Bloomberg News | November 11, 2022 |

Highland Valley Copper mine operation owned by Teck Resources.

(Image courtesy of Teck Resources)

China has built up stakes in more than two dozen Canadian mining companies, including some of the industry’s biggest names. Canada’s latest crackdown on foreign investments in critical minerals is about to put a chill on such activity.

At least 27 public companies including Teck Resources Ltd., Ivanhoe Mines Ltd. and First Quantum Minerals Ltd. have shareholders with ties to China, according to data compiled by Bloomberg. Attracting such investors — or encouraging them to increase their holdings — will now be much harder given Canada’s latest efforts to protect its minerals wealth.

China has built up stakes in more than two dozen Canadian mining companies, including some of the industry’s biggest names. Canada’s latest crackdown on foreign investments in critical minerals is about to put a chill on such activity.

At least 27 public companies including Teck Resources Ltd., Ivanhoe Mines Ltd. and First Quantum Minerals Ltd. have shareholders with ties to China, according to data compiled by Bloomberg. Attracting such investors — or encouraging them to increase their holdings — will now be much harder given Canada’s latest efforts to protect its minerals wealth.

Company Top Shareholders With China Ties % Held

Nickel North Exploration Corp. Sinotech Hong Kong Corp. 49.7%Ivanhoe Mines Ltd. Citic Metal Africa, Zijin Mining Group 39.5%First Quantum Minerals Ltd. Jiangxi Copper Co. 18.3%Fission Uranium Corp. CGN Mining Co. 14.2%Teck Resources Ltd. China Investment Corp. 10.4%Lithium Americas Corp. GFL Lithium Co. 11.1%Source: Data compiled by Bloomberg, company disclosures

“Canada has said it doesn’t want to see injections of capital from state-influenced investors,” said Subrata Bhattacharjee, who specializes in foreign investment law at Borden Ladner Gervais LLP. “That’s going to leave some mining companies in a bind in terms of finding alternate sources of financing.”

Chinese firms have been involved in 89 announced acquisitions and investments in Canadian metals and mining companies in the past decade, according to data compiled by Bloomberg. The value of those transactions is $14 billion. Many deals involve companies tied to the 31 critical minerals identified by Canada.

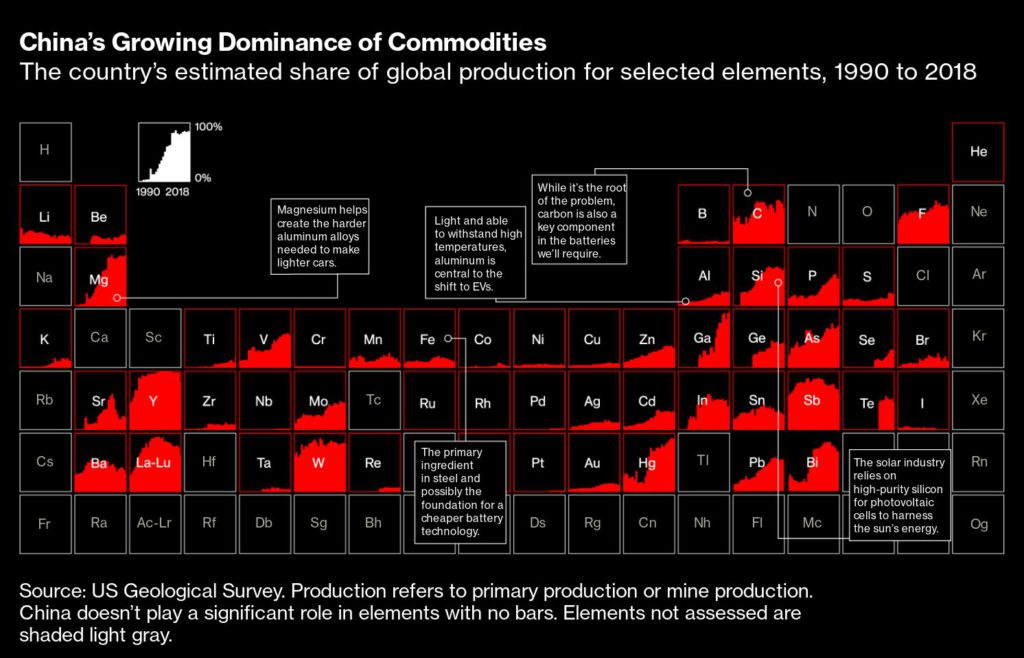

Metals such as lithium, copper, nickel and cobalt are essential ingredients for electric-vehicle batteries, solar panels and wind turbines — and securing access is key in reducing risks of supply bottlenecks and shortages. Canada has been working with the US and other friendly nations to develop supply chains for these minerals and reduce dependence on China, which dominates the industry and has stakes in resource firms far and wide.

Teck, which produces copper and zinc at mines in North and South America, lists sovereign wealth fund China Investment Corp. as its top shareholder, the data show. Ivanhoe Mines, founded by billionaire mining magnate Robert Friedland, counts China’s Zijin Mining Group Co. and a unit of state-owned Citic Metal Group among its biggest holders.

Among smaller firms, the largest investor in Lithium Americas Corp. is a subsidiary of China’s Ganfeng Lithium Group Co., while Fission Uranium Corp.’s biggest shareholder is tied to state-owned China General Nuclear Power Corp., the data show. Vancouver-based Nickel North Exploration Corp. lists Sinotech Hong Kong Corp. as its top investor.

Gold producers also count the Chinese government and entities as shareholders, though they have insignificant investments.

Ivanhoe Mines, Teck and First Quantum declined to comment. Emails and calls to Fission Uranium and Nickel North weren’t returned. Lithium Americas didn’t provide comment.

Canada announced tougher rules around investments in the country’s critical minerals last month, making it harder for foreign state-owned enterprises to pursue takeovers or invest in the industry. Any transactions in the sector now face “rigorous” national security oversight if they have such foreign involvement.

“The policy direction applies to future transactions,” said Alex Wellstead, spokesperson for Canada’s Industry Minister Francois-Philippe Champagne. The ministry declined to comment on specific companies.

“The Canadian government is taking a harder line on investments, not just by state-owned companies but also companies with links to foreign governments,” said Sandy Walker, a Toronto-based foreign investment and competition lawyer at Dentons. “You could be a private investor and still be considered a state-owned enterprise or at least subject to the influence of a foreign government.”

Canada’s stance triggered action last week, when Chinese firms were ordered by government to divest from three small battery metals explorers, including Calgary-based Lithium Chile Inc.

“The entire Canadian lithium sector has now lost the support of really the major player in the space,” Lithium Chile Chief Executive Officer Steven Cochrane said in an interview. “The impact is going to be felt by everybody.”

(By Jacob Lorinc, with assistance from Brian Platt, James Attwood and Doug Alexander)

No comments:

Post a Comment