Bloomberg News | September 3, 2021 |

NOx annihilating nugget. Stock image.

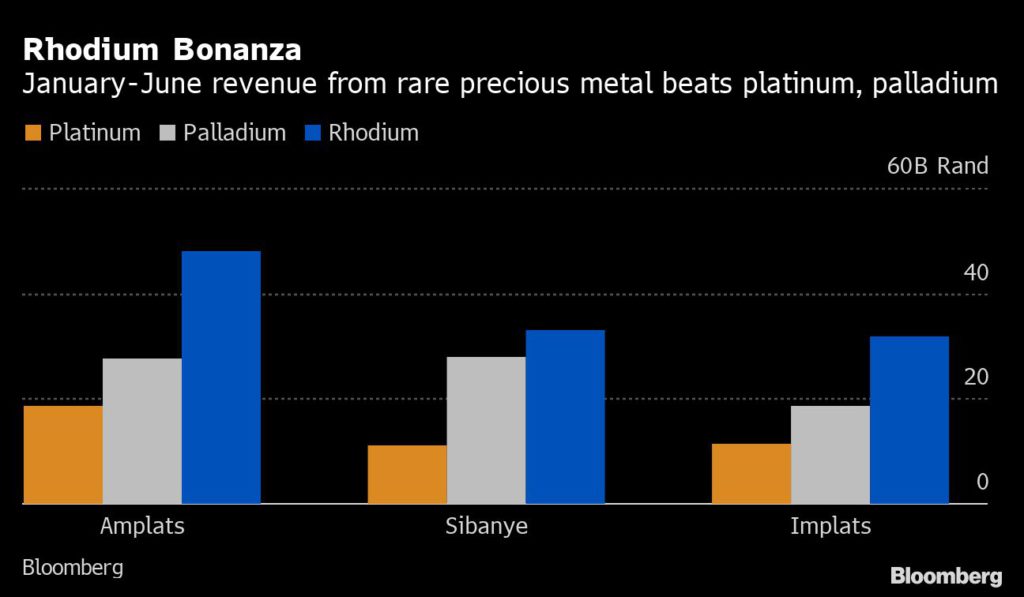

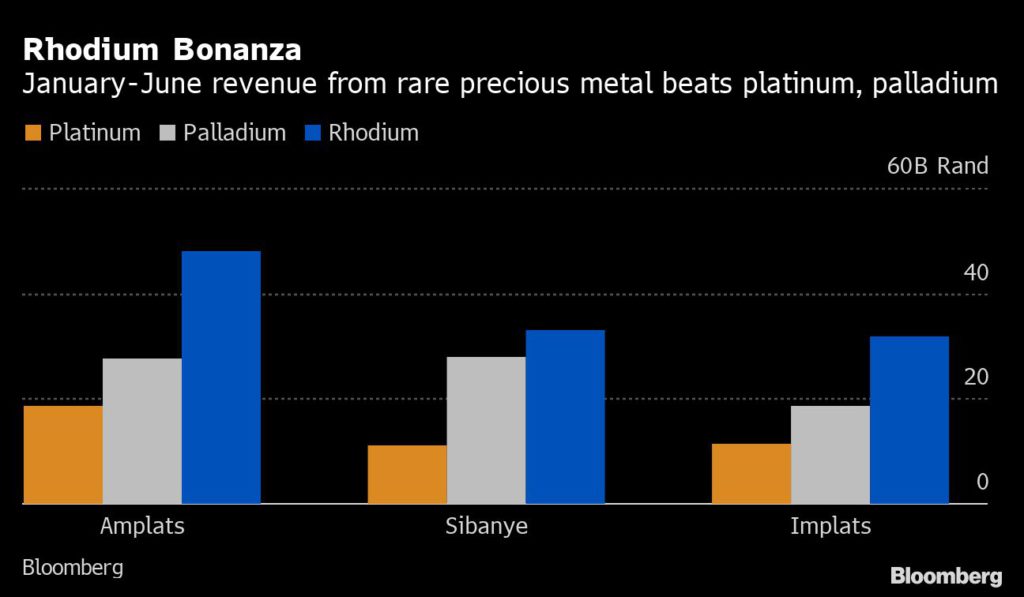

The rise of rhodium, the world’s most expensive precious metal, has made it the No. 1 revenue stream of the biggest platinum miners.

While the metal is well shy of its March peak, rhodium still accounted for 45% of Anglo American Platinum Ltd.’s first-half revenues. That’s more than platinum and palladium put together. For parent Anglo American Plc, the silvery-white metal generated more revenue than the diamonds mined by its De Beers business or the copper it extracts in Chile and Peru.

The scarcity of rhodium — a byproduct of platinum and palladium mining — and its unparalleled ability to curb nitrogen oxides from car exhaust fumes pushed up prices as stricter pollution laws boost demand. In March, it climbed to a record $29,800 an ounce, making it 17 times more valuable than gold.

Originally used for decoration or as corrosion-resistant coating, rhodium has also become the biggest export for South Africa, which produces more than 80% of global supply.

IN SOUTH AFRICAN RAND

“Rhodium prices have retreated somewhat but continue to contribute significantly to revenues particularly for rhodium-rich mines,” said Mandi Dungwa, a mining analyst at Kagiso Asset Management Ltd. in Cape Town.

With rhodium declining more than 40% from its peak, that contribution may not be repeated. Impala Platinum Ltd. Chief Executive Officer Nico Muller expects market tightness to keep the metal above $15,000 an ounce for the next year, but Neal Froneman, his counterpart at Sibanye Stillwater Ltd., expects prices to fall to a more “sustainable level” of about $10,000 over the next two years.

(By Felix Njini, with assistance from Yuliya Fedorinova and Thomas Biesheuvel)

“Rhodium prices have retreated somewhat but continue to contribute significantly to revenues particularly for rhodium-rich mines,” said Mandi Dungwa, a mining analyst at Kagiso Asset Management Ltd. in Cape Town.

With rhodium declining more than 40% from its peak, that contribution may not be repeated. Impala Platinum Ltd. Chief Executive Officer Nico Muller expects market tightness to keep the metal above $15,000 an ounce for the next year, but Neal Froneman, his counterpart at Sibanye Stillwater Ltd., expects prices to fall to a more “sustainable level” of about $10,000 over the next two years.

(By Felix Njini, with assistance from Yuliya Fedorinova and Thomas Biesheuvel)

No comments:

Post a Comment