IEEFA: Accepting gas power plants as sustainable investments in Asian taxonomies heightens greenwash risk

Accommodating the gas sector risks diluting standards and discouraging new pools of green capital

21 September 2021 (IEEFA Asia): Incorporating gas-powered generation as a sustainable investment into Asian taxonomies could have unintended consequences, finds a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

Doing so could lock Asia into a high-emitting future while also posing a credibility and greenwashing problem that Asian policymakers and ESG debt investors would be wise to avoid.

This is particularly important as Europe and the U.S. ramp up their climate ambition, with the U.S. Treasury releasing a guidance last month requesting multinational development banks rapidly align portfolios with the Paris Agreement, develop targets for green bonds, ‘green’ the partnerships with financial intermediaries, and align policy based operations with climate goals.

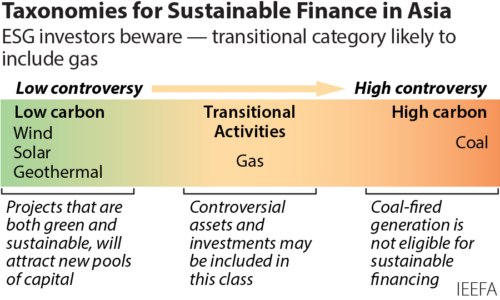

A taxonomy specifies the technical requirements of an asset or project that companies must satisfy to enable the labelling of the project as a green or sustainable investment, giving ESG investors reliable information on where to deploy capital to support the acceleration of a sustainable energy transition.

There are many Asian taxonomies in preparation

However, the report notes that controversial or ‘transitional’ economic activities such as gas-powered generation are likely to be recognised in Asian taxonomies as sustainable investments, with energy policy planners attempting to justify the merits of gas and LNG as a reasonable bridging fuel to greening the economy.

There are many Asian taxonomies in preparation that are designed to prioritise an ‘orderly transitional pathway’, including a regional taxonomy for Southeast Asia.

While most Asian taxonomies have yet to acknowledge the undue influence of the oil and gas industry, this will be controversial going forward as the region contemplates replacing coal-fired generation with gas-fired power.

“Gas is a fossil fuel and its high emissions—like coal’s—do not equate to it being a sustainable asset,” says report author Christina Ng.

“And after more than a decade’s effort, carbon capture is yet to be proven as economically and technically viable at scale, which creates a credibility issue for labelling gas power plants as sustainable investments.”

The report notes that financial institutions could also be entangled in greenwashing risk as many of them are lenders to gas-related power projects and are green/sustainable bond issuers themselves.

Financial institutions could be entangled in greenwashing risk

If a taxonomy recognises gas-powered assets as sustainable investments the proceeds from their green or sustainable bonds could be used to finance those assets. Under this scenario any such financial institution would fail the ESG market test.

Ng says policymakers and regulators that are hoping to unlock new pools of capital and meaningfully attract leading ESG investors must rationalise the issues related to gas as a sustainable investment or risk discrediting its taxonomy.

“Asian policymakers must anticipate the rigour with which ESG investors are analysing assets and using taxonomies in the most dynamic global markets,” says Ng.

The report notes policymakers considering adding gas-powered plants to an Asian taxonomy should consult widely first and consider what ESG debt investors—whose capital will determine the usefulness of a taxonomy—will be willing to fund under the sustainable label.

“ESG debt investors would need to be even more forensic in their research on what the different taxonomies will recognise and, as a result, what issuers will sell as ‘sustainable’,” says Ng.

ESG debt investors would need to be even more forensic in their research

“Investors could also be proactive and voice their concerns now over the direction of taxonomy discussions.”

Ng notes the existence of a sustainable finance taxonomy does not prevent projects that the taxonomy excludes—such as gas or carbon abatement projects—from being financed through conventional sources of finance. They just would not be labelled sustainable investments or qualify for sustainable debt instruments.

“If Asian policymakers and regulators want market development to proceed smoothly and taxonomies to be influential, now is the time to appreciate that industry is only one voice in market creation,” says Ng.

Media contact: Kate Finlayson (kfinlayson@ieefa.org) +61 418 254 237

Author contact: Christina Ng (cng@ieefa.org)

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)

No comments:

Post a Comment