Cesium Wars: Why Are China and North America Fighting Over This Rare Metal?

Editor OilPrice.com

Tue, June 20, 2023

The Canadian mining sector is on a mission: To create the world’s most secure supply of critical minerals—without Chinese involvement.

Critical minerals represent one of the most pressing present and future national security issues for the Western world. The Canadian government should be cautious in accepting Chinese investment in its crucial mining sector while creating new opportunities and reducing future risk for investors.

The rarer the mineral is, the more critical to national security. Access to rare metals is essential to gaining technological superiority, which in turn dictates superpower status. It’s the East-West battle of the century, and the critical mineral Cesium (Cs) is a key element at the heart of it all.

Cesium is so critical that its value is in the realm of the priceless.

In 2018, when junior miner Power Metals Corp (TSXV:PWM,OTC: PWRMF) discovered high-grade cesium while exploring for lithium, North America must have breathed a sigh of relief. Cesium is central to the United States’ goal of winning the 5G race. It’s a lofty goal considering that there is no cesium currently being produced anywhere in the world at all.

Chinese investors pounced on the play, until the Canadian federal government stepped in to keep things in Western hands.

The Chinese have now been kicked out, and replaced with large Australian investors, significantly reducing risk related to national security issues and rising tensions between East and West as the end game for the control of crucial elements intensifies

This may put Power Metals and its all-Western investors in control of the only potential cesium mine that China doesn’t own.

This could be highly strategic to hindering China’s potential to weaponize critical minerals.

Case Lake: North America’s Critical Minerals Coup

The oil and gas industry is taking note, too. Cesium formate brines are used as a lubricant for high-pressure, high-temperature well drilling equipment in the North Sea—one of the West’s most important oil and gas venues, even more so in the wake of Russia’s invasion of Ukraine.

Cesium bromide is also used in infrared detectors, optics, photoelectrical cells, scintillation counters, and spectrometers. Critical use goes beyond this, as well, with cesium isotopes necessary for maintaining atomic resonance frequency standards in atomic clocks (think: aircraft guidance systems, global positioning satellites, and internet and cellular telephone transmissions).

5G technology is expected to rule the world because it can create a continuous, real-time connection for every single device that exists and every single device that will be made because of it. The new 5G cellular wireless tech will transfer data and the correct time faster than ever before--fast enough and accurately enough to transform industries. None of it can happen without cesium.

Meanwhile, China is forging ahead with its Huawei-led plans for 5G (and global) domination.

The national security applications are wide, varied and of the highest level of urgency.

This is the Pandora’s Box that Power Metals may have opened for North America, and it’s all happening at its Case Lake property, nestled amongst Canada’s well-established gold-mining camps in the prolific Abitibi Greenstone Belt.

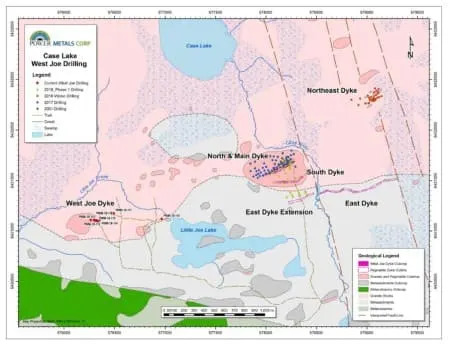

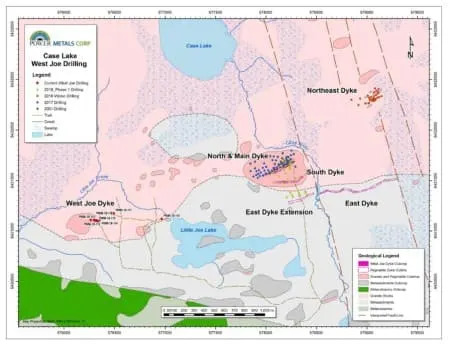

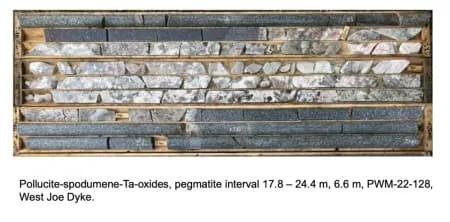

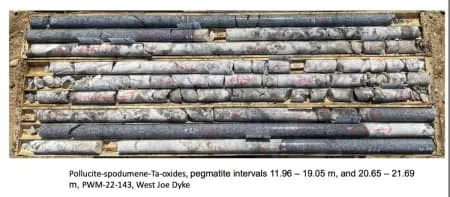

The first discovery came in August 2018, when Power Metals was drilling for lithium at Case Lake’s West Joe Dyke and intersected high-grade cesium mineralization in multiple drill holes.

That year, Power Metals (TSXV:PWM,OTC: PWRMF) drilled 18 holes at West Joe Dyke. Five drill holes intersected “exceptionally high-grade” lithium and tantalum (Li-Ta), and three holes delivered the cesium surprise.

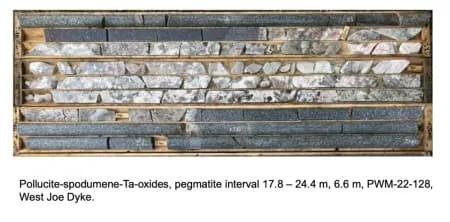

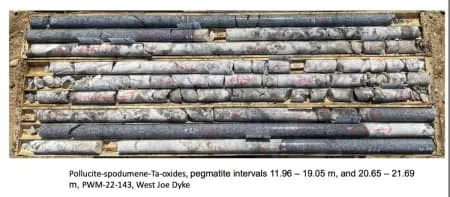

Fast forward to the summer of 2022, and Power Metals drilled another 36 holes, intersecting more high-grade lithium and cesium.

With three critical commodities on offer—lithium, cesium and tantalum—in our opinion, Case Lake is shaping up to be one of the most important mining venues to watch on the planet.

And those three commodities are found in pegmatite that is exposed on the surface, with a shallow depth of less than 50 meters—an arrangement that suits investors who are looking for miners that can reduce costs by not having to drill too deep.

It’s all along a massive, 10-kilometer mineralization trend that could turn up more discoveries as drilling continues.

The Australian Edge

Not only is Case Lake the first potential cesium mine not controlled by China, but it also looks like one of the most advantageous venues to explore and develop.

According to Power Metals, the venue houses high-grade cesium that is similar to Australia’s famous Sinclair Mine.

That could make the forced Chinese exit and their replacement with big Australian money and expertise one of the most propitious developments for investors on the critical mineral playing field.

And the Australian edge isn’t just about vital national security. It’s also about Australia’s cesium development expertise.

Australia's first commercial cesium mine, Sinclair, extracted its last cesium in 2019. And it’s one of only three in the world. The other two are the Tanco mine in Manitoba, Canada, and the Bikita mine in Zimbabwe. Tanco shut down after the mine collapsed in 2015, and Bitika was depleted in 2018.

That makes Power Metals’ Case Lake Property something to covet, globally. It’s also why Canada is adamant that China does not get its hands on what could end up being the only supply of cesium known, or left, in the world. It also has Washington’s full support as the U.S. backs any effort to overturn China’s dominance of critical mineral supply chains.

The smart Australian money we are referring to is Australia’s Winsome Resources (ASX:WR1) which jumped at the opportunity to replace Chinese investors when the Canadian government issued its eviction notice in November last year due to national security concerns. The involved Chinese company was mining giant Sinomine Resource Group a multi-billion market cap Beijing based giant. The new buyer, Winsome, bought their stake as soon as the Canadian government demanded the divesture. Not only did Winsome purchase Sinomine’s 5.7% stake in Power Metals, but they have also since increased their stake to 10.13 % in the past couple of months.

"While Canada continues to welcome foreign direct investment, we will act decisively when investments threaten our national security and our critical minerals supply chains, both at home and abroad," Industry Minister Francois-Philippe Champagne said in a November statement. With the takeover of Sinomine’s shares in Power Metals, Winsome also strategically acquired the Chinese company’s offtake rights for Case Lake’s prospective lithium, cesium and tantalum.

“The Case Lake Project is located in relatively close proximity to a number of our assets, in particular Mazerac and Decelles, with similar geological characteristics and strong drill results showing high-grade caesium, lithium and tantalum mineralization,” Winsome said in a statement. Winsome has soared with success in the past year on the Australian stock market after making a gigantic lithium discovery of their own in nearby Quebec over the past year.

“The minerals are all in high demand within North America and the rights to the offtake agreement are another positive step in the Winsome journey. We look forward to working with Power Metals to assist in developing this impressive project.”

Now, with what looks to be the only prospective cesium mine de-risked in terms of high-level national security, Power Metals (TSXV:PWM,OTC: PWRMF) is left to focus on fast-paced drilling and analysis of discoveries in what could be one of the most important mining venues of our time.

This junior miner is one to watch as it now finds itself at the heart of a battle for global dominance, while the U.S. and its Western allies make their biggest push yet to reduce reliance on China and establish alternative critical minerals supply chains.

Other companies to keep an eye on in the rare earth space:

Sociedad Quimica y Minera de Chile (NYSE:SQM): SQM is a prominent player in the lithium industry, and is poised for favorable growth prospects in the medium term as demand for lithium surges. The company has demonstrated solid profitability and cash flow generation in recent times. In the latest year, SQM achieved approximately $4.9 billion in free cash flow, and even under conservative assumptions, estimating free cash flow at $3 billion for 2023, the stock currently trades at a valuation of 7 times this year's free cash flow. When compared to other sectors in the stock market, where valuations often exceed 10 times free cash flow, SQM's valuation appears attractive, particularly considering the strong tailwinds propelling the lithium industry forward.

What sets SQM apart from many other lithium producers is its diversification. In addition to its lithium operations, the company derives significant earnings from its fertilizer, iodine, and potassium businesses. This diversification helps mitigate its exposure to the cyclical nature of the lithium market, providing a more balanced revenue stream. By having multiple revenue sources, SQM has built resilience into its business model, reducing the dependency on lithium prices alone.

Albemarle Corporation (NYSE: ALB): Few companies have profited as much from the electrification of transport as Albemarle, the world's largest lithium producer. Despite facing challenges from increased raw material costs and demand weakness in specialties, Albemarle is strategically positioned to capitalize on the long-term growth of the battery-grade lithium market.

During the first quarter of 2023, Albemarle witnessed higher volumes, supported by the La Negra III/IV expansion in Chile and an increase in tolling volumes. Furthermore, the company's cost-saving and productivity initiatives are expected to bolster its margins throughout 2023. To meet the growing demand for electric vehicles and lithium-ion batteries, Albemarle recently announced the location of its lithium mega-flex facility in South Carolina. With an initial investment of $1.3 billion or more, the facility aims to produce approximately 50,000 metric tons of battery-grade lithium hydroxide annually, with the potential to increase it to 100,000 metric tons. This capacity can support the production of about 2.4 million electric vehicles per year. The facility aligns with the Inflation Reduction Act and contributes to the localization of crucial minerals in North America. Additionally, the company is actively investing in projects in Western Australia and China to enhance its global lithium conversion capacity.

Tesla (NASDAQ:TSLA): Following a challenging year in 2022, Tesla is now on an upward trajectory. In the first quarter of 2023, the Model Y emerged as the top-selling vehicle globally, contributing to the company's stock price rebound. Tesla's CEO, Elon Musk, recently alluded to exciting developments on the horizon. While he didn't disclose specific new products during the annual shareholder meeting, Musk confirmed that two projects are in the works, generating anticipation among investors and enthusiasts alike. Surprisingly, Musk also announced a shift in Tesla's advertising strategy, expressing openness to exploring paid advertising, a departure from his previous stance against it.

While Tesla is not currently involved in lithium mining, it has made significant strides in securing its lithium supply chain. Tesla recently broke ground on a lithium refinery in Texas, marking a pivotal development for the company. According to Elon Musk, the facility has the potential to provide sufficient lithium for approximately 1 million electric vehicles (EVs) by 2025. With construction expected to be completed next year, Tesla aims to achieve full production capacity within a year thereafter. Specific details regarding the refinery's capacity are yet to be announced, highlighting the company's commitment to securing a sustainable and reliable lithium source for its EV production.

QuantumScape (NYSE: QS): QuantumScape is dedicated to the development of solid-state lithium-metal batteries for electric vehicles (EVs), presenting an intriguing opportunity accompanied by significant risk. The company's innovative battery technology has the potential to revolutionize the EV industry by enabling lighter, safer, and faster-charging batteries with longer life cycles. QuantumScape has achieved noteworthy progress, evidenced by promising testing results for its 24-layer cell prototype, demonstrating high-level fast charging and minimal capacity loss. Notably, the company has secured investments from major players such as Volkswagen and has garnered interest from other automotive companies. If QuantumScape successfully brings its products to market, it could experience explosive sales and earnings growth, leading to substantial returns for investors.

However, the company is still in the pre-revenue stage, relying on prototype technologies, and faces challenges in terms of reliability and commercialization. Its significant operating expenses and the need for substantial capital expenditures underscore the financial uncertainties it confronts. Furthermore, QuantumScape is not the sole player in the potentially revolutionary battery technologies sector, as competitors like CATL, Toyota, Samsung, and others present potential challenges. Scaling up manufacturing could prove costly and encounter unforeseen obstacles. Undoubtedly an exciting company in the space, but not without associated risks.

Lithium Americas Corp (NYSE:LAC, TSX:LAC): As a pre-production lithium miner, Lithium Americas Corp is poised for significant growth with promising projects on the horizon. While still awaiting production and facing the inherent uncertainties of such a stage, LAC presents an intriguing investment opportunity. The recent decline in lithium prices, coupled with the trend toward increased self-sufficiency and support for the US mining industry, makes LAC an attractive option at current levels.

LAC's flagship projects, Cauchari-Olaroz in Argentina and Thacker Pass in Nevada, USA, hold tremendous potential. The Cauchari-Olaroz project, a joint venture with Ganfeng Lithium, is expected to commence lithium carbonate production of 40 ktpa by early 2024. With a 45% interest in the project, LAC stands to benefit significantly from an estimated 18,000 tons of production next year, translating to approximately $520 million in revenues at current market prices. Meanwhile, LAC's Thacker Pass project, set to become the largest lithium mine in the United States, promises substantial production growth beyond 2024, reinforcing the company's long-term prospects.

As the global demand for electric vehicles continues to rise steadily, the anticipated rebound in lithium prices and the potential benefits of the IRA for US miners further strengthen LAC's position.

Patriot Battery Metals (TSXV: PMET) Patriot Battery Metals, an exploration and development company, has been making significant strides in advancing its Corvette lithium property located in Quebec's James Bay region. The company's commitment to exploration is evident through its ongoing winter 2023 drill program, which aims to extend the CV5 lithium pegmatite at the Corvette site.

With an impressive year-to-date gain of nearly 200%, Patriot's success can be attributed to its remarkable achievements, including reporting the highest-grade lithium intercept at the CV5 pegmatite and extending the pegmatite by at least 3.7 kilometers. The positive news, combined with strategic appointments, equity incentive plans, and successful drill campaigns, has generated upward momentum for Patriot's share price. Supported by a recent C$50 million flow-through raising, the company is well-positioned to continue its growth trajectory, with plans to release an initial resource estimate for CV5 in the near future.

Sigma Lithium (TSX.V:SGML) Sigma Lithium has made significant progress in the global lithium market with the commencement of lithium spodumene production at its Grota do Cirilo mine in Minas Gerais, Brazil, in April 2023. The company aims to become one of the world's largest lithium producers, with plans to scale up production to approximately 104 kilotons per annum (ktpa) of lithium carbonate equivalent (LCE) by 2025. This strategic move not only positions Sigma Lithium as a key player in the industry but also gives it a higher lithium production to market cap ratio than many of its competitors. The company's commitment to sustainability is evident in its greentech dense media separation production plant, which enables vertical integration and boasts environmentally friendly features such as 100% dry-stacked tailings, clean energy, recycled water, and zero hazardous chemicals.

Sigma Lithium's progress has been marked by important milestones, including the receipt of an environmental operating license for Grota do Cirilo from COPAM, the Minas Gerais state environmental regulator. This license grants Sigma Lithium the authority to sell all of its lithium from current and future operations. The company achieved first production at 75% of nameplate throughput capacity in April and prepared its first shipment of green lithium to take place. With a planned shipment of 15,000 MT, Sigma Lithium has commenced the process of transporting its lithium to port, with full production expected to be reached by July 2023.

Allkem (TSX:AKE): The recent merger between Allkem and Livent has caused significant disruption in the lithium industry, creating the world's third-largest vertically-integrated lithium producer and reshaping the industry landscape. The combined entity brings together a highly diversified asset portfolio, generating economies of scale and operational synergies. With an estimated EBITDA of approximately $1.5 billion and potential cost efficiencies of $125 million per year, the newly formed company is poised for significant growth.

Already a strong company, the merger mitigates execution risks by combining the expertise of Galaxy Resources in hard-rock lithium mining with Livent's experience in brine lithium extraction. While short-term risks such as lithium price volatility and foreign currency fluctuations persist, the merger positions the company favorably to capitalize on opportunities in the lithium market. As the lithium industry consolidates and battery manufacturers and automakers seek resilient supply chains, the merger between Allkem and Livent is likely a sign of things to come in the industry.

Standard Lithium (SLI TSX.V): Vancouver-based Standard Lithium is a near-commercial development company focused on lithium extraction, utilizing its proprietary technology. The company is actively advancing its Lanxess Project and South West Arkansas (SWA) Project, both located in Arkansas near the Louisiana border. Additionally, Standard Lithium holds well and drilling rights in the Smackover Foundation in East Texas.

The company is currently in the final stages of completing a Definitive Feasibility Study (DFS) and a Front-End Engineering Design (FEED) study for its Lanxess Project, with expected completion by the end of the second quarter. The company has the option to seek a partner for up to 49 percent of the project if LANXESS AG chooses not to acquire the equity stake. Furthermore, the ongoing Pre-Feasibility Study (PFS) for the SWA Project is also on track for completion by the end of the current quarter, showing impressive lithium grades from recent brine samples and anticipated low operating costs.

By. Tom Kool

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the Canadian mining sector will continue to protect its supply of critical minerals without involvement of China; that cesium and other metals will remain as critical minerals will continue as a national security issue for Western countries; that access to rare metals, and in particular cesium, will be essential to gaining technical superiority; that cesium and other rare earth metals will continue to be a critical for use in various technologies, including the 5G cellular and wireless technologies; that cesium will continue to be a critical mineral and considered as matter of national security for Western countries; that Power Metals Corp. (the “Company”) and its all-Western investors will be in control of the only cesium mine that China does not own; that the Company’s properties will be able to commercially produce cesium, lithium, tantalum and other critical minerals; that the Company will be able to finance and operationally establish mines on its properties to viably and commercially extract the critical minerals; that Australian shareholders and investors in the Company will provide development and other expertise to assist the Company; that Winsome Resources will continue to own a significant stake in the Company; that the Company’s property will one day have one of the only potential mines producing cesium; that the Company can finance ongoing operations and development; that the Company can achieve its business plans and objectives as anticipated. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include the development of alternative technologies that do not require the use of metals and resources currently considered as critical; that other resources are utilized in future in favour of rare earth metals such as cesium; that alternative technologies utilize other resources or that cesium, lithium, and tantalum are not utilized; that other companies discover resources of cesium and other battery metals that are more favorable or more easily developed into commercial production that the Company’s property; that the Company’s properties are unable to produce commercial amounts of cesium, lithium, tantalum or other critical metals; that the Company will be unable to finance or operationally establish mines on its properties for commercial extraction of any critical minerals; that the Company’s Australian investors will not be able to provide development and other expertise to meaningful assist the Company; that Winsome Resources may for various reasons divest its stake in the Company in future; that the Company’s properties may fail to develop mines producing cesium; that the Company may be unable to finance its ongoing operations and development; that the business of the Company may be unsuccessful for various reasons. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by Power Metals Corp. but may in the future be compensated to conduct investor awareness advertising and marketing for Power Metals Corp. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct. The content of this article is based solely on our opinions which are based on very limited analysis.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of Power Metals Corp. and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we are biased in our views and opinions in this article and why we stress that you should conduct your own extensive due diligence regarding the Company as well as seek the advice of your professional financial advisor or a registered broker-dealer before you consider investing in any securities.

NOT AN INVESTMENT ADVISOR. Oilprice.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment in any securities.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.

Editor OilPrice.com

Tue, June 20, 2023

The Canadian mining sector is on a mission: To create the world’s most secure supply of critical minerals—without Chinese involvement.

Critical minerals represent one of the most pressing present and future national security issues for the Western world. The Canadian government should be cautious in accepting Chinese investment in its crucial mining sector while creating new opportunities and reducing future risk for investors.

The rarer the mineral is, the more critical to national security. Access to rare metals is essential to gaining technological superiority, which in turn dictates superpower status. It’s the East-West battle of the century, and the critical mineral Cesium (Cs) is a key element at the heart of it all.

Cesium is so critical that its value is in the realm of the priceless.

In 2018, when junior miner Power Metals Corp (TSXV:PWM,OTC: PWRMF) discovered high-grade cesium while exploring for lithium, North America must have breathed a sigh of relief. Cesium is central to the United States’ goal of winning the 5G race. It’s a lofty goal considering that there is no cesium currently being produced anywhere in the world at all.

Chinese investors pounced on the play, until the Canadian federal government stepped in to keep things in Western hands.

The Chinese have now been kicked out, and replaced with large Australian investors, significantly reducing risk related to national security issues and rising tensions between East and West as the end game for the control of crucial elements intensifies

This may put Power Metals and its all-Western investors in control of the only potential cesium mine that China doesn’t own.

This could be highly strategic to hindering China’s potential to weaponize critical minerals.

Case Lake: North America’s Critical Minerals Coup

The oil and gas industry is taking note, too. Cesium formate brines are used as a lubricant for high-pressure, high-temperature well drilling equipment in the North Sea—one of the West’s most important oil and gas venues, even more so in the wake of Russia’s invasion of Ukraine.

Cesium bromide is also used in infrared detectors, optics, photoelectrical cells, scintillation counters, and spectrometers. Critical use goes beyond this, as well, with cesium isotopes necessary for maintaining atomic resonance frequency standards in atomic clocks (think: aircraft guidance systems, global positioning satellites, and internet and cellular telephone transmissions).

5G technology is expected to rule the world because it can create a continuous, real-time connection for every single device that exists and every single device that will be made because of it. The new 5G cellular wireless tech will transfer data and the correct time faster than ever before--fast enough and accurately enough to transform industries. None of it can happen without cesium.

Meanwhile, China is forging ahead with its Huawei-led plans for 5G (and global) domination.

The national security applications are wide, varied and of the highest level of urgency.

This is the Pandora’s Box that Power Metals may have opened for North America, and it’s all happening at its Case Lake property, nestled amongst Canada’s well-established gold-mining camps in the prolific Abitibi Greenstone Belt.

The first discovery came in August 2018, when Power Metals was drilling for lithium at Case Lake’s West Joe Dyke and intersected high-grade cesium mineralization in multiple drill holes.

That year, Power Metals (TSXV:PWM,OTC: PWRMF) drilled 18 holes at West Joe Dyke. Five drill holes intersected “exceptionally high-grade” lithium and tantalum (Li-Ta), and three holes delivered the cesium surprise.

Fast forward to the summer of 2022, and Power Metals drilled another 36 holes, intersecting more high-grade lithium and cesium.

With three critical commodities on offer—lithium, cesium and tantalum—in our opinion, Case Lake is shaping up to be one of the most important mining venues to watch on the planet.

And those three commodities are found in pegmatite that is exposed on the surface, with a shallow depth of less than 50 meters—an arrangement that suits investors who are looking for miners that can reduce costs by not having to drill too deep.

It’s all along a massive, 10-kilometer mineralization trend that could turn up more discoveries as drilling continues.

The Australian Edge

Not only is Case Lake the first potential cesium mine not controlled by China, but it also looks like one of the most advantageous venues to explore and develop.

According to Power Metals, the venue houses high-grade cesium that is similar to Australia’s famous Sinclair Mine.

That could make the forced Chinese exit and their replacement with big Australian money and expertise one of the most propitious developments for investors on the critical mineral playing field.

And the Australian edge isn’t just about vital national security. It’s also about Australia’s cesium development expertise.

Australia's first commercial cesium mine, Sinclair, extracted its last cesium in 2019. And it’s one of only three in the world. The other two are the Tanco mine in Manitoba, Canada, and the Bikita mine in Zimbabwe. Tanco shut down after the mine collapsed in 2015, and Bitika was depleted in 2018.

That makes Power Metals’ Case Lake Property something to covet, globally. It’s also why Canada is adamant that China does not get its hands on what could end up being the only supply of cesium known, or left, in the world. It also has Washington’s full support as the U.S. backs any effort to overturn China’s dominance of critical mineral supply chains.

The smart Australian money we are referring to is Australia’s Winsome Resources (ASX:WR1) which jumped at the opportunity to replace Chinese investors when the Canadian government issued its eviction notice in November last year due to national security concerns. The involved Chinese company was mining giant Sinomine Resource Group a multi-billion market cap Beijing based giant. The new buyer, Winsome, bought their stake as soon as the Canadian government demanded the divesture. Not only did Winsome purchase Sinomine’s 5.7% stake in Power Metals, but they have also since increased their stake to 10.13 % in the past couple of months.

"While Canada continues to welcome foreign direct investment, we will act decisively when investments threaten our national security and our critical minerals supply chains, both at home and abroad," Industry Minister Francois-Philippe Champagne said in a November statement. With the takeover of Sinomine’s shares in Power Metals, Winsome also strategically acquired the Chinese company’s offtake rights for Case Lake’s prospective lithium, cesium and tantalum.

“The Case Lake Project is located in relatively close proximity to a number of our assets, in particular Mazerac and Decelles, with similar geological characteristics and strong drill results showing high-grade caesium, lithium and tantalum mineralization,” Winsome said in a statement. Winsome has soared with success in the past year on the Australian stock market after making a gigantic lithium discovery of their own in nearby Quebec over the past year.

“The minerals are all in high demand within North America and the rights to the offtake agreement are another positive step in the Winsome journey. We look forward to working with Power Metals to assist in developing this impressive project.”

Now, with what looks to be the only prospective cesium mine de-risked in terms of high-level national security, Power Metals (TSXV:PWM,OTC: PWRMF) is left to focus on fast-paced drilling and analysis of discoveries in what could be one of the most important mining venues of our time.

This junior miner is one to watch as it now finds itself at the heart of a battle for global dominance, while the U.S. and its Western allies make their biggest push yet to reduce reliance on China and establish alternative critical minerals supply chains.

Other companies to keep an eye on in the rare earth space:

Sociedad Quimica y Minera de Chile (NYSE:SQM): SQM is a prominent player in the lithium industry, and is poised for favorable growth prospects in the medium term as demand for lithium surges. The company has demonstrated solid profitability and cash flow generation in recent times. In the latest year, SQM achieved approximately $4.9 billion in free cash flow, and even under conservative assumptions, estimating free cash flow at $3 billion for 2023, the stock currently trades at a valuation of 7 times this year's free cash flow. When compared to other sectors in the stock market, where valuations often exceed 10 times free cash flow, SQM's valuation appears attractive, particularly considering the strong tailwinds propelling the lithium industry forward.

What sets SQM apart from many other lithium producers is its diversification. In addition to its lithium operations, the company derives significant earnings from its fertilizer, iodine, and potassium businesses. This diversification helps mitigate its exposure to the cyclical nature of the lithium market, providing a more balanced revenue stream. By having multiple revenue sources, SQM has built resilience into its business model, reducing the dependency on lithium prices alone.

Albemarle Corporation (NYSE: ALB): Few companies have profited as much from the electrification of transport as Albemarle, the world's largest lithium producer. Despite facing challenges from increased raw material costs and demand weakness in specialties, Albemarle is strategically positioned to capitalize on the long-term growth of the battery-grade lithium market.

During the first quarter of 2023, Albemarle witnessed higher volumes, supported by the La Negra III/IV expansion in Chile and an increase in tolling volumes. Furthermore, the company's cost-saving and productivity initiatives are expected to bolster its margins throughout 2023. To meet the growing demand for electric vehicles and lithium-ion batteries, Albemarle recently announced the location of its lithium mega-flex facility in South Carolina. With an initial investment of $1.3 billion or more, the facility aims to produce approximately 50,000 metric tons of battery-grade lithium hydroxide annually, with the potential to increase it to 100,000 metric tons. This capacity can support the production of about 2.4 million electric vehicles per year. The facility aligns with the Inflation Reduction Act and contributes to the localization of crucial minerals in North America. Additionally, the company is actively investing in projects in Western Australia and China to enhance its global lithium conversion capacity.

Tesla (NASDAQ:TSLA): Following a challenging year in 2022, Tesla is now on an upward trajectory. In the first quarter of 2023, the Model Y emerged as the top-selling vehicle globally, contributing to the company's stock price rebound. Tesla's CEO, Elon Musk, recently alluded to exciting developments on the horizon. While he didn't disclose specific new products during the annual shareholder meeting, Musk confirmed that two projects are in the works, generating anticipation among investors and enthusiasts alike. Surprisingly, Musk also announced a shift in Tesla's advertising strategy, expressing openness to exploring paid advertising, a departure from his previous stance against it.

While Tesla is not currently involved in lithium mining, it has made significant strides in securing its lithium supply chain. Tesla recently broke ground on a lithium refinery in Texas, marking a pivotal development for the company. According to Elon Musk, the facility has the potential to provide sufficient lithium for approximately 1 million electric vehicles (EVs) by 2025. With construction expected to be completed next year, Tesla aims to achieve full production capacity within a year thereafter. Specific details regarding the refinery's capacity are yet to be announced, highlighting the company's commitment to securing a sustainable and reliable lithium source for its EV production.

QuantumScape (NYSE: QS): QuantumScape is dedicated to the development of solid-state lithium-metal batteries for electric vehicles (EVs), presenting an intriguing opportunity accompanied by significant risk. The company's innovative battery technology has the potential to revolutionize the EV industry by enabling lighter, safer, and faster-charging batteries with longer life cycles. QuantumScape has achieved noteworthy progress, evidenced by promising testing results for its 24-layer cell prototype, demonstrating high-level fast charging and minimal capacity loss. Notably, the company has secured investments from major players such as Volkswagen and has garnered interest from other automotive companies. If QuantumScape successfully brings its products to market, it could experience explosive sales and earnings growth, leading to substantial returns for investors.

However, the company is still in the pre-revenue stage, relying on prototype technologies, and faces challenges in terms of reliability and commercialization. Its significant operating expenses and the need for substantial capital expenditures underscore the financial uncertainties it confronts. Furthermore, QuantumScape is not the sole player in the potentially revolutionary battery technologies sector, as competitors like CATL, Toyota, Samsung, and others present potential challenges. Scaling up manufacturing could prove costly and encounter unforeseen obstacles. Undoubtedly an exciting company in the space, but not without associated risks.

Lithium Americas Corp (NYSE:LAC, TSX:LAC): As a pre-production lithium miner, Lithium Americas Corp is poised for significant growth with promising projects on the horizon. While still awaiting production and facing the inherent uncertainties of such a stage, LAC presents an intriguing investment opportunity. The recent decline in lithium prices, coupled with the trend toward increased self-sufficiency and support for the US mining industry, makes LAC an attractive option at current levels.

LAC's flagship projects, Cauchari-Olaroz in Argentina and Thacker Pass in Nevada, USA, hold tremendous potential. The Cauchari-Olaroz project, a joint venture with Ganfeng Lithium, is expected to commence lithium carbonate production of 40 ktpa by early 2024. With a 45% interest in the project, LAC stands to benefit significantly from an estimated 18,000 tons of production next year, translating to approximately $520 million in revenues at current market prices. Meanwhile, LAC's Thacker Pass project, set to become the largest lithium mine in the United States, promises substantial production growth beyond 2024, reinforcing the company's long-term prospects.

As the global demand for electric vehicles continues to rise steadily, the anticipated rebound in lithium prices and the potential benefits of the IRA for US miners further strengthen LAC's position.

Patriot Battery Metals (TSXV: PMET) Patriot Battery Metals, an exploration and development company, has been making significant strides in advancing its Corvette lithium property located in Quebec's James Bay region. The company's commitment to exploration is evident through its ongoing winter 2023 drill program, which aims to extend the CV5 lithium pegmatite at the Corvette site.

With an impressive year-to-date gain of nearly 200%, Patriot's success can be attributed to its remarkable achievements, including reporting the highest-grade lithium intercept at the CV5 pegmatite and extending the pegmatite by at least 3.7 kilometers. The positive news, combined with strategic appointments, equity incentive plans, and successful drill campaigns, has generated upward momentum for Patriot's share price. Supported by a recent C$50 million flow-through raising, the company is well-positioned to continue its growth trajectory, with plans to release an initial resource estimate for CV5 in the near future.

Sigma Lithium (TSX.V:SGML) Sigma Lithium has made significant progress in the global lithium market with the commencement of lithium spodumene production at its Grota do Cirilo mine in Minas Gerais, Brazil, in April 2023. The company aims to become one of the world's largest lithium producers, with plans to scale up production to approximately 104 kilotons per annum (ktpa) of lithium carbonate equivalent (LCE) by 2025. This strategic move not only positions Sigma Lithium as a key player in the industry but also gives it a higher lithium production to market cap ratio than many of its competitors. The company's commitment to sustainability is evident in its greentech dense media separation production plant, which enables vertical integration and boasts environmentally friendly features such as 100% dry-stacked tailings, clean energy, recycled water, and zero hazardous chemicals.

Sigma Lithium's progress has been marked by important milestones, including the receipt of an environmental operating license for Grota do Cirilo from COPAM, the Minas Gerais state environmental regulator. This license grants Sigma Lithium the authority to sell all of its lithium from current and future operations. The company achieved first production at 75% of nameplate throughput capacity in April and prepared its first shipment of green lithium to take place. With a planned shipment of 15,000 MT, Sigma Lithium has commenced the process of transporting its lithium to port, with full production expected to be reached by July 2023.

Allkem (TSX:AKE): The recent merger between Allkem and Livent has caused significant disruption in the lithium industry, creating the world's third-largest vertically-integrated lithium producer and reshaping the industry landscape. The combined entity brings together a highly diversified asset portfolio, generating economies of scale and operational synergies. With an estimated EBITDA of approximately $1.5 billion and potential cost efficiencies of $125 million per year, the newly formed company is poised for significant growth.

Already a strong company, the merger mitigates execution risks by combining the expertise of Galaxy Resources in hard-rock lithium mining with Livent's experience in brine lithium extraction. While short-term risks such as lithium price volatility and foreign currency fluctuations persist, the merger positions the company favorably to capitalize on opportunities in the lithium market. As the lithium industry consolidates and battery manufacturers and automakers seek resilient supply chains, the merger between Allkem and Livent is likely a sign of things to come in the industry.

Standard Lithium (SLI TSX.V): Vancouver-based Standard Lithium is a near-commercial development company focused on lithium extraction, utilizing its proprietary technology. The company is actively advancing its Lanxess Project and South West Arkansas (SWA) Project, both located in Arkansas near the Louisiana border. Additionally, Standard Lithium holds well and drilling rights in the Smackover Foundation in East Texas.

The company is currently in the final stages of completing a Definitive Feasibility Study (DFS) and a Front-End Engineering Design (FEED) study for its Lanxess Project, with expected completion by the end of the second quarter. The company has the option to seek a partner for up to 49 percent of the project if LANXESS AG chooses not to acquire the equity stake. Furthermore, the ongoing Pre-Feasibility Study (PFS) for the SWA Project is also on track for completion by the end of the current quarter, showing impressive lithium grades from recent brine samples and anticipated low operating costs.

By. Tom Kool

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the Canadian mining sector will continue to protect its supply of critical minerals without involvement of China; that cesium and other metals will remain as critical minerals will continue as a national security issue for Western countries; that access to rare metals, and in particular cesium, will be essential to gaining technical superiority; that cesium and other rare earth metals will continue to be a critical for use in various technologies, including the 5G cellular and wireless technologies; that cesium will continue to be a critical mineral and considered as matter of national security for Western countries; that Power Metals Corp. (the “Company”) and its all-Western investors will be in control of the only cesium mine that China does not own; that the Company’s properties will be able to commercially produce cesium, lithium, tantalum and other critical minerals; that the Company will be able to finance and operationally establish mines on its properties to viably and commercially extract the critical minerals; that Australian shareholders and investors in the Company will provide development and other expertise to assist the Company; that Winsome Resources will continue to own a significant stake in the Company; that the Company’s property will one day have one of the only potential mines producing cesium; that the Company can finance ongoing operations and development; that the Company can achieve its business plans and objectives as anticipated. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include the development of alternative technologies that do not require the use of metals and resources currently considered as critical; that other resources are utilized in future in favour of rare earth metals such as cesium; that alternative technologies utilize other resources or that cesium, lithium, and tantalum are not utilized; that other companies discover resources of cesium and other battery metals that are more favorable or more easily developed into commercial production that the Company’s property; that the Company’s properties are unable to produce commercial amounts of cesium, lithium, tantalum or other critical metals; that the Company will be unable to finance or operationally establish mines on its properties for commercial extraction of any critical minerals; that the Company’s Australian investors will not be able to provide development and other expertise to meaningful assist the Company; that Winsome Resources may for various reasons divest its stake in the Company in future; that the Company’s properties may fail to develop mines producing cesium; that the Company may be unable to finance its ongoing operations and development; that the business of the Company may be unsuccessful for various reasons. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by Power Metals Corp. but may in the future be compensated to conduct investor awareness advertising and marketing for Power Metals Corp. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct. The content of this article is based solely on our opinions which are based on very limited analysis.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of Power Metals Corp. and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we are biased in our views and opinions in this article and why we stress that you should conduct your own extensive due diligence regarding the Company as well as seek the advice of your professional financial advisor or a registered broker-dealer before you consider investing in any securities.

NOT AN INVESTMENT ADVISOR. Oilprice.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment in any securities.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.

No comments:

Post a Comment