Bloomberg News | November 16, 2021 |

Stock image.

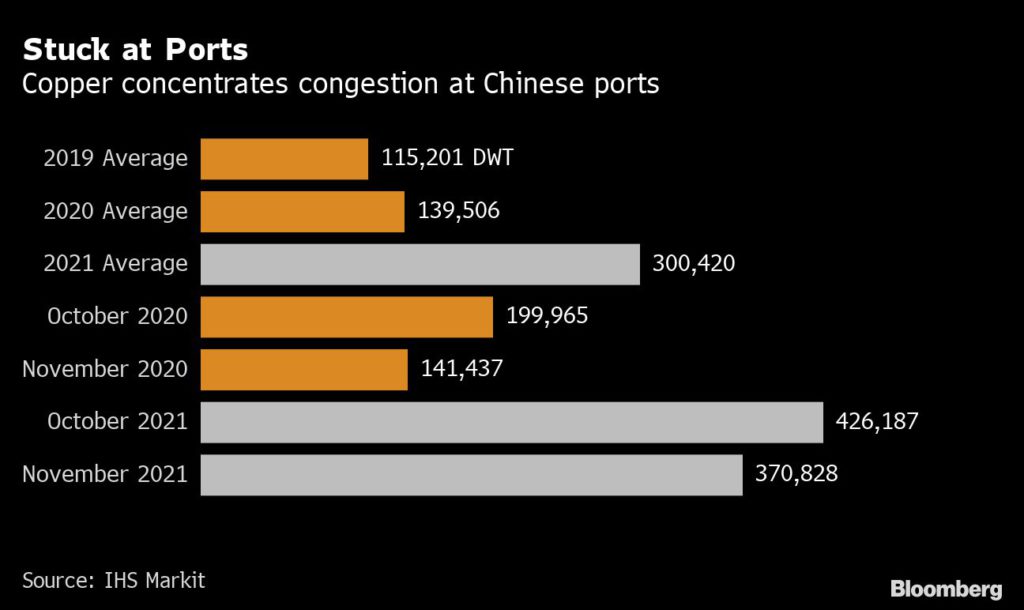

A copper logjam in Chinese ports is showing signs of easing but remains at more than triple pre-pandemic levels.

Ships able to carry about 370,000 tons of semi-processed concentrates from Chile and Peru are waiting to be unloaded, IHS Markit data show. While that’s down 13% from October, it’s still way above year-ago levels and represents 30-40% of all monthly deliveries to China from the top two mining nations.

The bullish take on the stubbornly long lineup is that it’s part of the global supply chain disruptions that have seen, for example, a record number of container ships outside California ports.

While bulk commodities are less affected than containers packed with toys and refrigerators, Covid-19 protocols at Chinese ports have generated congestion throughout the pandemic, according to Juan Carlos Guajardo, who heads consulting firm Plusmining. That means about a 10-day wait for ships carrying the South American concentrate that feeds Chinese copper smelters.

But while supply delays help explain tight global metal markets, there’s also a bearish read here. The commodity pileup may be partly due to slowing Chinese demand, with smelters and manufacturers under pressure to contain emissions and power use.

Still, IHS Markit analyst Daejin Lee expects congestion to ease toward year-end with fewer arrivals of dry bulk shipments over the winter. Delays in Peruvian cargoes amid community protests may also help break the logjam in China, albeit temporarily.

(By Yvonne Yue Li and James Attwood)

No comments:

Post a Comment