Scientists conceptualize a species 'stock market' to put a price tag on actions posing risks to biodiversity

So far, science has described more than 2 million species, and millions more await discovery. While species have value in themselves, many also deliver important ecosystem services to humanity, such as insects that pollinate our crops.

Meanwhile, as we lack a standardized system to quantify the value of different species, it is too easy to jump to the conclusion that they are practically worthless. As a result, humanity has been quick to justify actions that diminish populations and even imperil biodiversity at large.

In a study, published in the scholarly open-science journal Research Ideas and Outcomes, a team of Estonian and Swedish scientists propose to formalize the value of all species through a conceptual species 'stock market' (SSM). Much like the regular stock market, the SSM is to act as a unified basis for instantaneous valuation of all items in its holdings.

However, other aspects of the SSM would be starkly different from the regular stock market. Ownership, transactions, and trading will take new forms. Indeed, species have no owners, and 'trade' would not be about transfer of ownership rights among shareholders. Instead, the concept of 'selling' would comprise processes that erase species from some specific area—such as war, deforestation, or pollution.

"The SSM would be able to put a price tag on such transactions, and the price could be thought of as an invoice that the seller needs to settle in some way that benefits global biodiversity," explains the study's lead author Prof. Urmas Kõljalg (University of Tartu, Estonia).

Conversely, taking some action that benefits biodiversity—as estimated through individuals of species—would be akin to buying on the species stock market. Buying, too, has a price tag on it, but this price should probably be thought of in goodwill terms. Here, 'money' represents an investment towards increased biodiversity.

"By rooting such actions in a unified valuation system it is hoped that goodwill actions will become increasingly difficult to dodge and dismiss," adds Kõljalg.

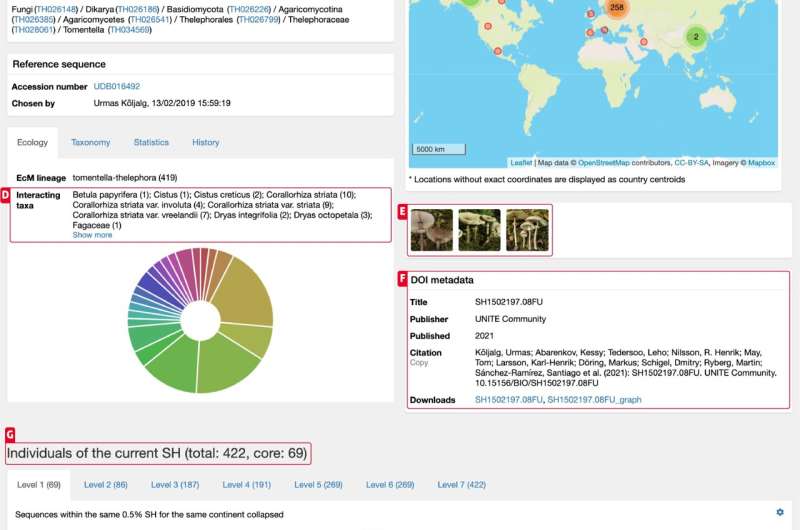

Interestingly, the SSM revolves around the notion of digital species. These are representations of described and undescribed species concluded to exist based on DNA sequences and elaborated by including all we know about their habitat, ecology, distribution, interactions with other species, and functional traits.

For the SSM to function as described, those DNA sequences and metadata need to be sourced from global scientific and societal resources, including natural history collections, sequence databases, and life science data portals. Digital species might be managed further by incorporating data records of non-sequenced individuals, notably observations, older material in collections, and data from publications.

The study proposes that the SSM is orchestrated by the international associations of taxonomists and economists.

"Non-trivial complications are foreseen when implementing the SSM in practice, but we argue that the most realistic and tangible way out of the looming biodiversity crisis is to put a price tag on species and thereby a cost to actions that compromise them," says Kõljalg.

"No human being will make direct monetary profit out of the SSM, and yet it's all Earth's inhabitants—including humans—that could benefit from its pointers."

Newly described species have higher extinction risk

More information: Urmas Kõljalg et al, A price tag on species, Research Ideas and Outcomes (2022). DOI: 10.3897/rio.8.e86741

Provided by Pensoft Publishers

No comments:

Post a Comment