Study identifies most likely locations for semiconductor plants in US

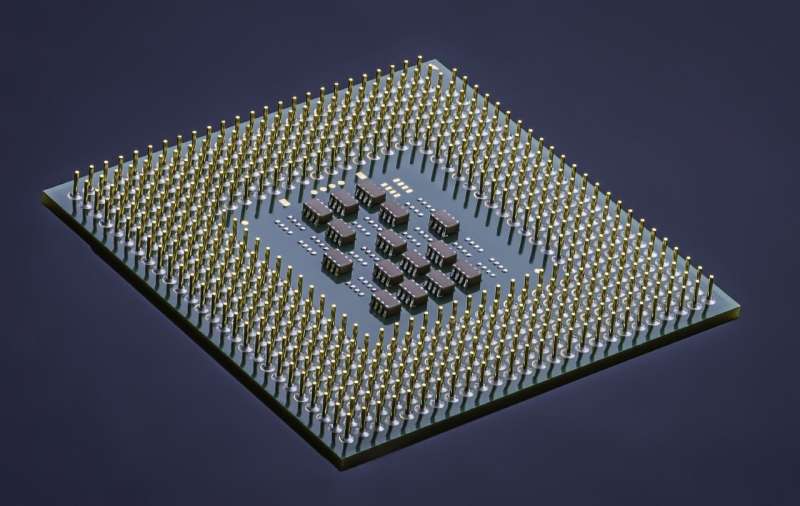

The passage of the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act has led to widespread enthusiasm regarding the possibility of increased manufacturing of semiconductors in the United States.

With the likelihood of the U.S. experiencing growth in the manufacturing of semiconductors, researchers at Ball State University have pinpointed the locations across the country most likely to experience expansion of semiconductor chip production in the coming years.

"Semiconductor Plant Location Decisions in the Wake of the CHIPS Act," a recently published study from Ball State's Center for Business and Economic Research (CBER), identifies 83 U.S. counties, sorted into three tiers, in which new plant locations are most likely. The study was co-authored by CBER researchers Dr. Michael Hicks and Dr. Dagney Faulk.

"The CHIPS Act offers incentives to increase the potential for growth in domestic semiconductor manufacturing," Dr. Hicks said. "Combined with the costly disruptions of chip production during COVID-19, it is especially likely the United States will see new semiconductor production. Where that production will occur is of substantial policy interest across much of the nation."

The CBER study combines data from the Semiconductor Industry Association, the U.S. Census Bureau, the Bureau of Economic Analysis, secondary studies, and other private sources to model the potential locations of semiconductor manufacturing firms.

Among the more important variables in explaining the expansion of the semiconductor industry are the educational attainment of the workforce (bachelor's degree or higher), the share of residents in graduate school, population growth, and high unexplained productivity (generalized agglomerations).

The "Tier 1" metropolitan areas considered most likely to be considered for a new semiconductor plant, according to the CBER study, are: Boulder, Colo., Chicago, Ill.; Columbus, Ohio; Dallas-Fort Worth-Arlington, Texas; Denver-Aurora-Lakewood, Colo.; Houston-The Woodlands-Sugarland, Texas; Madison, Wisc.; Miami-Dade County, Fla.; New York-Northern New Jersey-Long Island; San Diego-Carlsbad, Calif.; Seattle-Tacoma-Olympia, Wash.; and St. Louis, Mo.

The report also identifies 20 Tier 2 and 17 Tier 3 potential plant locations, which are considered "likely" and "somewhat likely" compared to Tier 1.

"Tier 1 locations are the most likely places to be selected for new semiconductor manufacturing facilities," Dr. Faulk said. "These locations all possess sufficiently large numbers of available workers and are large metropolitan areas with multiple suitable counties or at least one very suitable county for expansion."

The study also compared its results to a separate list of new proposed plants reported to the Semiconductor Industry Association; out of those 20 locations, the CBER model correctly predicts 18 of them. The two locations not included in the CBER study—West Lafayette, Ind., and Midland Metropolitan Area-Bay City, Mich.—both nearly met the researchers' inclusion criterion.

Though the U.S. currently manufactures a large share of the world's microconductors (microchips), recent widespread supply disruptions caused significant production delays in automobiles, appliances and consumer electronics.

The CHIPS Act of 2022 provides substantial funding and incentives for semiconductor and related firms to locate, upgrade, and expand within the United States. The Act provides $52.7 billion in emergency supplemental appropriations. The largest share, $50.0 billion over five years, is used to establish a CHIPS for America Fund to provide funding for provisions authorized in the FY2021 National Defense Authorization Act.

These provisions required the development of domestic semiconductor manufacturing capability, research and development, and workforce training programs. The largest share is allocated to legacy chip production, which is essential to the military, automotive, and other industries.

Provided by Ball State University Biden to attend groundbreaking of Intel's $20B Ohio plants

No comments:

Post a Comment