CHEAP LABOR, DEPRESSED ECONOMY

Why investors take a shine to eastern Germany

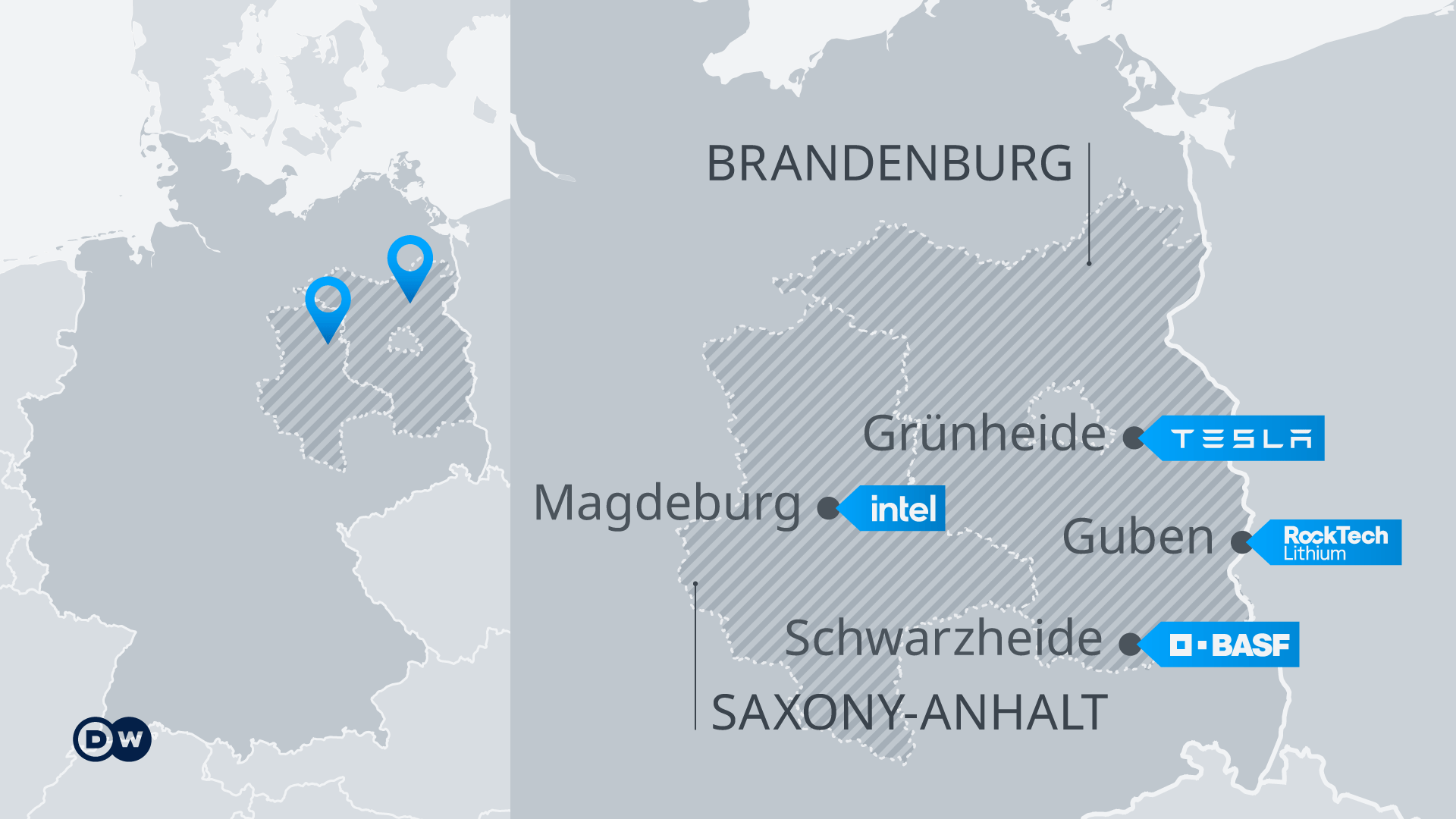

Foreign and domestic companies are increasingly looking to eastern Germany when seeking sound investment opportunities. There are a number of reasons for this trend as Hardy Graupner found out in the town of Guben.

Guben's mayor, Fred Mahro, points to where Rock Tech Lithium will hopefully build its facility to produce lithium hydroxide

From a window on the second floor of the town hall, mayor Fred Mahro overlooks the green spaces in the center of Guben. The eastern German town, located some 100 kilometers (62 miles) southeast of Berlin and close to the border with Poland, does not make it into the headlines very often.

But right now, says Mahro, Guben stands for the eastern German state of Brandenburg's increasing ability to attract crucial investments from home and abroad in future-oriented industries.

German-Canadian company Rock Tech Lithium is planning to build Europe's first lithium converter in Guben, which would be a pivotal element in the region's e-mobility drive. If everything goes to plan, the firm would produce 24,000 metric tons of lithium hydroxide annually — a crucial battery ingredient and enough to equip half a million electric vehicles with lithium-ion batteries.

Rock Tech Lithium has big plans for its building site in Guben — construction work is scheduled to start in autumn

Complete shift of focus

Like most areas in the former communist East Germany, Guben had to almost completely reinvent itself after German reunification in 1990. At that time most of its old industries broke away and the town's population shrank by half. The restructuring process has never really stopped, and when German lawmakers decided in 2020 to completely phase out coal, the lignite open-cast mining area around Guben was in shock again.

"When the debate about a possible exit from our lignite coal in the region started here some five years ago, we stuck our heads together in the town hall and discussed what it would take to create alternative jobs," Fred Mahro told DW. "It was clear that we needed to attract new businesses and that they would need suitable locations— so we didn't lose any time and secured permission from the authorities to build new plants in our huge industrial park."

Rock Tech Lithium is investing some €470 million ($473 million) in its future Guben location. It appreciated the fact that the groundwork was already prepared. The company had no doubt it wanted a European location for its converter as the continent takes the lead in electromobility and aspires to boost its self-reliance in critical industries. This is especially true now that the European Union is on its way to ban the sale of combustion-engine cars and passenger vans as of 2035. With these massive changes coming, the German-Canadian enterprise can count on rising demand for batteries for electric vehicles in the years ahead.

"We had looked all across Europe for a suitable production site, but in the end we prioritized Guben as our focus is not just on producing lithium hydroxide, but on sustainability," the CEO of Rock Tech Lithium, Markus Brügmann, told DW. "Guben had already been developed as an industrial site and it has an on-site rail connection which will allow us to avoid truck transportation."

Rock Tech Lithium CEO Markus Brügmann says opting for Guben was a strategic decision

The missing link in the value chain

The chief executive added that a location in the eastern German state of Brandenburg had almost become a must, considering the latest industrial activities in the area surrounding Berlin.

"Just look at what has been happening in Brandenburg in terms of the electric battery value and supply chain. We're just closing a gap," Brügmann explained. "You have everything here from the production of electric cars to battery manufacturing, but you don't have the production of lithium hydroxide yet, that's where we come in. So, strategically, we're at the right place in Guben with potential customers all nearby."

With negotiations about its Guben investment ongoing, Rock Tech Lithium doesn't want to disclose who its future customers may be. Suffice it to say that Brandenburg is also home to a Tesla Gigafactory and a large BASF plant where cathode active materials will be produced that are also needed for lithium-ion batteries.

Brügmann says that as early as 2030, about half of the materials to be used by Rock Tech Lithium in Guben will come from recycled batteries.

"There's no doubt that the big shift to electromobility has helped recent investment activities in eastern Germany," Claus Doll, project manager at the Fraunhofer Institute for Systems and Innovation Research (Fraunhofer ISI), told DW. "Had Germany continued to push combustion engine technology, it would have been a lot harder for them to secure a greater share of the pie, but now traditional structures are being dismantled as new technologies that didn't exist before are making inroads."

US chipmaker Intel plans to build several semiconductor plants in Magdeburg

Space is of the essence

What has played into the hands of authorities in eastern Germany is that the mostly rural and less densely populated states like Brandenburg and Saxony-Anhalt offer better greenfield investment opportunities than the traditional core industrial regions in the west and southwest of Germany.

"One big advantage that eastern Germany has is there's no lack of space for big projects — space that's so much harder to find in western Germany," said Doll. "And there's a profound interest in new technologies and industry in general. Communities there also come up with a lot of incentives to attract businesses and projects, which are quite often implemented faster in the east because of less red tape and a more practical approach."

The availability of vast spaces for new projects has indeed turned out to be a big plus, be it for Tesla's huge electric car factory in Grünheide, Brandenburg, or chipmaker Intel's plan to build several semiconductor factories for €17 billion in Magdeburg, Saxony-Anhalt.

"Space may not be relevant for all projects, but it certainly is for the big ones like the investments of Tesla and Intel where we're talking about at least 100 hectares each," Robert Hermann, co-CEO of the Germany Trade & Invest agency, agreed. "And such big available areas are definitely easier to find in eastern Germany," he told DW.

A large proportion of the overall investment in eastern Germany has been going into production and not so much into innovation or research and development (R&D) where higher-paying jobs can be found.

"Research and development is primarily taking place in the traditional western hubs of the German auto industry," said Fraunhofer ISI's Claus Doll. "But there's hope that the new production sites in eastern Germany will gradually attract more research clusters. We need better storage technology for renewables, and a lot of research on that is already underway in eastern Germany."

Germany Trade & Invest, which is responsible for marketing Germany as a business location and attracting companies, agrees that a shift toward more R&D in eastern Germany is already well underway.

"The big investment projects by the likes of CATL [China's biggest producer of lithium-ion batteries] in Thuringia, Rock Tech Lithium in Brandenburg or Intel in Saxony-Anhalt, all of them in eastern Germany, will no doubt contribute to attracting more R&D and innovation to the region," GTAI's Robert Hermann argued. "Tesla for instance has already announced that part of its battery cell research will happen in Brandenburg and Berlin."

Emerging energy dilemma a spoilsport?

No matter which company puts down roots in eastern Germany, it will need a steady energy supply for production.

"Renewables cover about 95% of eastern Germany's electricity needs, and that's crucial for many investors," Hermann said. "It often influences their decision on where to put their money as they want to produce sustainably and flag this sustainability to their customers."

Though a lot of eastern Germany's electricity comes from renewable sources, it can be unreliable at times. Many industries need additional sources of power like oil or gas to run their facilities.

Russia's war in Ukraine and the ensuing Western sanctions have changed everything, with supplies from Russia no longer guaranteed and both German households and businesses preparing for an energy crisis in the winter months.

That's certainly a big headache for Guben's mayor.

"Investors might get cold feet given the energy problems ahead," Fred Mahro conceded. "The question is just when we will be able to almost entirely do without gas — that's something I cannot imagine right now for many industries, including those in Guben."

Rock Tech Lithium's chief executive is confident that a solution can eventually be found. "We don't see this as the end of any investment here," Markus Brügmann emphasized.

"There will hopefully be alternative natural gas from other sources; we also have a plan to use hydrogen that might eventually replace natural gas — but in the beginning, we will need natural gas, liquefied natural gas, and we're confident to secure the amount of LNG that we'll need as of 2024 when production is scheduled to kick off."

No comments:

Post a Comment