Opinion: Germany needs a new business model

Germany's economic success is based largely on inflows of cheap energy. But the Ukraine war has put a sudden end to this. The rapid decarbonization of Europe's largest economy could be the solution, says Henrik Böhme.

Has Germany's business model run aground?

The first victim of war is the truth they say, and Russia's aggression against Ukraine has proven this once more. At the same time, war can also reveal truths that normally would remain hidden and undiscussed.

One tough truth about the German economy was laid bare by Martin Brudermüller in an interview with German daily Frankfurter Allgemeine Zeitung recently. The head of the world's biggest chemical corporation, German-based BASF, said it was an undeniable fact that "Russian gas is the foundation of German industry's global competitiveness." When asked if Germany wasn't fueling Putin's war with its energy imports from Russia, he said a ban on those imports "will destroy the well-being of Germans."

What Brudermüller described as "a mainstay of Germany's economic strength," has been an essential part of the country's business model and has secured its place as one of the largest exporting nations in the world. The successful business models built by German companies over the past 20 years or so included importing energy below market prices and using it to develop competitive products.

Russia, China and the forces of globalization

In more recent years, China has also contributed significantly to the success story after German corporate heads jumped on the Chinese economic juggernaut much earlier than their rivals elsewhere in the world. By doing so, they were able to secure not only large segments of the Chinese market but at the same time access to China's rare earths and other valuable minerals, too. Small wonder that the German auto giant Volkswagen (VW), for example, currently sells about 40% of its annual production in China.

What's also come in handy for Germany was the worldwide drive for national economies to open themselves up to international competition under the banner of globalization. "Made in Germany" couldn't but shine in a global, free-market environment.

Cheap Russian energy and China's huge markets, coupled with liberalized trade and a strong domestic industry, was the perfect setting for the German economy to race ahead. The results are a massive foreign trade surplus, with exports far surpassing imports, and at the same time, precarious dependencies on Russia and China.

But what has long been a straight road to success for German businesses has suddenly turned into a slippery slope because of the brutal war in Ukraine. The COVID-19 pandemic already came as a sort of harbinger for what many believe is "the end of globalization."

Business leaders are beginning to think seriously about disentangling supply chains that have proven too complex in times of a global pandemic. In Germany, the absence of medical mask production opened the eyes of politicians and the public alike to the fact that essential infrastructure has been completely outsourced to other parts of the world.

"Reshoring" is likely to become the buzzword for the post-COVID era although bringing production home may prove a tall order for most industrialized countries.

In more recent years, China has also contributed significantly to the success story after German corporate heads jumped on the Chinese economic juggernaut much earlier than their rivals elsewhere in the world. By doing so, they were able to secure not only large segments of the Chinese market but at the same time access to China's rare earths and other valuable minerals, too. Small wonder that the German auto giant Volkswagen (VW), for example, currently sells about 40% of its annual production in China.

What's also come in handy for Germany was the worldwide drive for national economies to open themselves up to international competition under the banner of globalization. "Made in Germany" couldn't but shine in a global, free-market environment.

Cheap Russian energy and China's huge markets, coupled with liberalized trade and a strong domestic industry, was the perfect setting for the German economy to race ahead. The results are a massive foreign trade surplus, with exports far surpassing imports, and at the same time, precarious dependencies on Russia and China.

But what has long been a straight road to success for German businesses has suddenly turned into a slippery slope because of the brutal war in Ukraine. The COVID-19 pandemic already came as a sort of harbinger for what many believe is "the end of globalization."

Business leaders are beginning to think seriously about disentangling supply chains that have proven too complex in times of a global pandemic. In Germany, the absence of medical mask production opened the eyes of politicians and the public alike to the fact that essential infrastructure has been completely outsourced to other parts of the world.

"Reshoring" is likely to become the buzzword for the post-COVID era although bringing production home may prove a tall order for most industrialized countries.

'Bipolar' economic world order?

Now, the Ukraine war has added a new spin to the deglobalization story in Germany, heightening the national sense of urgency for the country to wean itself off Russian energy imports, in order not to fuel Putin's aggression any longer.

Newly emerging on the horizon, too, is the question of how to deal with China which is apparently choosing to back the Kremlin. Mind you, this is not happening out of a sudden love for Putin in Beijing, but a shrewd awareness on the part of the Chinese president that huge amounts of Russian energy and raw materials are suddenly up for grabs. What unites Putin and Xi, though, is their joint hatred for Western values such as democracy, freedom of speech, and the rule of law.

So, is the world again splitting up into two antagonistic blocks, or as German economist Gabriel Felbermayr put it, are we witnessing "the end of 30 glorious years of globalization"? Are we headed for a world in which Europe and the United States will be leading the West, while Russia, China, and likely India, which is undecided yet, are joining forces in the Far East?

Will the multipolar world of globalization come tumbling down and make way for a new East-West standoff?

Such a 'bipolar world' would severely undermine the German business model, and there'd be need for a new one. What may help in this is German businesses' undeniable ability to adapt to the vagaries of economic life. Focusing on the opportunities opening up from the much-needed energy transformation and the decarbonization of German industry could pave the way toward the future.

To begin with, Germany must finally get serious about becoming energy-self-sufficient because electricity from renewable sources and hydrogen could provide a competitive advantage.

Economy Minister Robert Habeck wants Germany to have carbon-free electricity within the next 13 years and has declared power generation from solar, wind and biomass to be of "overwhelming public interest." If achieved, it would be a huge leap forward and enable German industry to continue producing at competitive prices, while safeguarding the well-being of Germany in the future.

This opinion piece was first published in German.

Russian nickel, palladium,

chromium exports a headache

for Germany

Now, the Ukraine war has added a new spin to the deglobalization story in Germany, heightening the national sense of urgency for the country to wean itself off Russian energy imports, in order not to fuel Putin's aggression any longer.

Newly emerging on the horizon, too, is the question of how to deal with China which is apparently choosing to back the Kremlin. Mind you, this is not happening out of a sudden love for Putin in Beijing, but a shrewd awareness on the part of the Chinese president that huge amounts of Russian energy and raw materials are suddenly up for grabs. What unites Putin and Xi, though, is their joint hatred for Western values such as democracy, freedom of speech, and the rule of law.

So, is the world again splitting up into two antagonistic blocks, or as German economist Gabriel Felbermayr put it, are we witnessing "the end of 30 glorious years of globalization"? Are we headed for a world in which Europe and the United States will be leading the West, while Russia, China, and likely India, which is undecided yet, are joining forces in the Far East?

Will the multipolar world of globalization come tumbling down and make way for a new East-West standoff?

Such a 'bipolar world' would severely undermine the German business model, and there'd be need for a new one. What may help in this is German businesses' undeniable ability to adapt to the vagaries of economic life. Focusing on the opportunities opening up from the much-needed energy transformation and the decarbonization of German industry could pave the way toward the future.

To begin with, Germany must finally get serious about becoming energy-self-sufficient because electricity from renewable sources and hydrogen could provide a competitive advantage.

Economy Minister Robert Habeck wants Germany to have carbon-free electricity within the next 13 years and has declared power generation from solar, wind and biomass to be of "overwhelming public interest." If achieved, it would be a huge leap forward and enable German industry to continue producing at competitive prices, while safeguarding the well-being of Germany in the future.

This opinion piece was first published in German.

Russian nickel, palladium,

chromium exports a headache

for Germany

Russian gas and oil are by far the most significant exports Moscow sells to Germany. Yet other important raw materials are also under the spotlight because of the war in Ukraine.

Russian nickel is important to the German economy

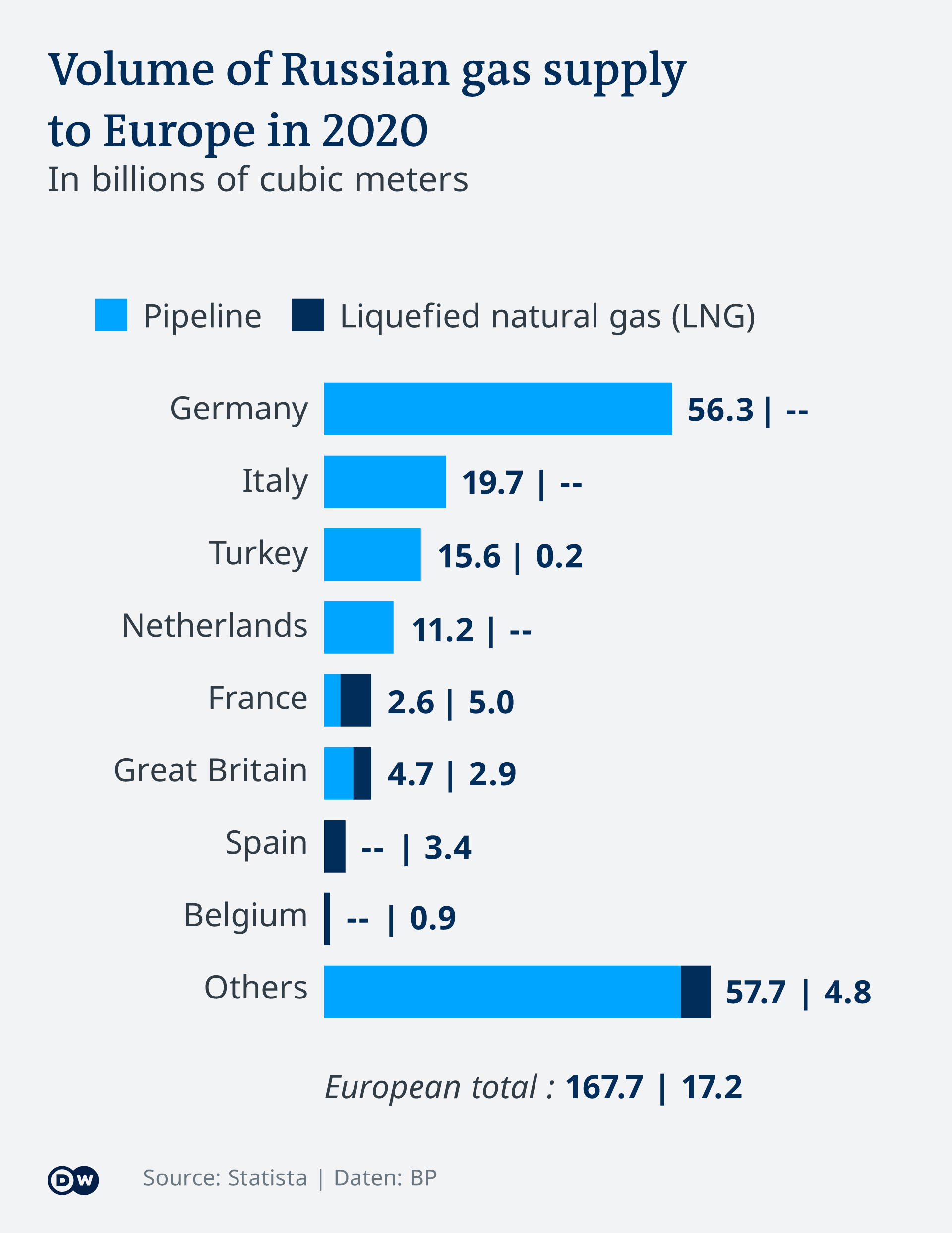

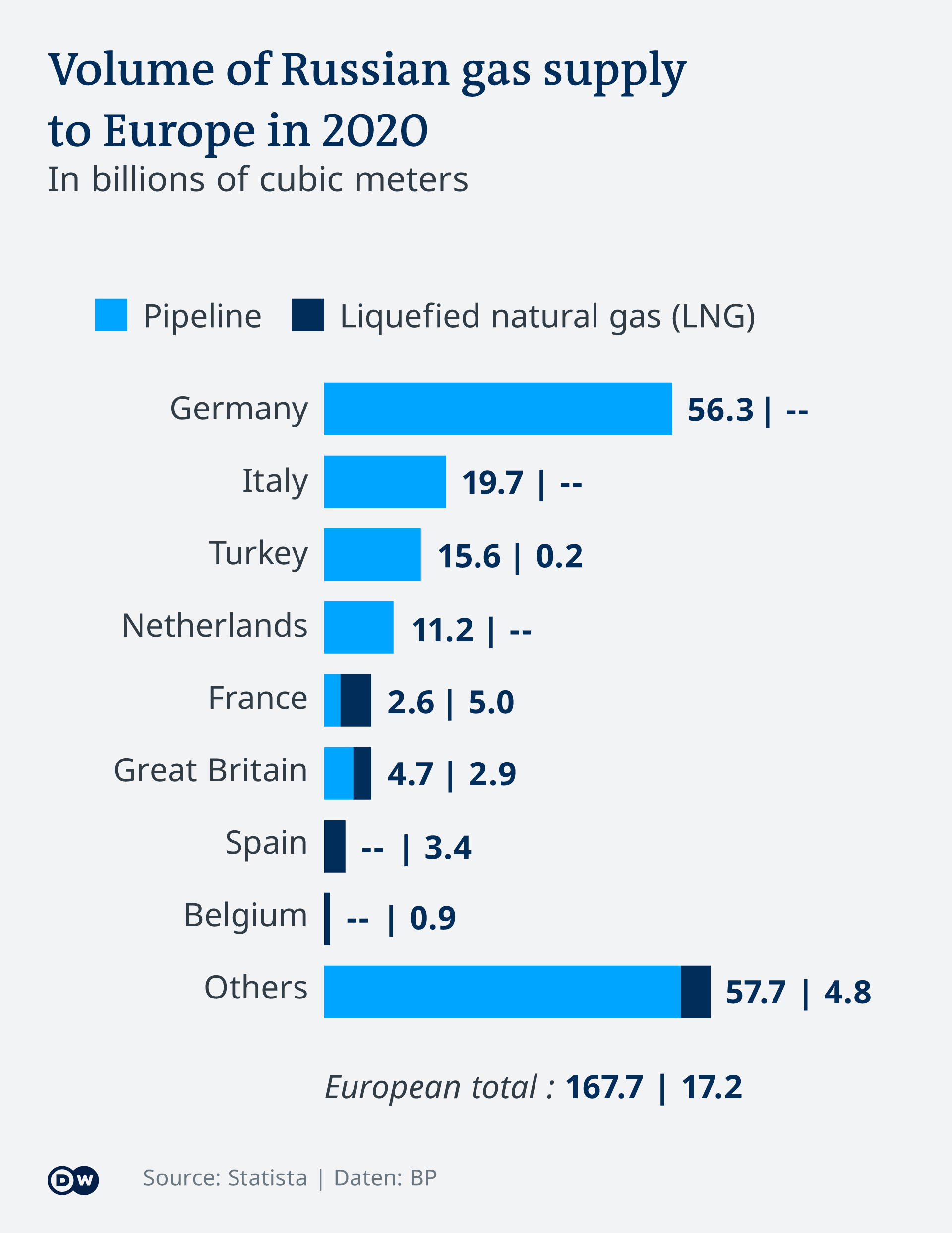

Almost all the debate surrounding Germany's economic ties with Russia since the invasion of Ukraine has focused on gas and oil. With good reason — Germany buys more Russian oil and gas than any other European country, making energy Russia's most lucrative import to Germany by far.

However, many German companies rely on a steady supply of other Russian exports, particularly raw materials such as nickel, palladium, copper and chromium.

Nickel is used in stainless steelmaking but is also an important component for lithium-ion batteries which are needed to power electric cars. Palladium is also vital for carmakers, as it is a critical component in the production of catalytic converters, which clean exhaust fumes in petrol and hybrid vehicles.

In 2020, Russia was Germany's biggest provider of raw nickel, accounting for 39% of the country's supply according to the MIT Observatory of Economic Complexity, a trade tracker.

It also provided around 25% of German imports of palladium, and between 15% and 20% of the heavy metals chromium and cadmium, which have a range of industrial uses. Russia also accounted for 11% of Germany's refined copper imports in 2020, 10.9% of its platinum and 8.5% of its iron ore.

Nickel and Daimler

A recent study by the German Economic Institute (IW), a Cologne-based think-tank, identified several raw materials imported from Russia which would be difficult to replace for Germany. "New trade relations with alternative export nations for these raw materials are essential," the institute said in a statement.

Nickel is important for making lithium-ion batteries for electric cars

Nickel is particularly important to consider. Germany's second-biggest import partner for raw nickel in 2020 was the Netherlands at 29%. But Russia is the market leader, supplying around 20% of the world's purest form of the metal, known as class 1 nickel.

High grade nickel has been in increasingly short supply for a few years now. The boom in electric vehicle production around the world — which needs high-grade nickel for batteries — has seen demand surge.

Tesla CEO Elon Musk has frequently tweeted about the lack of nickel. "Nickel is the biggest challenge for high-volume, long-range batteries!" he wrote in July 2020. "Australia & Canada are doing pretty well. US nickel production is objectively very lame. Indonesia is great!"

Class 1 nickel prices had already doubled over the last two years but Russia's invasion of Ukraine prompted fears that Moscow could impose an export ban. A trading frenzy in early March saw prices hit record highs, with the London Metal Exchange even suspending trading for a period, the first time it had taken such action in 37 years. Nickel prices have gone up 400% in 2022 alone.

Volkswagen — which has effectively staked its future on rapidly becoming an EV power — recently announced that it had struck an agreement with the Chinese companies Huayou Cobalt and Tsingshan Group for a joint venture to secure raw cobalt and nickel supply in Indonesia, one of the world's biggest producers.

Export bans, import bans

However, uncertainty over Russian raw materials will continue to stalk the market. Some analysts have predicted that the nickel crisis alone will add at least $1,000 (€919) to the costs of a new electric car for consumers.

The VDA, the trade body for German carmakers, says the war in Ukraine will lead to further disruption of vehicle production in Germany. "In the long term, the car industry is facing shortages and higher prices of raw materials," it said in a statement.

Not only carmakers are affected. In 2018, German chemicals giant BASF joined forces with Russia's Norilsk Nickel, the world's largest producer of refined nickel, for a deal which would see the Russian company supply BASF's new battery materials production facility in Finland with nickel and cobalt. Such deals are now being heavily scrutinized.

Norilsk is one of Russia's nickel-mining centers

Although Moscow did not put materials such as nickel on the export ban list it released in March, there remains a chance that sanctions either from Moscow or Brussels will end the flow of such raw materials to Europe.

On Friday, the EU announced import bans on several Russian products including coal, caviar, wood, rubber, cement and vodka. However, nickel and other commodities exported in high volume to countries such as Germany were left off the list.

Small potatoes compared to energy

Even if the sale of Russian nickel to Europe is not legally prohibited, the overwhelming pressure on German companies to cut business ties with Russia continues to mount in practically every sector.

Yet while myriad economic and business links between Germany and Russia die away and will continue to do so in the face of the outrage over what is happening in Ukraine, almost every scenario is dwarfed in significance by the possible consequences of an embargo on Russian oil and gas.

Many experts and business leaders have argued that Germany's economic prosperity of recent decades has largely been built on the cheap supply of Russian energy.

Ultimately, other German-Russian economic links are dwarfed by the energy question

BASF head Martin Brudermüller told the Frankfurter Allgemeine Zeitung that a sudden ban on Russian oil or gas could lead to an economic crisis as bad as any in Germany since World War II, and that his company would have to stop production if natural gas supplies fell to less than half the current usage.

Some disagree with such strong assessments. A study by the German National Academy of Sciences, Leopoldina, said ending supply immediately would be "manageable."

The fact that something as stringent as an outright ban on Russian energy is being seriously debated does make one thing clear for any German business with ties to Russia, regardless of their nature: Nothing is off limits, regardless of how economically "critical" it may be.

Edited by: Hardy Graupner

No comments:

Post a Comment