Ominous Oceans: Shadow Tankers Endanger Global Waters

- A shadow fleet of oil tankers from sanctioned countries like Iran, Russia, and Venezuela raises safety and environmental concerns.

- Reduced oversight and aging vessels contribute to increased accident risk.

- At least eight accidents or near misses involving these tankers were recorded in 2022.

A growing number of oil tankers, part of an unofficial "shadow" fleet, are transporting oil from countries impacted by Western sanctions. These tankers, moving oil from Iran, Russia, and Venezuela, have raised concerns about increased accidents and potential environmental damage, according to an analysis by Reuters based on ship tracking, accident data, and interviews with over a dozen industry experts.

The number of ships participating in this parallel trade has surged in recent years due to a rise in Iranian oil exports and restrictions on Russian energy sales caused by the ongoing conflict in Ukraine. Eric Hanell, CEO of Stena Bulk, a tanker operator, said, "The risk of having an accident is definitely going up."

Major certification providers, engine manufacturers, and insurers have withdrawn their services from these tankers, reducing vessel safety and seaworthiness oversight. This has alarmed some industry insiders, who worry that this clandestine trade may undermine decades of efforts to improve shipping safety following disasters like the 1989 Exxon Valdez spill in Alaska.

According to the analysis, there were at least eight accidents, near misses, or groundings involving tankers carrying sanctioned crude or oil products in 2022, the same as the previous three years combined. These incidents accounted for a small fraction of the 61 total accidents recorded in the shipping industry last year.

Jan Dieleman, president of Cargill's ocean transportation division, expressed concern over the lack of oversight and maintenance on these vessels, saying, "We do not have visibility on maintenance and safety as no one is really boarding the ships and doing checks - that is missing."

Estimates of the size of the shadow fleet range from over 400 to more than 600 ships, or about one-fifth of the global crude oil tanker fleet. Andrea Olivi, head of wet freight at commodity trader Trafigura, said their data showed around 650 units currently in operation.

The U.S. Treasury and State Department did not immediately respond to requests for comment.

Among the eight incidents reported in 2022, the Linda I tanker was detained in southern Spain carrying Russian oil. The Spanish Merchant Fleet authority confirmed the incident, citing deficiencies and a series of faults with the vessel's navigation system.

In eastern China, the Arzoyi tanker, which analysis from advocacy group United Against Nuclear Iran (UANI) showed was carrying Iranian oil, ran aground, causing a minor oil spill. Off the coast of Cuba, the Petion tanker, transporting Venezuelan crude, was involved in a collision with another tanker.

According to data provider VesselsValue, 774 of the 2,296 tankers in the global crude oil fleet are 15 years old or older. While the exact number of older vessels in the shadow fleet is unknown, they are generally believed to be less safe and well-maintained.

Industry participants also expressed concerns about ship-to-ship (STS) transfers involving these tankers, which pose significant safety and environmental risks.

Trafigura's Olivi said, "The risk of a major pollution incident is very high."

The New ‘Wild West’ In Oil Shipping

- Reuters: the shadow fleet at present entails between 400-600 vessels worldwide, which is around 20% of the total tanker fleet globally.

- Demand for shipping of Russian energy products has led to a major surge in the use of older tankers.

- Vortexa: Greek ships dominate the transportation of Russian crude oil.

The Russian invasion of Ukraine has not only led to an increase in the shipment of sanctioned crude oil and petroleum products by a shadow fleet, but it is also escalating overall maritime security risks.

A report by consultancy Vortexa indicates a renewed increase in Greek-owned vessels transporting sanctioned Russian crudes and products. Simultaneously, tanker experts are warning of a Wild West situation in maritime traffic, as a shadow fleet of uninsured tankers is sailing in international waters. Reuters reports that maritime security is under threat, as uninsured or shadow vessels are running aground or experiencing near collisions worldwide.

At present, an oil tanker has run aground offshore eastern China, while a collision between tankers has been averted near Cuba. Reuters analysis shows that a shadow fleet of hundreds of extra ships is sailing the seas, partly already linked to the opaque Iranian oil exports but now being supported by the demand for Russian energy shipping.

Statements made to Reuters by Eric Hanell, CEO of tanker operator Stena Bulk, indicate that “the risk of having an accident is definitely going up.” The risks of collisions by unreliable vessels due to a lack of certification or engine maintenance have increased as leading insurers and services companies are no longer wanting to work with ships carrying crude oil and petroleum products coming from Russia, Iran, and Venezuela. Reuters analysis based on ship-tracking information and Lloyd’s List Intelligence data on vessel incidents shows that eight groundings, collisions, or near misses involving tankers carrying sanctioned products were reported in 2022, which is the same as the whole period of 1999-2021.

According to Reuters, the shadow fleet at present entails between 400-600 vessels worldwide, which is around 20% of the total tanker fleet globally. Trafigura's Andrea Olivi, head of wet freight, even states that, according to them, it is now at 650 units. The main risks at present are related to ship-to-ship transfers, which are widely used by the shadow fleet at present. Claire Jungman of US advocacy group United Against Nuclear Iran (UANI) reports that Iran's shadow fleet has increased from 70 in November 2022 to 300 vessels right now. The latter could be correct, considering Iran's increased oil exports in recent months. Vessel data provider VesselsValue indicated that 774 tankers out of 2,296 worldwide are 15 years or older.

According to a report by independent consultancy Vortexa, Greek ships dominate the transportation of Russian crude oil. Vortexa suggests that Greek ship owners have taken advantage of the ban on Russian oil exports, which came into effect on December 5, 2022. Although the current practice is not illegal, tanker owners can transport Russian crude oil if they agree to a price cap. Greek owners reduced their involvement in the wake of the December 5 ban, but their participation has almost returned to pre-ban level

However, pressure is mounting on Greek owners, as Ukraine is openly pressuring well-known Greek shipping companies like TMS Tankers, Dynacom Tankers, Minerva Marine, Thenamaris, and Delta Tankers. These companies have even been added to the War and Sanctions website created by the Ukrainian government. On Monday, S&P Global Market Intelligence identified 1,900 vessels at risk of Russian sanctions, with the majority being Greek-owned. Since 2023, over 150 of these high-risk vessels have made port calls in Russia, the majority of which are also Greek-owned. Furthermore, Greek vessels are overwhelmingly involved in Ship-to-Ship operations in the Peloponnese region.

By Cyril Widdershoven for Oilprice.com

Little-Known Traders Now Rule Russian Oil Markets

- Six little-known companies based in Hong Kong and Dubai now dominate Russian oil trade.

- Nord Axis, a company that was incorporated just a year ago in Hong Kong, emerged as the biggest buyer, moving 521,000 barrels of Russian crude per day.

- Energy Intelligence: Russia’s crude and condensate production increased 2%, with oil production clocking in at 10.73 million b/d.

Historically, giant commodity traders such as Switzerland's Vitol, Glencore, and Gunvor as well as Singapore’s Trafigura have dominated the global oil trade while smaller trading desks that lack the wherewithal and deep infrastructure networks of the giants usually feed on crumbs. The same case applied to the Russian market before Russia invaded Ukraine, with Trafigura moving ~850,000 barrels of Russian crude per day at its peak. But the oil hegemony has now been severely disrupted thanks to Russia’s war. Bloomberg has reported that six little-known companies based in Hong Kong and Dubai now dominate Russian oil trade with the traditional leaders no longer in the picture.

According to Bloomberg, Russian customs data for the final four weeks of 2022 shows that Nord Axis Ltd, Tejarinaft FZCO,QR Trading DMCC, Concept Oil Services Ltd, Bellatrix Energy Ltd and Coral Energy DMCC together handled about 1.4 million barrels a day of Russian crude oil. That’s more oil than what the commodity giants typically handled before the war in Ukraine, and enough to meet the entire needs of countries such as the UK and Italy.

Interestingly it’s Nord Axis, a company that was incorporated just a year ago in Hong Kong, that emerged as the biggest buyer, moving 521,000 barrels of Russian crude per day. Nord Axis was virtually unknown in the oil market until it bought Trafigura’s stake in Rosneft’s flagship oil project Vostok Oil in July. Dubai-based Tejarinaft FZCO was the second largest buyer after it purchased 244,000 barrels a day from Rosneft while Dubai-based QR Trading DMCC was the third-largest buyer, moving 199,000 barrels a day from Surgutneftegas PJSC. Other top buyers were Hong Kong’s Concept Oil Services Ltd (152,000 b/d), Hong Kong-based Bellatrix Energy Ltd (151,000 b/d) and Dubai’s Coral Energy DMCC (121,000 b/d).

Source: Bloomberg

It’s not clear how these traders were able to finance the large flows of Russian oil, with Bloomberg estimating it was worth more $2 billion over the month of December.

Even more perplexing is the fact that Nord Axis, QR Trading DMCC and Bellatrix Energy Ltd were unknown entities before the west abandoned the Russian energy markets. Bloomberg has established that Bellatrix received loan facilities from Russian banks including Rosneft-owned Russian Regional Development Bank and Russian Agricultural Bank, though calls or emails to these traders, their banks and Russian oil producers have gone unanswered.

“Knowing who the big names are is an important step in understanding how oil markets are responding to the price cap and wider sanctions,” Steve Cicala, co-director of the Project on the Economic Analysis of Regulation at the National Bureau of Economic Research, has told Bloomberg.

Meanwhile, other experts have decried the opacity of Russian oil markets, “We’re coming to this with a lot of humility and we’re just asking that everyone else can adopt the same level of uncertainty. These are really opaque markets, the data’s not great on it. Let’s just acknowledge that from the outset when we’re making conclusions,” U.S. Assistant Treasury Secretary Ben Harris has told Bloomberg.

Russian Oil Flows Holding Up, But Not Forever

Last year, against all odds, Russia managed to grow its oil output despite being hit with tough sanctions, a plethora of oilfield service companies exiting the country as well as the refusal by western countries to buy its crude for the most part.

Indeed, Energy Intelligence reports that in 2022, Russia’s crude and condensate production increased 2%, with oil production clocking in at 10.73 million b/d, above Russia's ministry for economic development forecast of 10.33 million b/d.

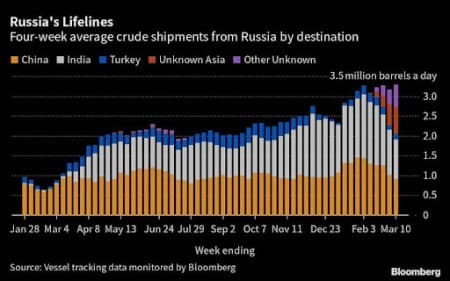

Russia managed to pull off this feat mainly by offering huge discounts to buyers like China and India, with Bloomberg's oil strategist Julian Lee reporting that the two were receiving discounts of $33.28 per barrel, or about 40% to international Brent crude prices oil at the time.

But Moscow cannot continue defying the odds indefinitely. BP Plc (NYSE: BP) has predicted that the country’s output is likely to take a big hit over the long-term, with production declining 25%-42% by 2035. BP says that Russia's oil output could decrease from 12 million barrels per day in 2019 to 7-9 million bpd in 2035 thanks to the curtailment of new promising projects, limited access to foreign technologies as well as a high rate of reduction in existing operating assets.

In contrast, BP says that OPEC will become even more dominant as the years roll on, with the cartel’s share in global production increasing to 45%-65% by 2050 from just over 30% currently. Bad news for the bulls: BP remains bearish about the long-term prospects for oil, saying demand for oil is likely to plateau over the next 10 years and then decline to 70-80 million bpd by 2050.

That said, Russia might still be able to avoid a sharp decline in production because many of the assets of oil companies that exited the country were abandoned or sold to local management teams who retained critical expertise.

By Alex Kimani for Oilprice.com

No comments:

Post a Comment