Henry Lazenby | May 20, 2022 |

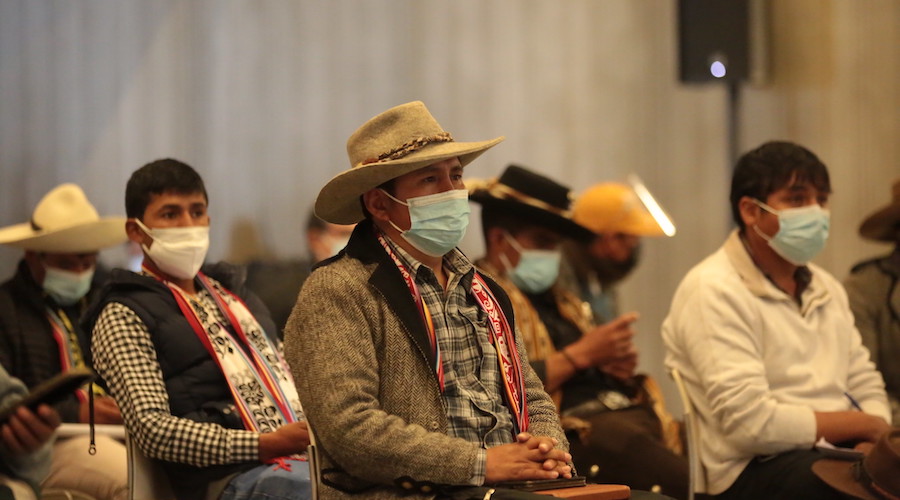

A 2021 meeting with farming communities protesting MMG’s Las Bambas copper mine in Peru. (Reference image by Peru’s Presidency of the Ministers’ Council, Flickr).

Companies operating in Colombia, Ecuador and Peru should do a better job of engaging and sharing the wealth their mines generate.

Observers tell The Northern Miner that implementing corporate social responsibility (CSSR) programs when mining business in Colombia, Ecuador, and Peru is simply not enough to guarantee success.

Instead, mineral explorers and developers often see substantial projects halted in their tracks by staunch community-level opposition, even when projects had passed regulatory muster, says mining sector researcher, analyst and reporter Paul Harris, in an interview.

Related: Peru fails yet again to broker truce allowing Las Bambas mine restart

Legacy CSR programs are simply no longer adequate. The analyst suggests those wishing to do business in these jurisdictions take a more holistic approach toward meaningful engagement with host communities before engaging governmental authorities about their respective projects.

The solution, according to Harris, is companies today have to be willing to give up an ownership stake in their projects so that local communities and local and federal governments have more skin in the game.

PAYWALL

KEEP READING AT NORTHERN MINER

Peru fails yet again to broker truce allowing Las Bambas mine restart

Reuters | May 19, 2022

Las Bambas copper mine. Image: YouTube

Peru’s prime minister on Thursday failed to broker a deal with indigenous communities to allow for the restart of operations at MMG Ltd’s Las Bambas copper mine, the government’s fourth failed negotiation attempt.

Chinese-owned Las Bambas is one of the world’s largest copper mines, accounting for 2% of global supplies. The mine suspended operations on April 20 after two indigenous communities entered company property, reclaiming land that had once belonged to them before the mine started operations in 2016.

Peru is the world’s No. 2 copper producer.

On Thursday, Prime Minister Anibal Torres traveled to the Andean region of Apurimac where the mine is located. But he arrived late and then abruptly left the meeting only an hour after it had started.

“It’s a lack of respect toward community members,” Baltazar Lataron, the governor of Apurimac, said about Torres’s departure.

The failed meeting extends the uncertainty on when Las Bambas will be able to restart copper production as its current suspension approaches the one-month mark, its longest shutdown so far.

Las Bambas accounts for 1% of Peru’s gross domestic product and company executives have warned that if a solution is not found soon they may have to furlough or fire some of its workers.

The protesting communities of Fuerabamba and Huancuire sold land to Las Bambas in the past for millions of dollars, but allege the mine has failed to honor all of its commitments.

Las Bambas is notorious for its social conflicts, involving dozens of different Andean communities that allege the benefits of its vast mineral wealth have not trickled down to them.

(By Marcelo Rochabrun; Editing by Marguerita Choy)

Las Bambas copper mine. Image: YouTube

Peru’s prime minister on Thursday failed to broker a deal with indigenous communities to allow for the restart of operations at MMG Ltd’s Las Bambas copper mine, the government’s fourth failed negotiation attempt.

Chinese-owned Las Bambas is one of the world’s largest copper mines, accounting for 2% of global supplies. The mine suspended operations on April 20 after two indigenous communities entered company property, reclaiming land that had once belonged to them before the mine started operations in 2016.

Peru is the world’s No. 2 copper producer.

On Thursday, Prime Minister Anibal Torres traveled to the Andean region of Apurimac where the mine is located. But he arrived late and then abruptly left the meeting only an hour after it had started.

“It’s a lack of respect toward community members,” Baltazar Lataron, the governor of Apurimac, said about Torres’s departure.

The failed meeting extends the uncertainty on when Las Bambas will be able to restart copper production as its current suspension approaches the one-month mark, its longest shutdown so far.

Las Bambas accounts for 1% of Peru’s gross domestic product and company executives have warned that if a solution is not found soon they may have to furlough or fire some of its workers.

The protesting communities of Fuerabamba and Huancuire sold land to Las Bambas in the past for millions of dollars, but allege the mine has failed to honor all of its commitments.

Las Bambas is notorious for its social conflicts, involving dozens of different Andean communities that allege the benefits of its vast mineral wealth have not trickled down to them.

(By Marcelo Rochabrun; Editing by Marguerita Choy)

Peru mining protests risk clogging $53 billion investment pipeline

Reuters | May 17, 2022

Yanacocha mine, in Peru’s northern Cajamarca region. (Image courtesy of Newmont.)

Peru, the world’s second-largest copper producer, risks losing out on billions of dollars of mining investment if the government fails to defuse protests that are hitting the industry and denting production, analysts and executives said.

Social conflicts have risen in the Andean nation over the past year since socialist President Pedro Castillo came into office, with a spate of protests against mines, including one that has halted production at the huge Las Bambas copper deposit.

With global prices soaring on high demand, that now threatens a mining investment pipeline of some $53 billion and could stall future projects expected by investment bank RBC to make up 12% of the world’s copper supply in years to come.

“Without any world-class projects on the horizon, the prospects for sustaining production are not good,” said Gonzalo Tamayo, analyst at Macroconsult and a former Peruvian mines and energy minister.

Mining executives and analyst met last week in Peru’s capital Lima, where the main concern was falling investment tied to rising social protests. A central bank report shows investment dipping some 1% this year and 15% in 2023.

The conflicts, mainly in poor Andean areas where communities feel bypassed by the huge mineral wealth beneath their soils, have started to bite, with protesters emboldened under Castillo who won election pledging to redistribute mining wealth.

Southern Copper’s Cuajone mine was paralyzed for almost two months earlier this year.

Las Bambas, owned by China’s MMG Ltd, suspended operations in April after an invasion of the mine by communities demanding what they called ancestral lands. The mine, which produces 2% of the world’s copper output, remains offline.

Las Bambas had received government approval in March to expand the mine, a plan which is now under threat.

Álvaro Ossio, vice president of commercial and finance for Las Bambas, said in a presentation at the Lima event, that the country faces a big task to benefit from high global prices.

“The great challenge that remains for all Peruvians is to take advantage of this great opportunity in these future trends,” he said.

Peru’s last big mining investments were in Anglo American’s Quellaveco and Minsur’s Mina Justa of a combined $6.6 billion. Their operations starting this year will help Peru hit annual output of 3 million tonnes of copper by 2025, experts say.

However, other major projects like Southern Copper’s Tia María, Michiquillay and Los Chancas worth some $6.7 billion, Buenaventura’s near billion dollar Trapiche and Rio Tinto’s $5 billion La Granja remain up in the air.

Not all was downbeat, however.

The world’s largest gold miner, Newmont Mining, said at the event that it was considering expanding into copper production in Peru, with a potential future return to the canceled Conga project.

Analyst Tamayo, though, stressed recent protests against mining had become harder to resolve.

“Now there are protests that stop mines in full operation,” he said. “The mining firms feel that the State does not support them and that the State has ceased to be the arbiter in conflicts.”

(By Marco Aquino; Editing by Adam Jourdan and Richard Pullin)

Yanacocha mine, in Peru’s northern Cajamarca region. (Image courtesy of Newmont.)

Peru, the world’s second-largest copper producer, risks losing out on billions of dollars of mining investment if the government fails to defuse protests that are hitting the industry and denting production, analysts and executives said.

Social conflicts have risen in the Andean nation over the past year since socialist President Pedro Castillo came into office, with a spate of protests against mines, including one that has halted production at the huge Las Bambas copper deposit.

With global prices soaring on high demand, that now threatens a mining investment pipeline of some $53 billion and could stall future projects expected by investment bank RBC to make up 12% of the world’s copper supply in years to come.

“Without any world-class projects on the horizon, the prospects for sustaining production are not good,” said Gonzalo Tamayo, analyst at Macroconsult and a former Peruvian mines and energy minister.

Mining executives and analyst met last week in Peru’s capital Lima, where the main concern was falling investment tied to rising social protests. A central bank report shows investment dipping some 1% this year and 15% in 2023.

The conflicts, mainly in poor Andean areas where communities feel bypassed by the huge mineral wealth beneath their soils, have started to bite, with protesters emboldened under Castillo who won election pledging to redistribute mining wealth.

Southern Copper’s Cuajone mine was paralyzed for almost two months earlier this year.

Las Bambas, owned by China’s MMG Ltd, suspended operations in April after an invasion of the mine by communities demanding what they called ancestral lands. The mine, which produces 2% of the world’s copper output, remains offline.

Las Bambas had received government approval in March to expand the mine, a plan which is now under threat.

Álvaro Ossio, vice president of commercial and finance for Las Bambas, said in a presentation at the Lima event, that the country faces a big task to benefit from high global prices.

“The great challenge that remains for all Peruvians is to take advantage of this great opportunity in these future trends,” he said.

Peru’s last big mining investments were in Anglo American’s Quellaveco and Minsur’s Mina Justa of a combined $6.6 billion. Their operations starting this year will help Peru hit annual output of 3 million tonnes of copper by 2025, experts say.

However, other major projects like Southern Copper’s Tia María, Michiquillay and Los Chancas worth some $6.7 billion, Buenaventura’s near billion dollar Trapiche and Rio Tinto’s $5 billion La Granja remain up in the air.

Not all was downbeat, however.

The world’s largest gold miner, Newmont Mining, said at the event that it was considering expanding into copper production in Peru, with a potential future return to the canceled Conga project.

Analyst Tamayo, though, stressed recent protests against mining had become harder to resolve.

“Now there are protests that stop mines in full operation,” he said. “The mining firms feel that the State does not support them and that the State has ceased to be the arbiter in conflicts.”

(By Marco Aquino; Editing by Adam Jourdan and Richard Pullin)

No comments:

Post a Comment