Bloomberg News | March 12, 2023 |

Stock image.

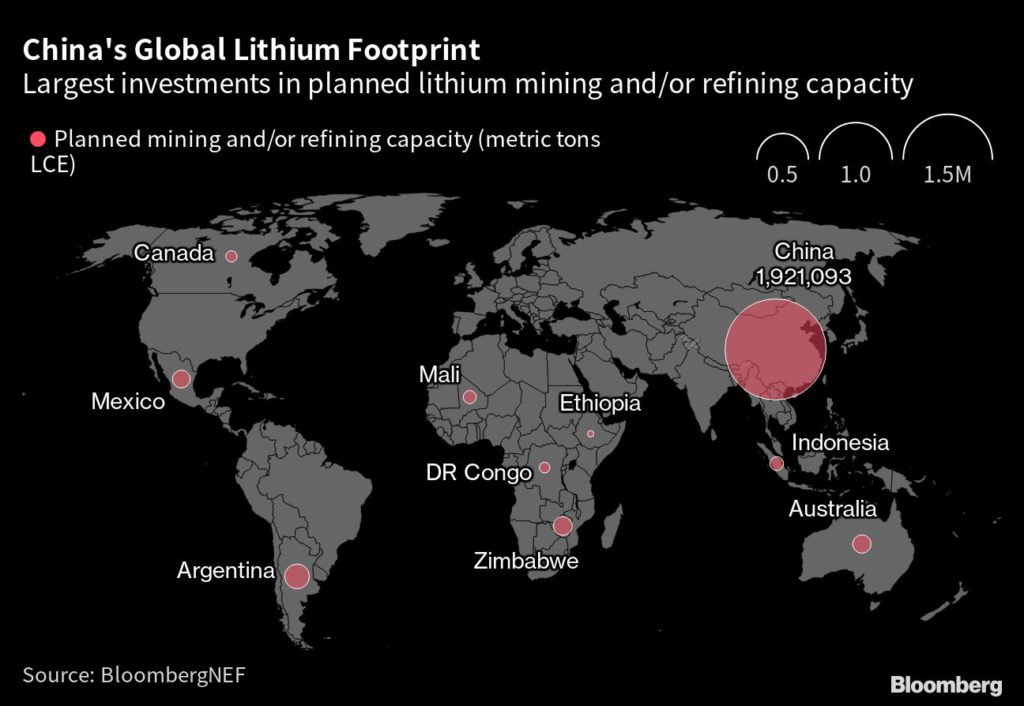

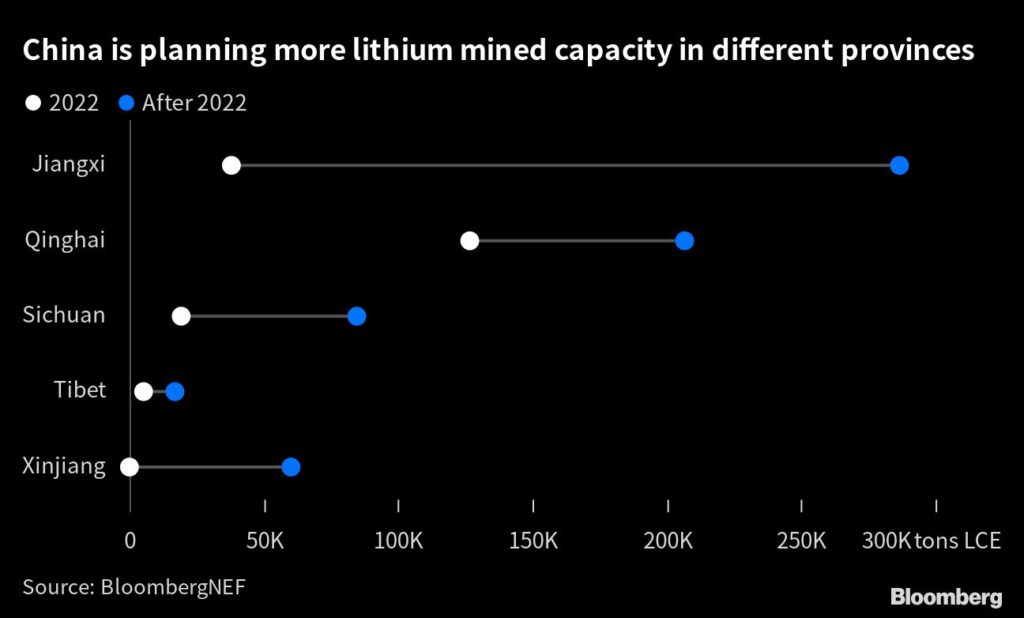

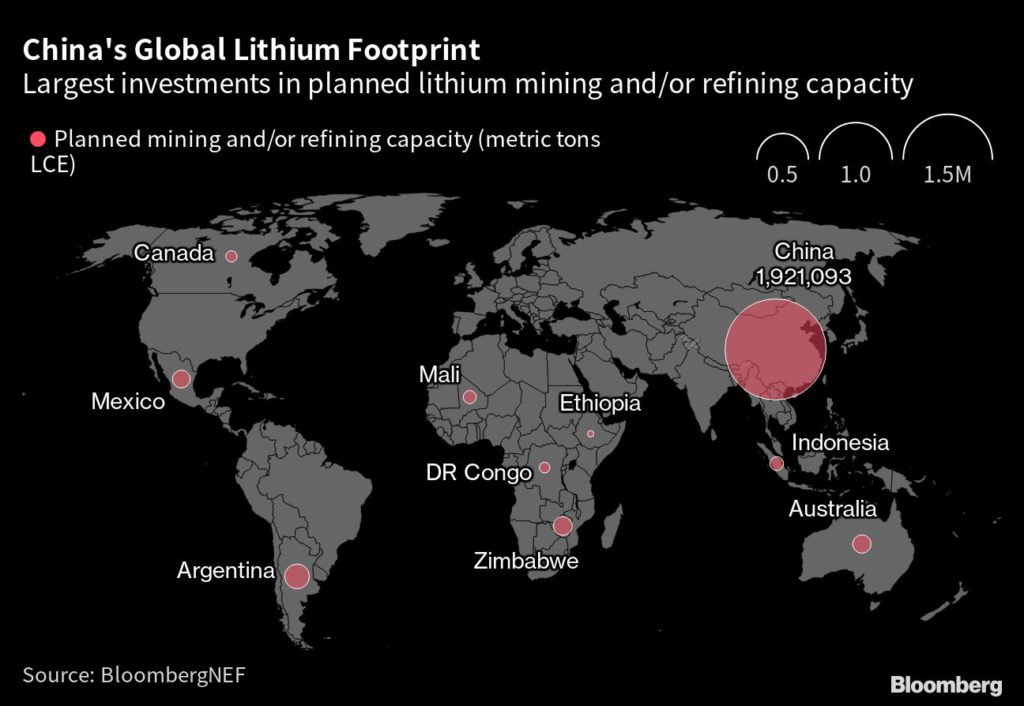

China’s efforts to ramp up lithium extraction could see it accounting for nearly a third of the world’s supply by the middle of the decade, according to UBS AG.

The bank expects Chinese-controlled mines, including projects in Africa, to raise output to 705,000 tons by 2025, from 194,000 tons in 2022. That would lift China’s share of the mineral critical to electric-vehicle batteries to 32% of global supply, from 24% last year, according to a note on Friday.

The race to secure lithium is playing out at the highest levels, with nations including the US prioritizing access to the materials necessary for making batteries as the world turns away from fossil fuels. China’s needs are particularly acute because it’s home to the world’s biggest market for new energy vehicles.

The rise in Chinese output will include an increase in material derived from lepidolite, a lithium-bearing rock often overlooked as poor quality and environmentally unsound because of its low yield and high energy costs. UBS sees lepidolite in China accounting for 280,000 tons of lithium in 2025, or 13% of global supply, from 88,000 tons last year, as the government continues to support the sector.

Beijing has already moved to curb unlicensed lepidolite extraction in Jiangxi province, a major mining hub, as it seeks to exert more control over its deposits.

Stock image.

China’s efforts to ramp up lithium extraction could see it accounting for nearly a third of the world’s supply by the middle of the decade, according to UBS AG.

The bank expects Chinese-controlled mines, including projects in Africa, to raise output to 705,000 tons by 2025, from 194,000 tons in 2022. That would lift China’s share of the mineral critical to electric-vehicle batteries to 32% of global supply, from 24% last year, according to a note on Friday.

The race to secure lithium is playing out at the highest levels, with nations including the US prioritizing access to the materials necessary for making batteries as the world turns away from fossil fuels. China’s needs are particularly acute because it’s home to the world’s biggest market for new energy vehicles.

The rise in Chinese output will include an increase in material derived from lepidolite, a lithium-bearing rock often overlooked as poor quality and environmentally unsound because of its low yield and high energy costs. UBS sees lepidolite in China accounting for 280,000 tons of lithium in 2025, or 13% of global supply, from 88,000 tons last year, as the government continues to support the sector.

Beijing has already moved to curb unlicensed lepidolite extraction in Jiangxi province, a major mining hub, as it seeks to exert more control over its deposits.

China lithium probe puts spotlight on reserves and ESG risks

“Due to the mammoth growth of lithium prices over the past two years, there has been an increased interest in capturing and exploring lithium resources within domestic shores,” said Leah Chen, an analyst at S&P Global Commodity Insights.

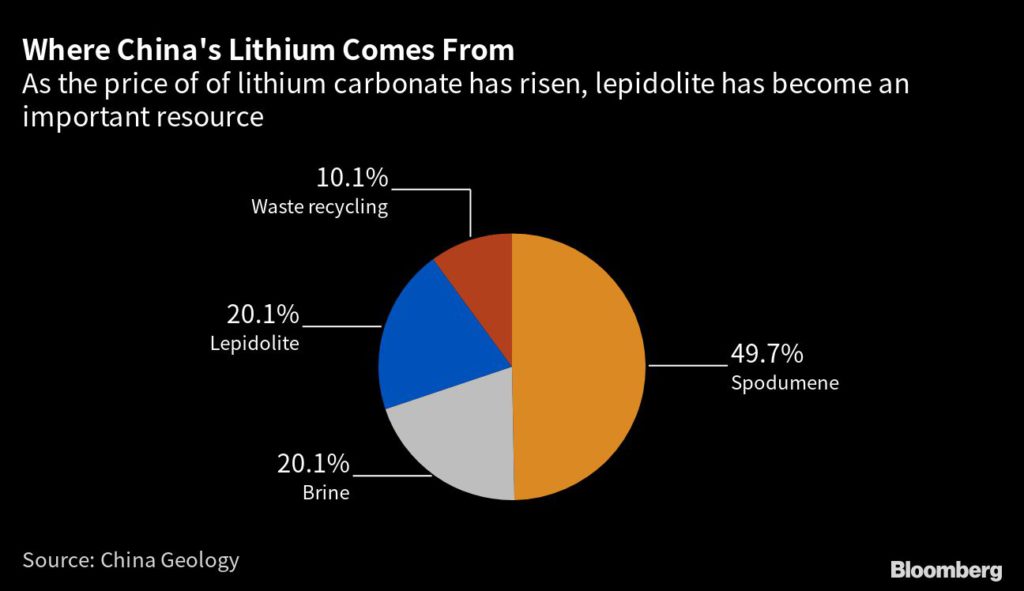

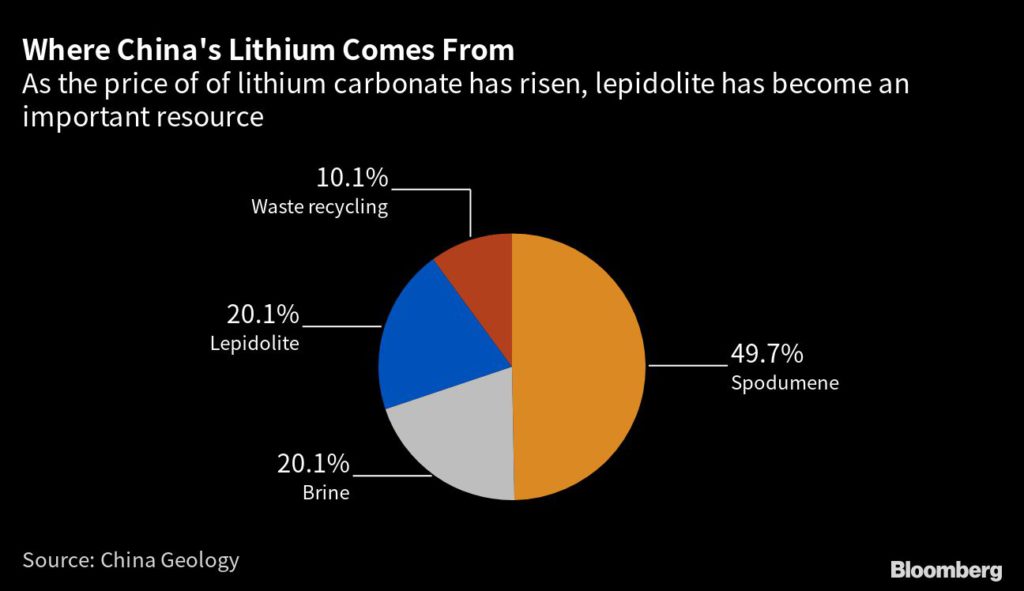

Like many other metals, China is central to the supply chain, housing over half of the world’s refining capacity but relying on imports for about two-thirds of the raw material. According to the US Geological Survey, it accounts for 8% of the world’s reserves, which are mostly held in an igneous rock called spodumene. Saltwater lakes are another key source.

Lithium prices hit an all-time high last year as booming demand for electric vehicles outstripped production. Despite a drop of over 40% from its November peak, lithium carbonate, a refined version of the metal, is still eight times more expensive in China than it was in 2020.

Related Story: “Lithium OPEC” in South America could drive away investment, says Sigma Lithium CEO

It’s the kind of circumstance that often tempts miners to skirt regulations in the pursuit of big rewards. That can deplete reserves too quickly, put the environment at risk and could ultimately rebound on buyers in the autos industry if they run afoul of increasingly stringent ESG rules adopted by investors.

Dirty mining

Some Chinese companies had already been pulled up by the government for infringements, including incidents of pollution, before the February inspection of Yichun. Another issue is so-called high-grading, where miners extract the best material first without worrying about how to conserve a deposit.

“High-grading is always a concern in these unregulated, marginal mines that will unfortunately lead to more rapid exhaustion of the reserve,” said Martin Jackson, head of Battery Raw Materials at CRU Group.

For lepidolite, which accounted for about a fifth of China’s lithium output in 2021, according to the China Geology journal, there are additional costs arising from its low-yield that directly conflict with lithium’s climate-friendly credentials. Yichun’s lepidolite rocks contain less than 1% lithium, according to the journal, which typically makes extraction more energy-intensive and expensive.

Lepidolite is “is a little bit opaque to most of us, but what we see, generally speaking, is very high-cost production,” Paul Graves, the chief executive officer of US producer Livent Corp., told a BMO Capital Markets conference in February.

“I don’t like the word dirty,” he said. “I just can’t think of a better one. A difficult process to do in an environmentally friendly way.”

For every ton of lithium carbonate equivalent processed from lepidolite, 200 tons of waste is produced, according to Benchmark Mineral Intelligence. All that needs treating and disposing of, said Tom Drabble, an ESG analyst at the consultancy.

“Some companies opt to sell the waste, but others have started to collect waste in large tailings ponds,” he said. “Tailings ponds have associated risks, if not managed correctly, of adversely affecting local communities through water pollution via leaching and taking up large areas of land.”

Some of China’s biggest names in batteries, including Contemporary Amperex Technology Co. and Gotion High-Tech Co., have invested in lepidolite mining to lock in supplies. That poses the question of whether they’ll eventually be penalized by investors for using raw materials with a big carbon footprint.

The checks have no impact on CATL and its project in Yichun is progressing as planned, the company told investors in a call on Thursday, according to a filing. CATL operates in strict accordance with local laws and regulations, it said. Gotion didn’t immediately respond to requests for comment.

While it’s too soon to assess the downstream impact, Chinese output that relies on domestic lithium production “is inferior to overseas-sourced, China-processed lithium in several key ESG areas,” Dennis Ip and Leo Ho, analysts at Daiwa Capital Markets, said in an emailed response to questions.

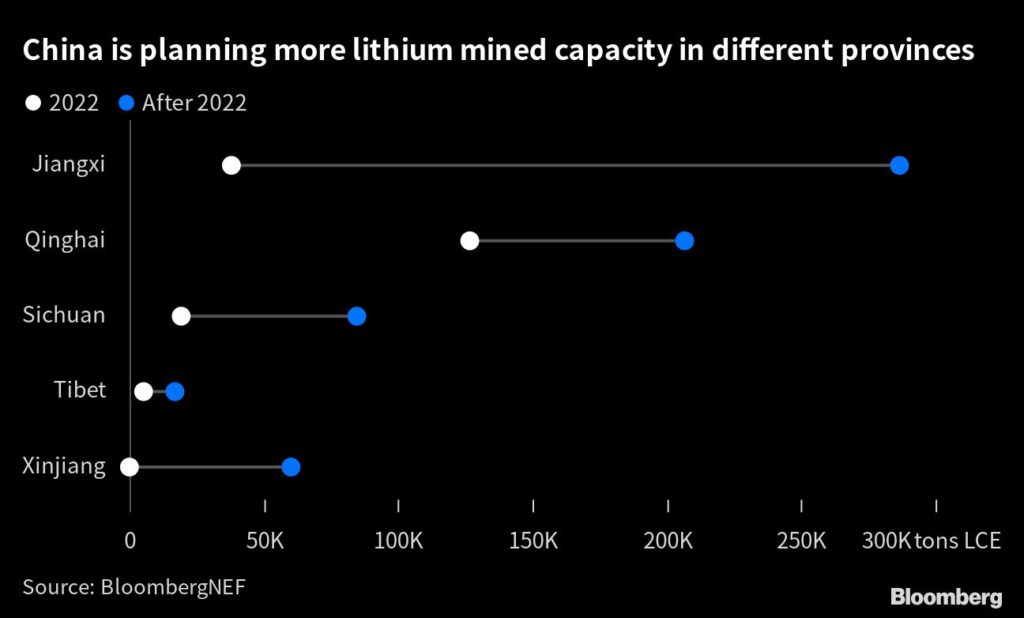

China’s lithium resources are mainly concentrated in Jiangxi, Qinghai, Sichuan and Tibet. It’s started looking in Xinjiang, too, a region that’s drawn scrutiny from US lawmakers amid allegations of forced labor that Beijing has denied. Chinese miners, automakers and battery manufacturers have snapped up resources further afield, from Argentina to Zimbabwe, increasing competition globally for a key resource.

“How to best utilize China’s reserves and how to be more self-sufficient have become more and more important, especially now there’s more geological tension, like between China and the US,” said Matty Zhao, head of Asia-Pacific research on basic materials at Bank of America Corp.

(By Annie Lee, with assistance from Jane Pong, Peng Xu and Martin Ritchie)

Bloomberg News | March 10, 2023

Salt Lake in Qinghai, China. (Image by Bfatphoto, Flickr).

If it’s grown, drilled or dug up, chances are there’s not enough of it in China.

Beijing’s ability to manage the mismatch between its scarce natural resources and vast industrial output is now playing out in the market for lithium, a mineral crucial to the world’s transition away from fossil fuels. It’s an effort complicated by skyrocketing prices, geopolitical tensions and the environmental devastation that can be wrought by a pell-mell approach to extraction.

China is the world’s biggest producer of new energy vehicles but holds only a modest slice of global reserves of lithium, used in the batteries that power electric cars. In that regard, lithium is of apiece with many of the commodities foundational to a modern economy — think crude oil for fuel, iron ore to make steel, or soybeans to feed pigs — where China is overly reliant on foreign supplies for its often world-beating production.

A government inspection last month, which has shuttered some producers at a lithium mining hub in eastern China, is a clear signal that Beijing is turning its attention to better marshaling its domestic resources of the mineral, against a backdrop of record prices and short supply across the globe.

Lithium producers in Jiangxi province’s Yichun city were targeted for environmental infringements and unlicensed mining, according to local media, threatening around a tenth of global output. Of particular concern was the extraction of lepidolite, a lithium-bearing rock often overlooked as lower-quality. The crackdown could signal that even lepidolite is now emerging as a key resource that officials are keen to preserve.

Salt Lake in Qinghai, China. (Image by Bfatphoto, Flickr).

If it’s grown, drilled or dug up, chances are there’s not enough of it in China.

Beijing’s ability to manage the mismatch between its scarce natural resources and vast industrial output is now playing out in the market for lithium, a mineral crucial to the world’s transition away from fossil fuels. It’s an effort complicated by skyrocketing prices, geopolitical tensions and the environmental devastation that can be wrought by a pell-mell approach to extraction.

China is the world’s biggest producer of new energy vehicles but holds only a modest slice of global reserves of lithium, used in the batteries that power electric cars. In that regard, lithium is of apiece with many of the commodities foundational to a modern economy — think crude oil for fuel, iron ore to make steel, or soybeans to feed pigs — where China is overly reliant on foreign supplies for its often world-beating production.

A government inspection last month, which has shuttered some producers at a lithium mining hub in eastern China, is a clear signal that Beijing is turning its attention to better marshaling its domestic resources of the mineral, against a backdrop of record prices and short supply across the globe.

Lithium producers in Jiangxi province’s Yichun city were targeted for environmental infringements and unlicensed mining, according to local media, threatening around a tenth of global output. Of particular concern was the extraction of lepidolite, a lithium-bearing rock often overlooked as lower-quality. The crackdown could signal that even lepidolite is now emerging as a key resource that officials are keen to preserve.

“Due to the mammoth growth of lithium prices over the past two years, there has been an increased interest in capturing and exploring lithium resources within domestic shores,” said Leah Chen, an analyst at S&P Global Commodity Insights.

Like many other metals, China is central to the supply chain, housing over half of the world’s refining capacity but relying on imports for about two-thirds of the raw material. According to the US Geological Survey, it accounts for 8% of the world’s reserves, which are mostly held in an igneous rock called spodumene. Saltwater lakes are another key source.

Lithium prices hit an all-time high last year as booming demand for electric vehicles outstripped production. Despite a drop of over 40% from its November peak, lithium carbonate, a refined version of the metal, is still eight times more expensive in China than it was in 2020.

Related Story: “Lithium OPEC” in South America could drive away investment, says Sigma Lithium CEO

It’s the kind of circumstance that often tempts miners to skirt regulations in the pursuit of big rewards. That can deplete reserves too quickly, put the environment at risk and could ultimately rebound on buyers in the autos industry if they run afoul of increasingly stringent ESG rules adopted by investors.

Dirty mining

Some Chinese companies had already been pulled up by the government for infringements, including incidents of pollution, before the February inspection of Yichun. Another issue is so-called high-grading, where miners extract the best material first without worrying about how to conserve a deposit.

“High-grading is always a concern in these unregulated, marginal mines that will unfortunately lead to more rapid exhaustion of the reserve,” said Martin Jackson, head of Battery Raw Materials at CRU Group.

For lepidolite, which accounted for about a fifth of China’s lithium output in 2021, according to the China Geology journal, there are additional costs arising from its low-yield that directly conflict with lithium’s climate-friendly credentials. Yichun’s lepidolite rocks contain less than 1% lithium, according to the journal, which typically makes extraction more energy-intensive and expensive.

Lepidolite is “is a little bit opaque to most of us, but what we see, generally speaking, is very high-cost production,” Paul Graves, the chief executive officer of US producer Livent Corp., told a BMO Capital Markets conference in February.

“I don’t like the word dirty,” he said. “I just can’t think of a better one. A difficult process to do in an environmentally friendly way.”

For every ton of lithium carbonate equivalent processed from lepidolite, 200 tons of waste is produced, according to Benchmark Mineral Intelligence. All that needs treating and disposing of, said Tom Drabble, an ESG analyst at the consultancy.

“Some companies opt to sell the waste, but others have started to collect waste in large tailings ponds,” he said. “Tailings ponds have associated risks, if not managed correctly, of adversely affecting local communities through water pollution via leaching and taking up large areas of land.”

Some of China’s biggest names in batteries, including Contemporary Amperex Technology Co. and Gotion High-Tech Co., have invested in lepidolite mining to lock in supplies. That poses the question of whether they’ll eventually be penalized by investors for using raw materials with a big carbon footprint.

The checks have no impact on CATL and its project in Yichun is progressing as planned, the company told investors in a call on Thursday, according to a filing. CATL operates in strict accordance with local laws and regulations, it said. Gotion didn’t immediately respond to requests for comment.

While it’s too soon to assess the downstream impact, Chinese output that relies on domestic lithium production “is inferior to overseas-sourced, China-processed lithium in several key ESG areas,” Dennis Ip and Leo Ho, analysts at Daiwa Capital Markets, said in an emailed response to questions.

China’s lithium resources are mainly concentrated in Jiangxi, Qinghai, Sichuan and Tibet. It’s started looking in Xinjiang, too, a region that’s drawn scrutiny from US lawmakers amid allegations of forced labor that Beijing has denied. Chinese miners, automakers and battery manufacturers have snapped up resources further afield, from Argentina to Zimbabwe, increasing competition globally for a key resource.

“How to best utilize China’s reserves and how to be more self-sufficient have become more and more important, especially now there’s more geological tension, like between China and the US,” said Matty Zhao, head of Asia-Pacific research on basic materials at Bank of America Corp.

(By Annie Lee, with assistance from Jane Pong, Peng Xu and Martin Ritchie)

Zimbabwe’s ban on lithium ore exports triggers stockpile buildup

Bloomberg News | March 14, 2023 |

Zimbabwe is one of the top 10 lithium producers but currently produces only a fraction of the worldwide total. (Image courtesy of Prospect Resources | Investor Presentation at Mining Indaba, Feb. 2018. )

Zimbabwe’s ban on lithium ore exports has resulted in stockpiles of the key battery metal building up in the southern African country.

The ban — introduced by the government last December in a bid to encourage local processing of the metal — has resulted in 2 million tons of ore being stockpiled, according to Zimbabwe Miners Federation President Henrietta Rushwaya. Now the industry has asked President Emmerson Mnangagwa to review the ban as it threatens the viability of their operations.

“The unexpected ban has prejudiced standing offtake agreements between miners and international buyers, some of whom had taken loans from their respective countries to trade in these minerals,” Rushwaya said in the letter to Mnangagwa.

The ban has impacted small- and medium-scale miners, but it’s not clear how much lithium is contained in the stockpiled ore.

Most of the lithium from Zimbabwe — which has one of Africa’s largest resources of the metal — is usually shipped to China or South Africa, Rushwaya said by phone. Nations from the US to China are rushing to secure supplies of materials necessary for green-energy transition as the world turns away from fossil fuels.

Chengxin Lithium Group Co. and Sinomine Resource Group Co. are exploring a joint venture to set up a battery metals processing plant in Zimbabwe, while Zhejiang Huayou Cobalt Ltd. has invested $300 million to develop a processing plant at its Arcadia lithium mine.

(By Godfrey Marawanyika, with assistance from Ray Ndlovu)

Bloomberg News | March 14, 2023 |

Zimbabwe is one of the top 10 lithium producers but currently produces only a fraction of the worldwide total. (Image courtesy of Prospect Resources | Investor Presentation at Mining Indaba, Feb. 2018. )

Zimbabwe’s ban on lithium ore exports has resulted in stockpiles of the key battery metal building up in the southern African country.

The ban — introduced by the government last December in a bid to encourage local processing of the metal — has resulted in 2 million tons of ore being stockpiled, according to Zimbabwe Miners Federation President Henrietta Rushwaya. Now the industry has asked President Emmerson Mnangagwa to review the ban as it threatens the viability of their operations.

“The unexpected ban has prejudiced standing offtake agreements between miners and international buyers, some of whom had taken loans from their respective countries to trade in these minerals,” Rushwaya said in the letter to Mnangagwa.

The ban has impacted small- and medium-scale miners, but it’s not clear how much lithium is contained in the stockpiled ore.

Most of the lithium from Zimbabwe — which has one of Africa’s largest resources of the metal — is usually shipped to China or South Africa, Rushwaya said by phone. Nations from the US to China are rushing to secure supplies of materials necessary for green-energy transition as the world turns away from fossil fuels.

Chengxin Lithium Group Co. and Sinomine Resource Group Co. are exploring a joint venture to set up a battery metals processing plant in Zimbabwe, while Zhejiang Huayou Cobalt Ltd. has invested $300 million to develop a processing plant at its Arcadia lithium mine.

(By Godfrey Marawanyika, with assistance from Ray Ndlovu)

Electra produces lithium from battery recycling trial

Staff Writer | March 13, 2023 |

Electra Battery Materials (NASDAQ: ELBM; TSX.V: ELBM) successfully recovered lithium, in its black mass recycling trial, conducted at its refinery north of Toronto.

Lithium is a critical mineral needed for the electric vehicle (EV) battery supply chain. Black mass is the term used to describe the material remaining once expired lithium-ion batteries are shredded and all casings removed.

Black mass contains high-value elements, including lithium, nickel, cobalt, manganese, copper, and graphite, that once recovered, can be recycled to produce new lithium-ion batteries. According to data from McKinsey & Company, available battery material for recycling is expected to grow by 20% per year, through 2040.

Electra launched its black mass demonstration plant at the end of December 2022 and has processed material in a batch mode, successfully extracting lithium, nickel, cobalt, manganese, copper, and graphite. Electra says the recovery and subsequent production of a technical-grade lithium carbonate at the plant validates the company’s proprietary hydrometallurgical process and efforts to date in commissioning the refinery complex.

As a result of preliminary results achieved to date and interest expressed by potential commercial partners, Electra has decided to extend its black mass processing and recovery activities through June 2023, beyond the company’s initial target of 75 tonnes.

“Recovering lithium from black mass represents a potential game changer for Electra and the North American EV supply chain,” said Trent Mell, CEO of Electra. “From Electra’s perspective, it considerably strengthens the economics of our battery recycling strategy by providing another high-value product we can sell,” Mell said.

Staff Writer | March 13, 2023 |

Electra Battery Materials (NASDAQ: ELBM; TSX.V: ELBM) successfully recovered lithium, in its black mass recycling trial, conducted at its refinery north of Toronto.

Lithium is a critical mineral needed for the electric vehicle (EV) battery supply chain. Black mass is the term used to describe the material remaining once expired lithium-ion batteries are shredded and all casings removed.

Black mass contains high-value elements, including lithium, nickel, cobalt, manganese, copper, and graphite, that once recovered, can be recycled to produce new lithium-ion batteries. According to data from McKinsey & Company, available battery material for recycling is expected to grow by 20% per year, through 2040.

Electra launched its black mass demonstration plant at the end of December 2022 and has processed material in a batch mode, successfully extracting lithium, nickel, cobalt, manganese, copper, and graphite. Electra says the recovery and subsequent production of a technical-grade lithium carbonate at the plant validates the company’s proprietary hydrometallurgical process and efforts to date in commissioning the refinery complex.

As a result of preliminary results achieved to date and interest expressed by potential commercial partners, Electra has decided to extend its black mass processing and recovery activities through June 2023, beyond the company’s initial target of 75 tonnes.

“Recovering lithium from black mass represents a potential game changer for Electra and the North American EV supply chain,” said Trent Mell, CEO of Electra. “From Electra’s perspective, it considerably strengthens the economics of our battery recycling strategy by providing another high-value product we can sell,” Mell said.

NOT INDIA'S IT'S KASHMIR'S

India to auction newly found lithium reserve

Reuters | March 13, 2023 |

Indian himalayas. Stock image.

India’s northern federal territory of Jammu and Kashmir will auction a lithium block discovered last month, the country’s mines minister said in parliament on Monday.

“The exploitation of lithium will depend upon successful auction of the mineral block,” minister Pralhad Joshi said, adding the timeline for an auction would be decided by Jammu and Kashmir authorities.

The block, with estimated reserves of 5.9 million tonnes, is the first known lithium reserve in the country.

(By Sakshi Dayal; Editing by Krishna N. Das)

India to auction newly found lithium reserve

Reuters | March 13, 2023 |

Indian himalayas. Stock image.

India’s northern federal territory of Jammu and Kashmir will auction a lithium block discovered last month, the country’s mines minister said in parliament on Monday.

“The exploitation of lithium will depend upon successful auction of the mineral block,” minister Pralhad Joshi said, adding the timeline for an auction would be decided by Jammu and Kashmir authorities.

The block, with estimated reserves of 5.9 million tonnes, is the first known lithium reserve in the country.

(By Sakshi Dayal; Editing by Krishna N. Das)

Iran’s lithium discovery and potential implications to the global battery and electric mobility ecosystem

Jamil Hijazi | March 13, 2023 |

Iran is ranked among 15 major mineral-rich countries with potential reserves worth more than $700 billion. Image: Iran’s Travertine mine. Adobe stock.

While the mining sector has started to pick up in the Arab Gulf states (also referred to as the Gulf cooperation council [GCC]), Iran has introduced measures to expand its mining and metals sector in recent years as part of plans to diversify its economy away from oil revenues.

Around 7% of global mineral reserves can be found in Iran, making it one of the most important mineral producers in the world; possessing major reserves of zinc, copper, salt, coal, iron ore, uranium, lead, gold, bauxite (for aluminium), molybdenum, antimony, sulphur, sand and gravel, and possibly lithium.

Despite its enormous riches, Iran still struggles to operate its mining sector at full capacity. One major cause is a lack of necessary machinery and equipment. To tackle the latter challenge the Iranian government is focusing efforts on supporting an export oriented industry and knowledge-based manufacturers to research and produce new machines as part of areas for development in the extractives sector. Through mining, Iran was able to increase activity generating billions of dollars of hard currency revenues for the country while creating hundreds of thousands of new jobs for its youth.

Ebrahim Ali Molabeigi Iran’s minister of Industry announces “the discovery of the first lithium reserve estimated to be 8.5 million tonnes of lithium carbonate equivalent (LCE) in Hamedan province signalling positive news of the possibility of other reserves in the western Iranian region”.

According to Mohammad-Hadi Ahmadi, the deputy head of the Ministry of Industry, Mining, and Trade Department in Hamedan said “the country will be able to extract lithium from two newly discovered Lithium deposits in the next two years. The deposits cover an area of around 11 square kilometres in Qahavand Plain, located more than 50 kilometres to the east of the provincial capital of Hamedan.

The discovery had taken nearly four years, whereby the Ministry of Industry, Mining, and Trade is currently studying technological capacities existing in two developed countries as part of efforts to start up the mines through a partnership with private investors. The ministry’s authorities expect more lithium ore deposits could be discovered in Hamedan through vast deposits of clay which is a source of Lithium.”

Should the 8.5 million-ton estimate be accurate, it may mean that Iran now holds the second-largest lithium reserve in the world. It will be the largest deposit outside of South America, second only to a 9.2-million-ton deposit in Chile. With global Lithium reserves estimated at 89 million tons, Iran may possibly possess almost one tenth of the world’s Lithium supply.”

Iran’s recent Lithium discovery will shift more attention to mining in the Middle East. Why? Firstly, because the strategic importance of the mineral demanded for most low carbon technologies that contribute to a low carbon future within the global battery and electric mobility ecosystem. Second, the geo-political weight that Iran can use Lithium as natural resource tool to negotiate the uplifting of existing sanctions imposed by the West (United States, European Union and its allies).

Third, Iran can market it’s mineral potential to further attract foreign investment of hard currency into the economy from Lithium exploration. Fourth which holds wider geo-political importance, Iran may leverage Lithium to further enhance its Sino-Relations with China. For example, Iran and Saudi Arabia agreed to restore diplomatic ties under a deal facilitated by China.

China is the largest consumer of lithium due to electronics manufacturing and EV industries, producing more than three-quarters of the world’s lithium-ion batteries and controlling most of the world’s lithium-processing facilities leading the global battery race.

There remains a wider set of geo-political implications that may shift the fate of diplomatic relations between nations. Will the West re-establish negotiations with Iran and lift their sanctions if it means gaining access to Lithium which is demanded for their Battery and EV industries? Does the recent discovery by Iran further raise tensions with its neighbours?

Iran is the first in the Middle East to announce a lithium discovery, will this further push other countries in the region to explore their mining sector potential with a focus on searching for critical minerals and battery metals? Will lithium be the cause of an invasion and political instability in the Middle East? Will new alliances and mineral diplomacy form between countries?

No one can predict how the future will unfold, all implied geo-political questions and statements above present possible scenarios. As the Middle East’s first entrant into lithium, all eyes will be on Iran. Finding lithium in the region indicates that the middle east mining sector may become a new and key player supplying battery metals and critical minerals contributing to the global battery and electric mobility ecosystem.

Jamil Hijazi is a Mineral Economist and reporter who holds a Dual Master’s Degree from the University of Dundee Centre for Energy, Petroleum, Mineral Law, and Policy (CEPMLP). His expertise and research interests are in: Supply Security of Critical Minerals, Energy transition, Industrial Policy, Economics of Mining and Metal Markets

Jamil Hijazi | March 13, 2023 |

Iran is ranked among 15 major mineral-rich countries with potential reserves worth more than $700 billion. Image: Iran’s Travertine mine. Adobe stock.

While the mining sector has started to pick up in the Arab Gulf states (also referred to as the Gulf cooperation council [GCC]), Iran has introduced measures to expand its mining and metals sector in recent years as part of plans to diversify its economy away from oil revenues.

Around 7% of global mineral reserves can be found in Iran, making it one of the most important mineral producers in the world; possessing major reserves of zinc, copper, salt, coal, iron ore, uranium, lead, gold, bauxite (for aluminium), molybdenum, antimony, sulphur, sand and gravel, and possibly lithium.

Despite its enormous riches, Iran still struggles to operate its mining sector at full capacity. One major cause is a lack of necessary machinery and equipment. To tackle the latter challenge the Iranian government is focusing efforts on supporting an export oriented industry and knowledge-based manufacturers to research and produce new machines as part of areas for development in the extractives sector. Through mining, Iran was able to increase activity generating billions of dollars of hard currency revenues for the country while creating hundreds of thousands of new jobs for its youth.

Ebrahim Ali Molabeigi Iran’s minister of Industry announces “the discovery of the first lithium reserve estimated to be 8.5 million tonnes of lithium carbonate equivalent (LCE) in Hamedan province signalling positive news of the possibility of other reserves in the western Iranian region”.

According to Mohammad-Hadi Ahmadi, the deputy head of the Ministry of Industry, Mining, and Trade Department in Hamedan said “the country will be able to extract lithium from two newly discovered Lithium deposits in the next two years. The deposits cover an area of around 11 square kilometres in Qahavand Plain, located more than 50 kilometres to the east of the provincial capital of Hamedan.

The discovery had taken nearly four years, whereby the Ministry of Industry, Mining, and Trade is currently studying technological capacities existing in two developed countries as part of efforts to start up the mines through a partnership with private investors. The ministry’s authorities expect more lithium ore deposits could be discovered in Hamedan through vast deposits of clay which is a source of Lithium.”

Should the 8.5 million-ton estimate be accurate, it may mean that Iran now holds the second-largest lithium reserve in the world. It will be the largest deposit outside of South America, second only to a 9.2-million-ton deposit in Chile. With global Lithium reserves estimated at 89 million tons, Iran may possibly possess almost one tenth of the world’s Lithium supply.”

Iran’s recent Lithium discovery will shift more attention to mining in the Middle East. Why? Firstly, because the strategic importance of the mineral demanded for most low carbon technologies that contribute to a low carbon future within the global battery and electric mobility ecosystem. Second, the geo-political weight that Iran can use Lithium as natural resource tool to negotiate the uplifting of existing sanctions imposed by the West (United States, European Union and its allies).

Third, Iran can market it’s mineral potential to further attract foreign investment of hard currency into the economy from Lithium exploration. Fourth which holds wider geo-political importance, Iran may leverage Lithium to further enhance its Sino-Relations with China. For example, Iran and Saudi Arabia agreed to restore diplomatic ties under a deal facilitated by China.

China is the largest consumer of lithium due to electronics manufacturing and EV industries, producing more than three-quarters of the world’s lithium-ion batteries and controlling most of the world’s lithium-processing facilities leading the global battery race.

There remains a wider set of geo-political implications that may shift the fate of diplomatic relations between nations. Will the West re-establish negotiations with Iran and lift their sanctions if it means gaining access to Lithium which is demanded for their Battery and EV industries? Does the recent discovery by Iran further raise tensions with its neighbours?

Iran is the first in the Middle East to announce a lithium discovery, will this further push other countries in the region to explore their mining sector potential with a focus on searching for critical minerals and battery metals? Will lithium be the cause of an invasion and political instability in the Middle East? Will new alliances and mineral diplomacy form between countries?

No one can predict how the future will unfold, all implied geo-political questions and statements above present possible scenarios. As the Middle East’s first entrant into lithium, all eyes will be on Iran. Finding lithium in the region indicates that the middle east mining sector may become a new and key player supplying battery metals and critical minerals contributing to the global battery and electric mobility ecosystem.

Jamil Hijazi is a Mineral Economist and reporter who holds a Dual Master’s Degree from the University of Dundee Centre for Energy, Petroleum, Mineral Law, and Policy (CEPMLP). His expertise and research interests are in: Supply Security of Critical Minerals, Energy transition, Industrial Policy, Economics of Mining and Metal Markets

Piedmont, Atlantic to seek legal advice against short-seller’s claims

Reuters | March 9, 2023 |

Atlantic Lithium has projects in Ghana and Côte d’Ivore. (Image courtesy of Atlantic Lithium.)

Piedmont Lithium Inc said on Thursday that the company and Atlantic Lithium Ltd will seek legal advice to address the claims made by short-seller Blue Orca Capital.

Blue Orca alleged in a report on Wednesday that the mining licences obtained by Atlantic in Ghana were through what appeared to be “textbook corruption”.

In 2021, Piedmont invested $100 million in Atlantic to secure spodumene – high-purity lithium ore – from Atlantic’s mine in Ghana. Piedmont has a spodumene supply agreement with electric-vehicle maker Tesla Inc.

Shares of Piedmont fell 1.6% to $58.58 in morning trade.

Piedmont has the right to buy half of Atlantic’s production at market prices on a life-of-mine basis, and to earn a 50% interest in the Ghanaian projects.

Blue Orca said in its report that Atlantic obtained key Ghana mining licenses by making secret payments and promises of payments to the immediate family of a high-level politician in Ghana. Reuters could not immediately verify Blue Orca’s allegation.

The short-seller also said it does not believe that authorities in Ghana will ratify Atlantic’s mining licenses, based on precedents in the country and around Africa.

Atlantic in a statement refuted the allegations made by Blue Orca.

Piedmont is planning to use spodumene concentrate from Atlantic as partial feed for its proposed Tennessee Lithium hydroxide plant.

The company, however, said that if for any reason it does not exercise its right to the offtake supply, Piedmont “is confident that alternative sources of spodumene concentrate would be available to feed the Tennessee facility.”

(By Arunima Kumar; Editing by Devika Syamnath)

Reuters | March 9, 2023 |

Atlantic Lithium has projects in Ghana and Côte d’Ivore. (Image courtesy of Atlantic Lithium.)

Piedmont Lithium Inc said on Thursday that the company and Atlantic Lithium Ltd will seek legal advice to address the claims made by short-seller Blue Orca Capital.

Blue Orca alleged in a report on Wednesday that the mining licences obtained by Atlantic in Ghana were through what appeared to be “textbook corruption”.

In 2021, Piedmont invested $100 million in Atlantic to secure spodumene – high-purity lithium ore – from Atlantic’s mine in Ghana. Piedmont has a spodumene supply agreement with electric-vehicle maker Tesla Inc.

Shares of Piedmont fell 1.6% to $58.58 in morning trade.

Piedmont has the right to buy half of Atlantic’s production at market prices on a life-of-mine basis, and to earn a 50% interest in the Ghanaian projects.

Blue Orca said in its report that Atlantic obtained key Ghana mining licenses by making secret payments and promises of payments to the immediate family of a high-level politician in Ghana. Reuters could not immediately verify Blue Orca’s allegation.

The short-seller also said it does not believe that authorities in Ghana will ratify Atlantic’s mining licenses, based on precedents in the country and around Africa.

Atlantic in a statement refuted the allegations made by Blue Orca.

Piedmont is planning to use spodumene concentrate from Atlantic as partial feed for its proposed Tennessee Lithium hydroxide plant.

The company, however, said that if for any reason it does not exercise its right to the offtake supply, Piedmont “is confident that alternative sources of spodumene concentrate would be available to feed the Tennessee facility.”

(By Arunima Kumar; Editing by Devika Syamnath)

No comments:

Post a Comment