Andrew McCabe and James Comey.

By Cristina Cabrera

July 7, 2022

The I.R.S. selected former FBI chiefs James Comey and Andrew McCabe, two of ex-President Donald Trump’s top foes during his presidency, for an incredibly rare exhaustive tax audit when the agency was led by a Trump appointee.

The New York Times obtained I.R.S. documents showing that Comey’s return filing for 2017 –- the same year Trump fired the then-FBI director for disloyalty –- was chosen for the rare, intensive audit, which is called the National Research Program. The Times noted that of the nearly 153 million individual returns filed that year, only 5,000 of them were selected for that specific audit.

The documents similarly showed that McCabe’s 2019 tax return filing –- the year after Trump also fired him –- was one of the mere 8,000 filings the I.R.S. picked for the same audit program in 2019.

Comey and McCabe were informed of the audits in 2019 and 2021, respectively, when Trump-appointed commissioner Charles P. Rettig oversaw the I.R.S. Rettig actually remains in that post until this coming November.

Throughout his presidency and even after, Trump repeatedly bashed Comey and McCabe in his ceaseless rage over their refusal to scuttle the Russia investigation at his demand.

“Maybe it’s a coincidence or maybe somebody misused the I.R.S. to get at a political enemy,” Comey told the Times on Wednesday. “Given the role Trump wants to continue to play in our country, we should know the answer to that question.”

The tax agency said in a statement to the Times that Rettig “has been committed to running the I.R.S. in an impartial, unbiased manner from top to bottom” and had nothing to do with Comey and McCabe’s audits.

“Commissioner Rettig is not involved in individual audits or taxpayer cases; those are handled by career civil servants,” the agency said. “As I.R.S. commissioner, he has never been in contact with the White House –- in either administration –- on I.R.S. enforcement or individual taxpayer matters.

It’s unknown how exactly Comey and McCabe were chosen or who made the decision to audit them. The I.R.S. does not publicly disclose its selection process for the intensive National Research Program and is prohibited from discussing specific cases. Comey gave the Times a privacy release so the I.R.S. could give the newspaper more information about the case.

Neither Comey nor McCabe knew they’d both been targeted until they were contacted by the Times reporter. McCabe called for an investigation into the matter during a CNN interview on Wednesday night.

“I think it should be investigated,” he said. “People need to be able to trust the institutions of government.”

Trump may have committed “serious federal crime” with “targeted” IRS audits of Comey, McCabe: expert

Comey and McCabe suspiciously both faced audits targeting just 1 in 30,000 people each year

By IGOR DERYSH

Former FBI Director James Comey and his top deputy Andy McCabe faced rate, intensive IRS audits after investigating former President Donald Trump, according to The New York Times.

Comey, whom Trump fired in 2017 while he oversaw the FBI's investigation into the Trump campaign's ties to Russia, and McCabe, who was similarly terminated after investigating Trump over the Coney firing, were selected for a "random" audit known as an "autopsy without the benefit of death," according to the report. Out of about 153 million individual tax returns filed in 2017, only about 5,000 people are selected for this type of invasive audit each year.

Comey and McCabe, along with their spouses, defied the odds, being selected for the audit after being fired. The two men were selected for an IRS research program that uses "compliance research examinations" to try to catch tax cheats. Unlike typical audits, these audits force individuals to produce bank records, copies of checks, receipts and letters effectively recreating their finances for the year in question. The process takes months and often costs thousands in accountant fees.

"Your federal income tax return for the year shown above was selected at random for a compliance research examination," the IRS said in letters to both men. "We must examine randomly selected tax returns to better understand tax compliance and improve fairness of the tax system. We'll give you the opportunity to explain any errors we may find during the examination."

The "minuscule chances" of the top two FBI officials being selected at random raised questions about whether Trump appointees in the government or at the IRS purposely targeted them, noted Times reported Michael Schmidt.

"Lightning strikes, and that's unusual, and that's what it's like being picked for one of these audits," former IRS Commissioner John Koskinen told the outlet. "The question is: Does lightning then strike again in the same area? Does it happen? Some people may see that in their lives, but most will not — so you don't need to be an anti-Trumper to look at this and think it's suspicious."

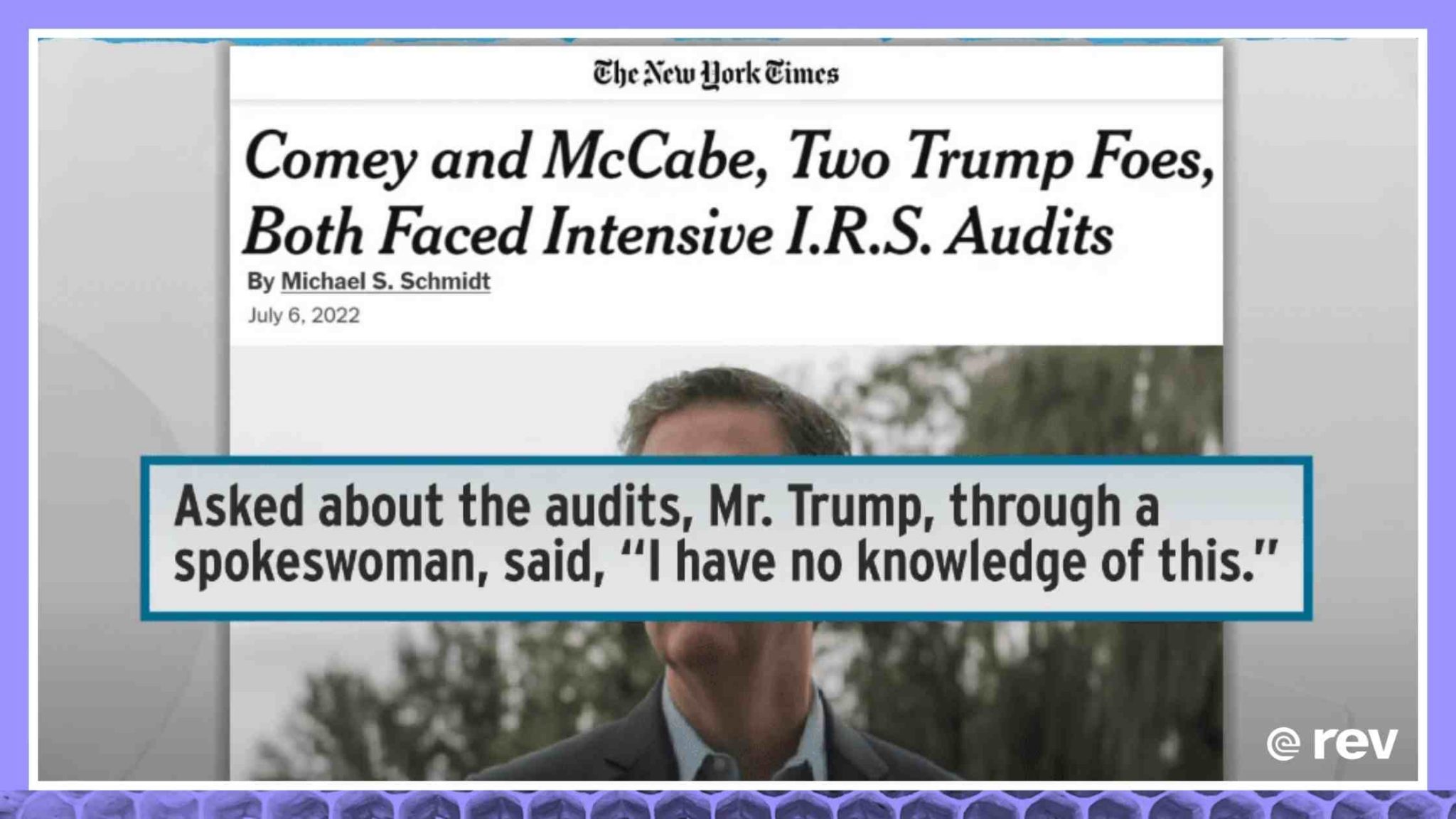

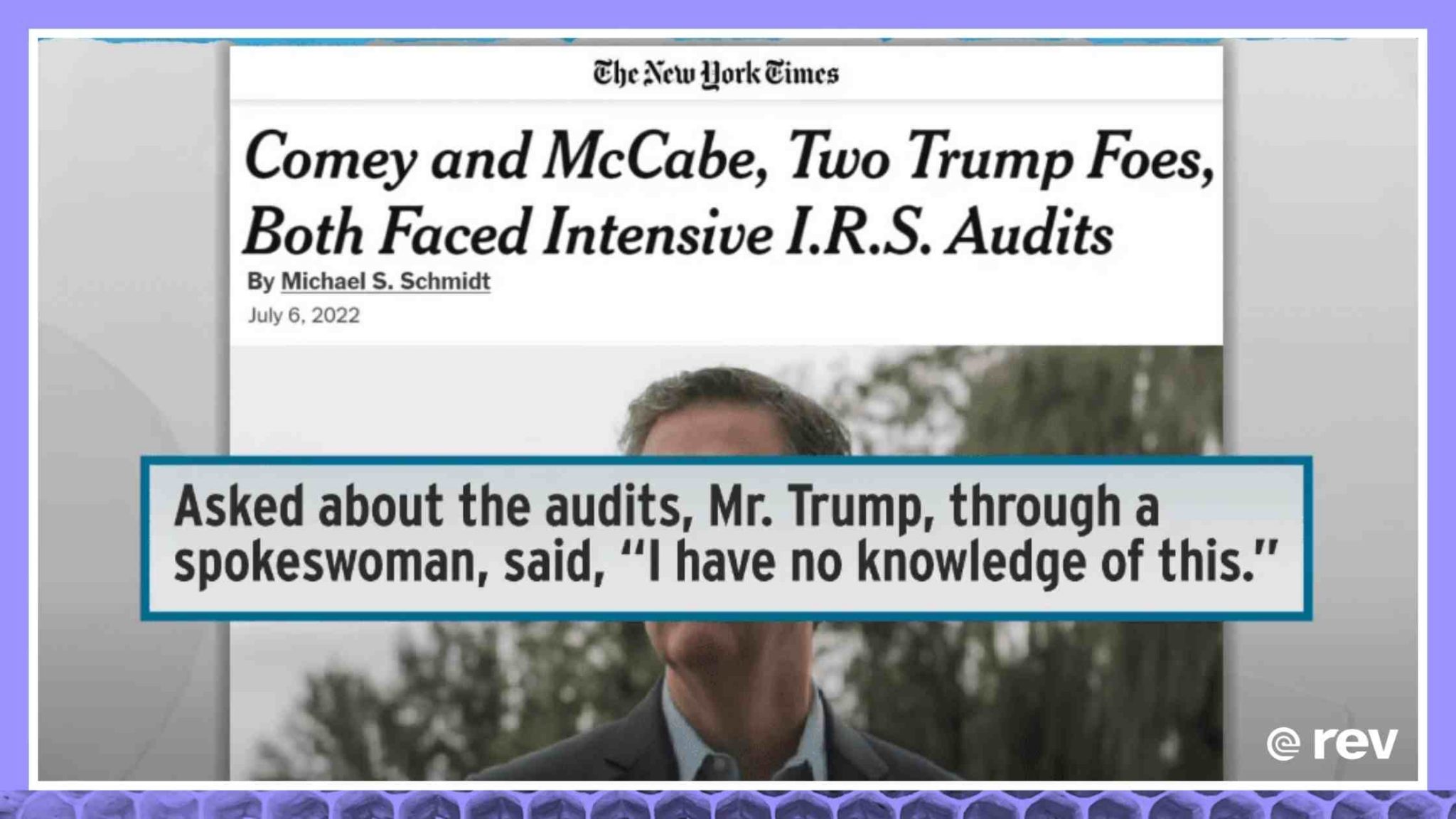

A Trump spokeswoman denied any knowledge of the audits.

IRS Commissioner Charles Rettig, a Trump appointee who remains on the job, declined an interview with the Times but said in a statement that he was not involved in any audit.

"Commissioner Rettig is not involved in individual audits or taxpayer cases; those are handled by career civil servants," the statement said. "As I.R.S. commissioner, he has never been in contact with the White House — in either administration — on I.R.S. enforcement or individual taxpayer matters. He has been committed to running the I.R.S. in an impartial, unbiased manner from top to bottom."

The IRS did not specifically comment on the cases but says it forwards any allegations of wrongdoing it receives to the Treasury Department for "further review."

It is illegal under federal law for nearly anyone in the executive branch to request an IRS audit of a specific individual's taxes.

Comey's audit, which lasted over a year, actually found that he and his wife overpaid their federal income taxes and they received a $347 refund, according to the Times.

Advertisement:

"I don't know whether anything improper happened, but after learning how unusual this audit was and how badly Trump wanted to hurt me during that time, it made sense to try to figure it out," Comey told the Times. "Maybe it's a coincidence or maybe somebody misused the I.R.S. to get at a political enemy. Given the role Trump wants to continue to play in our country, we should know the answer to that question."

McCabe said his audit found that he and his wife owed a small amount of money, which they paid.

"The revenue agent I dealt with was professional and responsive," McCabe told the outlet. "Nevertheless, I have significant questions about how or why I was selected for this."

Want a daily wrap-up of all the news and commentary Salon has to offer? Subscribe to our morning newsletter, Crash Course.

Months before McCabe's audit, Trump publicly questioned McCabe's finances, repeating a false claim about donations that his wife received when she ran for a Virginia state Senate seat.

"Was Andy McCabe ever forced to pay back the $700,000 illegally given to him and his wife, for his wife's political campaign, by Crooked Hillary Clinton while Hillary was under FBI investigation, and McCabe was the head of the FBI??? Just askin'?" Trump tweeted in September 2020.

McCabe was fired by Trump Attorney General Jeff Sessions in 2018, which cost him his pension shortly before he was set to retire. The Justice Department in October 2021, under new Attorney General Merrick Garland, reinstated his pension and cleansed his personnel record. He was informed his audit was completed last month.

McCabe claimed he was directly targeted for the audit.

"There was no penalties, there was no fines or anything like that, it was really pretty minimal thing in the end. But it's nerve-wracking, you know, it's really, it's really, kind of, you know – it's scary, really, to be … targeted like that," he told CNN. "I don't know what happened here. And like I said, I think they handled the business okay, you know, the person I dealt with was fine, but the question remains, how was I selected for this?"

Advertisement:

McCabe called for an investigation into the audits.

"It just defies logic to think that there wasn't some other factor involved," he said.

"No coincidence, for sure. Odds are 30,000 to 1," tweeted Harvard Law Professor Laurence Tribe, warning that "this kind of political targeting is a serious federal crime."

Comey and McCabe suspiciously both faced audits targeting just 1 in 30,000 people each year

By IGOR DERYSH

Deputy Politics Editor

SALON

PUBLISHED JULY 7, 2022

PUBLISHED JULY 7, 2022

James Comey (Getty/Carsten Koall)

Former FBI Director James Comey and his top deputy Andy McCabe faced rate, intensive IRS audits after investigating former President Donald Trump, according to The New York Times.

Comey, whom Trump fired in 2017 while he oversaw the FBI's investigation into the Trump campaign's ties to Russia, and McCabe, who was similarly terminated after investigating Trump over the Coney firing, were selected for a "random" audit known as an "autopsy without the benefit of death," according to the report. Out of about 153 million individual tax returns filed in 2017, only about 5,000 people are selected for this type of invasive audit each year.

Comey and McCabe, along with their spouses, defied the odds, being selected for the audit after being fired. The two men were selected for an IRS research program that uses "compliance research examinations" to try to catch tax cheats. Unlike typical audits, these audits force individuals to produce bank records, copies of checks, receipts and letters effectively recreating their finances for the year in question. The process takes months and often costs thousands in accountant fees.

"Your federal income tax return for the year shown above was selected at random for a compliance research examination," the IRS said in letters to both men. "We must examine randomly selected tax returns to better understand tax compliance and improve fairness of the tax system. We'll give you the opportunity to explain any errors we may find during the examination."

The "minuscule chances" of the top two FBI officials being selected at random raised questions about whether Trump appointees in the government or at the IRS purposely targeted them, noted Times reported Michael Schmidt.

"Lightning strikes, and that's unusual, and that's what it's like being picked for one of these audits," former IRS Commissioner John Koskinen told the outlet. "The question is: Does lightning then strike again in the same area? Does it happen? Some people may see that in their lives, but most will not — so you don't need to be an anti-Trumper to look at this and think it's suspicious."

A Trump spokeswoman denied any knowledge of the audits.

IRS Commissioner Charles Rettig, a Trump appointee who remains on the job, declined an interview with the Times but said in a statement that he was not involved in any audit.

"Commissioner Rettig is not involved in individual audits or taxpayer cases; those are handled by career civil servants," the statement said. "As I.R.S. commissioner, he has never been in contact with the White House — in either administration — on I.R.S. enforcement or individual taxpayer matters. He has been committed to running the I.R.S. in an impartial, unbiased manner from top to bottom."

The IRS did not specifically comment on the cases but says it forwards any allegations of wrongdoing it receives to the Treasury Department for "further review."

It is illegal under federal law for nearly anyone in the executive branch to request an IRS audit of a specific individual's taxes.

Comey's audit, which lasted over a year, actually found that he and his wife overpaid their federal income taxes and they received a $347 refund, according to the Times.

Advertisement:

"I don't know whether anything improper happened, but after learning how unusual this audit was and how badly Trump wanted to hurt me during that time, it made sense to try to figure it out," Comey told the Times. "Maybe it's a coincidence or maybe somebody misused the I.R.S. to get at a political enemy. Given the role Trump wants to continue to play in our country, we should know the answer to that question."

McCabe said his audit found that he and his wife owed a small amount of money, which they paid.

"The revenue agent I dealt with was professional and responsive," McCabe told the outlet. "Nevertheless, I have significant questions about how or why I was selected for this."

Want a daily wrap-up of all the news and commentary Salon has to offer? Subscribe to our morning newsletter, Crash Course.

Months before McCabe's audit, Trump publicly questioned McCabe's finances, repeating a false claim about donations that his wife received when she ran for a Virginia state Senate seat.

"Was Andy McCabe ever forced to pay back the $700,000 illegally given to him and his wife, for his wife's political campaign, by Crooked Hillary Clinton while Hillary was under FBI investigation, and McCabe was the head of the FBI??? Just askin'?" Trump tweeted in September 2020.

McCabe was fired by Trump Attorney General Jeff Sessions in 2018, which cost him his pension shortly before he was set to retire. The Justice Department in October 2021, under new Attorney General Merrick Garland, reinstated his pension and cleansed his personnel record. He was informed his audit was completed last month.

McCabe claimed he was directly targeted for the audit.

"There was no penalties, there was no fines or anything like that, it was really pretty minimal thing in the end. But it's nerve-wracking, you know, it's really, it's really, kind of, you know – it's scary, really, to be … targeted like that," he told CNN. "I don't know what happened here. And like I said, I think they handled the business okay, you know, the person I dealt with was fine, but the question remains, how was I selected for this?"

Advertisement:

McCabe called for an investigation into the audits.

"It just defies logic to think that there wasn't some other factor involved," he said.

"No coincidence, for sure. Odds are 30,000 to 1," tweeted Harvard Law Professor Laurence Tribe, warning that "this kind of political targeting is a serious federal crime."

Comey, McCabe, Objects Of Trump Ire, Were Subjects Of Rare IRS Audits Transcript

Rev › Blog › Transcripts › Andrew McCabe › Comey, McCabe, Objects Of Trump Ire, Were Subjects Of Rare IRS Audits Transcript

James Comey and Andrew McCabe, two people at the top of Donald Trump’s enemies list were both subject to uncommon, rigorous IRS audits. Read the transcript here.

Speaker 1: (00:00)

How did two of President Trump’s top perceive enemies end up facing that kind of audit, the kind of audit that seems designed to dig up any possible dirt? How exactly does that happen? A spokesperson for President Trump said he had, “No knowledge of this”, but in a statement to The Times, Comey said, what we were all thinking, “Maybe it’s a coincidence, or maybe somebody misused the IRS to get at a political enemy. “Given the role Trump wants to continue to play in our country, we should know the answer to that question”. Well that we should. And part of the story that I really don’t think we should overlook is how we almost never learned about it. James Comey and Andrew McCabe had worked together for years and neither one knew that the other had been audited like this both after they were fired from the FBI, “Neither man knew that the other had been audited until they were told by a reporter for The Times”. That reporter was New York Times, Michael Schmidt.

Speaker 1: (00:59)

I don’t know if there are any other Trump enemies out there that underwent intensive random audits by the IRS. But if there are, and they’re listening, please email my next guest Michael Schmidt. Joining us now is Michael. He’s the reporter for The New York times who broke this story. Michael, thank you for joining us this evening. We mentioned this particular type of audit is exhaustive and exhausting, but can you just help us understand how much in an audit like this, the IRS asks for and how much work it is to provide all of the material that they need?

Michael Schmidt: (01:31)

So most audits that the IRS does are set off by an algorithm or a computer that catches something weird in your return. Someone claims a 500,000 square foot home office. There’s something weird, something odd that the computer says, Hey, and they send you a letter and they say, Hey, what’s going on with this home office? Can you help us clarify that? And you have to explain that individual issue. That’s what most audits look like. They’re annoying. People don’t like them. They see them as invasive, but they’re part of the process for the IRS to collect the money that it needs to run the government. A small percentage of audits are done to figure out what the tax gap is. And that’s the gap between what Americans do pay in taxes and what they should be paying in taxes. So this is sort of a survey of the country to figure out who isn’t paying their taxes and they go out and the IRS says that they randomly pick Americans for this.

Michael Schmidt: (02:36)

And because they don’t know what they’re looking for, right, they’ve randomly picked these Americans, they have to turn over everything in your financial life to recreate your financial year, to determine whether you understated or overstated everything on your taxes. So that means producing receipts. In the case of Comey, there was a question about a printer cartridge he had bought two years earlier that I believe he had taken a write off on and whether he could come up with that receipt, or if there was an Amex statement to back that up. As you were pointing out, Comey had claimed dependence. To show that those dependents existed, that his children actually existed, he had to present the family’s Christmas card to the IRS. It took the Comey’s 15 months to get through this audit. And it cost them $5,000 in accounting fees, because they had to have an accountant that was going back and forth with the IRS agent who was doing the audit.

Speaker 1: (03:43)

Yeah. And the interesting thing about these audits is you can’t sort of just say, Hey, you’re the IRS. You know I have kids. Why don’t you handle that? When they ask you for information, you actually have to provide it. The odds of getting selected for one of these random audits is about one in 30,000 and a little bit, according to your article. The odds that both of these men who held the same position back to back in the same administration, both seen as political enemies of the president in charge and the IRS headed by a man that president appointed just makes it seem less than random.

Michael Schmidt: (04:18)

So we actually don’t in the story, lay out what the odds are because we don’t know how the IRS actually randomly selects these people, whether it’s weighted in a way. All we know is that the IRS says they’re trying to get a full picture of what the country looks like. They’re trying to get people that are W-2 employees, people that may be making millions of dollars a year. People that may be at the lower end of the economic spectrum. What the numbers we had in the story showed was, is like one out of how many taxpayers was subjected to this. So here were the numbers. For 2017, the year that they looked at Comey’s return, there were 5,000 audits of these done on individual taxpayers. So that could be a husband and a wife or partners together.

Michael Schmidt: (05:11)

So it could be a little bit more than 5,000 people, but out of 150 million returns. So they’re randomly picking 5,000 people out of 150 million returns. In 2019, the year that McCabe was audited for, there were 8,000 returns that were selected by the IRS for this out of 153 or 154 million returns that were from that year. So these are very, very low numbers. And what former IRS people that we talked to said is just that, like what are the chances that the people a top of Trump’s enemy’s list,

Speaker 1: (05:51)

Yeah.

Michael Schmidt: (05:51)

People who had overseen some of the most controversial decisions in the FBI’s history. Remember a lot of people blame Comey for the election of Hillary Clinton. There’s a lot of people that look very negatively on the FBI from this period of time. And these two people were subjected to these audits.

Speaker 1: (06:11)

Or the defeat of Hillary Clinton. The current IRS commissioner, Charles Rettig, he was appointed to his post by Donald Trump in 2018. Ironically, he had written an oped in Forbes at one point saying that he didn’t think it was necessary for Donald Trump to have to provide his personal tax returns. That was before he was appointed. What do we know about him and any potential role that he may have had in the selection of these two men to be part of this random audit?

Michael Schmidt: (06:38)

Well, the IRS in response to questions from us say that the commissioner plays no role in the selection of this, that he had had no discussions with the White House, any White House about any particular type of audit or law enforcement matter. So they pretty forcefully came back and said that on the record to us and we included that in the story. We know that he is someone that advocated during the 2016 election, that Trump should not release his returns. He is an attorney who had dedicated much of his career to helping people that were fighting with the IRS, often wealthy people that were fighting with the IRS.

Michael Schmidt: (07:19)

And we do know that Biden allowed him to stay in his position. So when Biden came in, he could have replaced pretty much anyone that he wanted in the executive branch. But I think going along with trying to restore some of the norms, he allowed the FBI director to stay in his position, even though Trump had appointed them. And he allowed commissioner Rettig to stay in at the IRS. His term is schedule to expire at the end of this year, towards the end of this year in the fall. So Biden could have replaced him, but allowed him to stay.

Rev › Blog › Transcripts › Andrew McCabe › Comey, McCabe, Objects Of Trump Ire, Were Subjects Of Rare IRS Audits Transcript

James Comey and Andrew McCabe, two people at the top of Donald Trump’s enemies list were both subject to uncommon, rigorous IRS audits. Read the transcript here.

Speaker 1: (00:00)

How did two of President Trump’s top perceive enemies end up facing that kind of audit, the kind of audit that seems designed to dig up any possible dirt? How exactly does that happen? A spokesperson for President Trump said he had, “No knowledge of this”, but in a statement to The Times, Comey said, what we were all thinking, “Maybe it’s a coincidence, or maybe somebody misused the IRS to get at a political enemy. “Given the role Trump wants to continue to play in our country, we should know the answer to that question”. Well that we should. And part of the story that I really don’t think we should overlook is how we almost never learned about it. James Comey and Andrew McCabe had worked together for years and neither one knew that the other had been audited like this both after they were fired from the FBI, “Neither man knew that the other had been audited until they were told by a reporter for The Times”. That reporter was New York Times, Michael Schmidt.

Speaker 1: (00:59)

I don’t know if there are any other Trump enemies out there that underwent intensive random audits by the IRS. But if there are, and they’re listening, please email my next guest Michael Schmidt. Joining us now is Michael. He’s the reporter for The New York times who broke this story. Michael, thank you for joining us this evening. We mentioned this particular type of audit is exhaustive and exhausting, but can you just help us understand how much in an audit like this, the IRS asks for and how much work it is to provide all of the material that they need?

Michael Schmidt: (01:31)

So most audits that the IRS does are set off by an algorithm or a computer that catches something weird in your return. Someone claims a 500,000 square foot home office. There’s something weird, something odd that the computer says, Hey, and they send you a letter and they say, Hey, what’s going on with this home office? Can you help us clarify that? And you have to explain that individual issue. That’s what most audits look like. They’re annoying. People don’t like them. They see them as invasive, but they’re part of the process for the IRS to collect the money that it needs to run the government. A small percentage of audits are done to figure out what the tax gap is. And that’s the gap between what Americans do pay in taxes and what they should be paying in taxes. So this is sort of a survey of the country to figure out who isn’t paying their taxes and they go out and the IRS says that they randomly pick Americans for this.

Michael Schmidt: (02:36)

And because they don’t know what they’re looking for, right, they’ve randomly picked these Americans, they have to turn over everything in your financial life to recreate your financial year, to determine whether you understated or overstated everything on your taxes. So that means producing receipts. In the case of Comey, there was a question about a printer cartridge he had bought two years earlier that I believe he had taken a write off on and whether he could come up with that receipt, or if there was an Amex statement to back that up. As you were pointing out, Comey had claimed dependence. To show that those dependents existed, that his children actually existed, he had to present the family’s Christmas card to the IRS. It took the Comey’s 15 months to get through this audit. And it cost them $5,000 in accounting fees, because they had to have an accountant that was going back and forth with the IRS agent who was doing the audit.

Speaker 1: (03:43)

Yeah. And the interesting thing about these audits is you can’t sort of just say, Hey, you’re the IRS. You know I have kids. Why don’t you handle that? When they ask you for information, you actually have to provide it. The odds of getting selected for one of these random audits is about one in 30,000 and a little bit, according to your article. The odds that both of these men who held the same position back to back in the same administration, both seen as political enemies of the president in charge and the IRS headed by a man that president appointed just makes it seem less than random.

Michael Schmidt: (04:18)

So we actually don’t in the story, lay out what the odds are because we don’t know how the IRS actually randomly selects these people, whether it’s weighted in a way. All we know is that the IRS says they’re trying to get a full picture of what the country looks like. They’re trying to get people that are W-2 employees, people that may be making millions of dollars a year. People that may be at the lower end of the economic spectrum. What the numbers we had in the story showed was, is like one out of how many taxpayers was subjected to this. So here were the numbers. For 2017, the year that they looked at Comey’s return, there were 5,000 audits of these done on individual taxpayers. So that could be a husband and a wife or partners together.

Michael Schmidt: (05:11)

So it could be a little bit more than 5,000 people, but out of 150 million returns. So they’re randomly picking 5,000 people out of 150 million returns. In 2019, the year that McCabe was audited for, there were 8,000 returns that were selected by the IRS for this out of 153 or 154 million returns that were from that year. So these are very, very low numbers. And what former IRS people that we talked to said is just that, like what are the chances that the people a top of Trump’s enemy’s list,

Speaker 1: (05:51)

Yeah.

Michael Schmidt: (05:51)

People who had overseen some of the most controversial decisions in the FBI’s history. Remember a lot of people blame Comey for the election of Hillary Clinton. There’s a lot of people that look very negatively on the FBI from this period of time. And these two people were subjected to these audits.

Speaker 1: (06:11)

Or the defeat of Hillary Clinton. The current IRS commissioner, Charles Rettig, he was appointed to his post by Donald Trump in 2018. Ironically, he had written an oped in Forbes at one point saying that he didn’t think it was necessary for Donald Trump to have to provide his personal tax returns. That was before he was appointed. What do we know about him and any potential role that he may have had in the selection of these two men to be part of this random audit?

Michael Schmidt: (06:38)

Well, the IRS in response to questions from us say that the commissioner plays no role in the selection of this, that he had had no discussions with the White House, any White House about any particular type of audit or law enforcement matter. So they pretty forcefully came back and said that on the record to us and we included that in the story. We know that he is someone that advocated during the 2016 election, that Trump should not release his returns. He is an attorney who had dedicated much of his career to helping people that were fighting with the IRS, often wealthy people that were fighting with the IRS.

Michael Schmidt: (07:19)

And we do know that Biden allowed him to stay in his position. So when Biden came in, he could have replaced pretty much anyone that he wanted in the executive branch. But I think going along with trying to restore some of the norms, he allowed the FBI director to stay in his position, even though Trump had appointed them. And he allowed commissioner Rettig to stay in at the IRS. His term is schedule to expire at the end of this year, towards the end of this year in the fall. So Biden could have replaced him, but allowed him to stay.

No comments:

Post a Comment