Nutrien will boost fertilizer production capacity as prices soar

Bloomberg News | June 9, 2022 |

Storage facility at Nutrien’s Rocanville, one of Canada’s lowest-cost potash mines. (Image courtesy of Nutrien (Former Potash Corp.)

The world’s largest fertilizer company will increase production after months of supply disruptions and skyrocketing commodity and food prices.

Nutrien Ltd. will ramp up potash production capability to 18 million tons by 2025, a 40% increase compared to 2020, the company said in a Thursday statement, citing “structural changes in global energy, agriculture and fertilizer markets.”

“The challenge of feeding a growing world has never been clearer as global supply constraints have contributed to higher commodity prices and escalated concerns for global food security,” said Ken Seitz, Nutrien’s interim president and CEO. “There is no simple or fast solution to overcome this challenge and we see potential for multi-year strength in agriculture and crop input market fundamentals.”

The announcement comes as fertilizer prices have been soaring after Russia’s invasion of Ukraine. Russia is an important exporter of every major kind of crop nutrient. Market players have been concerned about how much supply will make it out of the country and how global supply chains might change in the aftermath. Some prices have dropped off of records, but they’re still high.

Nutrien will be well-positioned to fill supply gaps, Seitz said.

“Financial sanctions and other restrictions on Russia and Belarus will create more lasting changes to global trade patterns as customers prioritize reliability of supply,” Seitz said on an investor call Thursday.

The Canadian company also says there’s a potential for delays in new potash capacity coming online from the region, which was supposed to account for 60% of new supply in next five years, he said.

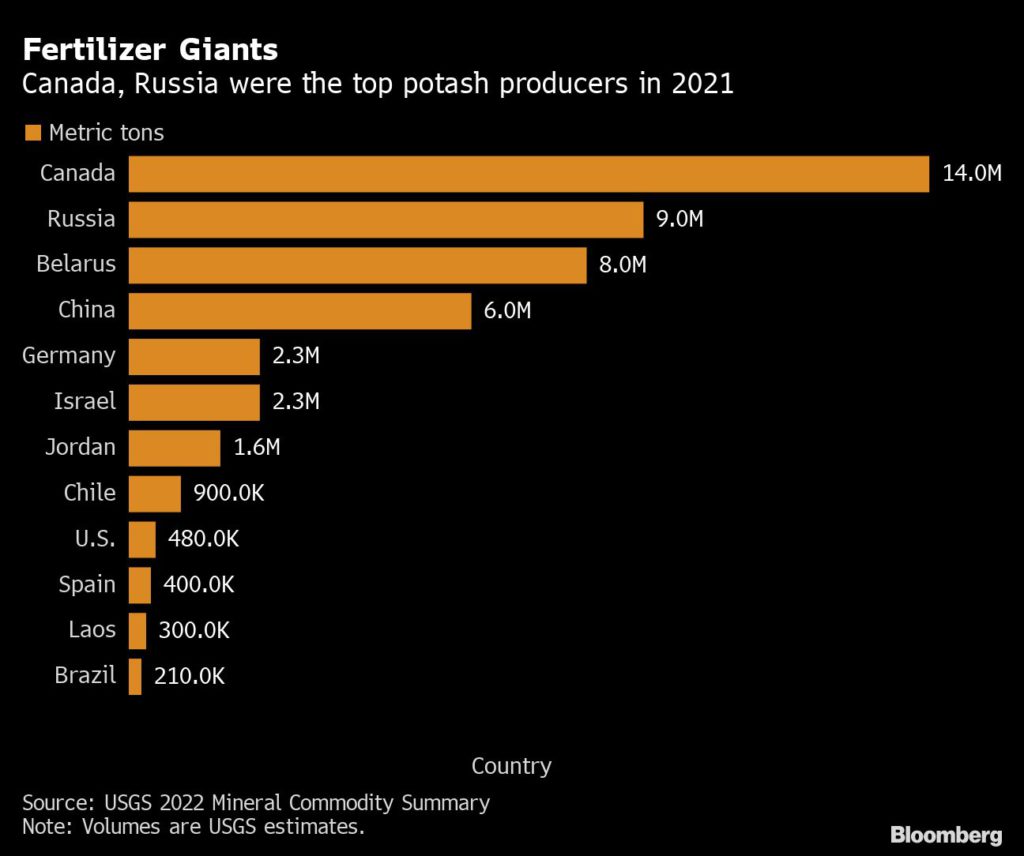

Canada is the world’s largest potash producer, followed by Russia and then Belarus. Belarus accounts for about a fifth of global supply, but in January, Lithuania cut off a key transit route for the nutrients amid US sanctions imposed on the country in 2021. That’s tightened the market.

Nutrien’s move could help serve a growing deficit as high commodity prices encourage farmers to purchase fertilizer to grow more crops and conflict in Europe threatens supply, Bloomberg Intelligence analyst Jason Miner said in a note.

“The key is remaining a low-cost producer,” Miner said. “Nutrien held potash cost per metric ton to $94 in 2021, yet construction and wage inflation are increasingly challenges to expansion projects across chemicals.”

(By Elizabeth Elkin and Jen Skerritt)

No comments:

Post a Comment