by Carlito Pablo on March 1st, 2022

A Rositch Hemphill Architects rendering of the proposed rental development at 277-291 West 42nd Avenue.

The City of Vancouver grants many incentives for developers of “for-profit affordable rental housing”.

It’s a policy that started during the time of then Mayor Gregor Robertson and his Vision Vancouver council.

The program continues with the current council led by Mayor Kennedy Stewart.

City incentives include waivers on the payment of development cost levies or DCLs, which typically amount to millions of dollars.

To be exempted from paying DCLs, the starting rents should not exceed rates set by the city based on average rents for all residential units built in Vancouver since 2005.

For those on the West Side of the city, the rents are set higher by 10 percent compared to the East Side.

A city staff report on a rezoning application provides an update on what West Side rates now qualify as “for-profit affordable rental housing”.

Marcon Properties Ltd. filed the application on behalf of W 42 Properties E Nominee Corp. to rezone 277-291 West 42nd Avenue.

The development involves an 18-storey residential building with 211 rental units.

The staff report listed the maximum starting rents for West Side rentals that could qualify for a DCL waiver.

For three-bedroom units, that would be $4,094.

For two bedrooms, it’s $2,912; one bedroom, $2,224; and studio, $1,818.

The Marcon Properties project includes only two-bedroom, one-bedroom, and studio units.

The staff report indicated that the applicant has not applied for a DCL waiver, but can do so at a later time.

“If the DCL waiver is taken, the value of the City-wide DCL waiver on the residential floor area would be approximately $2,357,903,” the staff report stated.

The rezoning application is included in the public hearing agenda of city council on Thursday (March 3).

Here's how much it costs to rent a one-bedroom apartment in Metro Vancouver this March

Residents of Metro Vancouver who are looking to score cheap rent may feel slightly deflated about this month's average apartment prices.

While prices haven't taken an enormous leap this month over last, March prices have increased slightly for the region and the City of Vancouver continues to see the highest rent in Canada.

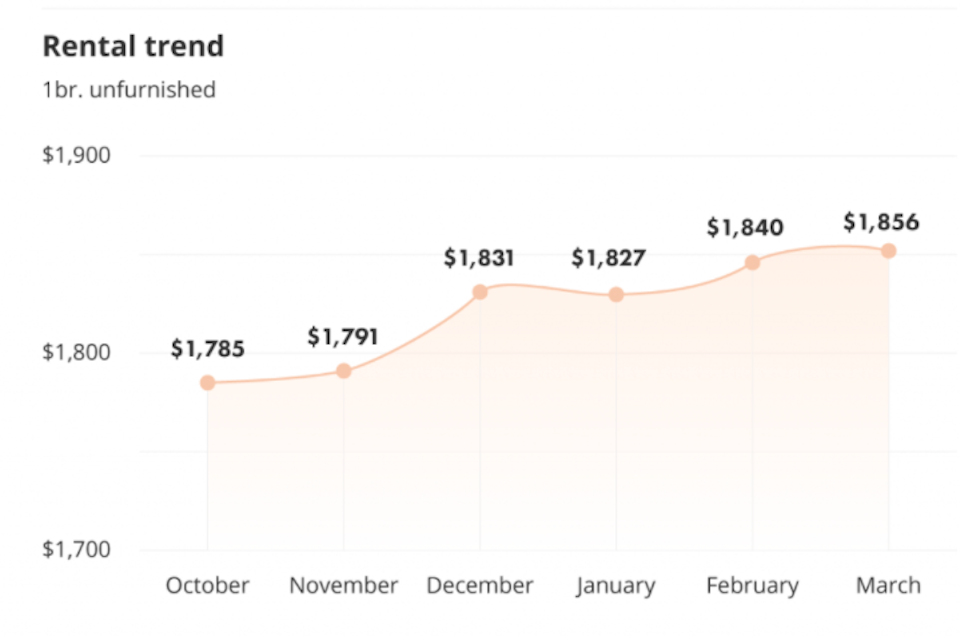

Metro Vancouver's rental prices for unfurnished, one-bedroom apartments have increased by $16 from $1,840 to $1,856 finds Liv.rent, a rental platform based in Vancouver and creates monthly rent reports for the region.

The City of Vancouver continues to see the highest rent of Canada's big cities, with average rents for unfurnished, one-bedroom apartments going for $2,039 in March. But report authors note that "most of the major price increases came from outside Vancouver itself, where rent prices remained largely the same this month. Areas like Langley, Coquitlam and North Vancouver saw comparatively significant gains this month, particularly for unfurnished, one-bedroom units."

Another B.C. city, Victoria, has the second-highest rent in the country, with average listings selling for $1,835. Toronto follows in third, with unfurnished units selling for an average of $1,772. Ottawa rounded out the top fourth, with rentals averaging $1,660.

Across the region, there has been only one month out of the past six where prices declined on the aggregate, and that was a mere $4 drop from December to January.

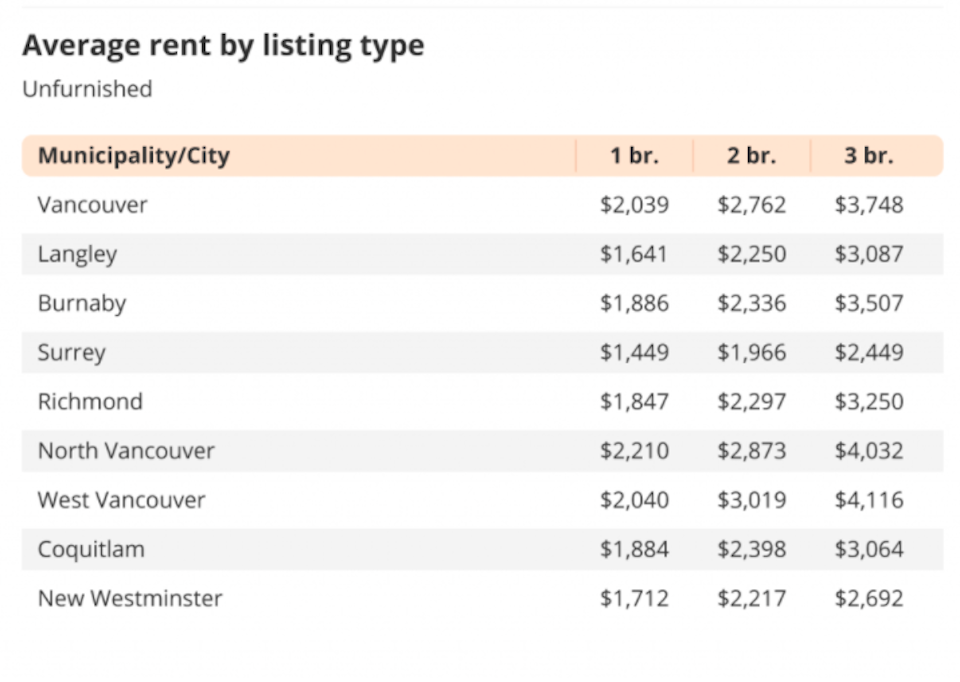

Metro Vancouver rent by city/municipality

Vancouver residents spend an average of 32.17 per cent of their income on rent, which Liv.rent notes is just above what financial advisors recommend spending.

Surrey is the least expensive city for unfurnished one-bedroom listings, at an average of just $1,449 this month. Langley follows, with average unfurnished one-bedroom units costing $1,641. New Westminster had the third-best market, with one-bedroom apartments averaging $1,712.

North Vancouver has the most expensive unfurnished one-bedroom apartments this month, with rentals costing an average of $2,210. West Vancouver has the second-highest rentals, with one-bedrooms costing an average of $2,040 this month. Vancouver came third, with one-bedroom apartments costing $2,039.

This month, Downtown Vancouver is the most expensive neighbourhood to rent an unfurnished, one-bedroom unit, at $2,327. Mount Pleasant and Fairview aren’t far behind, at $2,227 and $2,216 respectively.

Where are the cheapest neighbourhoods to rent in Metro Vancouver? Have a look at this rental map to find the lowest price listings in the region.

by Carlito Pablo on February 28th, 2022

Real-estate company rennie notes that the rental vacancy rate in the Lower Mainland is a low 1.2 percent.CMHC

It’s not uncommon to hear about people working extra jobs to make their rent.

A Canada Mortage and Housing Corporation report calculates how much more hours an individual has to do over full-time employment to keep rent affordable.

By affordable, the CMHC explains that it’s a dwelling where a renter household spends no more than 30 percent of gross income on rent.

Full-time work is 37.5 hours per week or 150 hours a month.

CMHC’s calculation also assumes that an individual is earning the average wage in their respective urban centre, and lives in a two-bedroom apartment.

Hence, metropolitan areas in Canada that show more than 150 hours required for the 30 percent affordability measure “implies that the average rent is not affordable for a single average wage earner without another source of income, even if they work full time”.

Guess which urban centre topped CMHC’s list of unaffordable places?

It’s Metro Vancouver, with Victoria following second.

The CMHC list shows that residents in Greater Vancouver have to work a total of 198 hours per month to keep their rental cost affordable or at the 30 percent mark.

This means doing 48 hours more over the full-time employment of 150 hours.

In Victoria, it’s 162.6 hours per month.

In its report, CMHC noted that major urban centres in B.C. and Ontario are “above 150 hours, indicating significant rental affordability challenges in these markets”.

The agency noted that data in its report indicates that “rent growth has exceeded wage growth” in most urban centres in the country.

As for Metro Vancouver, CMHC stated that “lower-income households face significant challenges in finding units that they can afford”.

For instance, less than one-fourth or 25 percent of purpose-built market rental units are affordable to households earning less than $48,000 in annual income.

A yearly income of $48,000 means that with a 30 percent affordability measure, a household’s rent should be $1,200 per month.

Moreover, CMHC reported that only one in 1,000 units in Metro Vancouver is affordable to households with the lowest incomes.

“Most of the lowest-priced units are small and unsuitable for families,” CMHC noted.

The CMHC report was released in February 2022, and is based on data as of October 2021.

The agency reported that the average rent for a two-bedroom unit in a purpose-built rental building in Metro Vancouver is $1,824 per month as of last fall.

This means that rent in the region increased by 2.4 percent compared to October 2020.

Vancouver real estate company rennie took a look at the housing agency’s report, and highlighted a number of points.

In its own report, rennie noted that Metro Vancouver continues to have the lowest purpose-built rental vacancy rate among major Canadian markets at 1.2 percent.

The national vacancy rate is 3.1 percent.

The 2021 vacancy rate of 1.2 percent in Metro Vancouver represents a tightening from the previous 2.6 percent in 2020.

“The return of international students, elevated immigration flows, and robust domestic in-migration each played a role in the market’s tightening,” rennie stated in its report.

The Vancouver real estate company also noted that while rental rates were frozen for existing tenants, rates increased by 1.9 percent overall “due to both the turnover of units and the addition of new units to the existing stock”.

And as the vacancy rate in Metro Vancouver fell, the average monthly rent increased by 1.9 percent between 2020 and 2021 to $1,537.

“The average rent for studios rose by 3.4% (driven by the chase for affordability), while that of three-bedroom homes rose by 5.4% (driven by the chase for space),” rennie reported.

For more details, see table below.

Follow Carlito Pablo on Twitter @carlitopablo

Carlito Pablo

@carlitopablo

Staff writer Carlito Pablo lives in Vancouver. On sunny weekends, he and his family are usually found on beaches and in parks. A journalist who formerly worked in Manila, he's a proud new Canadian.

No comments:

Post a Comment