Reuters | April 25, 2023 |

The largest end-use for tin is soldering in semiconductors. Image courtesy of Pixabay.

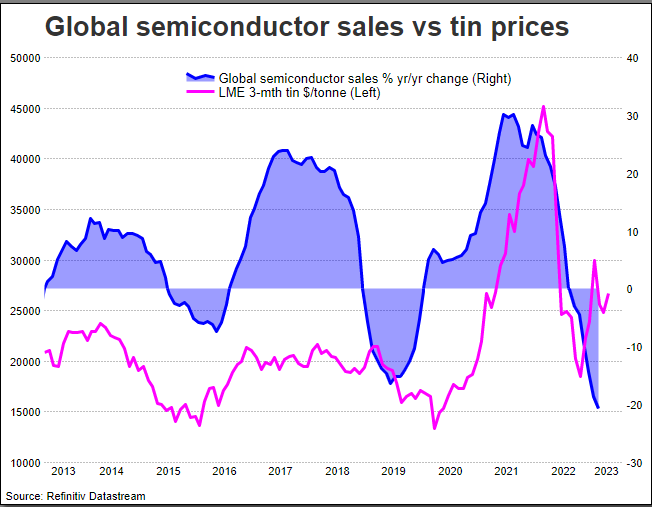

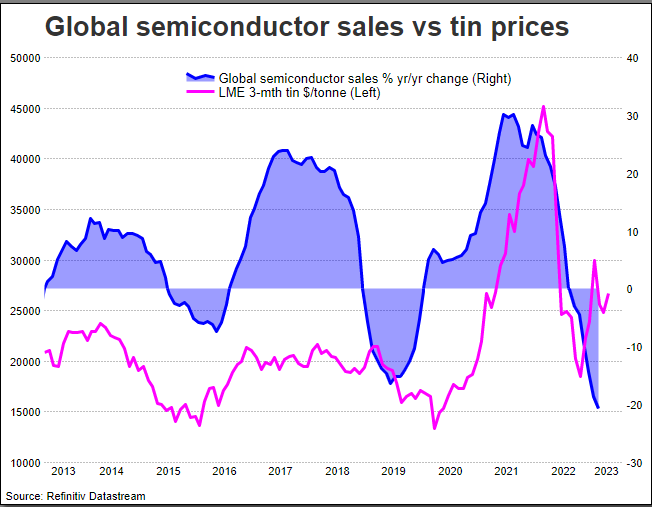

Plans by Myanmar’s Wa militia to suspend mining in areas it controls from August sent tin prices up 15% to 10-week highs, but a market surplus and high inventories are likely to offset the worst effects of a ban in the short-term.

Benchmark tin prices hit $28,440 a tonne on Tuesday last week, the highest since February 3. Prices of the soldering metal were last around $26,250.

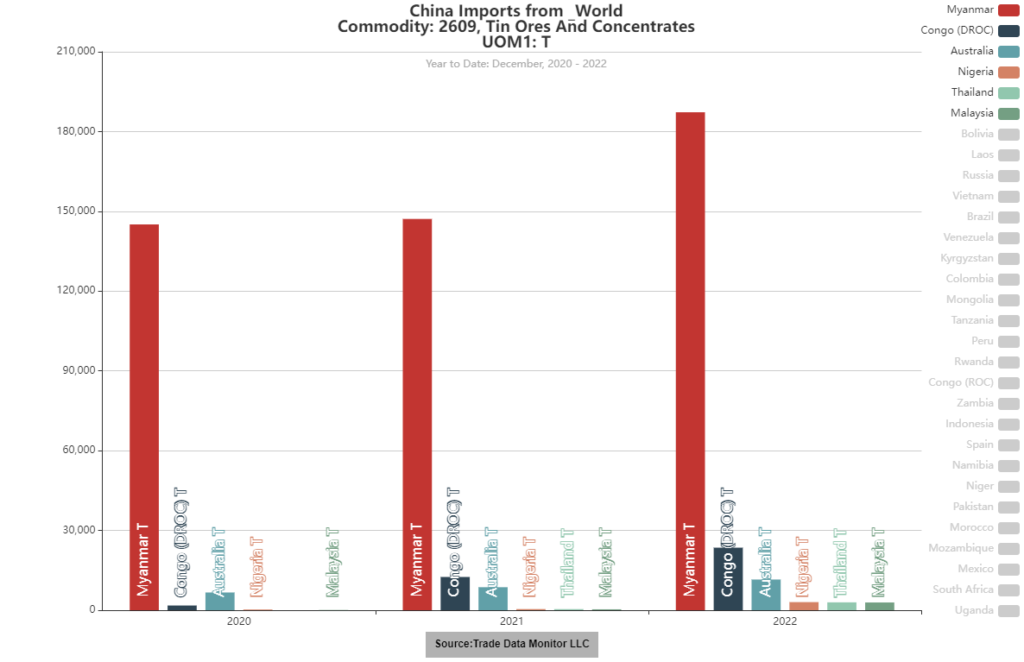

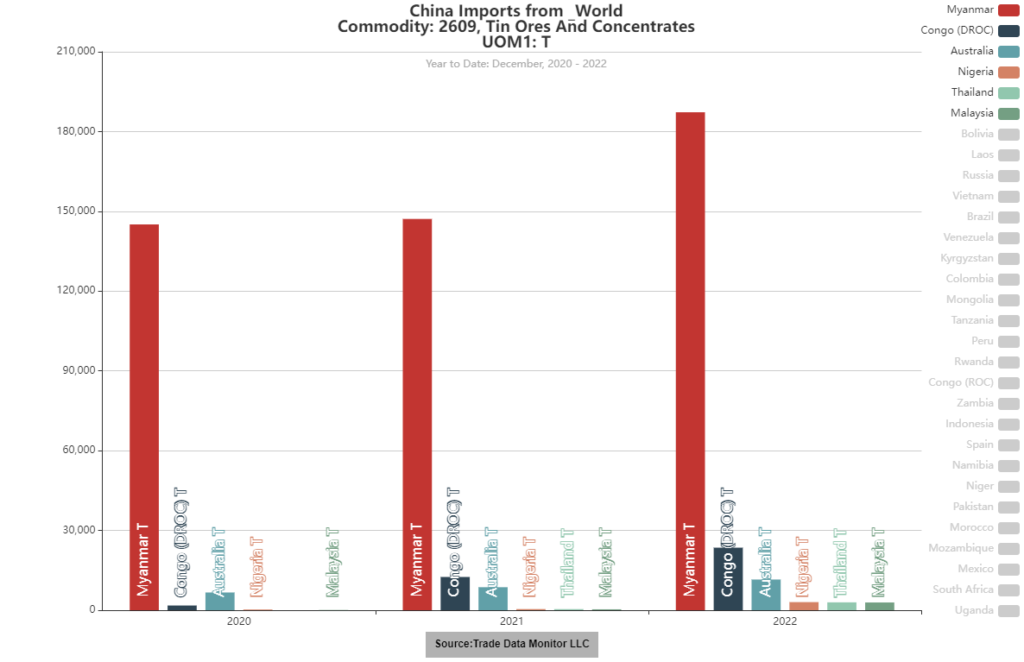

The International Tin Association (ITA) estimates Wa State represents about 10% of the world’s tin concentrate supply and that China accounted for about 47% or 181,000 tonnes of tin consumption last year of which 47,700 tonnes, or 26%, came from Myanmar.

“High visible refined tin inventories in China and likely tin concentrate stocks within Myanmar should dampen the impact of any short-term disruption to mining activities,” said Citi analyst Tom Mulqueen.

“We think market concern of major future disruption to Indonesian and/or Myanmar tin exports is excessive and believe a softening of fears will translate to weaker tin prices after the mid-April jump.”

Tin inventories in warehouses monitored by the Shanghai Futures Exchange at 8,150 tonnes are up 570% since September last year.

“All else equal, restrictions from August would quickly flip the market into deficit, but the extent and duration of volume losses (with potential for pre-stocking) remains uncertain,” Macquarie analysts said in a note.

Macquarie had expected a tin market surplus of 5,000 tonnes this year and global demand at 362,000 tonnes in March.

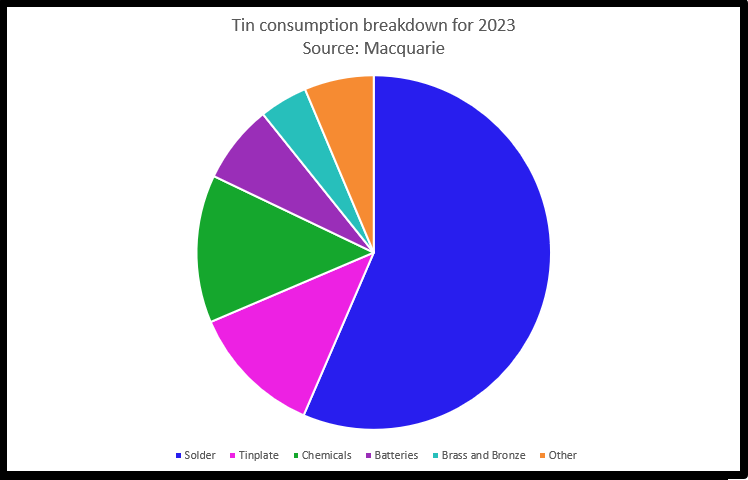

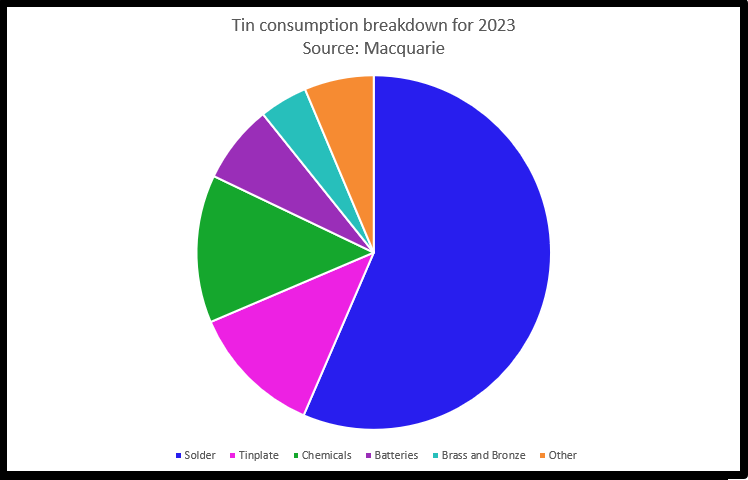

More than half of global tin supply is used as solder for circuit boards for the semiconductor industry, which is expected to consume less tin due to an economic slowdown and a brake on spending on consumer electronics.

“Stalled China demand and the likelihood of higher supplies from places like Peru and Congo mean the impact of any ban in Myanmar will be limited,” a metals-focused fund manager said.

In Peru, the San Rafael de Minsur tin mine, the world’s fourth largest, recently restarted operations after a roughly 10-week halt due to protests.

Alphamin Resources in the Democratic Republic of Congo produced 12,493 tonnes of tin last year, up 14% from 2021.

(By Pratima Desai; Editing by Sharon Singleton)

The largest end-use for tin is soldering in semiconductors. Image courtesy of Pixabay.

Plans by Myanmar’s Wa militia to suspend mining in areas it controls from August sent tin prices up 15% to 10-week highs, but a market surplus and high inventories are likely to offset the worst effects of a ban in the short-term.

Benchmark tin prices hit $28,440 a tonne on Tuesday last week, the highest since February 3. Prices of the soldering metal were last around $26,250.

The International Tin Association (ITA) estimates Wa State represents about 10% of the world’s tin concentrate supply and that China accounted for about 47% or 181,000 tonnes of tin consumption last year of which 47,700 tonnes, or 26%, came from Myanmar.

“High visible refined tin inventories in China and likely tin concentrate stocks within Myanmar should dampen the impact of any short-term disruption to mining activities,” said Citi analyst Tom Mulqueen.

“We think market concern of major future disruption to Indonesian and/or Myanmar tin exports is excessive and believe a softening of fears will translate to weaker tin prices after the mid-April jump.”

Tin inventories in warehouses monitored by the Shanghai Futures Exchange at 8,150 tonnes are up 570% since September last year.

“All else equal, restrictions from August would quickly flip the market into deficit, but the extent and duration of volume losses (with potential for pre-stocking) remains uncertain,” Macquarie analysts said in a note.

Macquarie had expected a tin market surplus of 5,000 tonnes this year and global demand at 362,000 tonnes in March.

More than half of global tin supply is used as solder for circuit boards for the semiconductor industry, which is expected to consume less tin due to an economic slowdown and a brake on spending on consumer electronics.

“Stalled China demand and the likelihood of higher supplies from places like Peru and Congo mean the impact of any ban in Myanmar will be limited,” a metals-focused fund manager said.

In Peru, the San Rafael de Minsur tin mine, the world’s fourth largest, recently restarted operations after a roughly 10-week halt due to protests.

Alphamin Resources in the Democratic Republic of Congo produced 12,493 tonnes of tin last year, up 14% from 2021.

(By Pratima Desai; Editing by Sharon Singleton)

No comments:

Post a Comment