2022 was record year for central bank gold buying, WGC confirms

Staff Writer | February 8, 2023 |

Gold bullion. (Image by National Bank Of Ukraine, Flickr).

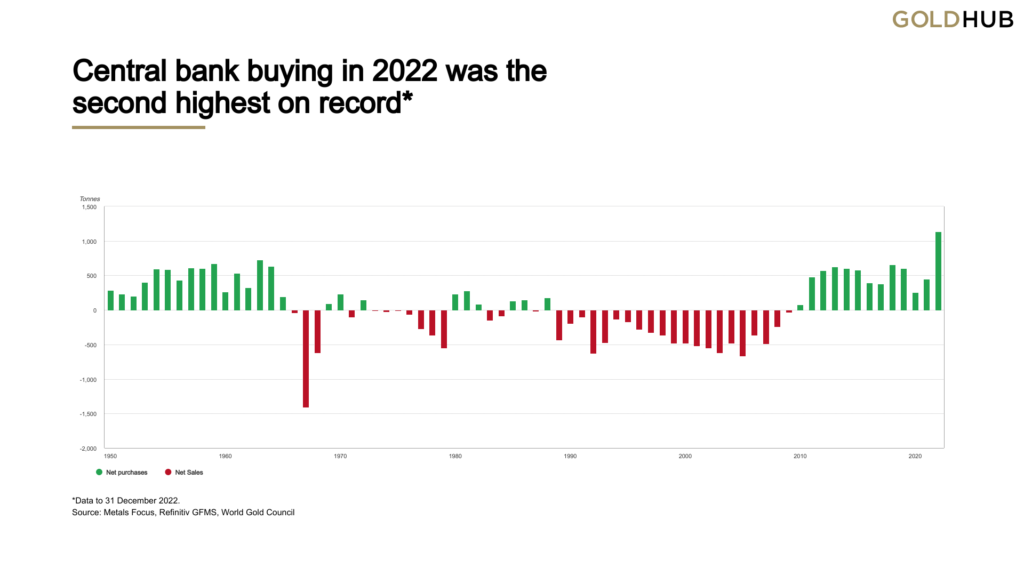

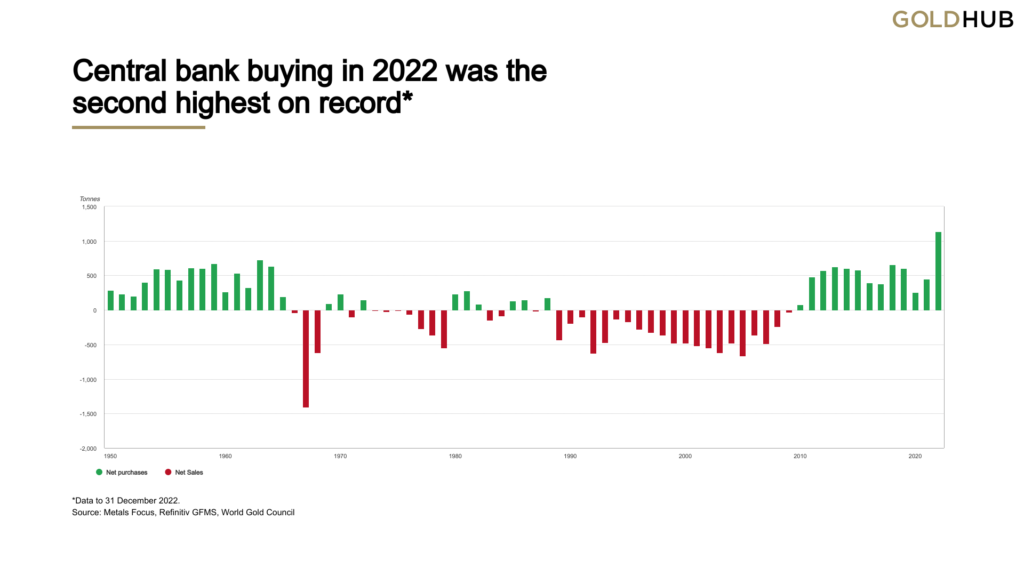

Two years on from dropping to its lowest level in a decade, central bank demand for gold has rebounded strongly, with net purchases rising by 1,136 tonnes valued at some $70 billion in 2022, the World Gold Council (WGC) said on Tuesday.

Correcting some of the historic data from its annual Gold Demand Trends report, the WGC confirmed that this level of purchase was indeed the most in any year dating back to 1950, and the 13th consecutive year of net inflows.

As disclosed earlier, central bank purchases in the fourth quarter were 417 tonnes, which almost matched the entire 2021 totals (450 tonnes). Like the third quarter, the final quarter of the year was a combination of reported purchases and a substantial estimate for unreported buying.

As a result, total gold buying in the second half of 2022 totalled 862 tonnes.

This data underline a shift in attitudes to gold since the 1990s and 2000s, when central banks, particularly those in Western Europe that own a lot of bullion, sold hundreds of tonnes a year.

Since the financial crisis of 2008-09, European banks have stopped selling (gold), and a growing number of emerging economies such as Russia, Turkey and India have bought.

“This is a continuation of a trend,” said WGC analyst Krishan Gopaul. “You can see those drivers feeding into what happened last year. You had on the geopolitical front and the macroeconomic front a lot of uncertainty and volatility.”

Buying dipped during the coronavirus pandemic but accelerated in the second half of 2022, with central banks purchasing 862 tonnes between July and December, according to the WGC.

Banks including those of Turkey, China, Egypt and Qatar said they bought gold last year. But around two-thirds of the gold bought by central banks last year was not reported publicly, the WGC said.

Banks that have not regularly published information about changes in their gold stockpiles include those in China and Russia.

However, the “central bank buying (in 2023) is unlikely to match 2022 levels,” the WGC added.

“Lower total reserves may constrain the capacity to add to existing allocations. But lagged reporting by some central banks means that we need to apply a high degree of uncertainty to our expectations, predominantly to the upside.”

The central bank purchases took total gold global gold demand last year to 4,741 tonnes, up 18% from 2021 and the highest for any year since 2011.

(With files from Reuters)

Staff Writer | February 8, 2023 |

Gold bullion. (Image by National Bank Of Ukraine, Flickr).

Two years on from dropping to its lowest level in a decade, central bank demand for gold has rebounded strongly, with net purchases rising by 1,136 tonnes valued at some $70 billion in 2022, the World Gold Council (WGC) said on Tuesday.

Correcting some of the historic data from its annual Gold Demand Trends report, the WGC confirmed that this level of purchase was indeed the most in any year dating back to 1950, and the 13th consecutive year of net inflows.

As disclosed earlier, central bank purchases in the fourth quarter were 417 tonnes, which almost matched the entire 2021 totals (450 tonnes). Like the third quarter, the final quarter of the year was a combination of reported purchases and a substantial estimate for unreported buying.

As a result, total gold buying in the second half of 2022 totalled 862 tonnes.

This data underline a shift in attitudes to gold since the 1990s and 2000s, when central banks, particularly those in Western Europe that own a lot of bullion, sold hundreds of tonnes a year.

Since the financial crisis of 2008-09, European banks have stopped selling (gold), and a growing number of emerging economies such as Russia, Turkey and India have bought.

“This is a continuation of a trend,” said WGC analyst Krishan Gopaul. “You can see those drivers feeding into what happened last year. You had on the geopolitical front and the macroeconomic front a lot of uncertainty and volatility.”

Buying dipped during the coronavirus pandemic but accelerated in the second half of 2022, with central banks purchasing 862 tonnes between July and December, according to the WGC.

Banks including those of Turkey, China, Egypt and Qatar said they bought gold last year. But around two-thirds of the gold bought by central banks last year was not reported publicly, the WGC said.

Banks that have not regularly published information about changes in their gold stockpiles include those in China and Russia.

However, the “central bank buying (in 2023) is unlikely to match 2022 levels,” the WGC added.

“Lower total reserves may constrain the capacity to add to existing allocations. But lagged reporting by some central banks means that we need to apply a high degree of uncertainty to our expectations, predominantly to the upside.”

The central bank purchases took total gold global gold demand last year to 4,741 tonnes, up 18% from 2021 and the highest for any year since 2011.

(With files from Reuters)

South Africa’s century-old gold refiner runs at 75% as mines dim

Bloomberg News | February 3, 2023 |

Bloomberg News | February 3, 2023 |

South Africa’s largest gold refiner is operating below capacity as output from local mines dwindles and supplies from elsewhere on the continent are scooped up by unaccredited rivals.

The 102 year-old Rand Refinery Ltd. in the east of Johannesburg — the only African refiner accredited with the London Bullion Market Association — is running at about 75% of capacity, said Chief Executive Officer Praveen Baijnath. While it still processes the output of its biggest shareholders — AngloGold Ashanti Ltd. Harmony Gold Mining Co. and Sibanye Stillwater Ltd. — about half of the continent’s gold, from artisanal and small-scale miners, goes to smaller unaccredited refiners.

“Our capacity is not fully utilized,” Baijnath said in an interview. “So should there be an increase in deliveries, we would be able to step up.”

That surplus capacity partly stems from the demise of South Africa’s gold industry, where output peaked decades ago. The plant was originally built to end the practice of shipping crude bullion to London from the vast Witwatersrand basin, the source of half the gold produced on earth. Now power outages are crippling the nation’s economy and threatening to hasten the end of those operations, the CEO said.

Rand Refinery also sources gold from Ghana, the Democratic Republic of Congo and Tanzania — the continent’s top producers — but much larger flows are ending up with smaller smelters that have sprung up across Africa. The plant aims to stay competitive by investing in new technology and improving the logistics of hauling gold dore from across Africa, including sometimes using charter flights, Baijnath said.

There’s currently no market pressure to curtail the refinery’s operations further, said Baijnath.

So far, the LBMA’s minimum output requirements and stringent rules around responsible sourcing have precluded other African refineries from gaining accreditation. That hasn’t prevented them from finding markets for their bullion in Dubai and some European countries, Baijnath said.

Many of those unaccredited plants are in South Africa, where illegal mining has long been a problem. The proliferation of some of those refiners could in turn be spurring gold smuggling across the continent, he said.

(By Felix Njini, with assistance from Eddie Spence)

Russians bought record number of gold bars in 2022, data shows

Reuters | February 3, 2023 |

Russia’s sovereign gold stockpile is the fifth-biggest in the world. (Image from Vladimir Putin’s website)

Russians bought an all-time record number of gold bars in 2022, finance ministry data showed on Friday, as tax cuts on precious metals encouraged people to stock up on bullion as a safe asset.

Moscow scrapped its 20% VAT on physical gold trades for individuals last March in a bid to draw people away from using the US dollar as a safe haven.

It also exempted people from paying income tax on profits gained from selling gold bars, further boosting demand for the metal.

According to the data, Russians bought over 50 tonnes of gold bars in 2022, ten times more than the year before. The most sought after were 1 kilogram bars which accounted for about 60% of those sold.

The figures are not yet final and only cover the period ending November 2022, the finance ministry told Reuters.

State-controlled VTB Bank said it sold 33.8 tonnes of gold bars to customers in 2022, with clients holding 50 billion roubles ($711 million) worth of the metal.

“Gold was a good protective financial solution last year,” said Yevgeny Beresnev from VTB’s investment products department.

“Customers shifted funds into this instrument in order to diversify their assets and make a profit when long-term planning.”

($1 = 70.30 roubles)

(By Darya Korsunskaya, Elena Fabrichnaya and Caleb Davis; Editing by Christina Fincher)

No comments:

Post a Comment