against Biden’s proposed tax increases.

President Joe Biden participates in a virtual meeting on Infrastructure Investment and Jobs Act at South Court Auditorium at Eisenhower Executive Office Building on Aug. 11, 2021 in Washington, D.C. Photo: Alex Wong/Getty Images

Akela Lacy

September 6 2021,

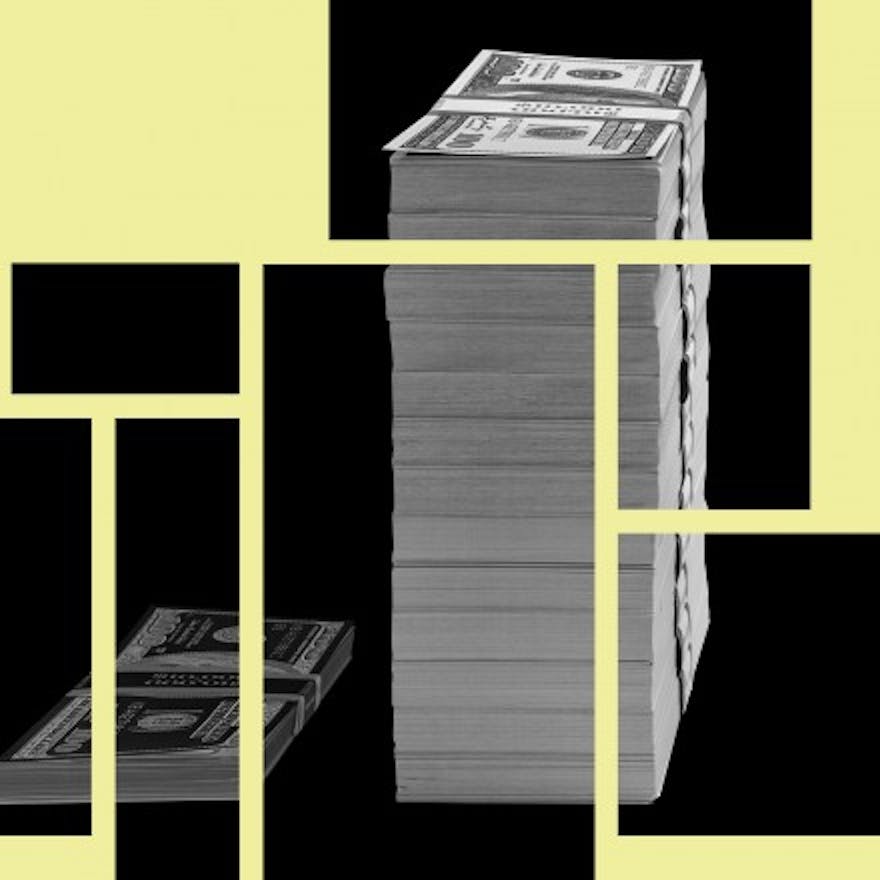

AN INFRASTRUCTURE PROPOSAL that would raise the corporate tax rate is facing opposition in Congress from companies that have dodged tens of billions of dollars in taxes over the last decade. Several such companies are lobbying against corporate tax increases and measures designed to crack down on tax havens in President Joe Biden’s economic proposal.

Biden’s American Jobs Plan would raise the corporate tax rate to 28 percent to help fund projects to rebuild highways and roads, expand high-speed broadband, build and renovate schools, and expand and upgrade power lines. Meanwhile, his American Families Plan would allocate $1.8 trillion over 10 years for education, child care, and national paid leave. To help fund those programs, he proposed a 39.6 percent capital gains tax for millionaires — almost double the current rate of 23.8 percent — and an increase in the marginal income tax rate for the top 1 percent, from 37 percent to 39.6 percent.

Highway construction on Interstate 285 near the interchange with State Road 400 in Sandy Springs, Ga., on July 14, 2021.

Photo: Elijah Nouvelage/Bloomberg via Getty Images

Companies that use such practices to avoid taxes and lobbied earlier this year on issues related to tax rates in Biden’s American Jobs Plan include Walmart, Oracle, Accenture, Bristol Myers Squibb, Shell, and Walgreens. Executives at companies that have historically avoided paying taxes, like Johnson & Johnson, JPMorgan Chase, FedEx, and DuPont, have spoken out publicly against Biden’s proposed tax increases.

Shell and Walgreens lobbied earlier this year on corporate tax issues in the American Jobs Plan. Walmart hired a lobbying firm tasked with “monitoring of tax proposals related to infrastructure” in the plan and proposed legislative efforts related to Donald Trump’s 2017 tax cuts. Accenture hired another firm to “monitor the American Jobs Plan as it relates to corporate taxes.” Oracle and Bristol Myers Squibb, a multinational pharmaceutical company, used the same firm hired by Accenture to monitor and lobby on similar issues in the proposal. Oracle also used that firm to monitor the American Rescue Plan, Biden’s first Covid-19 relief package, for provisions related to corporate taxes. Oracle spokesperson Jessica Moore said the company “has not lobbied on Corporate Tax issues since the new Administration.”

Nonprofit and media reports in recent years have found that those companies are among dozens of multinational corporations that have avoided tens of billions of dollars in taxes in recent years, and have used a variety of tax evasion mechanisms both in the U.S. and overseas, leading some to face fines and even criminal charges.

A Reuters report last year found that from 2018 to 2019, Shell reported $2.7 billion through offshore tax havens and avoided paying hundreds of millions of dollars in taxes. In 2019, Australia charged Shell $755 million for six years’ worth of taxes the company did not pay. The company reported that after getting tax refunds related to the closure of oil platforms, it paid no corporate income tax in the U.K. in 2018 on $731 million in profits. In 2013, India alleged that Shell had evaded taxes by underpricing a transfer of shares in 2009 by $2.8 billion.

A 2016 report from the U.S. Public Interest Research Group, Citizens for Tax Justice, and the Institute on Taxation and Economic Policy found that Bristol Myers Squibb held $25 billion across 23 tax haven subsidiaries. In 2012 the company set up a tax haven subsidiary in Ireland, which the IRS later described as an “abusive” tax shelter that could allow the company to avoid paying $1.4 billion in taxes.

Between 2008 and 2014, Walmart held more than $23.3 billion in offshore accounts and avoided paying more than $4.59 billion in U.S. taxes, according to a 2016 Oxfam report. In an arrangement internally known as “Project Flex,” the company routed money through an allegedly fictitious Chinese subsidiary, Quartz reported, which allowed it to avoid paying $2.6 billion in U.S. taxes between 2014 and 2017. The 2016 report from the U.S. PIRG, CTJ, and ITEP also found that Walmart reported zero tax haven subsidiaries despite having as many as 75. A 2013 report from CTJ found that the company held $19.2 billion in profits in offshore tax havens and did not disclose the U.S. tax rate it would pay if that money were repatriated.

Related

Race and Taxes

A 2015 report from Americans for Tax Fairness found that Walmart put $76 billion of assets in 78 subsidiaries across 15 tax havens where the company did not have stores. The report found that in 25 of 27 countries where Walmart has stores, the company operates through shell companies held in tax havens. In Luxembourg, where Walmart does not have stores, the company has 22 shell companies to which it transferred ownership of more than $45 billion in assets since 2011. The report claimed that in 2014, Walmart took $2.4 billion in low-interest loans from its tax haven subsidiaries, allowing U.S. affiliates to access foreign earnings without paying U.S. taxes, which the report said “may transgress the intent of U.S. law.” A 2014 analysis by the same group found that Walmart avoids paying $1 billion a year in taxes by exploiting U.S. tax loopholes, and that the company used various methods to dodge paying taxes on $21.4 billion in offshore profits in 2013 — more than double the profits it dodged taxes on in 2008. A 2011 report from Good Jobs First found that Walmart used tax avoidance schemes, including deducting rent payments to itself, to avoid $400 million in local and state taxes each year.

Walgreens is among several major retailers that have been accused of using a legal tactic to reduce their property taxes by pursuing reductions in the assessed value of their properties. After public outcry, the company backed off a decision in 2014 to move its U.S. headquarters overseas, a change that would have allowed the company to avoid some $4 billion in taxes. The 2016 report from U.S. PIRG, CTJ, and ITEP found that Walgreens had 71 subsidiaries in tax havens, including 23 in Luxembourg alone.

Buildings stand at the Oracle Corp. headquarters campus in Redwood City, California, on March 14, 2016.

Photo: Michael Short/Bloomberg via Getty Images

A 2016 Oxfam report found that Oracle held more than $38 billion in offshore accounts between 2008 and 2014 on which the company avoided paying $8.3 billion in U.S. taxes. The 2016 U.S. PIRG, CTJ, and ITEP report found that the company held $42.6 billion in five subsidiaries in offshore tax havens on which the company paid a 3.8 percent tax rate. The 2013 report from CTJ showed that in that fiscal year, Oracle held $20.9 billion in offshore tax havens on which if paid a 30 percent tax rate while the U.S. tax rate was 35 percent.

In 2019, Oracle Corporation Australia was charged more than $300 million for avoided, withheld, and backed taxes. Oracle Korea was fined $275 million in 2017 for alleged tax evasion that allowed the firm to dodge taxes for seven years by using tax havens abroad. A 2012 study commissioned by a member of the British Parliament found that Oracle had paid nothing in corporate taxes in the U.K. that year on a projected 446 million pounds in profits. Oracle declined to comment on these findings.

In 2019, Accenture paid $200 million in a settlement following reporting from the International Consortium of Investigative Journalists on leaked documents — the 2014 “Lux Leaks” scandal — revealing that major multinational companies avoided global taxes by entering into secret tax agreements with the government of Luxembourg. In 2010, acting through PriceWaterhouseCoopers, Accenture processed a transfer of intellectual property rights from Switzerland to Ireland through Luxembourg. Documents obtained as part of Lux Leaks showed that the value of the assets rose almost 600 percent in 48 hours from $1.2 billion to $7 billion, zero of which was taxed in Luxembourg. The company successfully lobbied the U.S. government in the early 2000s to move its place of incorporation to Bermuda to avoid taxes. When the government planned to change tax policies that would jeopardize Bermuda’s tax haven status, the company — which says it has no headquarters — moved its place of incorporation to Ireland. Accenture did not provide comment by the time of publication.

A 2012 report by the Sunday Times found that Accenture was able to lower its tax rate in the U.K. to less than 3.5 percent, while the nation’s standard rate was 24 percent.

Frederick Smith, chair and CEO of FedEx, speaks during the U.S. Chamber of Commerce Aviation Summit in Washington, D.C., on March 7, 2019.

Photo: Anna Moneymaker/Bloomberg via Getty Images

CONGRESS HAS BEEN struggling to pass the much-awaited bipartisan bill, and negotiations are ongoing (the Taliban’s takeover of Afghanistan and the withdrawal of U.S. troops last month put talks somewhat on hold). It’s unclear whether the measure will have enough support to pass. Democrats control the White House and both chambers of Congress but have had little luck moving forward on a number of Biden’s administrative goals even as calls to abolish the filibuster gain support.

Meanwhile, executives at other major companies that have reportedly dodged billions of dollars in taxes around the world have also spoken out against Biden’s plan to increase their taxes.

In April, Joseph Wolk, Johnson & Johnson’s executive vice president and chief financial officer, criticized the proposed corporate tax increase because it would make the U.S. “the highest-rated developed country in the world with respect to tax rates,” and said that the issue is something “we need a little more fact-based dialogue on and making sure that we remain competitive.” Following news of Biden’s proposal, strategists at JPMorgan Chase said the administration’s policies were “no longer so unambiguously positive.” Asked about Biden’s plan in May, JPMorgan Chase Chair and CEO Jamie Dimon said, “We already waste tremendous sums of money,” and the “notion that you can have uncompetitive corporate taxes and you can be a competitive nation is a little crazy.” FedEx Chair and CEO Fred Smith came out against Biden’s proposal in April and wrote in an email to staff that it would “reduce capital investment and significantly degrade U.S. competitiveness.” The same month, DuPont EVP and CFO Lori Koch said the proposed changes would put companies based in the U.S. “at a disadvantage” because they “would be subject to higher tax rates on their foreign earnings than their foreign competitors.”

Between 2013 and 2015, Johnson & Johnson reportedly dodged more than $1.7 billion in global taxes, including more than $1 billion in the U.S. alone, according to a 2018 Oxfam report. A 2016 report from the same group found that the company had avoided paying more than $16 billion in taxes between 2008 and 2014 by housing some $53 billion in offshore accounts. Johnson & Johnson did not respond to requests for comment.

Related

Tax Havens and Other Dirty Tricks Let U.S. Corporations Steal $180 Billion From the Rest of the World Every Year

JPMorgan Chase avoided $12 billion in U.S. taxes between 2008 and 2014 by holding more than $31 billion in offshore accounts, according to a 2016 Oxfam report. Another Oxfam report that year found that 96.8 percent of the bank’s foreign subsidiaries were housed in tax havens and that it only reported 0.9 percent of those on its 2014 10-K report to the Securities and Exchange Commission. The report also noted that the bank estimated its deferred tax bill from offshore accounts at $7 billion. A 2013 report from CTJ found that in that fiscal year, the bank disclosed that it held more than $25 billion in offshore tax havens on which it paid a 23 percent tax, 12 points below the 35 percent corporate tax rate that year.

In 2015, French prosecutors filed criminal charges against a unit of the bank for “alleged complicity in tax fraud,” the Wall Street Journal reported. The case was later thrown out because of “clerical errors.” According to the 2014 Lux Leaks report from the International Consortium of Investigative Journalists, JPMorgan Chase and FedEx were among companies that secured lucrative secret tax deals with the Luxembourg government that allowed them and other major companies to largely avoid global taxes. Members of the European Parliament subsequently investigated the country’s tax code and money-laundering schemes, and later took action to force Luxembourg to change its tax laws and follow new rules approved following the scandal. In 2012, the bank was in talks with the U.K. government to pay a 500 million pound settlement after it was found that the company used a tax-avoidance scheme there. The bank declined to comment.

FedEx used tax avoidance strategies that allowed the company to pay a negative 4.6 percent tax rate in 2018, according to a 2019 ITEP report. The same report showed that DuPont used government subsidies and tax avoidance strategies to pay a negative 54.8 percent tax rate in 2018 and avoided paying $119 million in taxes that year.

DuPont paid no net state income tax from 2008 to 2010, a net negative of $12 million, according to a 2011 report from ITEP and CTJ. A 2013 report from the same group found that the company held more than $13 billion in offshore tax havens. Before Dow Chemical and DuPont split in 2019, the merged companies agreed to pay a $1.75 million fine to the SEC after failing to disclose $3 million in perks given to Dow’s former chief executive.

The net effect of these tax dodges is catastrophic. According to a 2016 report by Kimberly Clausing, the Eric M. Zolt Chair in Tax Law and Policy at the UCLA School of Law who was appointed in February as deputy assistant secretary for tax analysis at the Treasury’s office of tax policy, the U.S. loses more than $111 billion each year due to tax dodging by multinational corporations.

“Lobbyists have already created so many loopholes in our tax code that help the rich and powerful and big corporations,” Sen. Elizabeth Warren, D-Mass., a member of the Senate Committee on Banking, Housing, and Urban Affairs, said in a statement to The Intercept. “The American people understand what’s going on here and this is our opportunity to put a stop to it. [Maine Sen.] Angus King and I are pushing for a corporate profits tax that is essentially a minimum tax for the richest companies — no loopholes — that will allow us to increase tax revenue and help pay for these infrastructure investments we badly need.”

No comments:

Post a Comment