Elliott Associates Go Activist On Suncor, It's About Time

Summary

- Elliott Associates took a 3.4% stake in Suncor and will be seeking 5 board seats.

- Suncor is the classic example of a company with great assets but a bad management team.

- If the activists are successful in replacing the management team, then we see SU as a long-term holding.

- Looking for a helping hand in the market? Members of HFI Research get exclusive ideas and guidance to navigate any climate. Learn More »

dan_prat/iStock Unreleased via Getty Images

Suncor Energy Inc. (NYSE:SU), our 4th largest holding, is getting a nice pop today on the announcement that Elliott Associates, a famous and large ($50+ billion) hedge fund, just took a 3.4% stake and will be seeking 5 board seats.

For starters, activism in Canada is a mixed bag. Pershing Square, Bill Ackman's fund, went activist in Canadian Pacific Railway (CP) and had great success. And then there were activists like Orange Capital which went activist on Bellatrix Exploration (OTC:BXEFF) and failed hard.

For Suncor, this has been a long time coming. Following SU's 2021 year-end results, we wrote this article. In it, we said the following:

If instead, the management team hears from shareholders about demanding a higher capital allocation plan, then a dividend increase is the only way.

And since we are shareholders, we are going to be voicing our concerns on this matter to the Suncor board. We will be making phone calls over the coming weeks to rally shareholder support for higher dividends by May's earnings release (for Q1).

With this much free cash flow leftover, we think the management will have no choice but to make the right move. Let's see, but we are going to be taking action.

We did make calls following the write-up. There was growing frustration amongst the SU investors base on the lack of urgency to increase capital return to shareholders. We suspect the opportunity presented itself to Elliott's team given the obviousness of the situation. An integrated oil major with a dominant market position unwilling to pay out a large amount of free cash flow back to shareholders is just screaming activism through and through.

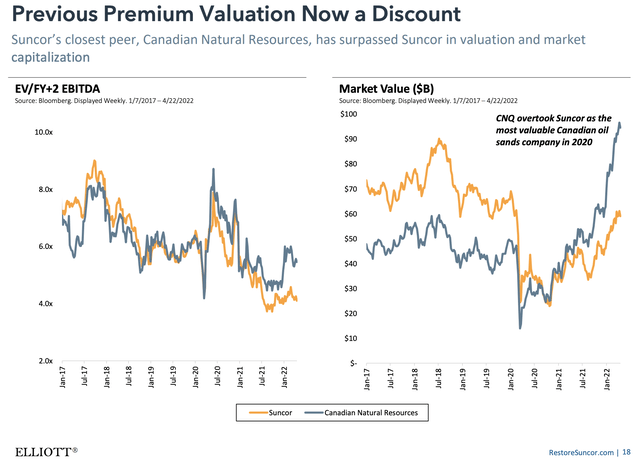

Since we started investing in SU, our key hesitancy was always the management team. Mark Little and the SU board are not competent capital allocators. It shows via the underperformance of SU vs. Canadian National Resources (CNQ). And we are very happy to see Elliott point that out in the slide deck:

Elliott

And it really is not surprising to see Suncor perform so horribly since Mark Little became the CEO in 2018.

So much cash...

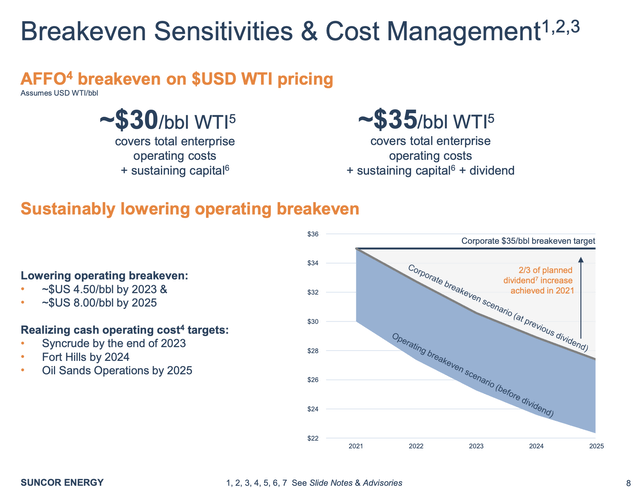

At $105/bbl WTI, Suncor is generating C$12+ billion in free cash flow. Despite this ridiculous figure, the SU board is still using $35/bbl for a sustainable dividend.

Suncor

As Cenovus Energy (CVE) demonstrated yesterday in its Q1 release, it's time to adopt a more flexible strategy. Dividend policies from producers should not be anchored to a fixed amount. Oil is a volatile commodity, and investors buy producers for the embedded upside potential of oil. As a result, adopting a variable dividend with excess free cash flow is the only way to reward shareholders for withstanding the volatility of owning oil producers.

This is clearly the way forward.

If management is gone, Suncor is a core position for the long run

If Elliott is successful in changing the management (hard to say at this moment), then SU is going to be a stock you want to own for the long run.

If Elliott is not successful, then SU will likely respond with a massive dividend increase, and the shares will react appropriately. We may look to exit if the activists aren't successful later on.

The investment thesis in SU is really simple. It is one of the best businesses in Canada (every producer in Canada wishes it had the assets of SU), and the integrated structure allows it to be insulated from crazy price volatility. But the management team is horrendous, so it was a valuation play, plain and simple.

If the management team is replaced, then this is no longer a valuation play, but a long-term hold as the new management team could compound capital.

Everything will be dependent on whether Elliott is successful or not. We think they will.

HFI Research, #1 Energy Service

For energy investors, the 2014-2020 bear market has been incredibly brutal. But as the old adage goes, "Low commodity prices cure low commodity prices." Our deep understanding of US shale and other oil market fundamentals leads us to believe that we are finally entering a multi-year bull market. Investors should take advantage of the incoming trend and be positioned in real assets like precious metals and energy stocks. If you are interested, we can help! Come and see for yourself!

Disclosure: I/we have a beneficial long position in the shares of SU, CVE, CNQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment