Bloomberg News | May 13, 2023 |

Nukem Technologies Engineering Services headquarters. (Image by Nukem, Flickr.)

Cutting the heart out of a nuclear power plant is a surgical procedure that only a few specialists are equipped to handle.

The process begins by launching plasma-torch-wielding robots into an empty pool surrounded by thick concrete walls. From there, the remote-controlled machines make circular cuts, as if slicing pineapple rings, through a 600-ton steel vessel that contains radiation generated over decades of splitting atoms. These rings are then diced into meter-long pieces and transported via secure convoy to radioactive waste repositories, where they are left to cool down — indefinitely.

Behind the scenes, scores of nuclear engineers, radiation safety experts and state regulators monitor this operation, which can cost upwards of a billion dollars and take years to plan and execute. The expertise needed to pull this off without error is why “there are only a handful of players” in the high-radiation decommissioning business, said Uniper SE’s Michael Baechler, who is supervising the dismantling of Sweden’s Barsebaeck Nuclear Power Plant.

Among the oldest and most experienced is Germany’s Nukem Technologies Engineering Services GmbH, which for decades has offered its unique services in Asia and Africa and across Europe. Nukem engineers helped contain radiation from the destroyed reactors in Chernobyl and Fukushima. They helped lead the clean-up of an atomic-fuel factory in Belgium. In France, the company devised ways to treat waste from the International Thermonuclear Experimental Reactor.

With researchers predicting that cleaning up after aging nuclear power plants will evolve into a $125 billion global business in the near future, Nukem should be ideally positioned to capitalize on the moment.

Except for one thing: the company is wholly owned by Rosatom Corp., the Kremlin-controlled nuclear giant, putting it in the center of an uncomfortable standoff.

While Germany has been vocal in urging EU countries to stop importing Rosatom’s nuclear fuel, a highly specialized commodity used for power plants, of which Rosatom is the world’s biggest exporter, authorities do not want to prevent Nukem from doing business in Germany, according to three government officials who asked not to be identified in return for discussing private deliberations. As sanctions have not been implemented, doing so would violate EU competition laws, they said.

Located in the rolling hills and orchards just east of Frankfurt, Nukem is a niche player in Rosatom’s global empire. At the same time, it exposes the fault line running through the EU’s approach to nuclear power.

Unlike Russia, which has cultivated expertise across all of the industrial processes needed to convert and enrich uranium atoms into forms usable for generating energy, Europe’s hodgepodge development of nuclear technologies has left states dependent on outside providers to fill gaps in production and services. Experts estimate it would take at least four or five years before the EU could match Rosatom’s fuel-manufacturing capacity, but even if that process were sped up, it would require more time still to replicate its global reach and array of services.

Pressure to cut Rosatom out of European supply chains has mounted since Russian forces seized Europe’s biggest nuclear power station outside the Ukrainian city of Zaporizhzhia and sent in Rosatom engineers to run it. The fact that it or Nukem, a subsidiary, haven’t been sanctioned, “should raise some serious questions,” said Darya Dolzikova, a researcher at the Royal United Services Institute.

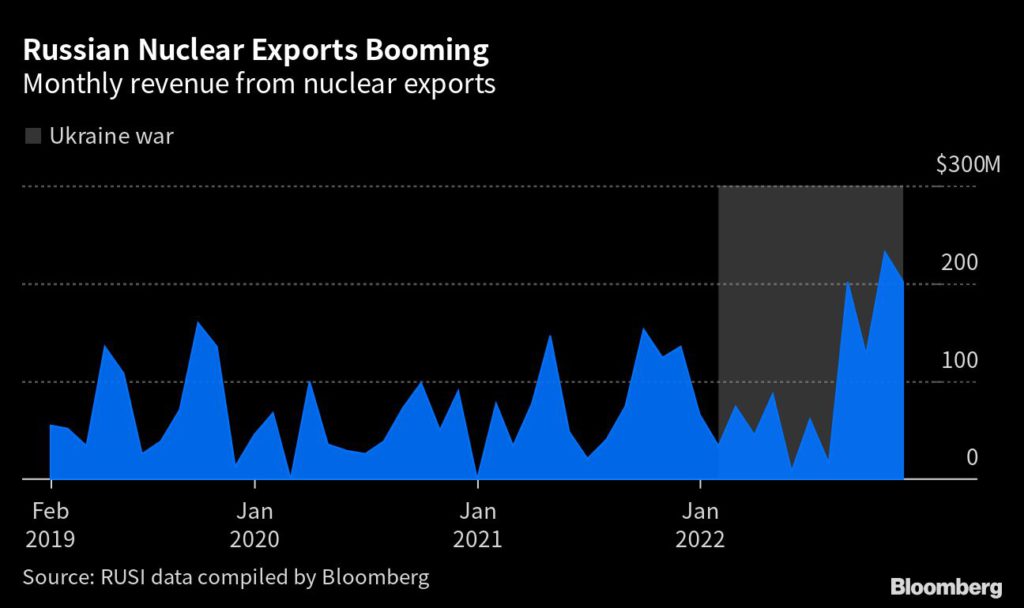

But more than a year later, it’s still up to individual companies to decide whether to continue doing business with the energy giant. So far, many are proceeding as usual: Rosatom saw exports surge more than 20% in the year after Russia invaded Ukraine.

Unlike Germany’s seizure of Russian storage and refining assets after the war, Nukem doesn’t have as much fixed infrastructure to go after. If sanctions were to be imposed, Rosatom might simply close shop or move Nukem’s headquarters to a friendlier jurisdiction.

This has left Nukem stuck in a strange kind of limbo, as customers interested in tapping its expertise are now faced with the choice of whether to work with a Kremlin-controlled company. Its experience is particularly valuable as its 120 mostly German engineers can work across the nuclear supply chain, a huge advantage in light of the fact that more young nuclear engineers study to build new installations than tear down existing ones. The International Atomic Energy Agency in Vienna has warned of an acute shortage of decommissioning workers.

“In Europe,” said Mark Hibbs, an analyst at the Carnegie Endowment for International Peace who has been tracking the company for more than three decades, “Nukem presides over a large pool of know-how.”

But even without sanctions, traditional markets such as Lithuania and Finland have stopped working with Nukem and Rosatom, respectively. Others, including the Czech Republic, Slovakia and Bulgaria are diversifying away from Russian suppliers. On a day-to-day level, it’s gotten trickier to do business since the Russian invasion, said Nukem chief executive officer Thomas Seipolt.

Money transfers take longer, as does securing the authorizations needed to ship technologies across borders, and some customers have been hesitant to sign contracts, he said. A consulting arrangement “was paused and then cancelled following the start of the Ukraine conflict,” said Boris Schucht, chief executive officer of the fuel consortium Urenco. Due to the political situation, Nukem’s Seipolt noted, “the further development of the company” has “become uncertain.”

To avoid continued decline, “the owner is trying to sell Nukem to a strategic investor by around the middle of the year,” Seipolt said. “We are already in talks with interested parties,” he added, without elaborating on how a buyer might skirt EU financial sanctions to take a stake in the company.

If that doesn’t happen, however, the company’s future may lie outside of Europe. While sanctions against Rosatom and Nukem could choke off the immediate supply of fuel and services within the EU bloc, they’d be harder to enforce in the company’s biggest growth markets. Rosatom is already building new nuclear plants in Bangladesh, China, Egypt in Turkey, with another dozen supply contracts under negotiation. Those deals potentially lock in cash flows and political clout for decades ahead.

For now at least, Nukem is finding some of its new projects further afield. At the Xudabao Nuclear Power Plant northeast of Beijing, Nukem specialists are currently designing a waste treatment center to accommodate the two new Rosatom reactors that will go online by 2028.

“We have already signed contracts,” Nukem announced last month. Next year, Rosatom’s German subsidiary will start shipping components to China.

(By Jonathan Tirone and Petra Sorge)

No comments:

Post a Comment