USA

Opinion: Social Security benefits should not be cutRaising the Full Retirement Age from 67 to 70 would be the worst way to cut them

Published: March 29, 2022

By Alicia H. Munnell

By Alicia H. Munnell

GETTY IMAGES

The American Academy of Actuaries — a group of usually sober and sensible people — recently issued a brief making the case for “Raising the Social Security Retirement Age.”

Their argument is straightforward. Social Security is running a 75-year deficit equal to 3.5% of taxable payrolls. The only way to fix the problem is to raise revenues or cut benefits. Life expectancy at 65 has increased, and is projected to continue to increase, which pushes up program costs. Therefore, Congress should make people work longer and postpone claiming their benefits. Raising the full age to 70 could cut the long-run deficit by about a third.

Just to be absolutely clear, increasing Social Security’s Full Retirement Age is not just a question of “postponing” claiming; it is a benefit cut. Those who are able to delay retirement receive one less year of benefits. Those who cannot adjust their retirement behavior get lower benefits due to the increased actuarial adjustment — an adjustment made to keep lifetime benefits constant regardless of claiming age. Currently, those claiming at age 62 receive only 70% of the benefit available at 67. If the Full Retirement Age were increased to 70, that amount falls to 55%.

I’m against any form of benefit cut, because the rest of the U.S. retirement system seems quite wobbly to me. At any moment, only about half of private sector workers are covered by any type of workplace retirement plan. That means some people never are covered and are totally reliant on Social Security, while others move in and out of coverage and end up with modest balances.

Read: Do I need to file a tax return if most of my income is from Social Security?

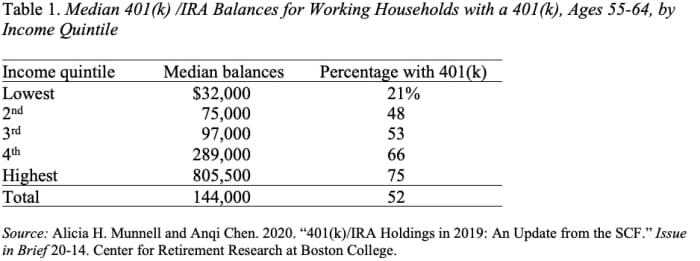

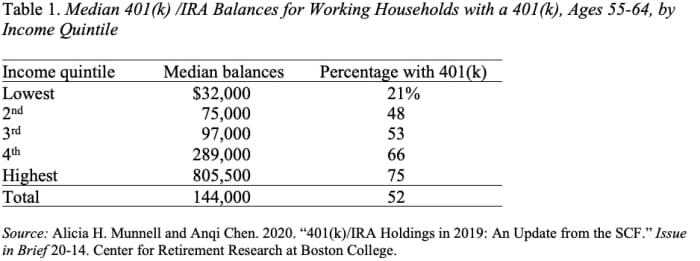

We actually know how much people have in their retirement accounts from the detailed financial data in the Federal Reserve’s Survey of Consumer Finances. As of 2019 — the date of the latest survey — households (with a 401(k)) approaching retirement (ages 55-64) had $144,000 in 401(k)/IRA balances (see Table 1). That may sound like a lot but if they buy a joint-and-survivor annuity, they will receive only about $600 per month. And this amount is likely to be their only source of retirement income beyond Social Security because the typical household holds no other financial assets. Cutting Social Security benefits would be a disaster for most Americans.

Moreover, increasing the Full Retirement Age is the most pernicious form of benefit cut, because it hurts the most vulnerable who are forced to claim early. And it’s clear who these people are.

Read: You could be getting the wrong Social Security benefit check — here’s how to fix it

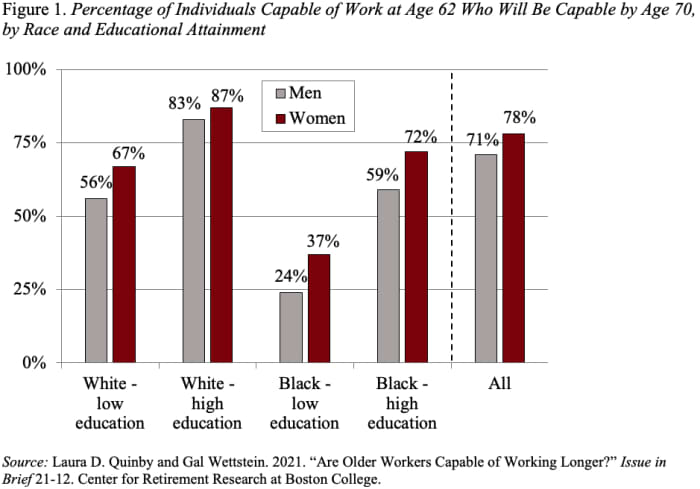

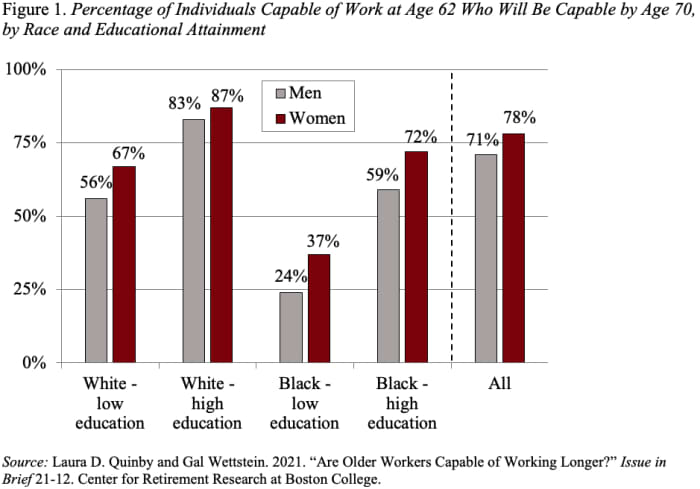

In a recent study, my colleagues examined “working life expectancy” for all individuals and by race and education. They looked at individuals who are expected to be working at 62 and calculated the probability that they will still be capable of work if Social Security’s Full Retirement Age were increased to 70 (see Figure 1). The exercise showed that while age 70 might be possible for a large majority of high-education whites, it is out of the question for many men and women with low education — particularly Blacks — and even for many high-education Black workers. These individuals would end up with grossly inadequate benefits.

Yes, it is possible, as the actuaries suggest, that some of the pain created by increasing the Full Retirement Age could be offset by expanding Disability Insurance. But I have no confidence this would happen. So, don’t cut Social Security benefits. And, if for some reason we decide to do so, don’t do it by raising the Full Retirement Age.

The American Academy of Actuaries — a group of usually sober and sensible people — recently issued a brief making the case for “Raising the Social Security Retirement Age.”

Their argument is straightforward. Social Security is running a 75-year deficit equal to 3.5% of taxable payrolls. The only way to fix the problem is to raise revenues or cut benefits. Life expectancy at 65 has increased, and is projected to continue to increase, which pushes up program costs. Therefore, Congress should make people work longer and postpone claiming their benefits. Raising the full age to 70 could cut the long-run deficit by about a third.

Just to be absolutely clear, increasing Social Security’s Full Retirement Age is not just a question of “postponing” claiming; it is a benefit cut. Those who are able to delay retirement receive one less year of benefits. Those who cannot adjust their retirement behavior get lower benefits due to the increased actuarial adjustment — an adjustment made to keep lifetime benefits constant regardless of claiming age. Currently, those claiming at age 62 receive only 70% of the benefit available at 67. If the Full Retirement Age were increased to 70, that amount falls to 55%.

I’m against any form of benefit cut, because the rest of the U.S. retirement system seems quite wobbly to me. At any moment, only about half of private sector workers are covered by any type of workplace retirement plan. That means some people never are covered and are totally reliant on Social Security, while others move in and out of coverage and end up with modest balances.

Read: Do I need to file a tax return if most of my income is from Social Security?

We actually know how much people have in their retirement accounts from the detailed financial data in the Federal Reserve’s Survey of Consumer Finances. As of 2019 — the date of the latest survey — households (with a 401(k)) approaching retirement (ages 55-64) had $144,000 in 401(k)/IRA balances (see Table 1). That may sound like a lot but if they buy a joint-and-survivor annuity, they will receive only about $600 per month. And this amount is likely to be their only source of retirement income beyond Social Security because the typical household holds no other financial assets. Cutting Social Security benefits would be a disaster for most Americans.

Moreover, increasing the Full Retirement Age is the most pernicious form of benefit cut, because it hurts the most vulnerable who are forced to claim early. And it’s clear who these people are.

Read: You could be getting the wrong Social Security benefit check — here’s how to fix it

In a recent study, my colleagues examined “working life expectancy” for all individuals and by race and education. They looked at individuals who are expected to be working at 62 and calculated the probability that they will still be capable of work if Social Security’s Full Retirement Age were increased to 70 (see Figure 1). The exercise showed that while age 70 might be possible for a large majority of high-education whites, it is out of the question for many men and women with low education — particularly Blacks — and even for many high-education Black workers. These individuals would end up with grossly inadequate benefits.

Yes, it is possible, as the actuaries suggest, that some of the pain created by increasing the Full Retirement Age could be offset by expanding Disability Insurance. But I have no confidence this would happen. So, don’t cut Social Security benefits. And, if for some reason we decide to do so, don’t do it by raising the Full Retirement Age.

Retirement-Reform Bill Could Slash Taxes

The House is ready to vote on H.R. 2954, also known as SECURE 2.0 -- a major revamp to the landmark 2019 law that overhauled retirement tax rules for older Americans – and the changes could mean even bigger savings for your investment portfolio and nest egg.

ROBERT POWELL

2 HOURS AGO

Congress is working on some major revisions to the 2019 law that overhauled retirement tax rules for older Americans – and the changes could mean big savings for your investment portfolio and nest egg.

The U.S. The House of Representatives was expected to vote Tuesday on H.R. 2954, also known as SECURE 2.0.

The first SECURE Act, also known as the Setting Every Community Up for Retirement Enhancement Act of 2019, included major provisions designed to increase access to tax-advantaged accounts and prevent retirees from outliving their assets.

Bigger Changes for RMDs

Under SECURE 1.0, the age for required minimum distributions, known as RMDs, increased from 70½ to 72. The new legislation, SECURE 2.0, would increase the age for RMDs to 73 in 2023, 74 in 2030 and 75 in 2033.

(RMDs? Once you reach a certain age, the IRS wants you to start withdrawing from your retirement account and pay taxes, whether you need the money or not.)

See: What Are Required Minimum Distributions and How Are They Calculated?

That’s just one of the changes being considered. Should SECURE 2.0 be signed into law, Americans’ retirement accounts – and their retirement planning – could be changed substantially, said Lisa Featherngill, the national director of wealth planning at Comerica Bank, in an interview with Bob Powell on TheStreet’s Retirement Daily.

According to Featherngill, increasing the age at which RMDs begin would likely increase the amount of RMDs one might take but it would also increase the number of years in which a retirement account holder would enjoy tax-deferred growth.

“The RMD is based on the value of the account and life expectancy,” she said. “So, assuming there's no change in the life expectancy tables, the distribution would be higher if you wait to 75 versus if you took it at 72. But you have additional years of deferred tax.”

Catch-up Contributions and Inflation

Another provision would Increase catch-up contributions to employer retirement plans for individuals ages 62, 63 and 64 from $6,500 to $10,000. And what’s notable about this provision is the catch-up contribution index for inflation, she said. So, it might be $10,000 in 2023 but for someone who is now age 50 it could be quite higher, say $14,250 if inflation runs at 3%, by the time that person turns 62.

Scroll to Continue

Another provision would provide an option for employer matching contributions to be made into the Roth portion of the retirement plans. Typically, the employer’s contribution goes into the employee’s pre-tax 401(k) account. So, for someone who is young and in a low tax bracket today but expects to be in a higher tax bracket in the future, this option could be “incredibly powerful,” said Featherngill.

“If you could afford to pay the tax on the employer match in the Roth today, then that money builds up tax-free for the rest of your life,” she said.

Employer Contributions, Charitable Contributions

SECURE 2.0 would also allow an employer contribution to an employee retirement plan based on the employee’s student loan payments. “If you've got an employee who's paying back student loans, the student loan payments can qualify as contributions to the retirement plan only for purposes of the employer match,” she said. “That could be really significant to help (workers) save for retirement while at the same time taking care of debt from college.”

SECURE 2.0 would also allow individuals age 70½ and older to make a one-time charitable distribution, up to $50,000, from an IRA to a split-interest trust such as a charitable remainder trust. “Most of my clients love qualified charitable distributions or QCDs,” she said.

Generally, a qualified charitable distribution is an otherwise taxable distribution from an IRA owned by an individual who is age 70½ or over that is paid directly from the IRA to a qualified charity.

The caveat, however, has always been that it has to be a public charity, said Featherngill. “It can't be your remainder trust or anything else where you have an interest,” she said. But SECURE 2.0 would allow an account owner to give up to $50,000 into a split interest trust, a charitable remainder trust. A charitable remainder trust allows a grantor to create a trust that generates revenue for a few years and then transfers the assets to a charity, according to the Legal Information Institute.

The proposed bill, HR 2954, would also allow domestic abuse survivors to take a distribution of the lesser of $10,000 or 50% of the plan balance without penalty for one year following the abuse. “This gives access to additional funds if somebody needs it,” she said.

Of note, there's a version of SECURE 2.0, the Retirement Security and Savings Act, in the Senate. That proposed legislation features many provisions included in the House's Securing a Strong Retirement Act but there are differences as well.

“It will be interesting to see if (the House and Senate) combine these bills,” said Featherngill.

And, of course, any proposed legislation must be signed into law by the President, she noted.

And until then, retirees and would-be retirees should keep an eye on Congress. “Let's see what happens and then we can plan for next year,” she said.

The House is ready to vote on H.R. 2954, also known as SECURE 2.0 -- a major revamp to the landmark 2019 law that overhauled retirement tax rules for older Americans – and the changes could mean even bigger savings for your investment portfolio and nest egg.

ROBERT POWELL

2 HOURS AGO

Congress is working on some major revisions to the 2019 law that overhauled retirement tax rules for older Americans – and the changes could mean big savings for your investment portfolio and nest egg.

The U.S. The House of Representatives was expected to vote Tuesday on H.R. 2954, also known as SECURE 2.0.

The first SECURE Act, also known as the Setting Every Community Up for Retirement Enhancement Act of 2019, included major provisions designed to increase access to tax-advantaged accounts and prevent retirees from outliving their assets.

Bigger Changes for RMDs

Under SECURE 1.0, the age for required minimum distributions, known as RMDs, increased from 70½ to 72. The new legislation, SECURE 2.0, would increase the age for RMDs to 73 in 2023, 74 in 2030 and 75 in 2033.

(RMDs? Once you reach a certain age, the IRS wants you to start withdrawing from your retirement account and pay taxes, whether you need the money or not.)

See: What Are Required Minimum Distributions and How Are They Calculated?

That’s just one of the changes being considered. Should SECURE 2.0 be signed into law, Americans’ retirement accounts – and their retirement planning – could be changed substantially, said Lisa Featherngill, the national director of wealth planning at Comerica Bank, in an interview with Bob Powell on TheStreet’s Retirement Daily.

According to Featherngill, increasing the age at which RMDs begin would likely increase the amount of RMDs one might take but it would also increase the number of years in which a retirement account holder would enjoy tax-deferred growth.

“The RMD is based on the value of the account and life expectancy,” she said. “So, assuming there's no change in the life expectancy tables, the distribution would be higher if you wait to 75 versus if you took it at 72. But you have additional years of deferred tax.”

Catch-up Contributions and Inflation

Another provision would Increase catch-up contributions to employer retirement plans for individuals ages 62, 63 and 64 from $6,500 to $10,000. And what’s notable about this provision is the catch-up contribution index for inflation, she said. So, it might be $10,000 in 2023 but for someone who is now age 50 it could be quite higher, say $14,250 if inflation runs at 3%, by the time that person turns 62.

Scroll to Continue

Another provision would provide an option for employer matching contributions to be made into the Roth portion of the retirement plans. Typically, the employer’s contribution goes into the employee’s pre-tax 401(k) account. So, for someone who is young and in a low tax bracket today but expects to be in a higher tax bracket in the future, this option could be “incredibly powerful,” said Featherngill.

“If you could afford to pay the tax on the employer match in the Roth today, then that money builds up tax-free for the rest of your life,” she said.

Employer Contributions, Charitable Contributions

SECURE 2.0 would also allow an employer contribution to an employee retirement plan based on the employee’s student loan payments. “If you've got an employee who's paying back student loans, the student loan payments can qualify as contributions to the retirement plan only for purposes of the employer match,” she said. “That could be really significant to help (workers) save for retirement while at the same time taking care of debt from college.”

SECURE 2.0 would also allow individuals age 70½ and older to make a one-time charitable distribution, up to $50,000, from an IRA to a split-interest trust such as a charitable remainder trust. “Most of my clients love qualified charitable distributions or QCDs,” she said.

Generally, a qualified charitable distribution is an otherwise taxable distribution from an IRA owned by an individual who is age 70½ or over that is paid directly from the IRA to a qualified charity.

The caveat, however, has always been that it has to be a public charity, said Featherngill. “It can't be your remainder trust or anything else where you have an interest,” she said. But SECURE 2.0 would allow an account owner to give up to $50,000 into a split interest trust, a charitable remainder trust. A charitable remainder trust allows a grantor to create a trust that generates revenue for a few years and then transfers the assets to a charity, according to the Legal Information Institute.

The proposed bill, HR 2954, would also allow domestic abuse survivors to take a distribution of the lesser of $10,000 or 50% of the plan balance without penalty for one year following the abuse. “This gives access to additional funds if somebody needs it,” she said.

Of note, there's a version of SECURE 2.0, the Retirement Security and Savings Act, in the Senate. That proposed legislation features many provisions included in the House's Securing a Strong Retirement Act but there are differences as well.

“It will be interesting to see if (the House and Senate) combine these bills,” said Featherngill.

And, of course, any proposed legislation must be signed into law by the President, she noted.

And until then, retirees and would-be retirees should keep an eye on Congress. “Let's see what happens and then we can plan for next year,” she said.

No comments:

Post a Comment