Sep 29, 2022

Daniela Sirtori-Cortina, Bloomberg News

The math of cutting carbon pollution means it will pay for itself: Queen's University prof

Sean Cleary, chair of Institute for Sustainable Finance at Queen’s University, joins BNN Bloomberg and discusses some of his team's research into the need for investment in greenhouse gas reductions. He says that with Canada warming at a rapid pace, spending money to bring down carbon emissions is a cost-effective way of reducing the vastly expensive damage caused by extreme weather events and other climate risks.

t

5:16

We’re putting a tap into the ocean with no carbon emissions: Onek...

7:55

We can surpass the government’s emissions target, but we need sup...

Corporate America’s top emitters are failing to effectively link greenhouse gas reduction targets to CEO pay, a report by a shareholder advocacy group found.

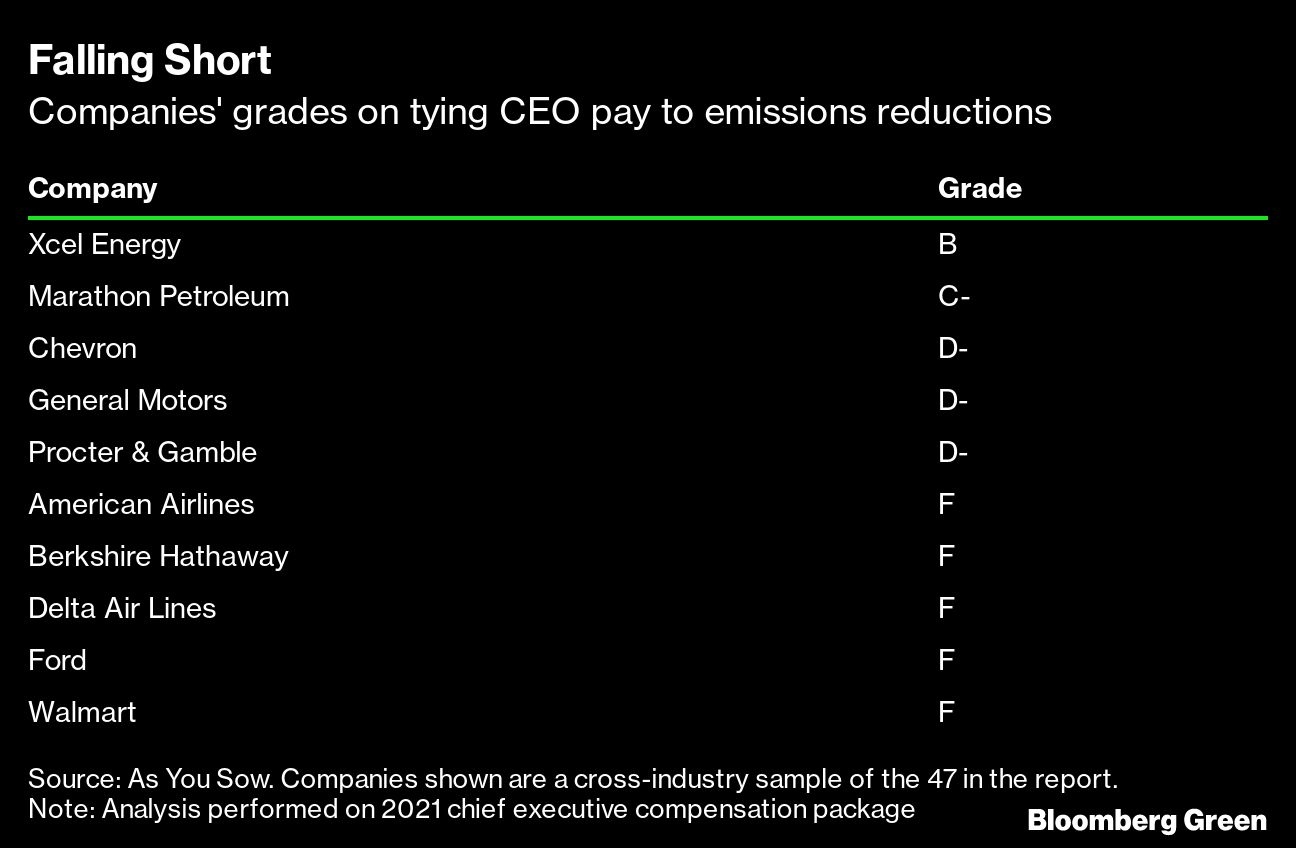

As You Sow analyzed the 2021 chief executive officer compensation packages of 47 US companies included in the Climate Action 100+ initiative, an investor-led program to ensure the world’s largest corporate greenhouse gas emitters curb their footprints. It found that many firms didn’t tie CEO pay to climate metrics, and when they did, it’s wasn’t to a level that would prompt bosses to meaningfully reduce emissions.

Linking environmental goals to compensation is gaining traction as a mechanism to rouse CEOs to action, as the world’s top climate scientists warn that the window to contain global warming is rapidly closing. Almost 70 per cent of S&P 500 companies that have filed 2022 proxy statements included ESG metrics in corporate incentive plans, up from 52 per cent in 2021. But the move won’t be effective if only a sliver of pay is tied to climate progress and the criteria used to assess chief executives is vague, according to As You Sow.

“The CEOs making net zero by 2050 pledges won’t be leading their companies when such pledges come due,” author Melissa Walton wrote in the As You Sow report. That means holding today’s executives accountable for the investments necessary to achieve those goals “is critical,” she wrote.

As You Sow assessed the companies on whether they included a climate metric in the CEO’s 2021 compensation package, giving higher marks for incentives in line with the Paris Agreement’s goal of limiting warming to 1.5°C. It also looked at whether the climate metric was quantitative and the amount of pay tied to it could be measured. Lastly, it analyzed whether the target was included in executives’ long-term incentive plan, which typically includes equity awards paid out over three years and can account for 60 per cent to 70 per cent of CEO pay.

The group then assigned grades based on the results, using a descending scale from A to F. Utility company Xcel Energy Inc. received the highest grade — a B — because it tied performance in reducing emissions to its long-term incentive plan and linked a measurable amount of pay to those goals. Almost 90 per cent of the corporations received D or F grades “for failing to include rigorous quantitative climate-related metrics with measurable payout or long-term incentive components.”

“Generalized linkages are generally insufficient to drive climate progress,” Walton wrote. “The amount of pay tied to most climate metrics was negligible relative to overall compensation.”

A spokesperson for Marathon Petroleum Corp., which got a C-, noted it was the first independent US downstream energy company to establish Scope 1 and 2 emissions intensity reduction targets linked to executive and employee compensation. “We continue to challenge ourselves to lead in sustainable energy by deepening environmental, social and governance commitments to drive long-term benefits for our business and stakeholders,” the spokesperson said.

General Motors Co., which got a D-, said, “We are aligning multiple aspects of the business with our climate goals, not just executive compensation (new this year),” citing a new sustainable finance framework and green bond issuance. A spokesperson also pointed to an announcement from CEO Mary Barra that the company will link a “significant part” of executives’ long-term compensation to meeting its electric vehicle goals.

Procter & Gamble Co. and Walmart Inc. declined to comment. American Airlines Inc., Berkshire Hathaway Inc., Chevron Corp., Delta Air Lines Inc. and Ford Motor Co. didn’t respond to requests for comment.

Multiple companies outlined a goal to “reduce emissions” without specifying the target required to receive a payout, according to the report. Others used vague terms such as “demonstrate leadership” in curbing greenhouse gases, a statement that can’t be quantified, while others touted milestones without having initially set measurable goals. That doesn’t cut it for investors.

“It’s important for companies to make this correlation clear, setting climate targets that convey real, science-based change,” said Simon Fischweicher, North America head of corporations and supply chains at the environmental disclosure nonprofit CDP, which wasn’t involved in the report. “This is particularly the case as investors are increasingly interested in how a company might be managing climate action.”

As You Sow also found that climate metrics were more commonly included in CEOs’ annual bonuses instead of in long-term incentive plans, which likely limits the potential to prompt action because bonuses tend to be a smaller portion of total compensation. And boards have more discretion over bonuses than incentive plans.

The group also took issue with a lack of disclosure in company proxy statements, which makes it harder to tell “performative” statements from effective ties between climate metrics and pay.

Compensation plans should clearly outline climate targets and the threshold required for a payout, according to the report.

“Companies are jumping on this bandwagon at a very alarming rate,” Walton said in an interview. “It needs to be done well.”

Sean Cleary, chair of Institute for Sustainable Finance at Queen’s University, joins BNN Bloomberg and discusses some of his team's research into the need for investment in greenhouse gas reductions. He says that with Canada warming at a rapid pace, spending money to bring down carbon emissions is a cost-effective way of reducing the vastly expensive damage caused by extreme weather events and other climate risks.

t

5:16

We’re putting a tap into the ocean with no carbon emissions: Onek...

7:55

We can surpass the government’s emissions target, but we need sup...

Corporate America’s top emitters are failing to effectively link greenhouse gas reduction targets to CEO pay, a report by a shareholder advocacy group found.

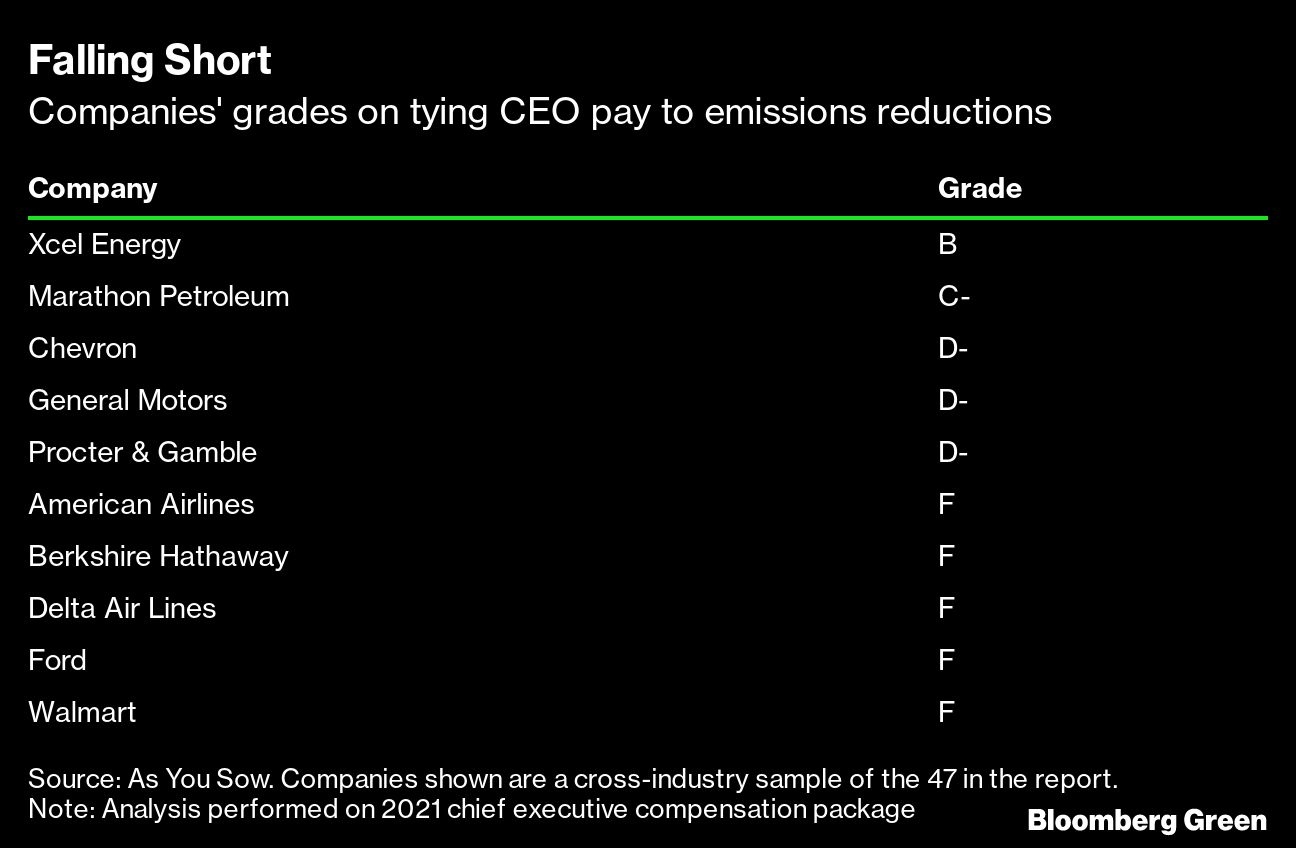

As You Sow analyzed the 2021 chief executive officer compensation packages of 47 US companies included in the Climate Action 100+ initiative, an investor-led program to ensure the world’s largest corporate greenhouse gas emitters curb their footprints. It found that many firms didn’t tie CEO pay to climate metrics, and when they did, it’s wasn’t to a level that would prompt bosses to meaningfully reduce emissions.

Linking environmental goals to compensation is gaining traction as a mechanism to rouse CEOs to action, as the world’s top climate scientists warn that the window to contain global warming is rapidly closing. Almost 70 per cent of S&P 500 companies that have filed 2022 proxy statements included ESG metrics in corporate incentive plans, up from 52 per cent in 2021. But the move won’t be effective if only a sliver of pay is tied to climate progress and the criteria used to assess chief executives is vague, according to As You Sow.

“The CEOs making net zero by 2050 pledges won’t be leading their companies when such pledges come due,” author Melissa Walton wrote in the As You Sow report. That means holding today’s executives accountable for the investments necessary to achieve those goals “is critical,” she wrote.

As You Sow assessed the companies on whether they included a climate metric in the CEO’s 2021 compensation package, giving higher marks for incentives in line with the Paris Agreement’s goal of limiting warming to 1.5°C. It also looked at whether the climate metric was quantitative and the amount of pay tied to it could be measured. Lastly, it analyzed whether the target was included in executives’ long-term incentive plan, which typically includes equity awards paid out over three years and can account for 60 per cent to 70 per cent of CEO pay.

The group then assigned grades based on the results, using a descending scale from A to F. Utility company Xcel Energy Inc. received the highest grade — a B — because it tied performance in reducing emissions to its long-term incentive plan and linked a measurable amount of pay to those goals. Almost 90 per cent of the corporations received D or F grades “for failing to include rigorous quantitative climate-related metrics with measurable payout or long-term incentive components.”

“Generalized linkages are generally insufficient to drive climate progress,” Walton wrote. “The amount of pay tied to most climate metrics was negligible relative to overall compensation.”

A spokesperson for Marathon Petroleum Corp., which got a C-, noted it was the first independent US downstream energy company to establish Scope 1 and 2 emissions intensity reduction targets linked to executive and employee compensation. “We continue to challenge ourselves to lead in sustainable energy by deepening environmental, social and governance commitments to drive long-term benefits for our business and stakeholders,” the spokesperson said.

General Motors Co., which got a D-, said, “We are aligning multiple aspects of the business with our climate goals, not just executive compensation (new this year),” citing a new sustainable finance framework and green bond issuance. A spokesperson also pointed to an announcement from CEO Mary Barra that the company will link a “significant part” of executives’ long-term compensation to meeting its electric vehicle goals.

Procter & Gamble Co. and Walmart Inc. declined to comment. American Airlines Inc., Berkshire Hathaway Inc., Chevron Corp., Delta Air Lines Inc. and Ford Motor Co. didn’t respond to requests for comment.

Multiple companies outlined a goal to “reduce emissions” without specifying the target required to receive a payout, according to the report. Others used vague terms such as “demonstrate leadership” in curbing greenhouse gases, a statement that can’t be quantified, while others touted milestones without having initially set measurable goals. That doesn’t cut it for investors.

“It’s important for companies to make this correlation clear, setting climate targets that convey real, science-based change,” said Simon Fischweicher, North America head of corporations and supply chains at the environmental disclosure nonprofit CDP, which wasn’t involved in the report. “This is particularly the case as investors are increasingly interested in how a company might be managing climate action.”

As You Sow also found that climate metrics were more commonly included in CEOs’ annual bonuses instead of in long-term incentive plans, which likely limits the potential to prompt action because bonuses tend to be a smaller portion of total compensation. And boards have more discretion over bonuses than incentive plans.

The group also took issue with a lack of disclosure in company proxy statements, which makes it harder to tell “performative” statements from effective ties between climate metrics and pay.

Compensation plans should clearly outline climate targets and the threshold required for a payout, according to the report.

“Companies are jumping on this bandwagon at a very alarming rate,” Walton said in an interview. “It needs to be done well.”

No comments:

Post a Comment