Why this UK-based Oil and Gas Company is Diversifying its Portfolio with Canadian Assets

| Jocelyn Aspa, The Market Herald | November 30, 2021 |

Canada is undoubtedly one of the world’s largest producers of oil reserves and natural gas, producing on average 3.5 million barrels per day of crude oil and 13.7 billion cubic feet of natural gas.

Canada is undoubtedly one of the world’s largest producers of oil reserves and natural gas, producing on average 3.5 million barrels per day of crude oil and 13.7 billion cubic feet of natural gas.Since early 2020, however, oil and gas production has suffered not only in Canada but around the world resulting from the COVID-19 pandemic. That being said, in 2021 and is projected to reach a valuation of $310.9 billion by 2035, resulting in growing investments in building Canada’s oil and gas infrastructure.

In line with this, it’s estimated that the production of crude oil in Canada is expected to outpace 2019 levels by the end of the year and continue its road to recovery in 2022.

To that end, companies like i3 Energy (TSX: ITE, LSE: I3E, Forum) are contributing to that growth thanks to its production base in Canada’s most prolific hydrocarbon region — the Western Canadian Sedimentary Basin — as well as appraisal assets in the North Sea.

With its primary headquarters in England, i3 Energy was first listed on the London Stock Exchange in 2017 and has been advancing its portfolio of assets in the United Kingdom since.

In the region, i3 Energy owns a 100 percent interest in Block 13/23c, which includes the Serenity oil field, discovered by i3 in late 2019, and the highly prospective Minos High region.

By late 2020, however, the company dipped its toes into the Canadian market by officially notching a listing on the Toronto Stock Exchange and acquiring Western Canadian Sedimentary Basin assets through a reverse takeover of privately-held Gain Energy and publicly-listed Toscana Energy Income Corporation.

With assets in both the United Kingdom and in Canada, i3 Energy presents itself as a unique oil and gas investment opportunity for investors looking for a company with a diverse portfolio in two well-established jurisdictions.

The Western Canadian Sedimentary Basin

Spanning 1.4 million square kilometres, the Western Canadian Sedimentary Basin (WCSB) is a vast sedimentary basin that spans southern Manitoba, southern Saskatchewan, Alberta, northeastern British Columbia, and the southwest corner of the Northwest Territories.

In a word, the region is considered a mature area for exploration of petroleum with more recent developments trending towards natural oil and gas sands instead of conventional oil — which includes light crude oil and heavy crude oil.

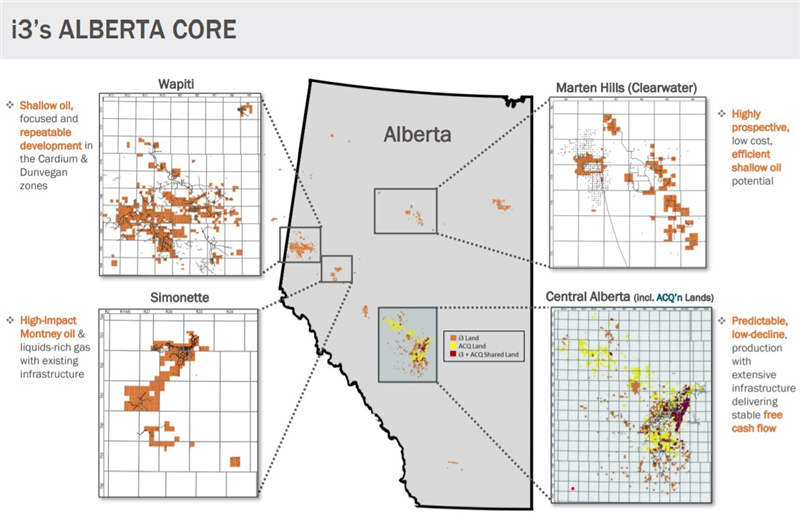

i3 Energy is firmly in control of its destiny in the WCSB with the company operating over 70% of its production across its ~800 (net) long-life, low-risk and low-decline wells, and having a sizeable land base of greater than 625,000 net acres.

(Click to enlarge image)

The company currently has 2P reserves in the country of roughly 130 million barrels of oil equivalent and current production of over 18,000 boepd from large contiguous holdings in the WCSB’s most economic play types.

In an interview with Stockhouse Editorial Graham Heath, CFO of i3 Energy, said the company stands out in the Canadian market thanks to its access to capital in London — and its international focus — he said this has allowed i3 Energy to grow its business “very quickly.”

“A lot of our peers have taken 15 years to get to 20,000 boepd per day, and we’ve been able to do so in 18 months,” he said. “That continued access to capital will give us a strategic advantage to allow us to continue to not only grow organically but continue mergers and acquisitions as opportunities present themselves that fall within our metrics.”

Growing through M&A activity

Majid Shafiq, CEO of i3 Energy, explained to Stockhouse Editorial that part of i3 Energy’s business model is to grow through acquisitions, which it has been able to do thanks to several acquisitions — including the acquisition of all of the assets of Gain Energy in the WCSB.

The company said it is primarily targeting long-life and low-cost proved developed producing (PDP) assets with robust PUD inventories and a focus on distressed, overleveraged, or non-core asset packages of high API-BTU production streams with low-sustaining CAPEX and decom exposure.

In line with this, i3 Energy has been able to make moves and close acquisitions resulting from low oil prices and — in turn — start a drilling program once oil prices recovered.

This also led the company to acquire assets in central Alberta from Cenovus Energy Inc., a Canadian oil and gas producer, for C$65 million.

While oil and gas prices are “much higher” than they were several months ago, Shafiq said this won’t stop the company from continuing to expand its portfolio through M&A.

“We’re still seeing the opportunity to add accretive barrels via acquisition while we continue to grow production through the drill bit,” he told Stockhouse Editorial.

Posting record Q3 results

As part of the company’s continued growth, i3 Energy recorded impressive results during the third quarter, with average production of approximately 13,740 boepd based on net field sales estimates and September alone averaging approximately 18,985 boepd.

Since the company began acquiring Canadian assets in Q3 2020, i3 Energy has successfully implemented a strategy to offset natural field declines through operational attentiveness, the high-grading of low-cost drilling, reactivation, and recompletion opportunities, and through small-scale bolt-on acquisitions.

Heath told Stockhouse Editorial that highlights from the quarter “show the benefits of being bold at the bottom”. He said buying assets for 1.3x cash flow when oil is between $25 and $30 provides a greater margin of safety.

Essentially, Heath said all that needs to be done to turn a profit is for commodity prices to “do what they’ve done” to make those assets valuable. He added that the company is already seeing those benefits, with the company having produced £12.5 million (CAD$21 million) of net operating income (revenue minus royalties, opex, processing, and transportation) during H1 2021 while forecasting an additional £39 million (CAD$66 million) of net operating income during the second half.

Furthermore, Heath points out that they expect to produce almost CAD$150 million of net operating income from their WCSB assets during the coming 12 months – a figure that substantially surpasses what they have paid for their entire Canadian portfolio.

Future milestones

With 2021 ending soon, Shafiq said several key milestones are coming that investors should watch for, including the announcement of its planned 2022 capital budget for its Canadian assets.

In terms of the UK, Shafiq said that the company expects to further appraise its Serenity discovery in 2022, with its continued UK strategy focussed on the development of discoveries located close to existing infrastructure.

“We’re currently going through a farm-out process to bring in some capital and drill an appraisal well on Serenity, which will hopefully prove up the millions of barrels sitting in that field,” he told Stockhouse Editorial.

Additionally, the company has commenced a project with a consultancy to develop a comprehensive ESG strategy and expects to publish its first sustainability report in Q1 2022.

The management team

Majid Shafiq, CEO

Majid Shafiq has over 30 years of experience in technical and investment banking focused on the global E&P sector.

Before joining Argentil Capital Partners as CEO in 2015, Shafiq spent 12 years in energy investment banking with a focus on advising on asset level acquisitions and divestments and corporate M&A and equity financing for private and public companies in the oil and gas sector.

Additionally, Shafiq worked for Mobil Oil Corporation for 13 years in a range of petroleum engineering and commercial roles. Shafiq holds a bachelor’s degree in Nuclear Engineering from Manchester University, a master’s degree in petroleum engineering from Heriot-Watt University, and an MBA from London Business School.

Graham Heath, CFO

Before co-founding i3 in late 2014, Heath worked as VP of Corporate Development and also as interim CFO at Iona Energy.

At his time at Iona Energy, Heath worked with the senior management team, building the company from infancy to 40MMboe of 2P reserves and production above 6,000 boe per day and listing the company on the TSX Venture Exchange.

Between 1998 and 2010, Heath consulted Colt Engineering, Pan Canadian Petroleum, EnCana Corporation, and Cenovus Energy. Between 2002 and 2006, Heath was co-founder and VP of strategic development for The CO2 Hub, which is a marketplace to facilitate the sale and purchase of carbon dioxide and related purification, compression, storage, and transportation services.

Heath has a Bachelor of Commerce from the University of Calgary.

The investment corner

In short, the company presents itself as a unique opportunity to investors thanks to the unprecedented growth i3 Energy has undergone since making its acquisitions in Canada.

What’s more, i3 Energy implemented dividend payments during 2021, with Shafiq saying that the return of capital to investors is “absolutely fundamental to the company,” adding that i3 Energy will return capital to shareholders as it is generated.

Moving into the next year, Shafiq said investors will have plenty to keep their eyes on when it comes to i3 Energy as it looks to begin drilling and delivering good news from both Canada and the UK, which he said should translate to significant share price growth.

No doubt, i3 Energy is an exciting company to watch for — at a current share price of $0.18, investors won’t want to wait for good news to flow before diving in.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.

No comments:

Post a Comment