Hydrogen Goes Nuclear as U.K. Reactor

Pivots Toward Renewables

TWO MYTHICAL TECHNOLOGIES CREATE A CHIMERA

, Bloomberg News

(Bloomberg) -- The $28 billion Sizewell C nuclear station is touted as an anchor for Britain reaching net-zero emissions, yet its reactors will compete with wind farms over the North Sea horizon. On gusty days, where will the plant’s excess power go? Toward making hydrogen.

Nuclear developers in Europe, North America and Russia are looking at the clean gas as an outlet for their low-carbon power to maximize revenue from one of the most expensive energy assets on the planet. They also want to capitalize on the $70 billion-plus pledged by governments to help develop the industry as a way to reach climate goals.

Electricite de France SA wants to make hydrogen at the proposed 20 billion-pound Sizewell C plant on the southeast coast, marking the first time these technologies would be combined on a commercial scale in Europe. With enough supply, clean hydrogen could meet a quarter of the world’s energy needs by 2050, and annual sales have potential to reach 630 billion euros ($744 billion).

“The amount of clean hydrogen that we’re going to need to really decarbonize our economic sectors is just immense,” said Elina Teplinsky, a Washington-based partner at Pillsbury Winthrop Shaw Pittman LLP who focuses on nuclear projects and deals. “We need all of the hydrogen production sources that are available -- we’re going to need nuclear.”

Electricity grids want more renewable-power sources as nations commit to reducing greenhouse gas emissions to the point where their economies are carbon-neutral. Operators are preparing to run networks on 100% renewables at some times of the day, meaning nuclear, natural gas and coal sources won’t be needed. And that means less revenue for those plant owners.

On the days when wind, solar and hydropower produce enough, the low-carbon electricity generated by Sizewell C would be diverted to an electrolyzer producing clean hydrogen. The waste heat produced by the atomic plant also can be used to make the process 10% more efficient, according to EDF. If the company secures planning permission and the necessary financing, the facility likely will come online in the early 2030s.

“It’s not nuclear versus wind versus solar - we need to use everything and cooperate to make the most of the technologies,” Julia Pyke, Sizewell C’s financing director, said in an interview. “Ideally, you’d have the electrolyzer supplied both by nuclear and by wind.”

The U.K.’s long-awaited hydrogen strategy is expected to be technology neutral, leaving the door open for reactors. That blueprint could be released in coming days.

EDF’s plans were imperiled amid reports Britain wants to oust China’s state-owned nuclear energy company from all future power projects. The Chinese have a 20% stake in Sizewell C, but the U.K. government says the project will move forward with alternative financing.

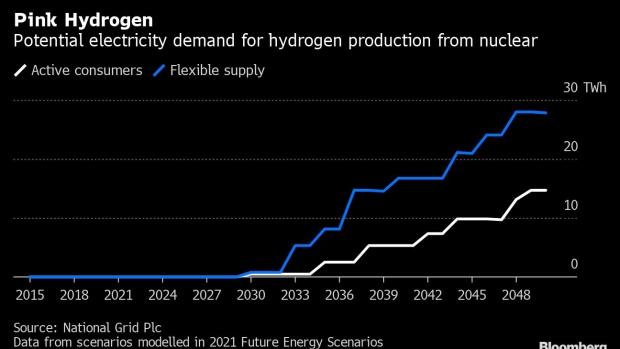

Hydrogen produced using nuclear fuel is dubbed “pink hydrogen” within the industry. The U.K. grid operator, National Grid Plc, modeled production of the fuel in its long-term report this year for the first time. As much as 28 terawatt-hours of electricity from reactors could be siphoned off to make the clean gas by 2050 – the equivalent of about 14% of the nation’s production.

Trial runs to pair these technologies also are being held in North America. The U.S. Department of Energy has awarded $26.2 million to two projects run by Xcel Energy Inc. and FuelCell Energy Inc. to help nuclear plants switch between electricity generation and hydrogen production when necessary.

Bloom Energy and the Idaho National Laboratory are testing an electrolyzer run on nuclear-generated electricity.

“This expands the markets for nuclear power plants,” said Tyler Westover, project lead at the laboratory.

Canada gets almost 15% of its electricity from nuclear stations and is looking to expand production using small modular reactors. In its hydrogen strategy published in December, the government outlined a role for nuclear electricity to produce hydrogen at off-peak times. Bruce Power LP is studying the economics and opportunities for the two technologies.

Achieving net-zero emissions by 2050 could require as much as $173 trillion in investments globally, according to BloombergNEF. By then, Britain’s energy market will have transformed: renewable capacity is expected to triple while electricity demand doubles. The U.K.’s Nuclear Industry Association estimates that a third of the nation’s hydrogen could come from atomic energy.

But there are questions about the economics of this marriage and whether it’s the most efficient use of investor money. Hydrogen and nuclear are capital-intensive industries by themselves, and combining the two will only increase project costs, said Rob Gross, professor at Imperial College London and director of researcher UKERC.

“The proposition would take a very expensive thing – a nuclear power station – and add on another expensive thing – hydrogen production,” he said.

While the two are highly combustible, the nuclear fuel is nowhere near the hydrogen being produced.

Germany, the continent’s biggest economy, turned its back on the technology after the 2011 disaster at Japan’s Fukushima plant, a stand that’s made cutting emissions more difficult. Belgium and Spain also plan to exit atomic energy.

With ample supply, Russia could be the first to deliver nuclear-produced hydrogen.

EDF signed a cooperation agreement in April with Rosatom Corp., which operates 38 nuclear units at 11 sites. Rosatom says developing hydrogen production is a priority, and it plans to export the fuel to Europe. The same type of smaller reactor -- purpose-built to produce hydrogen -- is being considered by both the U.K. government and Rosatom.

The U.K. has set a target for 5 gigawatts of hydrogen production by 2030, envisioning its use in road transportation, home heating and ship propulsion. EDF currently runs 27 plants in the U.K. and France, and is building two more. Sizewell C would be its 30th.

“The nuclear industry does need to broaden its ambition and recognize the value of these opportunities,” said Kirsty Gogan, managing director of consultant Lucid Catalyst in London and member of a government nuclear advisory board. “We have started to see this happening.”

©2021 Bloomberg L.P.

The Drift: Could the mining industry consider the nuclear option to power remote mines?

Is there a viable marriage between mining and nuclear power? Laurentian University researcher François Caron aims to find out.

There are 10 off-grid operating mines in remote areas of Canada, most of them reliant on diesel generation.

That'll be a no-go in the years to come as the mining industry faces mounting pressure from society, government climate change legislation, even environmentally conscious investors, to cut its greenhouse-gas emissions and carbon footprint.

To be able to power potential mining camps in greenfield areas where grid power doesn't reach, the nuclear energy option is being increasingly examined.

Helping to put the pieces together is Caron, the director of the Energy Centre at MIRARCO (Mining Innovation, Rehabilitation, and Applied Research Corporation), a research arm at the Sudbury university.

Caron was the lead author on a new study examining the feasibility of using very small nuclear reactors (vSMRs) to power a mining operation at a remote, off-grid, site.

"The mining companies are very, very curious," said Caron, who also holds the title at MIRARCO of the Bruce Power Chair in Sustainable Energy Systems.

Small nuclear reactors are categorized as generating up to 300 megawatts of power. The very small nuclear reactors (vSMRs), a subcategory of reactors studied in this report, produce up to 10 megawatts per module.

An undisclosed mining company, operating in the Arctic, provided data for the study involving a hypothetical mine with a 14-year mine life.

The company helped partially fund the research along with Ontario Power Generation (OPG) and Canadian Nuclear Laboratories (CIL).

Part of putting the economic case together was figuring out if these remote operations can be powered by nuclear energy alone or combined with other fuel sources, such as wind energy and battery storage technology.

Caron's research determined the most cost-effective way is using a blend of nuclear and diesel.

Nuclear energy generated from vSMRs could be used 90 per cent of the time – as the baseload source of energy – with diesel augmenting the peak demands of power, such as for wintertime heating. It's considered a more reliable and consistent energy mix.

Compared to strictly diesel power used by remote mines today, this mix would reduce emissions by 85 per cent. Despite being greenhouse gas-emitting, diesel is considered a more reliable source of power – being easier to switch on – than more environmentally friendly alternatives like wind energy.

The report said emissions could be further lowered by adding other renewables to the mix – rather than using diesel. But the trade-off is that it slightly increases operating costs.

The reactor type they are using in the study was developed by USNC Power, a Seattle-based vendor of micro-modular nuclear reactors.

The reactor's maximum operating life is up to 60 years – possibly outlasting the longevity of an actual mine – with the reactor cores replaced every 20 years. After that, these modules are dismantled and taken away to be properly disposed of.

Among the advantages of vSMRs is that they're easily delivered to a remote site, atop a flatbed truck or by barge on a waterway. The reactor core, Caron said, is the size of a refrigerator. VSMRs are also scalable.

One reactor module could be deployed to serve the actual mining operation, one for the processing plant, and another for the worker accommodations camp. Any excess power, or an added module, could serve a neighbouring community.

Another advantage is nuclear energy also isn't prone to extreme fuel price fluctuations. Then there's always the potential for a spill and the costs associated with soil remediation.

Fabricating and installing a vSMR is an expensive endeavour, so more work needs to be done on the costing side. But the unit cost of energy diminishes over time and by adding more energy consumers.

So far, Caron said, they've had many positive interactions with three mining companies interested in deploying nuclear energy, none of them with mines or projects in this province's Far North.

"The mining companies we've dealt with have no connection to the Ring of Fire."

Prior to joining Laurentian in 2000 to work in biochemistry, environmental and earth sciences, Caron was a research scientist with Atomic Energy of Canada, specializing in waste management systems, environmental research, reactors emissions reduction, and reactor chemistry.

Caron's and MIRARCO's paper builds on other studies assessing whether nuclear energy can work at mining camps in the Far North.

Engineering firm Hatch released a 2016 feasibility study for the Ontario Ministry of Energy on small reactors. NRCan advanced the conversation with its SMR Roadmap study in 2018.

Caron said it'll be a while before people start seeing mining companies adopt this technology for the field.

"We're not quite at that stage. This is still conceptual. We're getting closer to the real dollar figures."

A demonstration plant is in the works to prove out this technology. One is being planned on the grounds of the Canadian Nuclear Laboratory at Chalk River, a two-hour drive east of North Bay.

Ontario Power Generation and USNC are teaming up to build and operate such a model plant for future small reactor placements.

The Global First Power project received Canadian Nuclear Safety Commission approval in May to move to the next phase of licensing with the start of a technical review, moving the test plant closer to construction. Making the project a reality depends on federal government funding.

The project timelines say construction would start next year with the reactor operating by 2026. There's been the suggestion that vSMRs provide such an attractive source of energy that it could deployed in the field by the latter half of this decade.

Caron prefers to wait and see what happens with the Chalk River demonstration project.

He acknowledges wider discussion, engagement and education need to take place on the matter of deploying nuclear power in remote and sensitive areas of Canada. The mere mention of nuclear power has a stigma and fears associated with it.

Caron noted there have been informal discussions about assessing other similar small reactors types, from other vendors, which might be ready in two or three years' time.

OPG's Darlington nuclear plant is being talked about as an on-grid small reactor, and Bruce Power has expressed interest in hosting one as well.

In Russia, state-owned Rosatom placed a floating small reactor on a barge that was put online in northern Russia to power a town a year and a half ago. Rosatom plans to build a small-scale land-based nuclear plant in the eastern Russian Arctic with aims to produce power from a 50-megawatt plant by 2028. It will result in a two-fold reduction in the cost of electricity in that region.

Caron said more study needs to be done on the greater business case such as how power purchase agreements could be structured between mine owners and nuclear operators, the cost and environmental trade-offs in extending power lines to remote mining sites, and the larger issue of how nuclear waste should be disposed of in Ontario, all beyond the scope of his current work.

The Drift features profiles on the people, companies and institutions making important contributions to Greater Sudbury’s mining sector. From exploration, operation and remediation to research and innovation, this series covers the breadth of mining-related expertise that was born out of one of the world’s richest mining camps and is now exported around the world.

Two projects take aim at nuclear waste issue

Scott Miller

WINGHAM, ONT. -- In a couple of weeks time, a massive drill will be digging into a farmer's field north of Teeswater, to see if what’s under the ground could permanently house all of Canada’s most radioactive nuclear waste.

“That’s a big part of putting things together to understand the safety and suitability of this site for a potential repository, so it’s a very exciting time,” says Martin Sykes, a senior geoscientist with the Nuclear Waste Management Organization (NWMO).

As the NWMO spends the next year examining the rock under Bruce County fields to find out if it really could support housing Canada’s first permanent nuclear waste facility, scientists in Eastern Canada will be trying to recycle that used nuclear fuel -- 5.5 million radioactive bundles worth.

“Essentially, instead of putting the waste in the ground, we could take it, get some of the remaining energy out of it and turn it into clean energy, using nuclear power,” says Rory O’Sullivan, CEO of Moltex Energy in New Brunswick.

Moltex and Ontario Power Generation have teamed up to try to recycle Canada’s used nuclear fuel bundles, which are currently stored in above-ground containers at Canada’s nuclear plants, and eventually bound for an underground storage facility either in South Bruce or Ignace, Ont.

O’Sullivan says if their project works, there would still be radioactive waste left over that needs to be managed, but there would be less of it, and it would be less radioactive.

“We can’t get rid of all the waste. It’s not a magic solution, but the aim is to reduce the amount of high-level radioactive waste that goes into the repository."

So why the rush to find permanent storage, ask those in South Bruce opposed to the potential permanent Deep Geological Repository (DGR) in their municipality.

“Technology is advancing at a very fast pace, so why not take a chance with later, and find a technology that really does neutralize this stuff,” says Bill Noll, from the group Protect our Waterways-NO DGR.

For those locals in favour of the $23-billion project, there’s excitement about the borehole drilling getting underway.

“It will be yes or no, we can host it or we can’t. Whether or not the site is suitable comes down to the rock,” says Sheila Whytock, from the group Willing to Listen-South Bruce Proud.

The NWMO will choose between South Bruce and Ignace by 2023 and construction of the underground nuclear waste facility could begin as early as 2033.

O’Sullivan says they’ll spend the next three to four years figuring out if their nuclear waste recycling program will work or not.

As work starts to see if Bruce County can house the waste, others are researching recycling some of it. CTV London's Scott Miller explains.

Poll suggests South Bruce residents don't want nuclear waste

Bruce Power sets net zero goal for 2027

Bruce Power reactor refurbishment marks one-year milestone

Small modular reactors coming to Ontario, but some say not soon enough

Big step begins Thursday in search for used nuclear fuel home

Mark Winfield’s recent take on the issues that face Ontario’s electricity sector and ratepayers is puzzling. It mischaracterizes nuclear power as not being part of the solution to climate change, and it ignores the many benefits nuclear is providing and has the potential to supply in the years ahead. Nuclear innovation will support global healthcare workers through the COVID-19 pandemic and beyond, address energy concerns in rural and Indigenous communities, and help Canada (indeed the world) meet climate change targets and the goal of net-zero emissions by 2050.

Let’s get this straight – nuclear power is the anchor keeping down the price of electricity in Ontario and will continue to be for years to come. Refurbishments at Darlington and Bruce Power are proceeding safely and cost-effectively while supporting jobs and economic recovery through our manufacturing supply chain. A 2017 report by Ontario’s Financial Accountability Office stated, “there is currently no portfolio of alternative low emissions generation which could replace nuclear generation at a comparable cost.” The notion that nuclear is somehow hindering affordability for Ontario ratepayers is just plain wrong.

Nuclear has given the province so much more than just affordable electricity – it provides the chance to reach Ontario’s climate change goals. It was nuclear power, not renewables, that drove Ontario’s elimination of coal-powered generation over the past decade. Nuclear was responsible for 89 per cent of the greenhouse gas emissions reduction achieved by displacing coal in Ontario. Smog days fell from 53 in 2005 to zero by 2015.

The federal government has been clear over the past year. There is no credible path to net-zero without nuclear power. In fact, our emissions would rise without it. We can leverage the potential that clean baseload electricity from nuclear holds to further innovate, electrify and decarbonize. Whether it’s through small modular reactor development (SMRs) to assist remote communities move away from diesel-powered generators among other applications, or to mass-produce hydrogen fuel for use across Canada, the opportunities stemming from nuclear are immense. Ontario Power Generation and Bruce Power both launched net-zero strategies last fall and the nuclear industry is excited to be an innovation leader in this respect.

Canada’s nuclear industry is also a global leader in the supply of medical isotopes, producing 40 per cent of the supply of Cobalt-60, an isotope used to treat cancer and sterilize medical equipment including gowns and swabs. Think about how critical this has been over the past 12 months in helping our frontline workers around the world in the fight against COVID-19.

There are many tangible benefits provided by Ontario’s nuclear industry. And nuclear innovation is poised to revolutionize the fight against climate change and global disease – all while providing the clean, affordable electricity Ontarians need and can rely on.

In summary, Ontario’s nuclear industry is ready and poised to help lead Canada’s post-pandemic recovery and the global clean energy transition in the years ahead. And it will do so while keeping the price of electricity down for ratepayers.

Photo: Shutterstock.com, by Yurchanka Siarhei

Do you have something to say about the article you just read? Be part of the Policy Options discussion, and send in your own submission, or a letter to the editor.

Taylor McKenna is project manager for Ontario’s Nuclear Advantage, an ongoing public communications campaign focused on maintaining support for nuclear energy across Ontario.

Bruce Power & Westinghouse Electric to

pursue applications for micro nuclear reactors

in Canada’s remote mines & communities

Bruce Power and Westinghouse Electric Company today announced an agreement to pursue applications of Westinghouse’s leading eVinci™ micro reactor program within Canada, to provide a reliable source of carbon-free energy. The agreement supports efforts by the federal and provincial governments to study applications for nuclear technology to reach their goal of a Net Zero Canada by 2050.

The eVinci micro reactor is a next-generation, small battery for decentralised generation markets and micro grids such as remote communities, remote industrial mines and critical infrastructure. It is designed to provide competitive and resilient power and superior reliability with minimal maintenance and its small size allows for standard transportation methods and rapid, on-site deployment. The reactor core is designed to run for three or more years, eliminating the need for frequent refuelling.

The key benefits of the eVinci Micro Reactor are attributed to its solid core and advanced heat pipes. The heat pipes enable passive core heat extraction, allowing autonomous operation and inherent load following capabilities. These advanced technologies together make the eVinci Micro Reactor a pseudo “solid-state” reactor with minimal moving parts.

“Small modular and micro reactors represent an incredible opportunity to bring GHG-emission free, affordable energy to the farthest regions of our province, supporting resource and economic development across our country,” said Greg Rickford, Minister of Energy, Northern Development and Mines. “Today’s announcement further positions Bruce Power and Ontario as a global leader in nuclear innovation. I’m proud to see the technology that will power tomorrow being advanced right here in Ontario.”

“Our eVinci technology can provide clean, reliable energy to remote areas and industrial applications across Canada,” said Patrick Fragman, President and Chief Executive Officer, Westinghouse Electric Company. “We are proud to partner with Bruce Power to power the future with carbon-free, affordable electricity that will provide Canadian communities with increased energy flexibility and security.”

Over the next year, the work between the two companies will focus on furthering the public policy and regulatory framework; assessing the economic, social and environmental contribution of the eVinci technology compared to alternates such as diesel or other fossil fuels; identifying potential industrial applications; and accelerating the roadmap for Canada to host a globally recognised demonstration as part of the federal small modular reactor (SMR) action plan.

“Bruce Power and Westinghouse Canada have a strong existing relationship and as Canada seeks new innovative options to build on its existing clean, CO2-free nuclear advantage, this is an exciting opportunity to advance further towards a Net Zero Canada by 2050,” said Mike Rencheck, President and CEO of Bruce Power. “Bruce Power will leverage our relationships and capacity within the Nuclear Innovation Institute (NII) and Laurentian University-based Mining Innovation, Rehabilitation and Applied Research Corporation (MIRARCO) towards this exciting opportunity for Canada.”

Bruce Power says it is committed to advancing future opportunities for nuclear energy to provide a clean, reliable source of electricity that provides life-saving medical isotopes around the world, in addition to being a source of jobs and innovation in communities across Canada.

This agreement is the latest partnership between Bruce Power, Westinghouse and key Canadian stakeholders to work towards Canada’s Net Zero by 2050 goal. This follows a Westinghouse presentation on the eVinci program at a conference hosted by the Organization of Canadian Nuclear Industries (OCNI) last month and attended by 200 people from leading Canadian suppliers.

No comments:

Post a Comment