Reuters | May 15, 2023

Image by Hans-Joachim Müller-le Plat from Pixabay

Rising demand from automakers, industry and investors will push the global platinum market into its biggest deficit in years, three industry reports predicted on Monday.

The reports underline an emerging change in fortunes for platinum and its sister metal palladium, both used chiefly in vehicle exhausts to neutralize harmful engine emissions

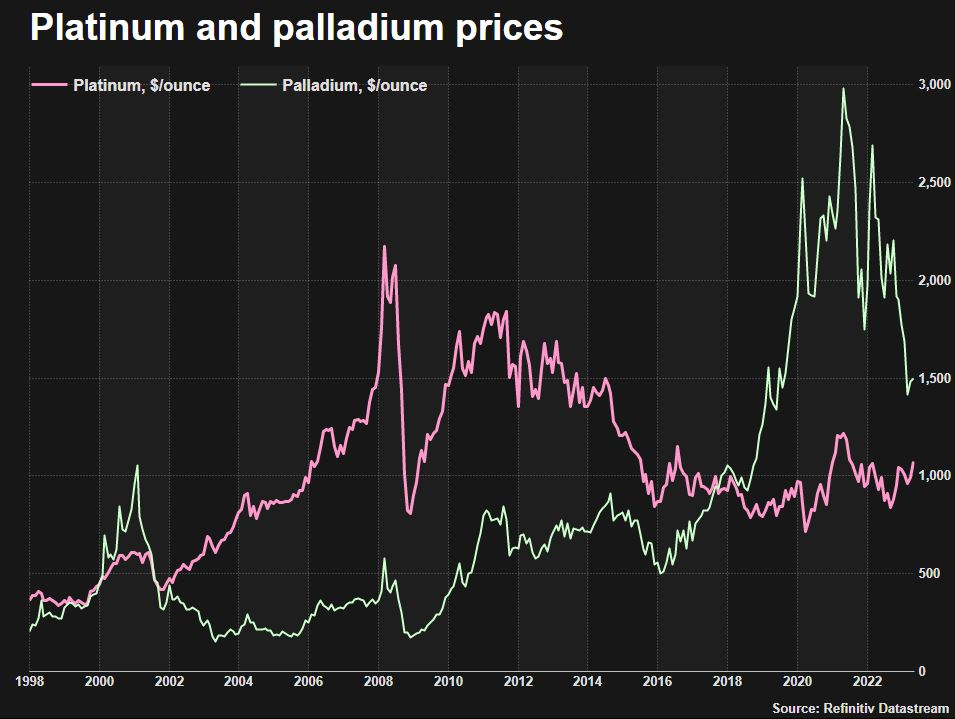

For years, rising demand and undersupply of palladium pushed prices higher, while lacklustre consumption and more plentiful availability kept platinum prices low.

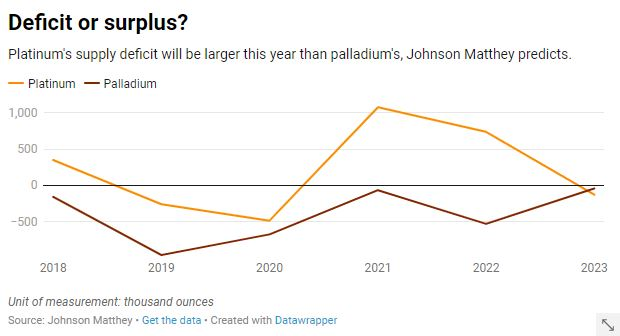

Two of Monday’s reports predicted that while palladium would remain in deficit this year, platinum’s undersupply would be bigger.

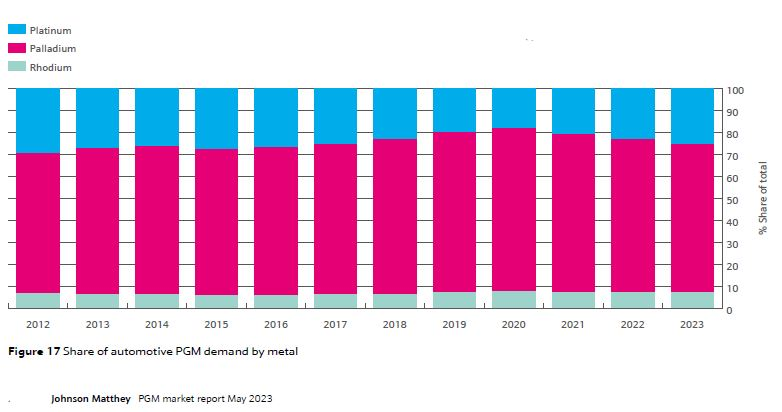

Automakers are now shifting from palladium to platinum to save money, production of platinum-intensive heavy-duty vehicles is rising, and exhaust-free electric vehicles are making inroads into the palladium-focused light vehicle market.

Also supporting platinum are consumption by industry and jewellers, while palladium demand depends almost entirely on autos.

Palladium prices have fallen sharply in recent months, while platinum prices show signs of recovery.

(Click here for an interactive chart of palladium prices)

Specialist materials maker Johnson Matthey said the roughly 8 million ounce a year platinum market would be undersupplied by 128,000 ounces this year, the first deficit since 2020 and a major shift from last year’s surplus of 740,000 ounces.

The World Platinum Investment Council predicted a 983,000-ounce platinum deficit – the biggest since at least 2014 – after last year’s surplus of 854,000 ounces.

Consultants Metals Focus forecast a 953,000-ounce platinum undersupply, up from just 53,000 ounces in 2022.

The forecasts use slightly different methodology, with Metals Focus excluding platinum bought or sold by exchange-traded funds.

JM also predicts a rise in supply of both platinum and palladium this year, which Metals Focus and the WPIC do not.

For the roughly 10 million ounce a year palladium market, JM predicted a deficit of 43,000 ounces this year, down from 531,000 ounces in 2022.

Metals Focus, however, foresees the deficit rising to 707,000 ounces from 547,000 ounces last year.

Following are numbers and comparisons from Johnson Matthey’s report

Platinum (thousands of ounces)

| 2022 | 2023 | % change | |

| SUPPLY | |||

| Primary supply (mined) | 5,530 | 5,808 | 5% |

| Secondary supply (recycled) | 1,468 | 1,521 | 4% |

| TOTAL SUPPLY | 6,998 | 7,329 | 5% |

| DEMAND | |||

| Automotive | 2,762 | 3,063 | 11% |

| Chemical | 699 | 697 | 0% |

| Dental & biomedical | 253 | 257 | 2% |

| Electrical & electronics | 235 | 266 | 13% |

| Glass | 594 | 565 | -5% |

| Investment | -565 | 283 | |

| Jewellery | 1,344 | 1,351 | 1% |

| Petroleum | 230 | 213 | -7% |

| Pollution control | 223 | 260 | 17% |

| Other | 483 | 502 | 4% |

| TOTAL DEMAND | 6,258 | 7,457 | 19% |

| Movement in stocks | 740 | -128 |

Palladium (thousands of ounces)

| 2022 | 2023 | % change | |

| SUPPLY | |||

| Primary supply (mined) | 6,307 | 6,556 | 4% |

| Secondary supply (recycled) | 3,099 | 3,234 | 4% |

| TOTAL SUPPLY | 9,406 | 9,790 | 4% |

| DEMAND | |||

| Automotive | 8,449 | 8,251 | -2% |

| Chemical | 589 | 534 | -9% |

| Dental & biomedical | 186 | 171 | -8% |

| Electrical & electronics | 544 | 545 | 0% |

| Investment | -109 | 25 | |

| Jewellery | 87 | 88 | 1% |

| Pollution control | 108 | 123 | 14% |

| Other | 83 | 96 | 16% |

| TOTAL DEMAND | 9,937 | 9,833 | -1% |

| Movement in stocks | -531 | -43 |

Rhodium (thousands of ounces)

| 2022 | 2023 | % change | |

| SUPPLY | |||

| Primary supply (mined) | 695 | 724 | 4% |

| Secondary supply (recycled) | 338 | 345 | 2% |

| TOTAL SUPPLY | 1033 | 1069 | 3% |

| DEMAND | |||

| Automotive | 953 | 947 | -1% |

| Chemical | 66 | 82 | 24% |

| Electrical & electronics | 5 | 6 | 20% |

| Glass | -41 | 5 | |

| Other | 15 | 15 | 0% |

| TOTAL DEMAND | 998 | 1055 | 6% |

| Movement in stocks | 35 | 14 |

(By Peter Hobson; Editing by Jan Harvey)

No comments:

Post a Comment