byJoe Mazumdar, Editor/Analyst, Exploration Insights

For most North American retail investors, it is easier to put the entire African continent into one category: too complicated. The region covers over 30M km2 and features over 50 countries where 3,000 distinct ethnic groups speak 2,000 languages (some endangered).

However, judging by the following problems that the global mining industry is facing, it is easy to conclude that everywhere is complicated:Changing investment climate in critical mining jurisdictions (e.g., Chile and Peru)

Water shortages throughout the western half of the Americas that make projects and operations more difficult to permit and sustain. Also, Chile, Burkina Faso, and Namibia are considered high to extremely high in the water-stressed economies list

Environmental and indigenous pushback on mining that challenges the social licence to operate. Recent examples include the Jadar lithium project in Serbia and Resolution copper project in Arizona

Lengthy permitting timelines in the US such as the Arctic polymetallic VMS project and creeping nationalism, which is playing out at the Cobre Panama porphyry copper mine, not to mention the impact of ESG-related investing on access to capital

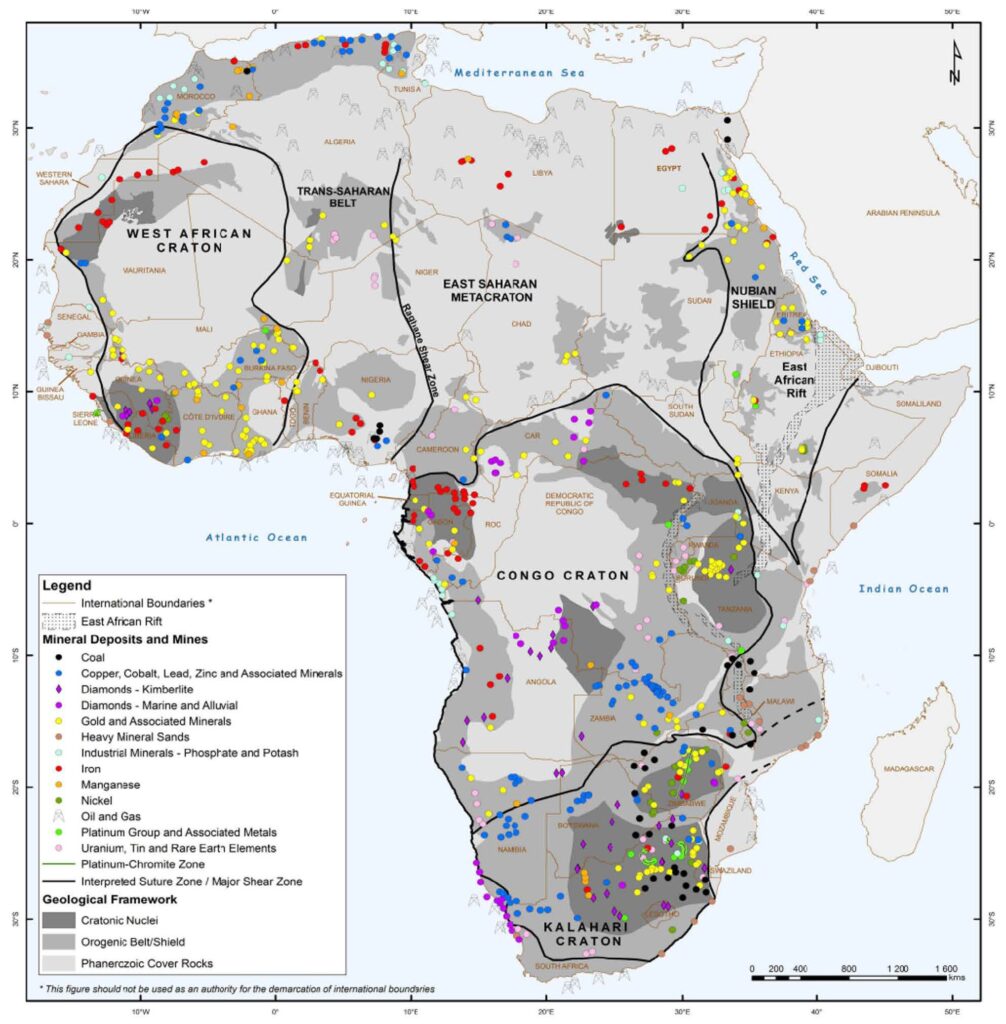

(Africa’s mineral occurrences. Source: Frost-Killian, Master, Viljoen and Wilson, IUGS, 2016

Back to Africa, its mineral potential is well-proven and comprises major resources of gold (South Africa, West Africa, East Africa), diamonds (Angola, Botswana, and DR Congo), platinum group metals or PGMs (South Africa), copper (DR Congo, Zambia and Namibia), coal (South Africa, Mozambique, Zimbabwe), uranium (Namibia, Niger), iron ore (South Africa, Guinea), and bauxite (Guinea, Ghana). Furthermore, many of them are considered critical by more advanced economies.

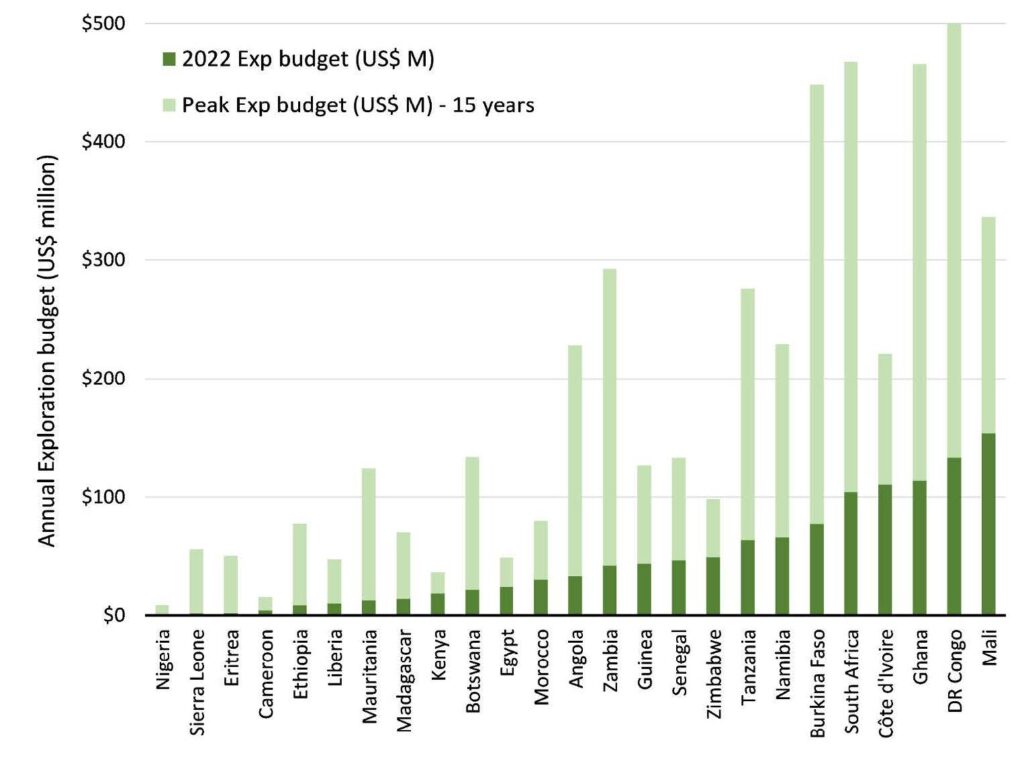

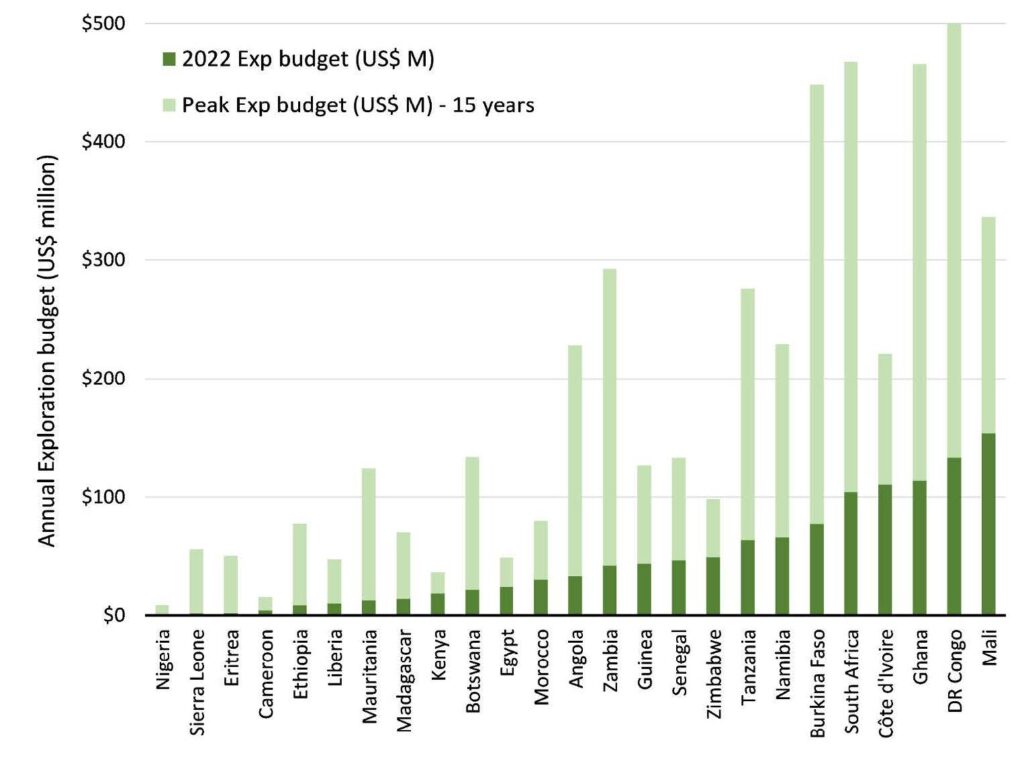

The global mining industry invested US$1.1-1.2B in exploration in 2022 on about half of the African nations, mostly on gold in Mali, Ghana, Côte d’Ivoire, South Africa, and Ghana, and copper and gold in the Democratic Republic of the Congo.

Back to Africa, its mineral potential is well-proven and comprises major resources of gold (South Africa, West Africa, East Africa), diamonds (Angola, Botswana, and DR Congo), platinum group metals or PGMs (South Africa), copper (DR Congo, Zambia and Namibia), coal (South Africa, Mozambique, Zimbabwe), uranium (Namibia, Niger), iron ore (South Africa, Guinea), and bauxite (Guinea, Ghana). Furthermore, many of them are considered critical by more advanced economies.

The global mining industry invested US$1.1-1.2B in exploration in 2022 on about half of the African nations, mostly on gold in Mali, Ghana, Côte d’Ivoire, South Africa, and Ghana, and copper and gold in the Democratic Republic of the Congo.

(Annual exploration expenditures in Africa for 2022 [dark green bars] and the peak for each country over the past 15 years [light green bars]. Source: S&P Global Market Intelligence and Exploration Insights)

The 2022 investments represent only 35% of the peak annual spending over the past 15 years. Part of the decline can be attributed to negative market trends, which make it more difficult to invest in geopolitically challenged jurisdictions.

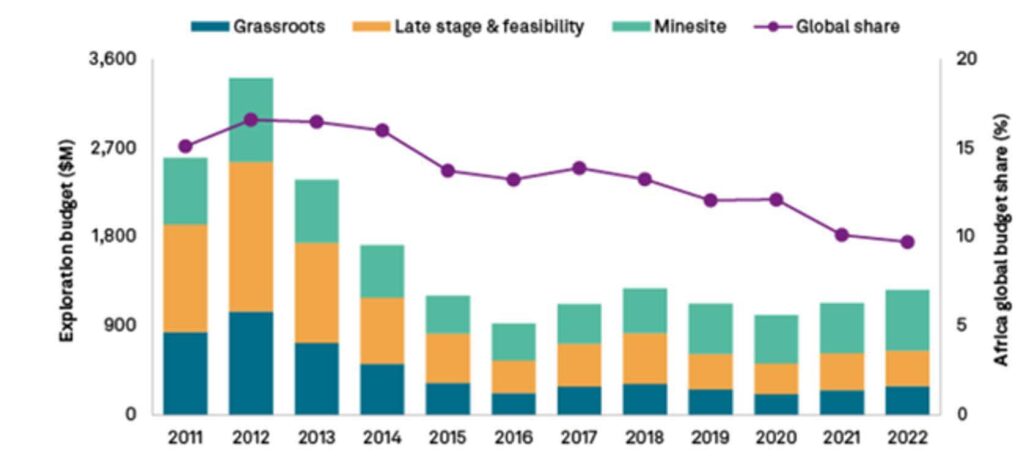

Over the past decade, the proportion of global exploration expenditures directed to Africa shrunk from 16-17% in 2012 to less than 10% in 2022.

(African exploration budgets since 2011 [US$ M]. Source: S&P Global Market Intelligence)

For example, last year’s mineral exploration expenditures in Eritrea were less than 5% of the peak recorded in 2011 due to restrictive internal policies, including forced conscription.

In a case that gained notoriety a couple of years ago, Nevsun Resources had to settle a dispute with three Eritrean refugees who accused the Canadian miner of being linked to human rights abuses. Although Nevsun was acquired by Zijin Mining (HKE: 2899) in 2018 for US$1.4B in September 2018, the case was settled in a Canadian court in 2020. The case illustrates how difficult it is for a company operating in the country to be considered an attractive target by ESG-linked equity funds.

In contrast, Côte d’Ivoire achieved peak expenditure in gold-focused exploration as it may be attracting funds previously directed to Burkina Faso (20% of peak in 2022), which is experiencing an increase in Islamic extremism. Nonetheless, Orezone Gold Corp. (TSX: ORE) declared commercial production at its Bomboré open pit gold mine (5.2Mtpa) in late 2022. The project was funded, in part, by US$96M in debt from a West African Bank at a cost of 8-9% (Coris Bank).

The Democratic Republic of the Congo (DRC) recorded an annual exploration expenditure of about a third of its latest peak in 2012 (US$132M). Interest in the highly endowed region of central Africa has been negatively impacted by the exodus of major North American-based copper producers over the past decade.

For instance, First Quantum Minerals (TSX: FM) left in 2012 upon ending a legal dispute that netted it US$1.25B in compensation. Also, in 2016, Freeport McMoRan (NYSE: FCX) sold its majority stake (70%) in the Tenke Fungurume copper-cobalt mine for US$2.65B to China Molybdenum (HKE: 3993).

However, over the past several years, exploration and development of the high grade Kamoa-Kakula underground copper mine, operated by Ivanhoe Mines (TSX: IVN) in a joint venture with Zijin Mining, has reinvigorated exploration in this part of the Central African Copper Belt.

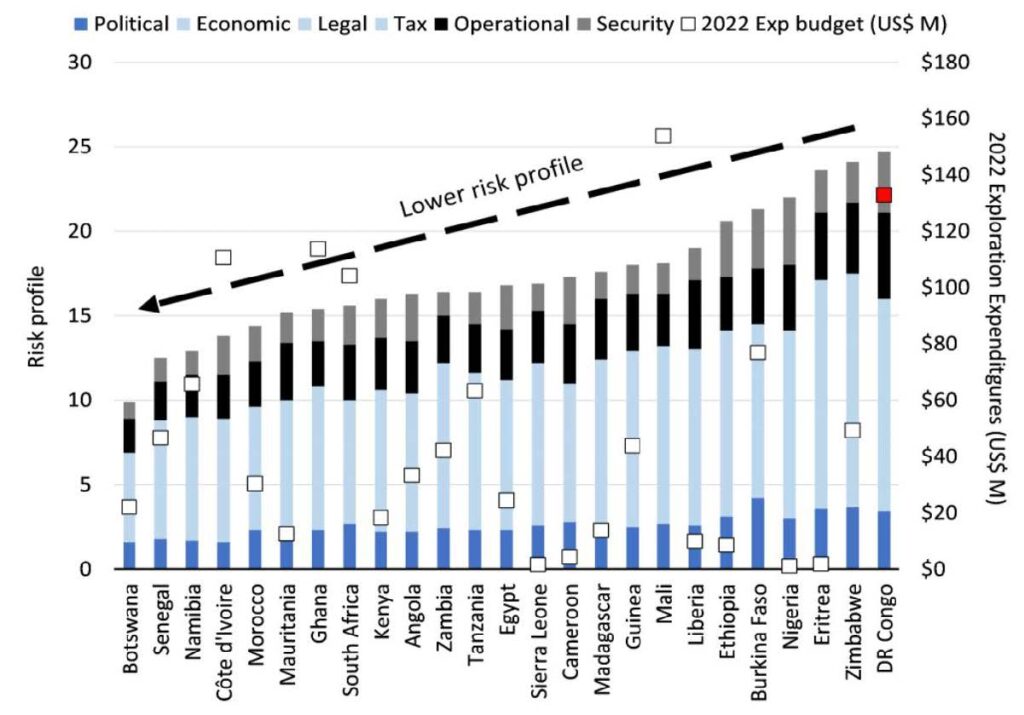

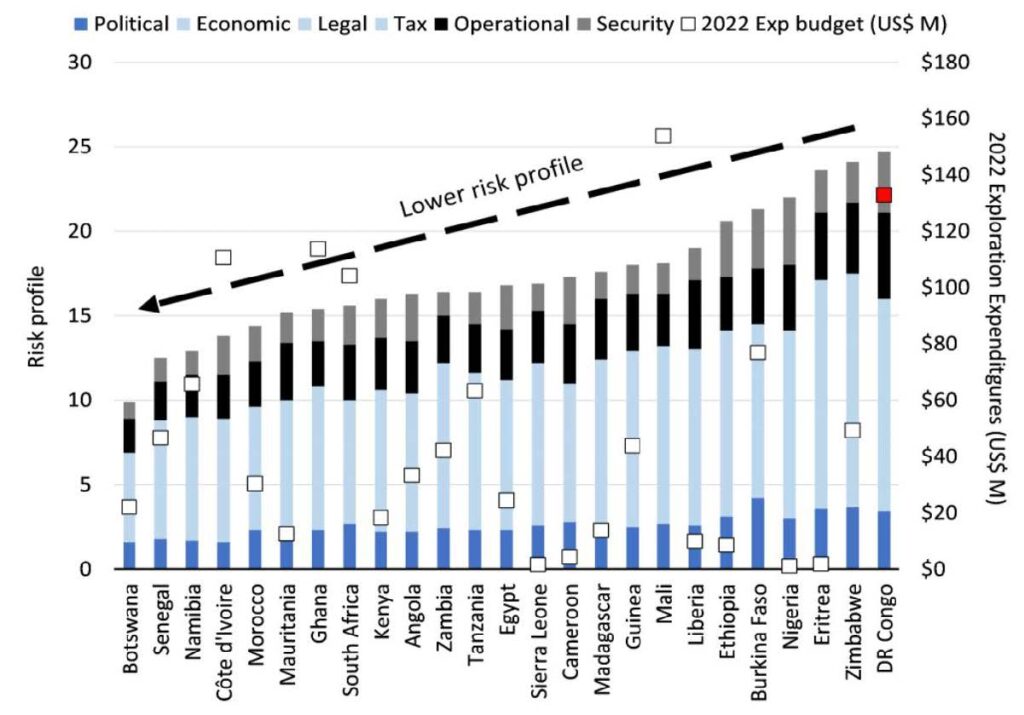

Despite the many challenges mentioned, the DRC, considered a highly risky jurisdiction in 2022, had the second highest exploration expenditures among a peer group of African countries I surveyed (Mali was no. 1).

Other risks faced by the mining industry in Africa include, inadequate infrastructure, political instability, corruption, lack of social licence to operate, and stability of tax and royalty agreements, although these are by no means limited to the continent.

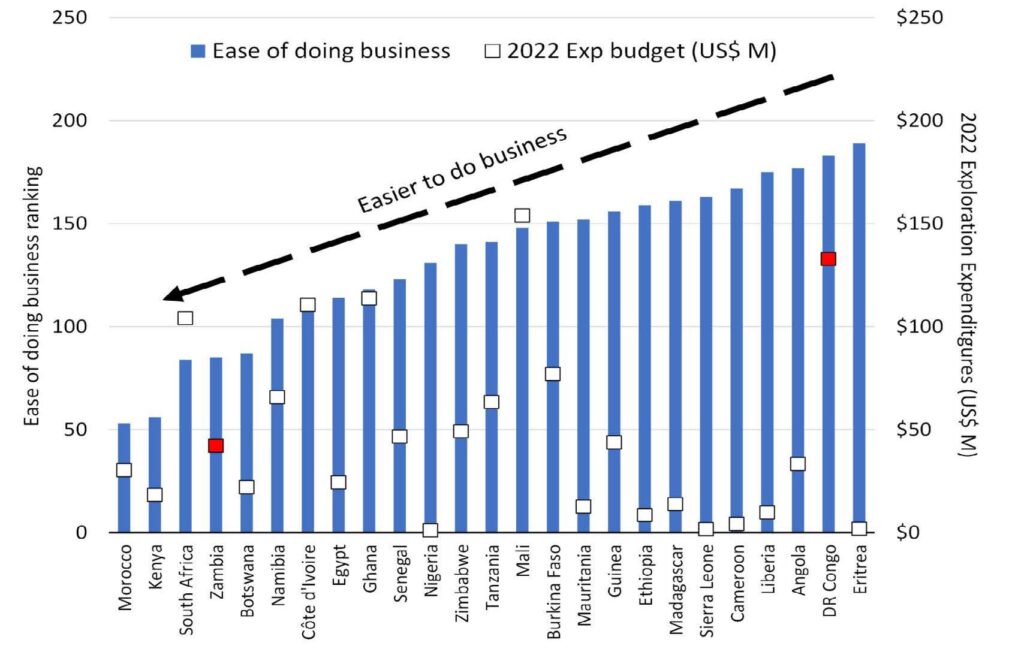

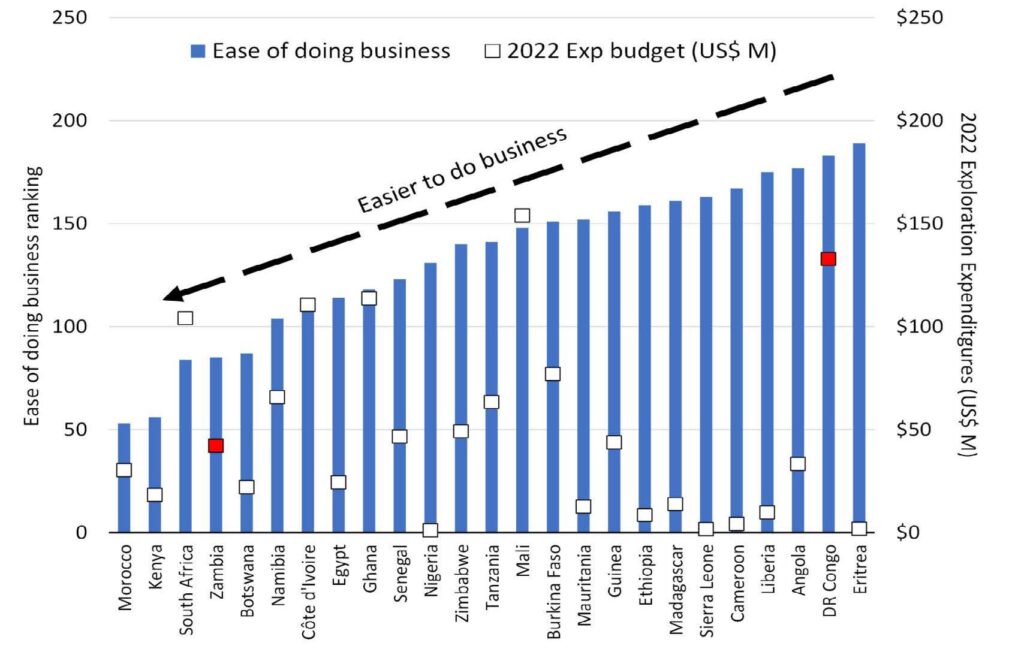

Of course, the ease of doing business (EDB) is an important metric for attracting foreign direct investment. Normally, expenditures in a country are positively correlated with a lower ranking.

For example, last year’s mineral exploration expenditures in Eritrea were less than 5% of the peak recorded in 2011 due to restrictive internal policies, including forced conscription.

In a case that gained notoriety a couple of years ago, Nevsun Resources had to settle a dispute with three Eritrean refugees who accused the Canadian miner of being linked to human rights abuses. Although Nevsun was acquired by Zijin Mining (HKE: 2899) in 2018 for US$1.4B in September 2018, the case was settled in a Canadian court in 2020. The case illustrates how difficult it is for a company operating in the country to be considered an attractive target by ESG-linked equity funds.

In contrast, Côte d’Ivoire achieved peak expenditure in gold-focused exploration as it may be attracting funds previously directed to Burkina Faso (20% of peak in 2022), which is experiencing an increase in Islamic extremism. Nonetheless, Orezone Gold Corp. (TSX: ORE) declared commercial production at its Bomboré open pit gold mine (5.2Mtpa) in late 2022. The project was funded, in part, by US$96M in debt from a West African Bank at a cost of 8-9% (Coris Bank).

The Democratic Republic of the Congo (DRC) recorded an annual exploration expenditure of about a third of its latest peak in 2012 (US$132M). Interest in the highly endowed region of central Africa has been negatively impacted by the exodus of major North American-based copper producers over the past decade.

For instance, First Quantum Minerals (TSX: FM) left in 2012 upon ending a legal dispute that netted it US$1.25B in compensation. Also, in 2016, Freeport McMoRan (NYSE: FCX) sold its majority stake (70%) in the Tenke Fungurume copper-cobalt mine for US$2.65B to China Molybdenum (HKE: 3993).

However, over the past several years, exploration and development of the high grade Kamoa-Kakula underground copper mine, operated by Ivanhoe Mines (TSX: IVN) in a joint venture with Zijin Mining, has reinvigorated exploration in this part of the Central African Copper Belt.

Despite the many challenges mentioned, the DRC, considered a highly risky jurisdiction in 2022, had the second highest exploration expenditures among a peer group of African countries I surveyed (Mali was no. 1).

Other risks faced by the mining industry in Africa include, inadequate infrastructure, political instability, corruption, lack of social licence to operate, and stability of tax and royalty agreements, although these are by no means limited to the continent.

Of course, the ease of doing business (EDB) is an important metric for attracting foreign direct investment. Normally, expenditures in a country are positively correlated with a lower ranking.

(Risk profile [political, economic, legal, tax, operational, and security, bars] versus 2022 exploration budget

[squares]. Source: S&P Global Market Intelligence and Exploration Insights)

[squares]. Source: S&P Global Market Intelligence and Exploration Insights)

Risk profile [political, economic, legal, tax, operational and security, bars] versus 2022 exploration budget [squares]. Source:

World Bank, S&P Global Market Intelligence and Exploration Insights)

However, there are anomalies such as the DRC, where the potential to develop high quality deposits (Kamoa-Kakula) trumps the risks of operating in shaky jurisdictions for companies like Ivanhoe Mines and Chinese state-owned entities such as Zijin Mining.

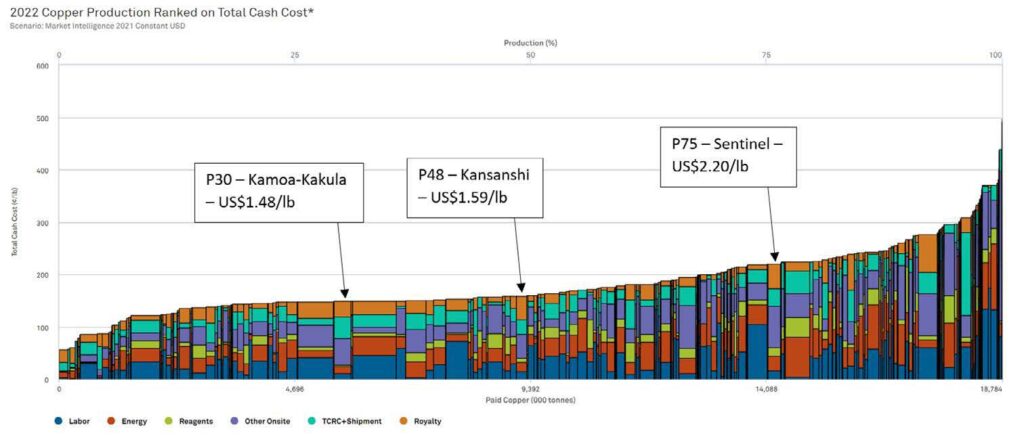

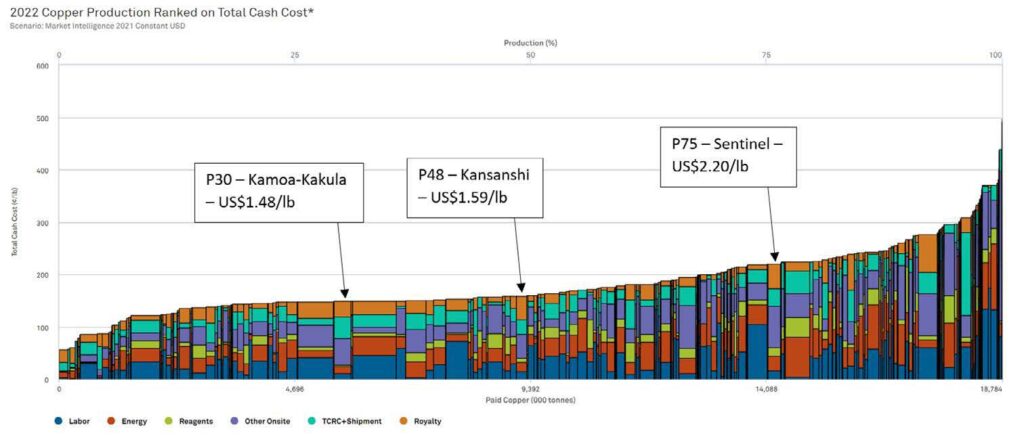

The Kamoa-Kakula, which hosts ~23Blb of copper grading 4.47% in proven and probable reserves, reflects its quality and underpins its favourable operating costs that fall in the lower part of the global cost curve. Another prime producer in the Central African Copper Belt is the Kansanshi open pit mine in Zambia, operated by First Quantum Minerals, which lies in the middle part of the cost curve.

Encouragingly for all miners and explorers, the new Zambian government (New Dawn) has improved the investment climate and the ease of doing business in the country, including reintroducing the deductibility of mineral royalties against corporate taxes effective in January 2022.

Critically for First Quantum, its long-term plans to expand operations at Kansanshi (>US$1.35 B) were approved after the resolution of outstanding value-added tax receivables and a new way to use repayments to offset future mining taxes and royalties.

World Bank, S&P Global Market Intelligence and Exploration Insights)

However, there are anomalies such as the DRC, where the potential to develop high quality deposits (Kamoa-Kakula) trumps the risks of operating in shaky jurisdictions for companies like Ivanhoe Mines and Chinese state-owned entities such as Zijin Mining.

The Kamoa-Kakula, which hosts ~23Blb of copper grading 4.47% in proven and probable reserves, reflects its quality and underpins its favourable operating costs that fall in the lower part of the global cost curve. Another prime producer in the Central African Copper Belt is the Kansanshi open pit mine in Zambia, operated by First Quantum Minerals, which lies in the middle part of the cost curve.

Encouragingly for all miners and explorers, the new Zambian government (New Dawn) has improved the investment climate and the ease of doing business in the country, including reintroducing the deductibility of mineral royalties against corporate taxes effective in January 2022.

Critically for First Quantum, its long-term plans to expand operations at Kansanshi (>US$1.35 B) were approved after the resolution of outstanding value-added tax receivables and a new way to use repayments to offset future mining taxes and royalties.

(2022 total cash cost [US$ per lb] for copper producers. Source: S&P Global Market Intelligence and Exploration Insights)

A push by western economies to secure the supply of critical minerals in the current environment of deglobalization and market fragmentation triggered a September 2022 meeting between the US administration and five African nations including the DRC, Zambia, Namibia, Mozambique, and Tanzania.

A memorandum of understanding (MOU) to develop electric vehicle supply chains was signed with the DRC and Zambia only a couple of months after that meeting, reflecting the urgency of the US strategy,

Although the bulk of exploration expenditures in Africa is directed to gold, the push for critical minerals will continue attracting the interest of the US and Europe, potentially generating more foreign direct investment and facilitate the influx of new miners and explorers to countries that host such resources.

A push by western economies to secure the supply of critical minerals in the current environment of deglobalization and market fragmentation triggered a September 2022 meeting between the US administration and five African nations including the DRC, Zambia, Namibia, Mozambique, and Tanzania.

A memorandum of understanding (MOU) to develop electric vehicle supply chains was signed with the DRC and Zambia only a couple of months after that meeting, reflecting the urgency of the US strategy,

Although the bulk of exploration expenditures in Africa is directed to gold, the push for critical minerals will continue attracting the interest of the US and Europe, potentially generating more foreign direct investment and facilitate the influx of new miners and explorers to countries that host such resources.

Summary & ConclusionsThe myriad challenges faced by the mining industry around the world, including, among others, access to clean water, social license to operate, ESG investing, changing geopolitical climate, lengthy permitting timelines, stability of tax and royalty agreements, and nationalization, render many jurisdictions too complicated to invest

When market sentiment is bleak, investing in riskier jurisdictions is challenging. Exploration expenditures in 2022 were on average only 35% of the most recent peak over the past 15 years. Although some of the drop can be linked to the overall market, Africa’s proportion of global exploration expenditures has fallen from 16-17% in 2012 to less than 10% in 2022

In Africa, anomalies running contrary to the trend of investing in favourable jurisdictions with low ease of doing business (EDB) rankings include highly prospective geological terranes that can generate high quality deposits, like the Kamoa-Kakula copper mine in the DRC

A positive change in the Zambian government policies last year supported a major copper producer’s decision to trigger a multi-billion investment in expanding its mining and smelting operations at Kansanshi

A West African gold developer managed to attract funding from a local bank to build its open pit gold project in Burkina Faso at a reasonable cost of capital of 8-9%

Western countries keen on securing supply of critical minerals in a bid to reduce their carbon footprint, like the US, are signing MOUs with the DRC and Zambia to advance their strategy

Although most exploration expenditures in Africa are directed to gold, the push for critical minerals has piqued the interest of the US and Europe, and has the potential to generate more foreign direct investment and facilitate the influx of new miners and explorers to the continent

No comments:

Post a Comment