| July 22, 2022 |

Flake graphite. (Image by 2×910, Wikimedia Commons).

Although EV market share is still tiny compared to traditional vehicles, that is likely to change in the coming years as major economies transition away from fossil fuels and move into clean energy.

US President Joe Biden has signed an executive order requiring that half of all new vehicle sales be electric by 2030. China, the world’s biggest EV market, has a similar mandate that requires electric cars to make up 40% of all sales. The European Union is also seeking to have at least 30 million zero-emission vehicles on its roads by then.

According to the IEA’s Global Electric Vehicle Outlook, if governments are able to ramp up their efforts to meet energy and climate goals, the global electric vehicle fleet could reach as high as 230 million by the end of the decade, compared to about 20 million currently.

With more electric cars comes the need for more raw materials like lithium, nickel and graphite to build batteries. The IEA believes mineral demand for use in EVs and battery storage must grow at least 30 times by 2040 to meet various climate goals.

Fastmarkets forecast that EV sales will experience a compound annual growth rate of 40% per year through 2025, when EV penetration is expected to reach 15%. After that, EV market share is expected to rise further, reaching 35% by 2030.

One mineral that has been overlooked, but is an essential part of vehicle electrification, is graphite.

At AOTH, we believe graphite represents a “backdoor” market opportunity brought about by the clean energy transition. This is for several reasons:

Graphite as anode material

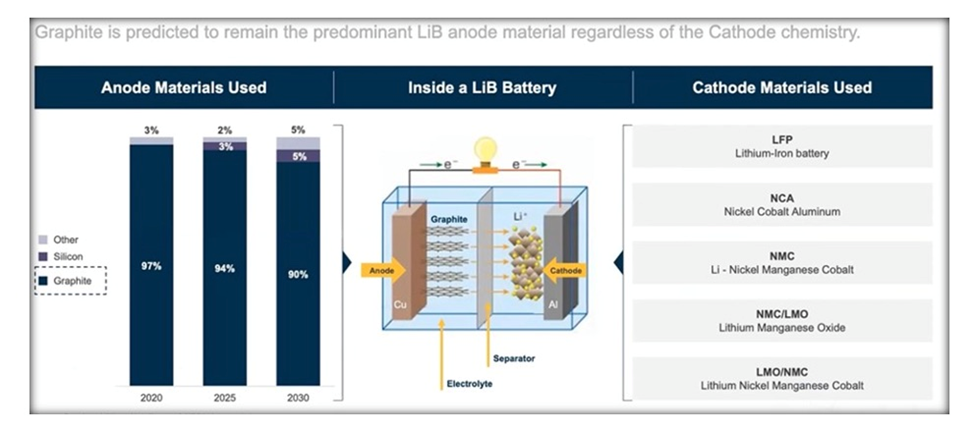

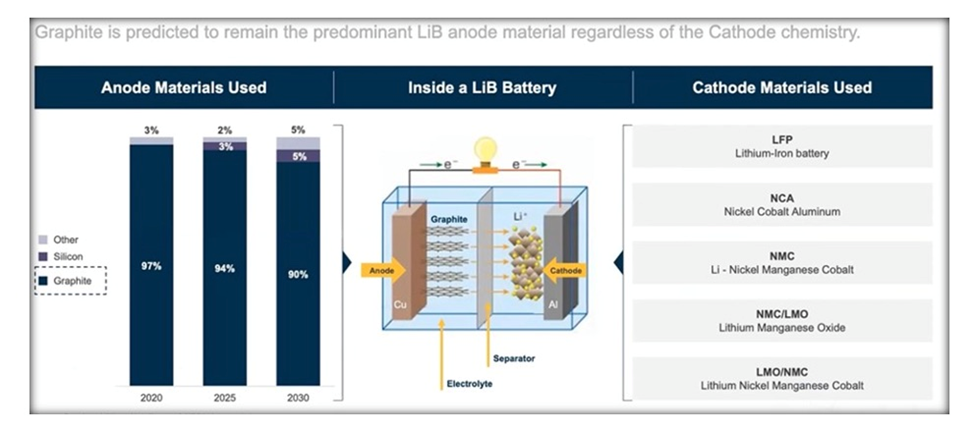

The lithium-ion battery used to power electric vehicles is made of two electrodes — an anode (negative) on one side and a cathode (positive) on the other. At the moment, graphite is the only material that can be used in the anode, there are no substitutes.

This is due to the fact that, with high natural strength and stiffness, graphite is an excellent conductor of heat and electricity. Being the only other natural form of carbon besides diamonds, it is also stable over a wide range of temperatures.

The cathode is where metals like lithium, nickel, manganese and cobalt are used. Depending on the battery chemistry, there are different options available to battery makers (see below).

Graphite is thus considered indispensable to the global shift towards electric vehicles. It is also the largest component in lithium-ion batteries by weight, with each battery containing 20-30% graphite. But due to losses in the manufacturing process, it actually takes 30 times more graphite than lithium to make the batteries.

According to the World Bank, graphite accounts for nearly 53.8% of the mineral demand in batteries, the most of any. Lithium, despite being a staple across all batteries, accounts for only 4% of demand.

An electric car contains more than 200 pounds (>90 kg) of coated spherical purified graphite (CSPG), meaning it takes 10 to 15 times more graphite than lithium to make a Li-ion battery.

Graphite is so essential to a lithium battery, that Tesla’s Elon Musk famously said, “Our cells should be called Nickel-Graphite, because primarily the cathode is nickel and the anode side is graphite with silicon oxide.”

Demand overflow

The anode material, called spherical graphite, is manufactured from either flake graphite concentrates produced from graphite mines, or from synthetic/artificial graphite. Only flake graphite upgraded to 99.95% purity can be used.

An average plug-in EV has 70 kg of graphite, or 10 kg for a hybrid. Every 1 million EVs requires about 75,000 tonnes of natural graphite, equivalent to a 10% increase in flake graphite demand.

According to Benchmark Mineral Intelligence (BMI), the flake graphite feedstock required to supply the world’s lithium-ion anode market is projected to reach 1.25 million tonnes per annum by 2025. The amount of mined graphite for all uses in 2021, was just 1 million tonnes. (USGS)

Furthermore, the London-based price reporting agency forecasts demand for graphite from the battery anode segment could increase by seven times in the next decade as the growth in EV sales continues to drive construction of lithium-ion megafactories.

Bloomberg

Flake graphite. (Image by 2×910, Wikimedia Commons).

Although EV market share is still tiny compared to traditional vehicles, that is likely to change in the coming years as major economies transition away from fossil fuels and move into clean energy.

US President Joe Biden has signed an executive order requiring that half of all new vehicle sales be electric by 2030. China, the world’s biggest EV market, has a similar mandate that requires electric cars to make up 40% of all sales. The European Union is also seeking to have at least 30 million zero-emission vehicles on its roads by then.

According to the IEA’s Global Electric Vehicle Outlook, if governments are able to ramp up their efforts to meet energy and climate goals, the global electric vehicle fleet could reach as high as 230 million by the end of the decade, compared to about 20 million currently.

With more electric cars comes the need for more raw materials like lithium, nickel and graphite to build batteries. The IEA believes mineral demand for use in EVs and battery storage must grow at least 30 times by 2040 to meet various climate goals.

Fastmarkets forecast that EV sales will experience a compound annual growth rate of 40% per year through 2025, when EV penetration is expected to reach 15%. After that, EV market share is expected to rise further, reaching 35% by 2030.

One mineral that has been overlooked, but is an essential part of vehicle electrification, is graphite.

At AOTH, we believe graphite represents a “backdoor” market opportunity brought about by the clean energy transition. This is for several reasons:

Graphite as anode material

The lithium-ion battery used to power electric vehicles is made of two electrodes — an anode (negative) on one side and a cathode (positive) on the other. At the moment, graphite is the only material that can be used in the anode, there are no substitutes.

This is due to the fact that, with high natural strength and stiffness, graphite is an excellent conductor of heat and electricity. Being the only other natural form of carbon besides diamonds, it is also stable over a wide range of temperatures.

The cathode is where metals like lithium, nickel, manganese and cobalt are used. Depending on the battery chemistry, there are different options available to battery makers (see below).

Graphite is thus considered indispensable to the global shift towards electric vehicles. It is also the largest component in lithium-ion batteries by weight, with each battery containing 20-30% graphite. But due to losses in the manufacturing process, it actually takes 30 times more graphite than lithium to make the batteries.

According to the World Bank, graphite accounts for nearly 53.8% of the mineral demand in batteries, the most of any. Lithium, despite being a staple across all batteries, accounts for only 4% of demand.

An electric car contains more than 200 pounds (>90 kg) of coated spherical purified graphite (CSPG), meaning it takes 10 to 15 times more graphite than lithium to make a Li-ion battery.

Graphite is so essential to a lithium battery, that Tesla’s Elon Musk famously said, “Our cells should be called Nickel-Graphite, because primarily the cathode is nickel and the anode side is graphite with silicon oxide.”

Demand overflow

The anode material, called spherical graphite, is manufactured from either flake graphite concentrates produced from graphite mines, or from synthetic/artificial graphite. Only flake graphite upgraded to 99.95% purity can be used.

An average plug-in EV has 70 kg of graphite, or 10 kg for a hybrid. Every 1 million EVs requires about 75,000 tonnes of natural graphite, equivalent to a 10% increase in flake graphite demand.

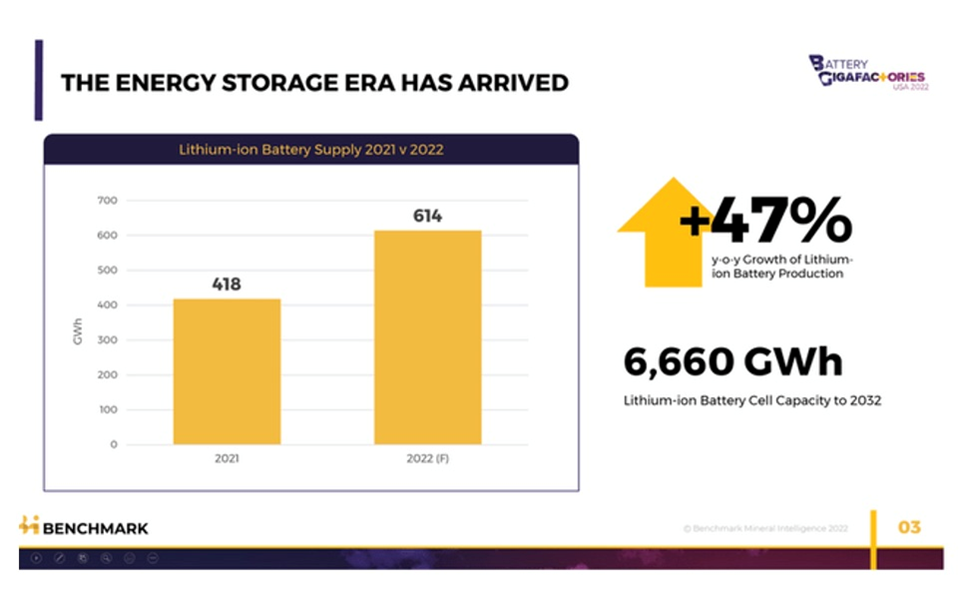

According to Benchmark Mineral Intelligence (BMI), the flake graphite feedstock required to supply the world’s lithium-ion anode market is projected to reach 1.25 million tonnes per annum by 2025. The amount of mined graphite for all uses in 2021, was just 1 million tonnes. (USGS)

Furthermore, the London-based price reporting agency forecasts demand for graphite from the battery anode segment could increase by seven times in the next decade as the growth in EV sales continues to drive construction of lithium-ion megafactories.

Bloomberg

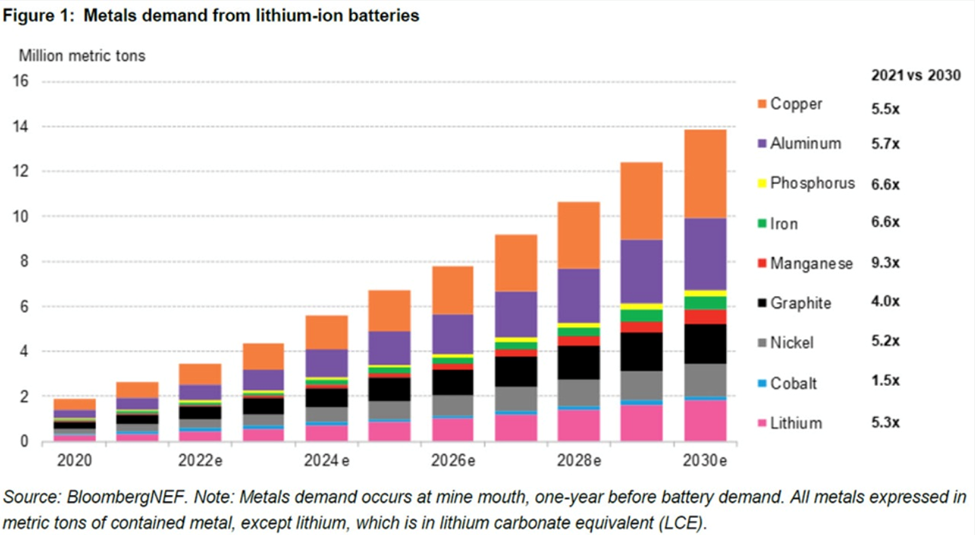

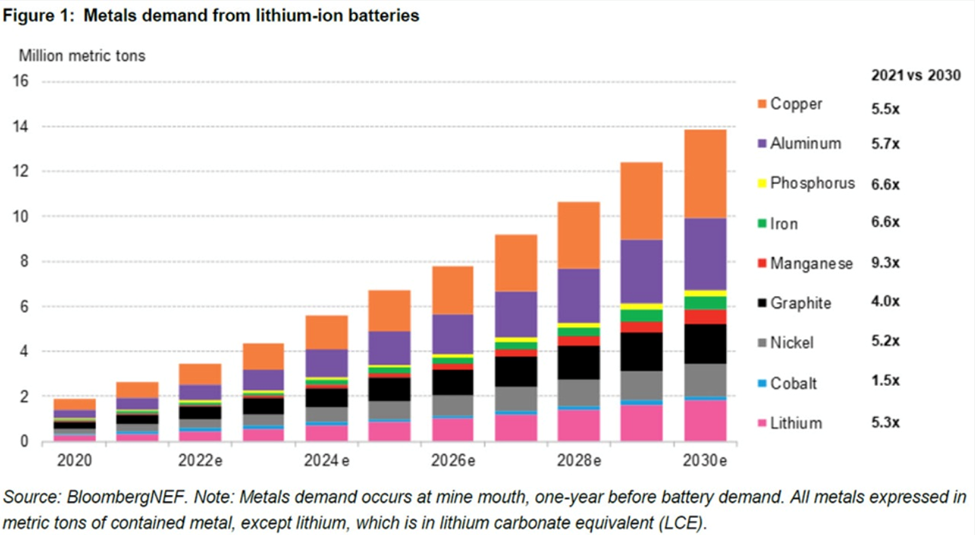

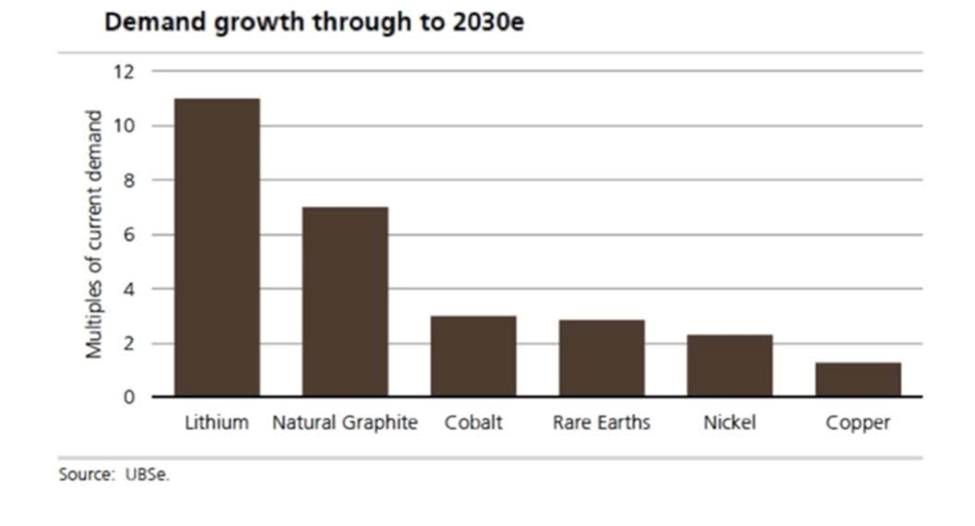

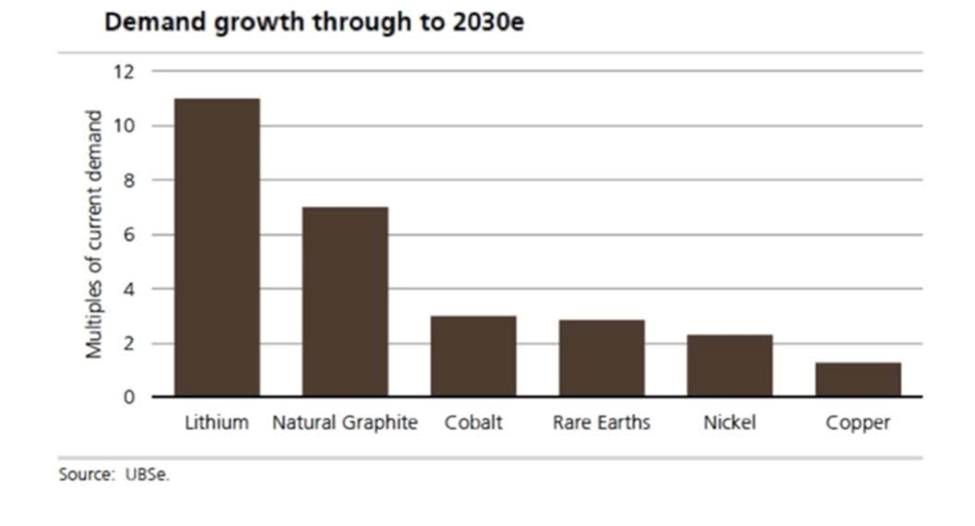

NEF expects demand for battery minerals to remain robust through 2030, with graphite demand increasing four-fold.

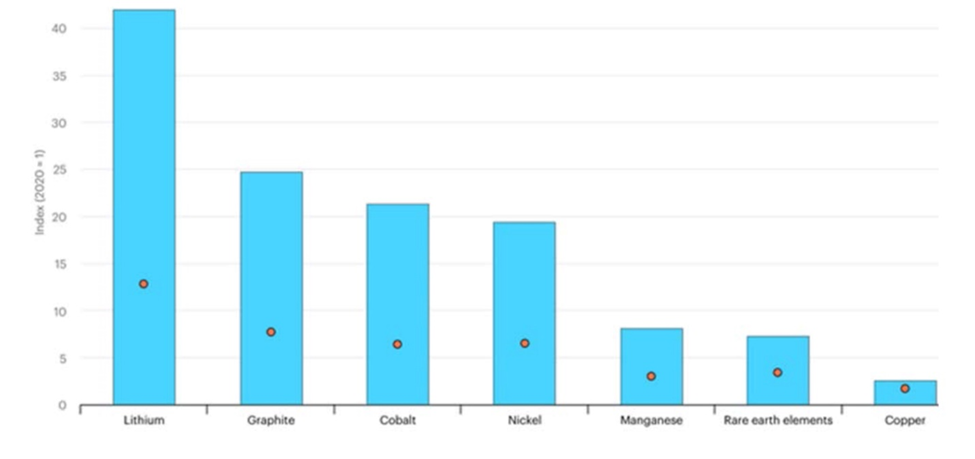

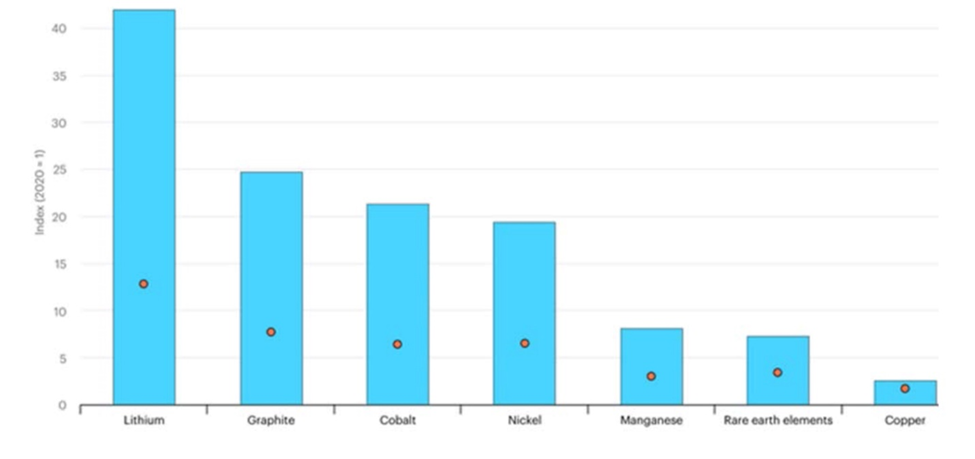

The International Energy Agency (IEA) goes 10 years further out, predicting that growth in demand for selected minerals from clean energy technologies by scenario, 2020 relative to 2040, will see: increases of lithium 13x to 42x, graphite 8x to 25x, cobalt 6x to 21x, nickel 7x to 19x, manganese 3x to 8x, rare earths 3x to 7x, and copper 2x to 3x.

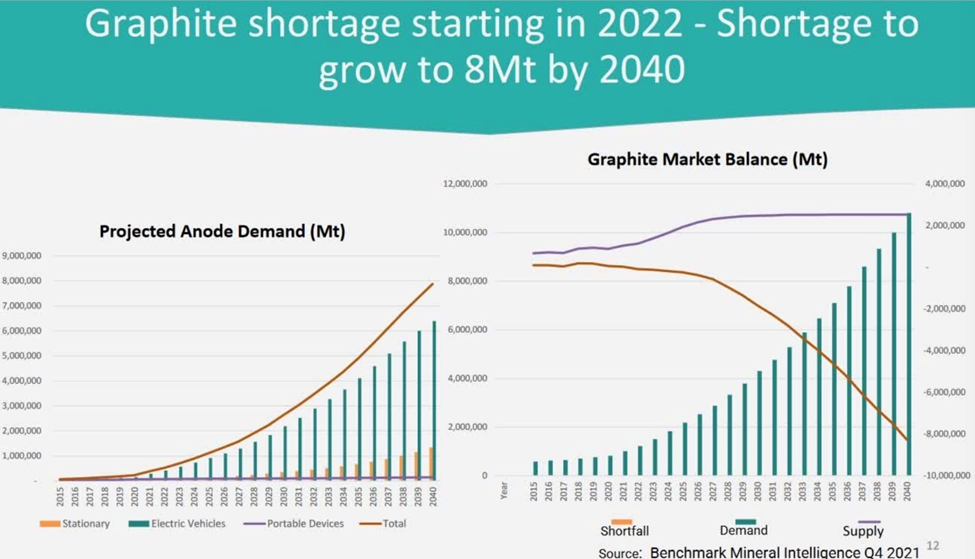

Supply squeeze

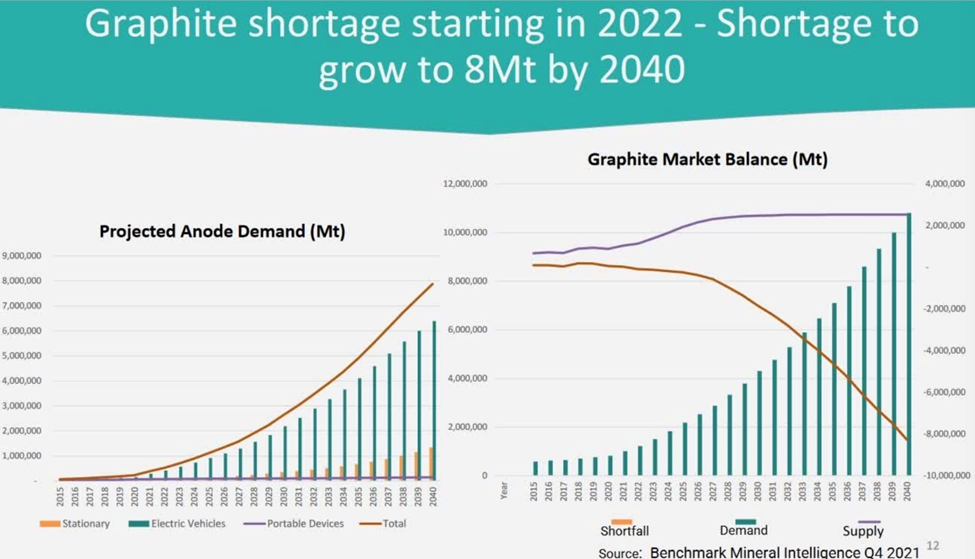

As vehicle electrification continues, and few new sources are discovered worldwide, BMI estimates the graphite market could reach a deficit as early as this year, with the supply shortfall growing to 8Mt by 2040; to fill this gap, the mining industry would need to produce nearly 8x as much graphite as it does currently, over the next 18 years.

The International Energy Agency (IEA) goes 10 years further out, predicting that growth in demand for selected minerals from clean energy technologies by scenario, 2020 relative to 2040, will see: increases of lithium 13x to 42x, graphite 8x to 25x, cobalt 6x to 21x, nickel 7x to 19x, manganese 3x to 8x, rare earths 3x to 7x, and copper 2x to 3x.

Source: UBS

Source: IEA

Supply squeeze

As vehicle electrification continues, and few new sources are discovered worldwide, BMI estimates the graphite market could reach a deficit as early as this year, with the supply shortfall growing to 8Mt by 2040; to fill this gap, the mining industry would need to produce nearly 8x as much graphite as it does currently, over the next 18 years.

Source: BMI

On June 7, in an article titled ‘How a battery metals squeeze puts EV future at risk’, The Washington Post reported, Factory lines churning out power packs to fuel a clean energy future are being built faster than strained supply chains can keep up. A global rush to lock in stocks of lithium, nickel, cobalt and other key ingredients from a handful of nations has sent prices hurtling higher… While factories can be built in about 18 months, mines can typically take seven years or longer to come online.

June saw repeated concerns over the supply of battery metals forecast for the decade ahead, including from Tesla. CEO Elon Musk reportedly explained that production has been hindered by raw material shortages and shutdowns of assembly lines in China.

Lack of diverse supply

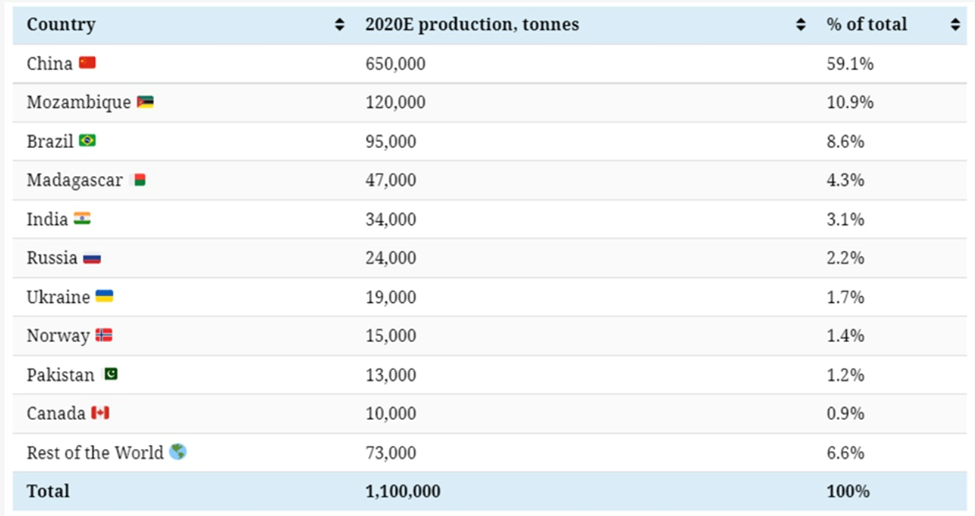

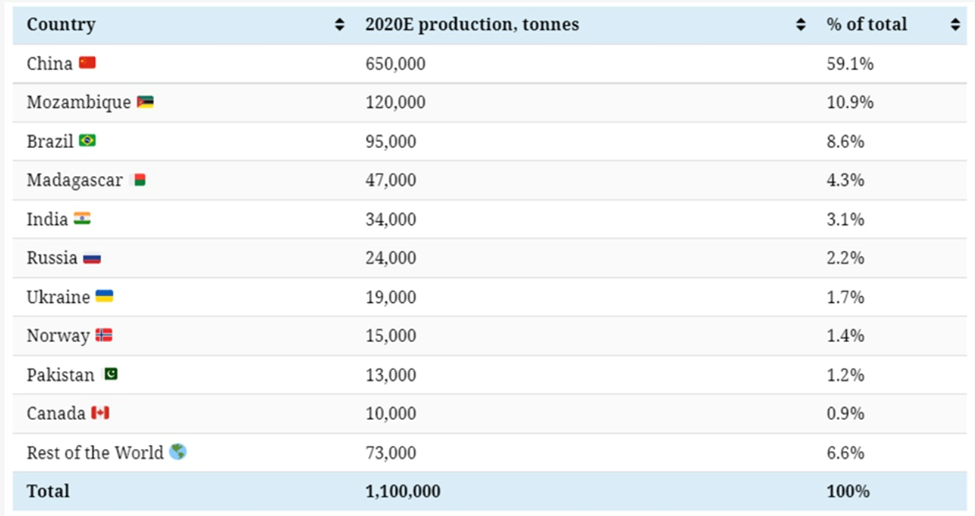

Almost all graphite processing today takes place in China because of the ready availability of graphite there, weak environmental standards and low costs. Nearly 60% of the world’s mined production last year also came from China, making it a dominant player in every stage of the graphite supply chain.

After China, the next leading graphite producers are Mozambique, Brazil, Madagascar, Canada and India. The US does not produce any natural graphite, therefore it must rely solely on imports to satisfy domestic demand.

On June 7, in an article titled ‘How a battery metals squeeze puts EV future at risk’, The Washington Post reported, Factory lines churning out power packs to fuel a clean energy future are being built faster than strained supply chains can keep up. A global rush to lock in stocks of lithium, nickel, cobalt and other key ingredients from a handful of nations has sent prices hurtling higher… While factories can be built in about 18 months, mines can typically take seven years or longer to come online.

June saw repeated concerns over the supply of battery metals forecast for the decade ahead, including from Tesla. CEO Elon Musk reportedly explained that production has been hindered by raw material shortages and shutdowns of assembly lines in China.

Lack of diverse supply

Almost all graphite processing today takes place in China because of the ready availability of graphite there, weak environmental standards and low costs. Nearly 60% of the world’s mined production last year also came from China, making it a dominant player in every stage of the graphite supply chain.

After China, the next leading graphite producers are Mozambique, Brazil, Madagascar, Canada and India. The US does not produce any natural graphite, therefore it must rely solely on imports to satisfy domestic demand.

Data source: USGS. Image by Visual Capitalist

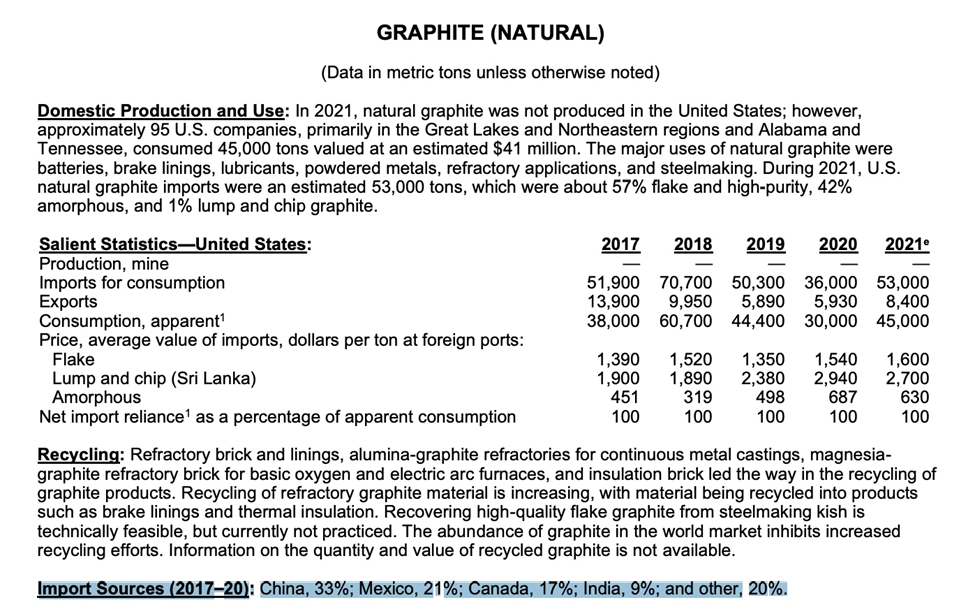

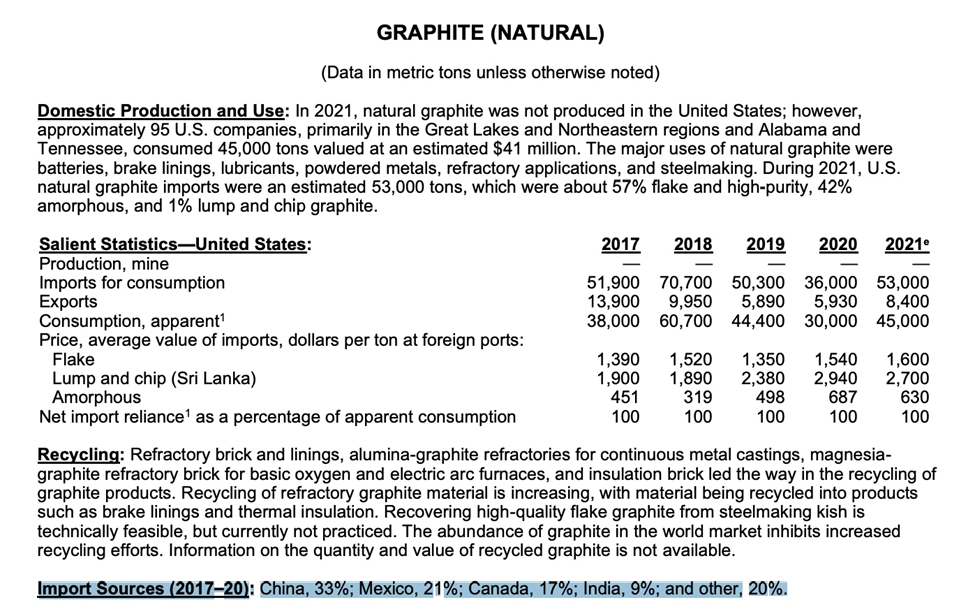

The level of foreign dependence has increased over the years. The US imported 38,900 tonnes of graphite in 2016, then peaking at 70,700 tonnes in 2018.

The latest publication from the USGS shows that imports in 2021 totaled 53,000 tonnes, of which 71% was high-purity flake graphite, 42% was amorphous, and 1% was lump and chip graphite.

The main import sources were China (33%), Mexico (21%), Canada (17%) and India (9%).

Since China controls all spherical graphite processing, the US is not actually 33% dependent on China for its battery-grade graphite, but 100%.

This is why the US government has included graphite among the 35 minerals that it deems “critical to its national security and economy.”

A White House report on critical supply chains showed that graphite demand for clean energy applications will require 25 times more graphite by 2040 than was produced worldwide in 2020.

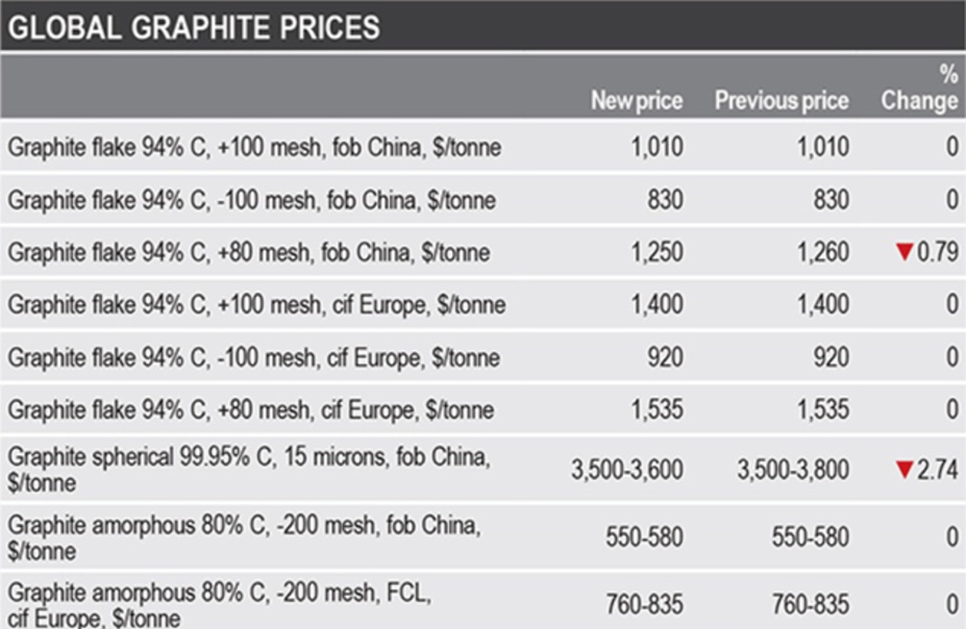

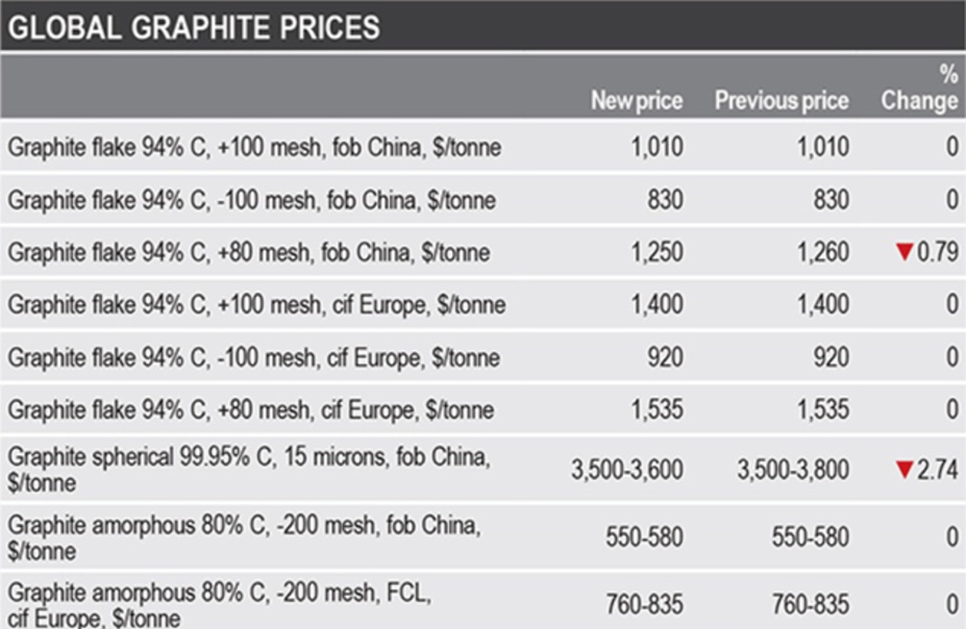

Graphite pricing

The value of natural graphite has increased significantly over the course of the past year, with demand continuing to outstrip supply. According to Benchmark Mineral Intelligence, prices have gone up steadily since January 2021 on all types of graphite, with fines increasing 44.50% from USD$500/ton in January of 2021 to $723/t in May of 2022. Using those same dates, large flake graphite prices climbed 19.85% from $983/t to $1,187/t, and spherical graphite rose 8.39% from $2,958/t to $3,207/t.

More recently, flake and spherical graphite prices are both up slightly. According to Fastmarkets, for the week ending June 16, the spot price of China flake graphite 194 EXW was up 0.37% over 30 days, and 19.39% over 360 days. Graphite produced at 94-97% purity is considered best suited for batteries, before it is upgraded to 99.99% purity to make spherical graphite. Spherical graphite 99.95% min EXW China was up 1.58% over the past 30 days, for the week ended June 16.

China flake graphite 94% C (-100 mesh) was priced at $830 per ton, with Europe flake graphite of the same grade and size selling for $920/t.

Conclusion

During a time of price weakness for a number of industrial metals (copper, zinc, aluminum, for example), the price of graphite, being critical to the electric-vehicle transition, has held up extremely well.

Flake and spherical graphite are both trending higher, in fact the prices of all types of graphite (fines, large flake, spherical) have increased significantly since January 2021, on the back of robust demand from battery-makers and EV manufacturers, and limited supply.

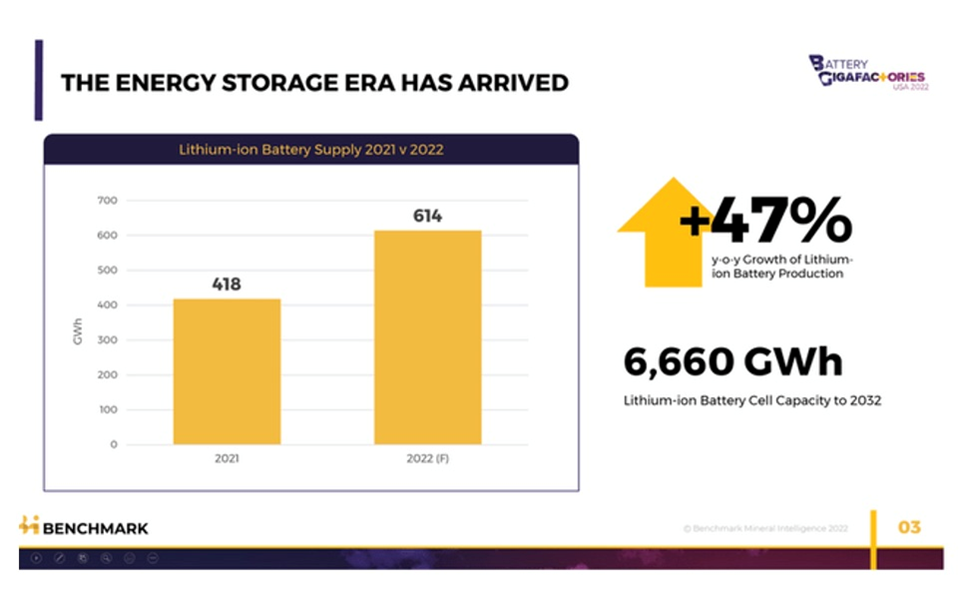

According to BMI, in 2022 demand for lithium-ion batteries is growing at its fastest ever, on course for a year-on-year growth rate of nearly 50%.

The level of foreign dependence has increased over the years. The US imported 38,900 tonnes of graphite in 2016, then peaking at 70,700 tonnes in 2018.

The latest publication from the USGS shows that imports in 2021 totaled 53,000 tonnes, of which 71% was high-purity flake graphite, 42% was amorphous, and 1% was lump and chip graphite.

The main import sources were China (33%), Mexico (21%), Canada (17%) and India (9%).

Since China controls all spherical graphite processing, the US is not actually 33% dependent on China for its battery-grade graphite, but 100%.

This is why the US government has included graphite among the 35 minerals that it deems “critical to its national security and economy.”

A White House report on critical supply chains showed that graphite demand for clean energy applications will require 25 times more graphite by 2040 than was produced worldwide in 2020.

Graphite pricing

The value of natural graphite has increased significantly over the course of the past year, with demand continuing to outstrip supply. According to Benchmark Mineral Intelligence, prices have gone up steadily since January 2021 on all types of graphite, with fines increasing 44.50% from USD$500/ton in January of 2021 to $723/t in May of 2022. Using those same dates, large flake graphite prices climbed 19.85% from $983/t to $1,187/t, and spherical graphite rose 8.39% from $2,958/t to $3,207/t.

More recently, flake and spherical graphite prices are both up slightly. According to Fastmarkets, for the week ending June 16, the spot price of China flake graphite 194 EXW was up 0.37% over 30 days, and 19.39% over 360 days. Graphite produced at 94-97% purity is considered best suited for batteries, before it is upgraded to 99.99% purity to make spherical graphite. Spherical graphite 99.95% min EXW China was up 1.58% over the past 30 days, for the week ended June 16.

China flake graphite 94% C (-100 mesh) was priced at $830 per ton, with Europe flake graphite of the same grade and size selling for $920/t.

Source: Fastmarkets

Conclusion

During a time of price weakness for a number of industrial metals (copper, zinc, aluminum, for example), the price of graphite, being critical to the electric-vehicle transition, has held up extremely well.

Flake and spherical graphite are both trending higher, in fact the prices of all types of graphite (fines, large flake, spherical) have increased significantly since January 2021, on the back of robust demand from battery-makers and EV manufacturers, and limited supply.

According to BMI, in 2022 demand for lithium-ion batteries is growing at its fastest ever, on course for a year-on-year growth rate of nearly 50%.

Source: BMI

While this will increase the need for other battery minerals, such as lithium, nickel and cobalt, graphite remains the highest-intensity mineral in the lithium-ion battery by weight, with over 570,000 tonnes of natural flake to be consumed in 2022.

Yet as Seeking Alpha observes, consumer demand for electric vehicles surpasses our ability to supply them. Waiting times for EVs are lengthening, a lithium ion battery shortage is hitting many automakers, and, most crucially, key raw material prices are at all-time highs.

This bodes well for companies with large graphite deposits in safe jurisdictions, that can not only capitalize on high prices, but contribute to the local graphite supply chain and lessen the dependence on China for graphite mining and especially, graphite processing.

For years neglected by governments, critical minerals like graphite are finally getting the attention they deserve. In June, the Canadian government unveiled its low-carbon industrial strategy, that will see Ottawa partnering with each province to “identify, prioritize and pursue opportunities”. Specific to critical minerals, this means battery manufacturing in Quebec and electric vehicle production in Ontario.

Natural Resources Minister Jonathan Wilkinson pointed to CAD$3.8 billion already earmarked for critical minerals in the April budget. On top of that, “we have a billion and a half dollars in the Clean Fuels Fund, we have eight billion dollars in the Net Zero Accelerator, we’re setting up the Clean Growth Fund, we have the Canada Infrastructure Bank,” Bloomberg quoted him saying. He added:

“The average mine takes 15 years to bring into production. In the context of the energy transition, we don’t have 15 years if we’re actually going to provide enough of the minerals to be able to support just the battery development. So it behooves us to bring everybody into the room to figure out how to do it.”

At AOTH, we couldn’t agree more. Canada’s new industrial strategy dovetails with what is happening south of the border.

The US, which has long sought to improve its battery supply chain, recently invoked its Cold War powers by including lithium, nickel, cobalt, graphite and manganese on the list of items covered by the 1950 Defense Production Act, previously used by President Harry Truman to make steel for the Korean War.

To bolster domestic production of these minerals, US miners can now access $750 million under the act’s Title III fund, which can be used for current operations, productivity and safety upgrades, and feasibility studies. The DPA could also cover the recycling of these materials.

Later this year, the Department of Energy will begin doling out $6 billion in grants for battery production, half of which are earmarked for domestic supplies of materials and battery recycling.

The Biden administration has already allocated $6 billion as part of the $1.2 trillion infrastructure bill, towards developing a reliable battery supply chain and weaning the auto industry off its reliance on China, the biggest EV market and leading producer of lithium-ion cells.

Among the minerals key to winning the global EV race, graphite arguably is most significant and should be a top priority for the US, given it is the essential ingredient in electric vehicle batteries.

A global graphite shortage is a matter of when, not if, without new sources of supply. For the US, which is 100% dependent on foreign imports of the material, it’s a ticking time bomb that could completely derail the nation’s vehicle electrification and decarbonization ambitions.

This all goes back to the importance of establishing a reliable, secure and sustainable “mine to battery” EV supply chain, beginning with a domestic graphite source and integrating it with processing, manufacturing and recycling to create a full circular economy.

(By Richard Mills)

While this will increase the need for other battery minerals, such as lithium, nickel and cobalt, graphite remains the highest-intensity mineral in the lithium-ion battery by weight, with over 570,000 tonnes of natural flake to be consumed in 2022.

Yet as Seeking Alpha observes, consumer demand for electric vehicles surpasses our ability to supply them. Waiting times for EVs are lengthening, a lithium ion battery shortage is hitting many automakers, and, most crucially, key raw material prices are at all-time highs.

This bodes well for companies with large graphite deposits in safe jurisdictions, that can not only capitalize on high prices, but contribute to the local graphite supply chain and lessen the dependence on China for graphite mining and especially, graphite processing.

For years neglected by governments, critical minerals like graphite are finally getting the attention they deserve. In June, the Canadian government unveiled its low-carbon industrial strategy, that will see Ottawa partnering with each province to “identify, prioritize and pursue opportunities”. Specific to critical minerals, this means battery manufacturing in Quebec and electric vehicle production in Ontario.

Natural Resources Minister Jonathan Wilkinson pointed to CAD$3.8 billion already earmarked for critical minerals in the April budget. On top of that, “we have a billion and a half dollars in the Clean Fuels Fund, we have eight billion dollars in the Net Zero Accelerator, we’re setting up the Clean Growth Fund, we have the Canada Infrastructure Bank,” Bloomberg quoted him saying. He added:

“The average mine takes 15 years to bring into production. In the context of the energy transition, we don’t have 15 years if we’re actually going to provide enough of the minerals to be able to support just the battery development. So it behooves us to bring everybody into the room to figure out how to do it.”

At AOTH, we couldn’t agree more. Canada’s new industrial strategy dovetails with what is happening south of the border.

The US, which has long sought to improve its battery supply chain, recently invoked its Cold War powers by including lithium, nickel, cobalt, graphite and manganese on the list of items covered by the 1950 Defense Production Act, previously used by President Harry Truman to make steel for the Korean War.

To bolster domestic production of these minerals, US miners can now access $750 million under the act’s Title III fund, which can be used for current operations, productivity and safety upgrades, and feasibility studies. The DPA could also cover the recycling of these materials.

Later this year, the Department of Energy will begin doling out $6 billion in grants for battery production, half of which are earmarked for domestic supplies of materials and battery recycling.

The Biden administration has already allocated $6 billion as part of the $1.2 trillion infrastructure bill, towards developing a reliable battery supply chain and weaning the auto industry off its reliance on China, the biggest EV market and leading producer of lithium-ion cells.

Among the minerals key to winning the global EV race, graphite arguably is most significant and should be a top priority for the US, given it is the essential ingredient in electric vehicle batteries.

A global graphite shortage is a matter of when, not if, without new sources of supply. For the US, which is 100% dependent on foreign imports of the material, it’s a ticking time bomb that could completely derail the nation’s vehicle electrification and decarbonization ambitions.

This all goes back to the importance of establishing a reliable, secure and sustainable “mine to battery” EV supply chain, beginning with a domestic graphite source and integrating it with processing, manufacturing and recycling to create a full circular economy.

(By Richard Mills)

No comments:

Post a Comment