Bloomberg News | April 22, 2022 |

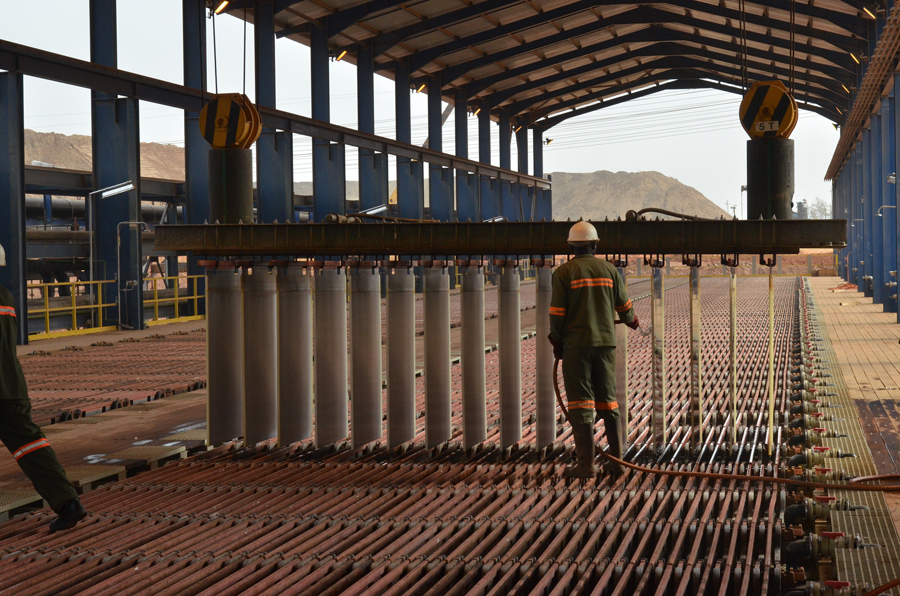

Mutanda copper mine. (Image: Fleurette Group)

Democratic Republic of Congo added Glencore Plc’s giant Mutanda copper and cobalt operation to a list of projects that could face renegotiation, just as the key battery metals mine is in the process of restarting.

The move to probe Mutanda comes as Congo President Felix Tshisekedi increases his scrutiny of extractive deals made under his predecessor, Joseph Kabila. Congo is examining copper and cobalt projects controlled by China Molybdenum Co. and China Railway Group, while the president’s advisers are also renegotiating the rights to multiple raw material permits and royalty streams controlled by Israeli billionaire Dan Gertler.

“When you see what happened in this sector during the previous regime, it was scandalous in terms of concessions given to foreign companies,” Andre Wameso, the president’s deputy chief of staff for economic issues, said in an interview on Thursday in the capital Kinshasa.

Some of Mutanda’s permits expire next month, and Tshisekedi has used the renewal process to create an ad-hoc commission that will assess the project’s benefits for Congo, Wameso, said.

Mutanda has not been formally notified in respect of any commission, a Glencore spokesman said by email Friday.

Glencore confirmed in December that it planned to reopen Mutanda, which was put on care and maintenance in 2019 after cobalt prices slumped. The operation will produce about 11,000 tons of cobalt a year between 2022 and 2025, with output over the full 20-year mine life expected to average about 76,000 tons copper and 21,000 tons cobalt, the commodity giant said.

A reopening of Mutanda comes amid renewed demand for battery metals from automakers as economies shift toward cleaner technologies that use electricity for energy. Cobalt and copper are key metals in that green transition.

Three of Mutanda’s four permits are set to expire in May, according to Congo’s mining cadastre.

“This is an opportunity for us to see very calmly how things have been done and if there are improvements in terms of rebalancing the partnership with Glencore,” he said. “We have nothing against Glencore,” Wameso said, adding that any rebalancing would be to ensure that the state’s “interests are preserved.”

Congo’s mining code stipulates that miners submit permit renewal applications solely through the cadastre and the mines ministry. Neither responded to requests for comment. The code also requires companies to cede 5% of their shares to the state at the time of renewal.

According to the code, the cadastre gives the permit-renewal dossier to the mines minister, who has 30 days to accept or reject it. If the minister says nothing, the permit then is considered accepted, presuming the cadastre has advised that it be accepted.

After that the renewal must be registered by the cadastre.

Mutanda is following the process set out in Congo’s mining code in respect of its renewal, which it expects to be registered in the coming weeks, the Glencore spokesman said.

Mutanda produced a fifth of the world’s cobalt and nearly 200,000 tons of copper in 2018, its last year of full production. The company restarted processing stockpiles of oxide ore late last year while it explores the future mining of Mutanda’s sulphide resources, according to Glencore’s 2021 annual report.

Negotiations with China Moly over its Tenke mine are gridlocked over a dispute relating to different definitions for estimating the mineral reserves in the project, according to Wameso.

Congo believes the Chinese company has underreported its reserves, starving its minority partner, state-owned miner Gecamines, of contractual payments. Last month, the government said it was trying to resolve the dispute amicably and that Gecamines was suspending a court case against China Moly’s Tenke Fungurume Mining SA.

Wameso declined to comment on legal proceedings.

The two sides are engaging a third-party to conduct an assessment, said Vincent Zhou, a spokesman for China Moly, who added that Tenke Fungurume posted better-than-planned production results in the first quarter of 2022.

(By Michael J. Kavanagh, with assistance from Thomas Biesheuvel)

No comments:

Post a Comment