Bloomberg News | March 7, 2023 |

Stock image.

As automakers seek stakes in lithium miners to lock in supplies for electric-vehicle batteries, they’re following a path already forged by their shareholders.

Take Tesla Inc., which is reportedly interested in buying Toronto-listed Sigma Lithium Corp. If Tesla succeeds, it would follow prominent funds including Manulife Financial Corp., 1832 Asset Management, Maven Securities, DZ Bank and several others that have been snapping up Sigma shares, even as they cut exposure to the electric-vehicle maker.

It’s not hard to see the attraction. Policymakers and governments around the globe have ratcheted up calls to move toward cleaner transportation and poured billions into developing EV infrastructure, which has caused the price of lithium — used in the batteries that power electric cars, buses and trucks — to skyrocket. In fact, lithium has been the top performing commodity in the past two years.

“Lithium offers investors an opportunity to get an exposure to the EV expansion at much lower valuations, and without ancillary exposure to a CEO selling billions of dollars in stock,” said Will McDonough, the chief executive officer of EMG Advisors, which runs the Element EV & Solar Battery Materials Futures ETF (ticker: CHRG) that invests in the futures of lithium, cobalt, copper, and nickel.

“The underlying technology of all EV batteries requires lithium,” he said. “There is yet to be a prominent player that does not require lithium as the cornerstone metal.”

General Motors Co. sent Lithium Americas Corp. shares flying when it became the Canadian headquartered miner’s largest investor, which helped the company break ground on a new mine this week. Other car makers stalk mining conferences in an effort to secure supply.

“You’re only as strong as the weak point in your supply chain, which is lithium,” Sprott Asset Management CEO John Ciampaglia said in an interview, adding that a supply crunch has led investors playing the electric vehicle transition to move their capital upstream, buying up undervalued lithium producers. Sprott launched a lithium miners ETF in February in an effort to capitalize on investor interest.

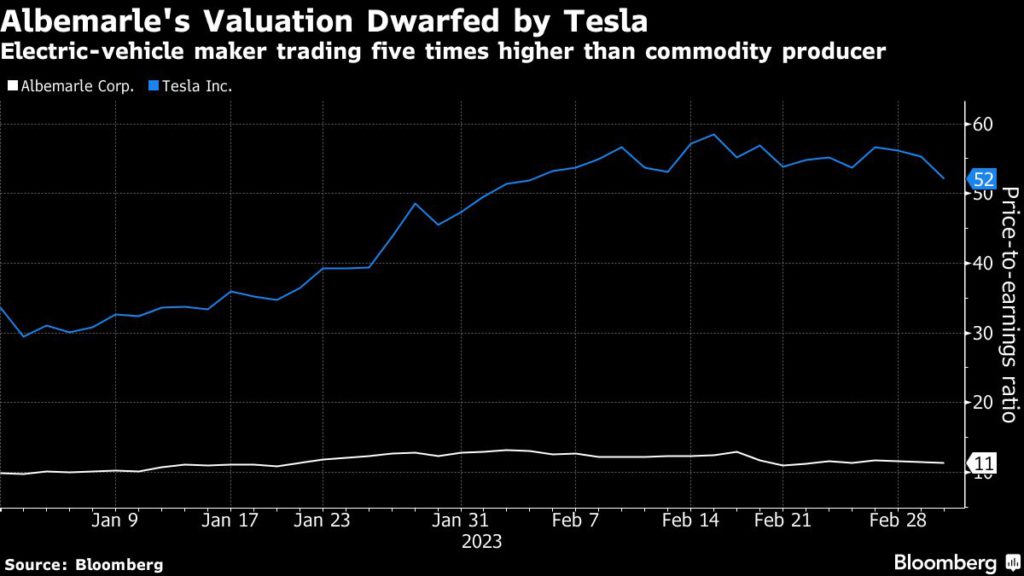

Despite the surging price of the metal, the stock prices don’t necessarily reflect the booming demand. Albemarle Corp. — the largest producer of the metal — has seen sales and income surge. Still, the stock trades at a roughly 11-times price to earnings multiple — below the 14.8-times multiple of the S&P 500 Materials Index and just a fraction of Tesla’s 56-times multiple.

In addition to their cheap valuations, fund managers and analysts see a catalyst for the stocks as new buyers for the equities emerge, including US auto giants. “These are probably not the last deals that we’re going to see in the space,” Pedro Palandrani, head of research for Global X ETFs, said in an interview, referring to carmakers buying lithium-mining stocks.

Palandrani anticipates that more auto companies will take stakes in miners because the market for lithium is expected to quintuple to 3.7 million metric tons per year over the next decade from the current 800,000 metric tons.

“Lithium miners have margins of a software as a service company,” Palandrani said, adding that EV investors are taking notice as the outlook for most EV-making startups flounder, and the legacy carmakers’ gas-fueled auto businesses make the opportunity from battery-driven cars murky.

Even so, investing in early-stage mining companies is fraught with a different type of risk than car manufacturers — and their shareholders — generally face, including the potential that a proposed mine doesn’t produce at the expected rate or mineral grade. Goldman Sachs Group Inc.’s commodities research head, Jeff Currie, recently warned carmakers against buying lithium miners by saying “it always ends in tears” when commodity consumers move upstream.

Still, investors and car makers continue to bet on lithium miners, wagering that a shift toward EVs will become a permanent trend that will boost demand for the metal. “Lithium is today the common denominator across all battery technology and it’s likely going to stay that way for the next 10 to 15 years,” Global X’s Palandrani said, adding that he expects lithium producers to outperform.

(By Geoffrey Morgan and Esha Dey)

Battery metals projects catch eye of pension funds and carmakers

Bloomberg News | March 6, 2023 |

Critical minerals projects are attracting newfound interest from pension funds and automakers to help tackle a looming shortage of battery metals, say some of Canada’s top investment bankers.

The rush for metals like lithium, copper and nickel needed to power electric vehicles has “clearly brought the sector into a spotlight that it wasn’t in a few years ago,” Ilan Bahar, global mining co-head at BMO Capital Markets, said during a Monday panel discussion at a mining conference in Toronto.

Bank of Montreal’s investment banking business has seen more interest from the auto industry wanting to buy stakes in miners as the US Inflation Reduction Act encourages manufacturers to source material on North American soil, according to Bahar.

Governments worldwide pushing for EVs “really, really quickly” to meet emissions targets are discovering supply constraints for key metals, Bahar said. “What everybody quickly realized is, one, that the supply is not fully available here, and two, that it’s controlled by a certain country that has a 15-year head start.”

Governments and companies around the world have been pushing to accelerate a shift from fossil fuels into cleaner energy sources, with battery metals like lithium, cobalt and nickel underpinning the transition. The issue has gained more urgency in recent months due to rising competition among automakers for the metals and wild swings in raw material costs.

Pension funds are starting to consider investing in the battery metals industry, though some have expressed concerns tied to environmental, social and governance issues and bureaucracy, said Navdeep Bains, vice-chair of global investment banking at Canadian Imperial Bank of Commerce.

“I’ve talked to pension funds, and they’ve been like: ‘We’ll invest in this space, we’ve heard of the OEMs investing directly, but we have to see Indigenous issues resolved and permitting issues resolved’,” Bains said.

BMO’s Bahar said the sector will need more outside investment to meet future demand.

“We need a certain amount of supply that doesn’t yet exist, and we need investment beyond the amount of dollars in institutional investment funds,” he said.

(By Jacob Lorinc)

Shortage of metals for EVs is rising up the agenda in automakers’ C-suites

Bloomberg News | March 5, 2023 |

Credit: BMO Metals and Mining

The merry-go-round of private meetings at an annual mining industry conference at Florida’s Hollywood Beach had a cast of new faces this year: auto sector executives increasingly anxious about surging prices and tighter supply of metals used in electric vehicle batteries.

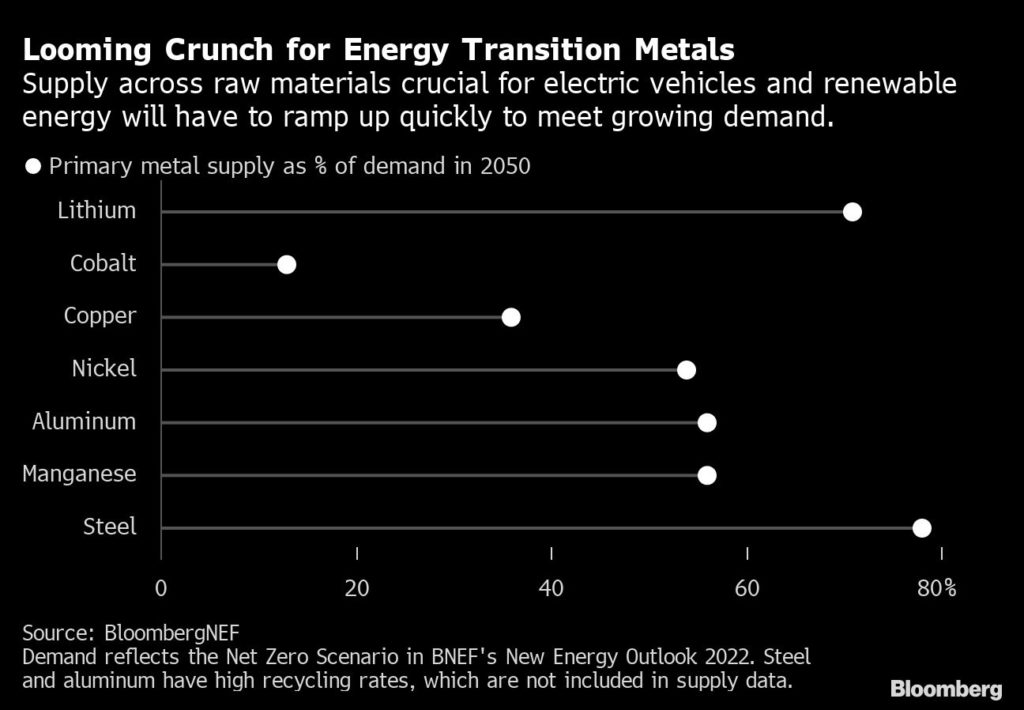

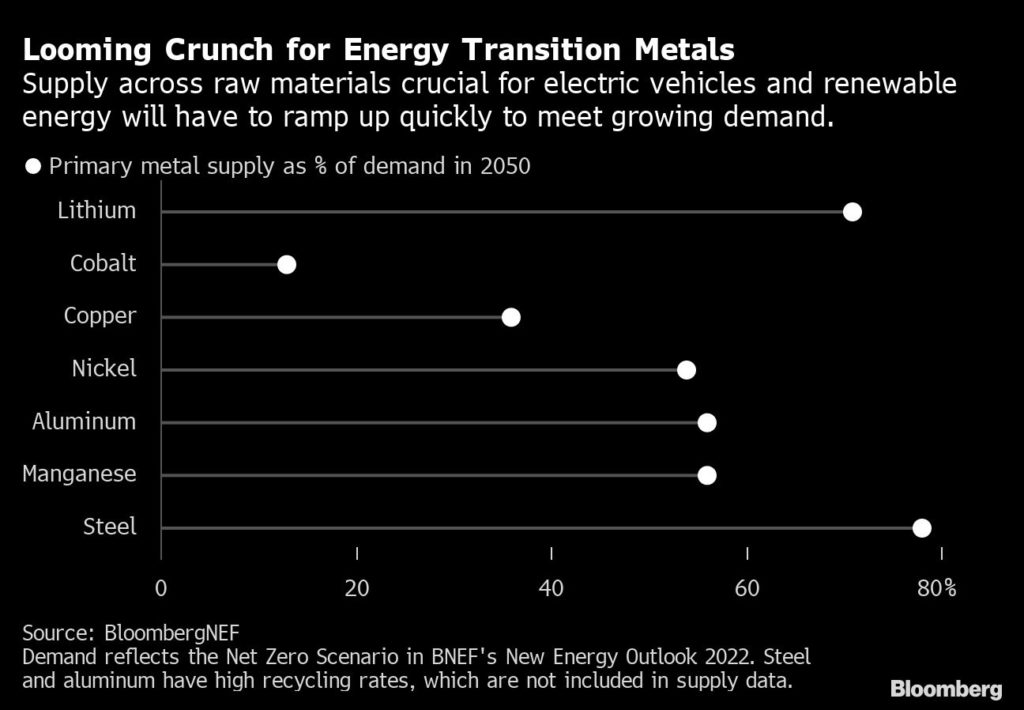

Tesla Inc., Ford Motor Co. and Mercedes-Benz Group AG were among automakers which sent senior staff to mingle with about 1,500 delegates at the BMO Global Metals & Mining Conference, an event normally attended mainly by iron ore and aluminum producers. Their presence underscores the growing popularity of battery-powered cars, helped by a global push toward clean energy, which is estimated to require $10 trillion worth of metals through 2050, according to BloombergNEF.

Car producers “had room-to-room meetings with a lot of companies, like ourselves, trying to understand how to address their own supply chain,” said Trent Mell, an attendee and chief executive officer of Electra Battery Materials Corp., a Toronto-based developer of mining and refining projects. Auto companies have recently expanded their teams and are now filling rooms with specialists in metals like lithium — the metal that’s ubiquitous in electric car batteries — and manganese, or in battery recycling, he said. “Once you might have had one or two people dealing with raw materials procurement.”

Availability and costs of crucial battery materials like lithium, cobalt and nickel have been key concerns for years among EV makers trying to build out their electric lineups. The issue has gained more urgency in recent months due to rising competition to strike supply pacts with miners and project developers and by wild swings in raw material costs. The spot value of lithium consumption alone surged to about $35 billion in 2022, from $3 billion in 2020, according to Bloomberg calculations.

Lithium “was a meaningful source of cost increase,” for Tesla in the final quarter of 2022, CFO Zachary Kirkhorn said in January. While a key lithium benchmark has tumbled almost a third this year, prices remain 590% higher than at the start of 2021.

Volvo Car AB, Nio Inc. and Jeep-maker Stellantis NV have also said they’re being affected by the impact of higher raw material prices, and some are looking for new deals with suppliers to tie-up potential sources of metals. Like others, EV maker Rivian Automotive Inc. is spending a lot of time examining potential new deal structures with suppliers, and this “could involve ownership positions” in mining assets, CEO RJ Scaringe said on a Feb. 28 earnings call.

General Motors Co. last year struck a prepayment deal for lithium, while Ford Motor Co. offered a loan to help fund a mine project.

“Investing in these raw materials provides a way for automakers to control margins along the supply chain and ensure they remain competitive,” said Andrew Miller, chief operating officer at Benchmark Mineral Intelligence, an industry data provider. “Raw materials are now the largest cost driver for a battery.”

Automakers are also getting involved in the development of new mining projects.

GM added a $650 million stake in Lithium Americas Corp. to help deliver a mine in Nevada, and has considered buying an interest in Brazilian giant Vale SA’s base metals unit. Tesla, which is constructing a metal refinery in Corpus Cristi, Texas, has studied a takeover of miner Sigma Lithium Corp. The world’s No. 2 miner Rio Tinto Group is hunting for lithium deals, but expects to be outbid by car producers, CEO Jakob Stausholm said last month.

Car manufacturers are also putting more senior managers, rather than junior procurement executives, in charge of discussions over metals, according to Kent Masters, CEO of Charlotte, North Carolina-based Albemarle Corp., one of the world’s top lithium suppliers.

“It’s obviously become a more critical issue for OEMs,” Masters told the Florida conference, organized by Bank of Montreal. “We’ve been able to change the level at which we interact with those customers, and they’re investing significant amounts of money in electric vehicles.”

Volkswagen AG has pledged to boost cooperation with Canada’s mining sector, formed a joint venture with Belgium-based materials supplier Umicore SA and has a deal with would-be lithium supplier Vulcan Energy Resources Ltd. which aims to develop an operation in Germany.

VW is “sounding out the market” and is in talks with “many potential partners” on strategic raw materials, according to a spokesperson. “Various instruments are possible, from long-term agreements to streaming deals and equity investments,” the person said. Hedging of commodities prices is likely an important tool to cope with rising raw material costs, according to the group’s CFO Arno Antlitz.

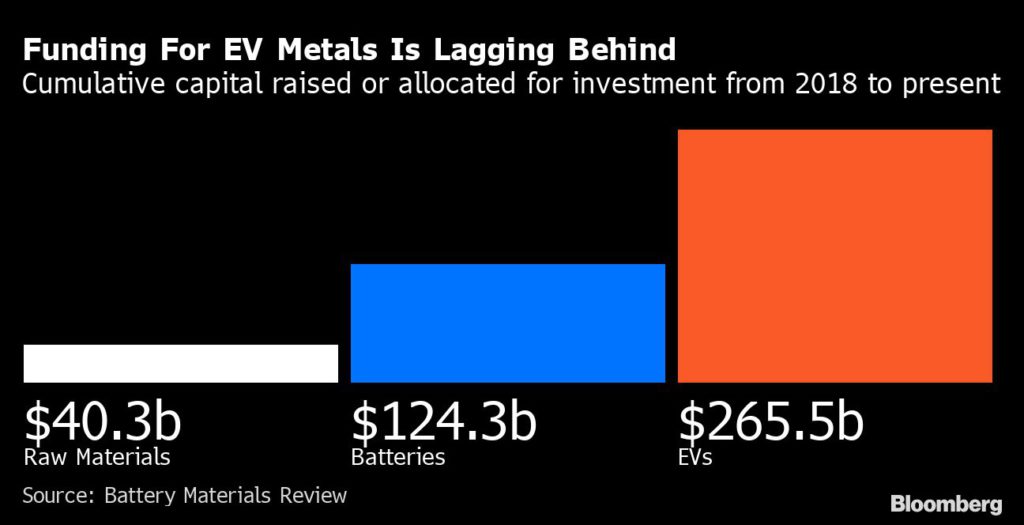

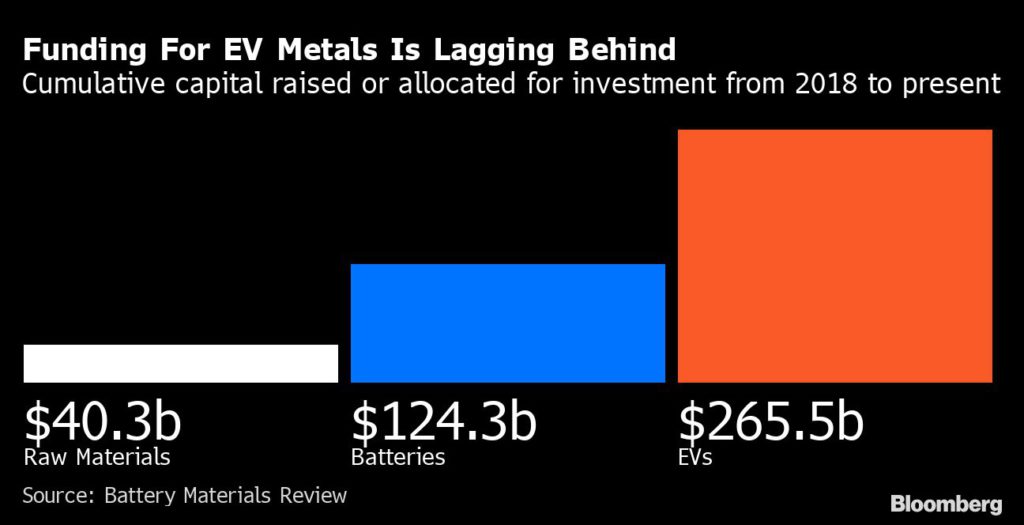

About $265.5 billion has been invested in developing EVs since 2018 but only $40 billion on raw materials, according to Battery Materials Review, which tracks investment in the sector.

Even so, some said moves by car manufacturers to buy directly into metals could be doomed by their lack of expertise in mining and dismal record on acquisitions, according to Jeff Currie, Goldman Sachs Group Inc.’s head of commodities.

“It always ends in tears,” he told Bloomberg Radio. “It requires an expertise that is very different than producing cars.”

(By Danny Lee, David Stringer and Jacob Lorinc, with assistance from Yvonne Yue Li, Monica Raymunt, Annie Lee, Mark Burton and Keith Naughton)

Bloomberg News | March 5, 2023 |

Credit: BMO Metals and Mining

The merry-go-round of private meetings at an annual mining industry conference at Florida’s Hollywood Beach had a cast of new faces this year: auto sector executives increasingly anxious about surging prices and tighter supply of metals used in electric vehicle batteries.

Tesla Inc., Ford Motor Co. and Mercedes-Benz Group AG were among automakers which sent senior staff to mingle with about 1,500 delegates at the BMO Global Metals & Mining Conference, an event normally attended mainly by iron ore and aluminum producers. Their presence underscores the growing popularity of battery-powered cars, helped by a global push toward clean energy, which is estimated to require $10 trillion worth of metals through 2050, according to BloombergNEF.

Car producers “had room-to-room meetings with a lot of companies, like ourselves, trying to understand how to address their own supply chain,” said Trent Mell, an attendee and chief executive officer of Electra Battery Materials Corp., a Toronto-based developer of mining and refining projects. Auto companies have recently expanded their teams and are now filling rooms with specialists in metals like lithium — the metal that’s ubiquitous in electric car batteries — and manganese, or in battery recycling, he said. “Once you might have had one or two people dealing with raw materials procurement.”

Availability and costs of crucial battery materials like lithium, cobalt and nickel have been key concerns for years among EV makers trying to build out their electric lineups. The issue has gained more urgency in recent months due to rising competition to strike supply pacts with miners and project developers and by wild swings in raw material costs. The spot value of lithium consumption alone surged to about $35 billion in 2022, from $3 billion in 2020, according to Bloomberg calculations.

Lithium “was a meaningful source of cost increase,” for Tesla in the final quarter of 2022, CFO Zachary Kirkhorn said in January. While a key lithium benchmark has tumbled almost a third this year, prices remain 590% higher than at the start of 2021.

Volvo Car AB, Nio Inc. and Jeep-maker Stellantis NV have also said they’re being affected by the impact of higher raw material prices, and some are looking for new deals with suppliers to tie-up potential sources of metals. Like others, EV maker Rivian Automotive Inc. is spending a lot of time examining potential new deal structures with suppliers, and this “could involve ownership positions” in mining assets, CEO RJ Scaringe said on a Feb. 28 earnings call.

General Motors Co. last year struck a prepayment deal for lithium, while Ford Motor Co. offered a loan to help fund a mine project.

“Investing in these raw materials provides a way for automakers to control margins along the supply chain and ensure they remain competitive,” said Andrew Miller, chief operating officer at Benchmark Mineral Intelligence, an industry data provider. “Raw materials are now the largest cost driver for a battery.”

Automakers are also getting involved in the development of new mining projects.

GM added a $650 million stake in Lithium Americas Corp. to help deliver a mine in Nevada, and has considered buying an interest in Brazilian giant Vale SA’s base metals unit. Tesla, which is constructing a metal refinery in Corpus Cristi, Texas, has studied a takeover of miner Sigma Lithium Corp. The world’s No. 2 miner Rio Tinto Group is hunting for lithium deals, but expects to be outbid by car producers, CEO Jakob Stausholm said last month.

Car manufacturers are also putting more senior managers, rather than junior procurement executives, in charge of discussions over metals, according to Kent Masters, CEO of Charlotte, North Carolina-based Albemarle Corp., one of the world’s top lithium suppliers.

“It’s obviously become a more critical issue for OEMs,” Masters told the Florida conference, organized by Bank of Montreal. “We’ve been able to change the level at which we interact with those customers, and they’re investing significant amounts of money in electric vehicles.”

Volkswagen AG has pledged to boost cooperation with Canada’s mining sector, formed a joint venture with Belgium-based materials supplier Umicore SA and has a deal with would-be lithium supplier Vulcan Energy Resources Ltd. which aims to develop an operation in Germany.

VW is “sounding out the market” and is in talks with “many potential partners” on strategic raw materials, according to a spokesperson. “Various instruments are possible, from long-term agreements to streaming deals and equity investments,” the person said. Hedging of commodities prices is likely an important tool to cope with rising raw material costs, according to the group’s CFO Arno Antlitz.

About $265.5 billion has been invested in developing EVs since 2018 but only $40 billion on raw materials, according to Battery Materials Review, which tracks investment in the sector.

Even so, some said moves by car manufacturers to buy directly into metals could be doomed by their lack of expertise in mining and dismal record on acquisitions, according to Jeff Currie, Goldman Sachs Group Inc.’s head of commodities.

“It always ends in tears,” he told Bloomberg Radio. “It requires an expertise that is very different than producing cars.”

(By Danny Lee, David Stringer and Jacob Lorinc, with assistance from Yvonne Yue Li, Monica Raymunt, Annie Lee, Mark Burton and Keith Naughton)

No comments:

Post a Comment