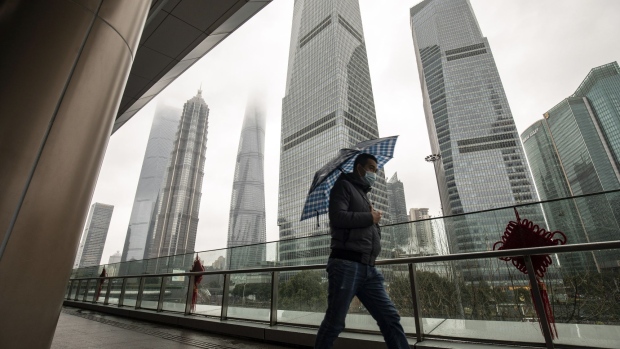

Unchecked Power of Senior Bankers Is Exposed by China Crackdown

CRIMINAL CAPITALI$M WITH CHINESE CHARACTERISTICS

, Bloomberg News

(Bloomberg) -- Bribery. Kickbacks. Cover-ups. For one week in January, Chinese state television devoted its prime-time slot to a series that detailed high-profile financial crimes by some of country’s most senior bankers.

There was the former head of China’s largest policy bank, who accepted bribes to approve a $4.8 billion credit line to a conglomerate that failed shortly after. Another state-owned bank executive used carefully structured shadow firms to receive 10 million yuan in kickbacks for approving real-estate loans of more than 4 billion yuan to a single developer.

The multipart broadcast was framed as a celebration of Beijing’s long-running anti-corruption campaign, part of President Xi Jinping’s overall attempts to stabilize the economy ahead of a meeting that’s expected to award him a third term in office. But it also revealed how senior bankers have been allowed to operate with few checks and even less accountability, and connected their actions with massive credit defaults and other market instability.

The recent investigation into 25 entities marks the first systematic review of the financial sector since 2015, and last month, when it concluded, the nation’s top disciplinary watchdog sharply criticized financial institutions and regulators for prominent corruption and insufficient risk monitoring – problems it said were “common.”

More than 20 finance industry officials have been punished or probed since the investigation began; over the past few years, lax governance has contributed to estimated losses of hundreds of billions of yuan.

Without intervention, China’s financial sector could become “a runaway elephant in a china shop,” said Shen Meng, a director at Beijing-based boutique investment bank Chanson & Co. “Deep down, people still lack this awareness that essentially, corporate governance serves to cut the risk of decision making, by checking and balancing all parties.”

Listed firms are required to implement modern corporate governance structures, but China’s standards are often lower than those in developed markets. In the U.S., for example, independent directors make up about 80% of the board, on average. Most Chinese companies only meet the minimum requirement of one-third independent directors, a “lack of oversight that ultimately allows for poor operational and financial controls,” said Rob Du Boff, a Bloomberg Intelligence analyst specializes in ESG.

The collapse of China Huarong Asset Management Co. is one of the best-known cases where traditional governance mechanisms failed. Former chairman Lai Xiaomin was also the head of the internal party committee and the company’s legal representative. The company’s party discipline chief reported to him. “It was difficult for him to supervise me, to be honest,” Lai said in 2020.

Without any meaningful oversight, Lai drove Huarong to aggressive expansion. Eventually, the firm posted a record loss that led to a $6.6 billion state-orchestrated bailout, and Lai was executed for bribery and other crimes.

But there have also been smaller examples. Hu Huaibang, the former chairman of China Development Bank, took some 85.5 million yuan in bribes over a decade through 2019. In exchange, he facilitated loans that included $4.8 billion to the now failed conglomerate CEFC China Energy Co., even though China had called for the policy bank to cut its exposure to such commercial projects.

His motivation was basic: “As a senior executive in the finance sector, you get to make contact with people with relatively high classes and they own private jets and everything,” he said in the state-sponsored docuseries. “That’s when I felt the unfairness and became weak-minded and slipped into the abyss.”

Senior leaders at Chinese financial institutions, especially state-owned ones, hold official government titles and earn government-limited salaries. The chairmen of China’s largest state-owned banks each earn about $120,000 a year – less than 1% of what their U.S. counterparts made in 2020.

The former governor of China Citic Bank Corp., Sun Deshun, often neglected the bank’s internal credit approval board and intervened directly to facilitate loans for developers in exchange for bribes. Investigators found he used more than a dozen shadow firms, managed by his two surrogates, for bribes disguised as financial products and equity investments.

In early 2020, the banking regulator levied a 22 million yuan fine on Citic Bank for 19 violations, of which 13 were linked to the property sector. Later that year, Sun was expelled from the Communist Party, arrested for alleged bribery among other violations, and prosecuted.

But regulators were also susceptible. A former deputy chairman of China’s banking regulator, Cai Esheng, used his personal influence to facilitate loans and projects in exchange for cash, banquets, travel and other gifts.

In the case of Baoshang Bank Co., at least five officials including the former head of the Inner Mongolian banking watchdog took hundreds of millions of yuan in bribes to make way for its “wild expansion and illegal operations” that eventually led to its collapse and China’s first bank seizure in more than 20 years.

These kinds of investigations are common across sectors in China, where the government intends them to both deter bad behavior and reassure investors, said Oliver Rui, a professor of finance at China Europe International Business School in Shanghai.

“It takes some time to fully develop governance mechanisms,” he said. “The current systems in the U.S. were also built gradually. I like to say -- in Chinese terms -- let the bullet fly for a while.”

Meanwhile, officials have introduced measures designed to prevent future corruption. Last year, authorities issued guidelines targeting bribers and have pledged to step up internal controls to keep regulators in line. The government has also strengthened Communist Party control over management decisions at state-owned banks. The central bank and the banking and securities regulators have vowed to correct their wrongdoings and to enhance financial regulation.

The prime-time series and the high-profile media coverage of the latest anti-corruption efforts may also offer a wake-up call. “A lot of people working at the institutions don’t even truly understand corporate governance, let alone retail investors,” Chanson & Co.’s Shen said.

©2022 Bloomberg L.P.

Evergrande Investors Left Baffled by $2.1

Billion in Seized Cash

, Bloomberg

(Bloomberg) -- Investors in China Evergrande Group are still in the dark over just how $2.1 billion of deposits at its property-services unit came to be used as security for pledge guarantees and seized by banks.

In a call with investors late Tuesday, the developer’s officials reiterated comments from earlier filings that they were investigating the matter without sharing fresh details, according to people who attended and asked not to be identified. The third-party pledge guarantee wipes out most of Evergrande Property Services Group Ltd.’s cash holdings.

“It’s peculiar because investors expect Evergrande management should be aware of where the cash went rather than instead setting up an investigation committee to find out,” said Bloomberg Intelligence analyst Andrew Chan.

While the 13.4 billion yuan ($2.1 billion) in seized cash is small in the context of the broader restructuring, it raises questions over the reliability of the financial accounts of the services unit “if the group plans to sell it at a good price to achieve maximum recovery for creditors,” Chan said.

Representatives for Evergrande didn’t immediately respond to a request for comment about the call.

Evergrande creditors are keeping a close eye on the beleaguered developer as it embarks on a debt restructuring that’s likely to be among China’s largest and most complex. Worries over transparency have surfaced repeatedly as Chinese developers struggle to cope with a credit crunch that’s swept the sector as Beijing clamps down on excessive borrowing.

©2022 Bloomberg L.P.

Tencent Share Buyback Speculation Grows After Alibaba, Xiaomi

, Bloomberg News

(Bloomberg) -- Share buybacks are emerging as the hottest trend among Chinese tech giants and industry leader Tencent Holdings Ltd. may be the next to jump on the bandwagon.

The online gaming giant climbed as much as 3.1% in Hong Kong on Wednesday, just before it’s expected to announce its slowest profit growth ever. Investors are betting that the company will follow in the footsteps of Alibaba Group Holding Ltd. and Xiaomi Corp., which both announced massive buybacks after their earnings, with the moves fueling a rally in their shares.

The improving sentiment in tech stocks reflects broader hopes that China’s crackdown on the sector is coming to an end after the government pledged greater support for the economy and capital markets. But, a recovery remains dependent on concrete action from the authorities, and Morgan Stanley’s equity strategists warn that it’s too early to be optimistic.

“Alibaba and Xiaomi have probably kick-started shareholders’ focus on buybacks after a horrendous performance in share prices in the last year,” said Kerry Goh, chief investment officer at Kamet Capital Partners Pte. “Tougher restrictions on investing in other firms, coupled with a strong balance sheet and good cash flow should motivate Tencent to do a share buyback like the others.”

An 18% surge in Alibaba’s stock since Tuesday indicates that share buybacks have become a more rewarding strategy for Chinese tech giants, after valuations slumped to near record lows and regulatory fears eased. Still, the scale of repurchases is small compared to megacaps in the U.S., which have bought back more than $20 billion worth of stock in each of the recent quarters.

“In consideration of cash usage, shareholder returns may now become a priority over something, say like the M&A back in the past,” said Vey-Sern Ling, senior analyst at Union Bancaire Privee.

Tencent boosted its dividend payout, including offering JD.Com Inc. shares, in order to lure investors. But, those moves have failed to reverse a downtrend in its stock. This year, Tencent overtook Alibaba to become the biggest loser in China’s tech rout after it shed about $450 billion in market value since last February.

Tencent certainly has the financial resources for a buyback. The company held about $40 billion in cash and short-term instruments on its balance sheet at the end of September, a figure that may well have increased when it reports the December quarter results.

The company’s business is under pressure with revenue growth projected to fall to its slowest pace on record when it reports earnings later Wednesday. Tencent’s games business has been handicapped by Beijing’s freeze on new titles, while its online advertising business is expected to have contracted for the first time on record in the fourth quarter.

Still, many analysts see opportunity in a buyback after Tencent plunged during Beijing’s crackdown, at one point shedding more than $500 billion in market value. Even after their recent rally, the shares trade at about 16 times earnings compared with Baidu Inc.’s 32 times and Twitter Inc.’s multiple of more than 100.

(Adds background in last three paragraphs)

©2022 Bloomberg L.P.

No comments:

Post a Comment