Bloomberg News | October 1, 2021 |

Image: SB Energy

The world’s electric grids are creaking under the pressure of volatile fossil-fuel prices and the imperative of weaning the world off polluting energy sources. A solution may be at hand, thanks to an innovative battery that’s a cheaper alternative to lithium-ion technology.

SB Energy Corp., a U.S. renewable-energy firm that’s an arm of Japan’s SoftBank Group Corp., is making a record purchase of the batteries manufactured by ESS Inc. The Oregon company says it has new technology that can store renewable energy for longer and help overcome some of the reliability problems that have caused blackouts in California and record-high energy prices in Europe.

The units, which rely on something called “iron-flow chemistry,” will be used in utility-scale solar projects dotted across the U.S., allowing those power plants to provide electricity for hours after the sun sets. SB Energy will buy enough batteries over the next five years to power 50,000 American homes for a day.

“Long-duration energy storage, like this iron-flow battery, are key to adding more renewables to the grid,” said Venkat Viswanathan, a battery expert and associate professor of mechanical engineering at Carnegie Mellon University.

ESS was founded in 2011 by Craig Evans, now president, and Julia Song, the chief technology officer. They recognized that while lithium-ion batteries will play a key role in electrification of transport, longer duration grid-scale energy storage needed a different battery. That’s because while the price of lithium-ion batteries has declined 90% over the last decade, their ingredients, which sometimes include expensive metals such as cobalt and nickel, limit how low the price can fall.

The deal for 2 gigawatt-hours of batteries is worth at least $300 million, according to ESS. Rich Hossfeld, chief executive officer of SB Energy, said the genius of the units lies in their simplicity.

“The battery is made of iron salt and water,” said Hossfeld. “Unlike lithium-ion batteries, iron flow batteries are really cheap to manufacture.”

Every battery has four components: two electrodes between which charged particles shuffle as the battery is charged and discharged, electrolyte that allows the particles to flow smoothly and a separator that prevents the two electrodes from forming a short circuit.

Flow batteries, however, look nothing like the battery inside smartphones or electric cars. That’s because the electrolyte needs to be physically moved using pumps as the battery charges or discharges. That makes these batteries large, with ESS’s main product sold inside a shipping container.

What they take up in space, they can make up in cost. Lithium-ion batteries for grid-scale storage can cost as much as $350 per kilowatt-hour. But ESS says its battery could cost $200 per kWh or less by 2025.

Crucially, adding storage capacity to cover longer interruptions at a solar or wind plant may not require purchasing an entirely new battery. Flow batteries require only extra electrolyte, which in ESS’s case can cost as little as $20 per kilowatt hour.

“This is a big, big deal,” said Eric Toone, science lead at Breakthrough Energy Ventures, which has invested in ESS. “We’ve been talking about flow batteries forever and ever and now it’s actually happening.”

The U.S. National Aeronautics and Space Administration built a flow battery as early as 1980. Because these batteries used water, they presented a much safer option for space applications than lithium-ion batteries developed around that time, which were infamous for catching on fire. Hossfeld says he’s been able to get permits for ESS batteries, even in wildfire-prone California, that wouldn’t have been given to lithium-ion versions.

Still, there was a problem with iron flow batteries. During charging, the battery can produce a small amount of hydrogen, which is a symptom of reactions that, left unchecked, shorten the battery’s life. ESS’s main innovation, said Song, was a way of keeping any hydrogen produced within the system and thus hugely extending its life.

“As soon as you close the loop on hydrogen, you suddenly turn a lab prototype into a commercially viable battery option,” said Viswanathan. ESS’s iron-flow battery can endure more than 20 years of daily use without losing much performance, said Hossfeld.

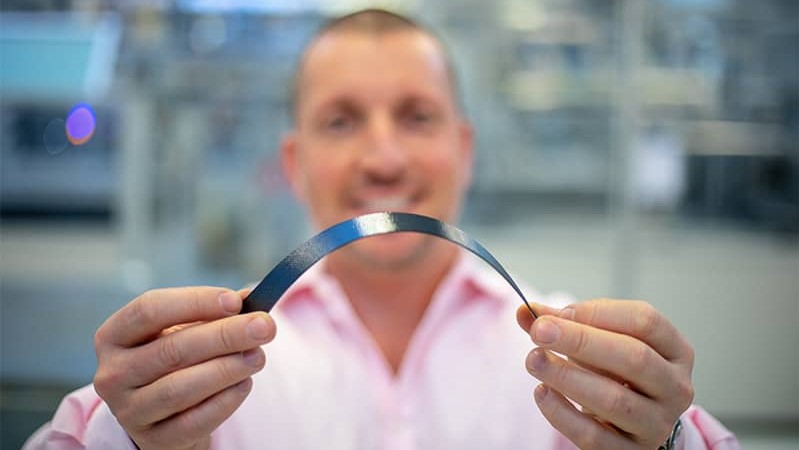

At the company’s factory near Portland, yellow robots cover plastic sheets with chemicals and glue them together to form the battery cores. Inside the shipping containers, vats full of electrolyte feed into each electrode through pumps — allowing the battery to do its job of absorbing renewable power when the sun shines and releasing it when it gets dark.

It’s a promising first step. ESS’s battery is a cheap solution that can currently provide about 12 hours of storage, but utilities will eventually need batteries that can last much longer as more renewables are added to the grid. Earlier this month, for example, the lack of storage contributed to a record spike in power prices across the U.K. when wind speeds remained low for weeks. Startups such as Form Energy Inc. are also using iron, an abundant and cheap material, to build newer forms of batteries that could beat ESS on price.

So far, ESS has commercially deployed 8 megawatt-hours of iron flow batteries. Last week, after a six-month evaluation, Spanish utility Enel Green Power SpA signed a single deal for ESS to build an equivalent amount. SB Energy’s Hossfeld, who also sits on ESS’s board, said the company would likely buy still more battery capacity from ESS in the next five years.

Even as its order books fill up, ESS faces a challenging road ahead. Bringing new batteries to market is notoriously difficult and the sector is littered with failed startups. Crucially, lithium-ion technology got a head start and customers are more familiar with its pros and cons. ESS will have to prove that its batteries can meet the rigorous demands of power plant operators.

The new order should help ESS as it looks to go public within weeks through a special-purpose acquisition company at a valuation of $1.07 billion. The listing will net the company $465 million, which it plans to use to scale up its operations.

(By Akshat Rathi, with assistance from Tom Metcalf)

ESS Inc signs 2GWh iron flow battery deal with Softbank’s SB Energy

ByAndy Colthorpe

October 1, 2021

SB Energy: ‘US-made clean energy technology aligns with Biden policy aims’

While the specific projects SB Energy intends to equip with the iron flow batteries have not been revealed in a press release issued yesterday, it did point out that the developer owns 1.7GW of solar PV capacity across five utility-scale projects in Texas and California, already in operation or under construction. It has a further multi-gigawatt pipeline of solar and storage projects in development in the US for execution in the next few years.

“ESS’s unique ability to manufacture and ship batteries using iron, salt, and water is a game-changer, enabling SB Energy to offer our customers safe, sustainable and low-cost energy storage today,” SB Energy’s co-chief executive officer Rich Hossfeld said.

“Long-duration storage is absolutely critical to providing flexible, affordable renewable energy at scale and aligns perfectly with the Biden administration’s ambitious clean energy initiatives,” Hossfeld, who is also an ESS Inc board member, added, while also highlighting that ESS Inc will be capable of manufacturing its battery systems in the US.

ESS Inc claimed an industry first in 2019 by launching a 10-year battery insurance plan through Munich Re which covered its Energy Warehouse 50kW-70kW / 400kWh-600kWh product but has since been expanded to include the 3MW Energy Center product.

The company is currently targeting a listing on the New York Stock Exchange (NYSE) through combination with special purpose acquisition company (SPAC) ACON 2 Acquisition Corp. The deal will value the combined company at just over a billion dollars and will release around US$465 million in net proceeds.

ACON 2 shareholders are set to vote on the merger in the next few days.

In terms of other recent deployments, Energy-Storage.news reported just a few days ago that 17 Energy Warehouse systems totalling 8.5MWh are being sold to Enel Green Power España for installation across solar farms in Spain. Again, ESS Inc has said that that deal is for a wider engagement with Enel Green Power across various European Union territories.

“The energy transition will require massive amounts of storage capacity in the coming years and we are focused on scaling up our manufacturing capacity to help meet that demand,” ESS Inc CEO Eric Dresselhuys said.

ByAndy Colthorpe

October 1, 2021

An ESS Inc Energy Warehouse being lowered into place. Image: ESS Inc via Twitter.

A framework agreement for the deployment of 2GWh of iron electrolyte flow batteries has been signed between manufacturer ESS Inc and SB Energy, the clean energy arm of Japanese telecoms giant Softbank.

SB Energy will use the long-duration battery energy storage systems (BESS) at utility-scale solar projects that it has under development in the US, in Texas and California. ESS Inc said the first order in the 2GWh deal, which runs to 2026, has already been delivered to an SB Energy project site in California, for commissioning during October.

The agreement appears to mark a significant step up for the Oregon-headquartered long-duration battery storage company, which was founded in 2011. It also appears to be the biggest flow battery deal of any kind seen so far.

After years of lab development and pilot deployments, ESS Inc has been working more recently to turn its unique, proprietary technology offering into a commercial offering and towards the beginning of this year launched a grid-scale product based on its iron and saltwater electrolyte battery chemistry.

The non-toxic, non-degrading battery chemistry is designed to be environmentally sustainable and last many years in the field. It is configurable to offer from four hours up to 12 hours of storage and ESS Inc said that in addition to using abundant materials, it is low-cost.

In 2019, former CEO and co-founder Craig Evans told this site that the batteries can “cycle tens of thousands of times,” and do so with “zero capacity fade”. Evans was speaking then on the occasion of a US$30 million Series C funding round closing, with SB Energy among investors participating. Other investors in the company have included the Bill Gates-founded Breakthrough Energy Ventures.

A framework agreement for the deployment of 2GWh of iron electrolyte flow batteries has been signed between manufacturer ESS Inc and SB Energy, the clean energy arm of Japanese telecoms giant Softbank.

SB Energy will use the long-duration battery energy storage systems (BESS) at utility-scale solar projects that it has under development in the US, in Texas and California. ESS Inc said the first order in the 2GWh deal, which runs to 2026, has already been delivered to an SB Energy project site in California, for commissioning during October.

The agreement appears to mark a significant step up for the Oregon-headquartered long-duration battery storage company, which was founded in 2011. It also appears to be the biggest flow battery deal of any kind seen so far.

After years of lab development and pilot deployments, ESS Inc has been working more recently to turn its unique, proprietary technology offering into a commercial offering and towards the beginning of this year launched a grid-scale product based on its iron and saltwater electrolyte battery chemistry.

The non-toxic, non-degrading battery chemistry is designed to be environmentally sustainable and last many years in the field. It is configurable to offer from four hours up to 12 hours of storage and ESS Inc said that in addition to using abundant materials, it is low-cost.

In 2019, former CEO and co-founder Craig Evans told this site that the batteries can “cycle tens of thousands of times,” and do so with “zero capacity fade”. Evans was speaking then on the occasion of a US$30 million Series C funding round closing, with SB Energy among investors participating. Other investors in the company have included the Bill Gates-founded Breakthrough Energy Ventures.

SB Energy: ‘US-made clean energy technology aligns with Biden policy aims’

While the specific projects SB Energy intends to equip with the iron flow batteries have not been revealed in a press release issued yesterday, it did point out that the developer owns 1.7GW of solar PV capacity across five utility-scale projects in Texas and California, already in operation or under construction. It has a further multi-gigawatt pipeline of solar and storage projects in development in the US for execution in the next few years.

“ESS’s unique ability to manufacture and ship batteries using iron, salt, and water is a game-changer, enabling SB Energy to offer our customers safe, sustainable and low-cost energy storage today,” SB Energy’s co-chief executive officer Rich Hossfeld said.

“Long-duration storage is absolutely critical to providing flexible, affordable renewable energy at scale and aligns perfectly with the Biden administration’s ambitious clean energy initiatives,” Hossfeld, who is also an ESS Inc board member, added, while also highlighting that ESS Inc will be capable of manufacturing its battery systems in the US.

ESS Inc claimed an industry first in 2019 by launching a 10-year battery insurance plan through Munich Re which covered its Energy Warehouse 50kW-70kW / 400kWh-600kWh product but has since been expanded to include the 3MW Energy Center product.

The company is currently targeting a listing on the New York Stock Exchange (NYSE) through combination with special purpose acquisition company (SPAC) ACON 2 Acquisition Corp. The deal will value the combined company at just over a billion dollars and will release around US$465 million in net proceeds.

ACON 2 shareholders are set to vote on the merger in the next few days.

In terms of other recent deployments, Energy-Storage.news reported just a few days ago that 17 Energy Warehouse systems totalling 8.5MWh are being sold to Enel Green Power España for installation across solar farms in Spain. Again, ESS Inc has said that that deal is for a wider engagement with Enel Green Power across various European Union territories.

“The energy transition will require massive amounts of storage capacity in the coming years and we are focused on scaling up our manufacturing capacity to help meet that demand,” ESS Inc CEO Eric Dresselhuys said.

No comments:

Post a Comment