Frik Els | June 8, 2023 |

Copper demand coming in waves now. Stock image.

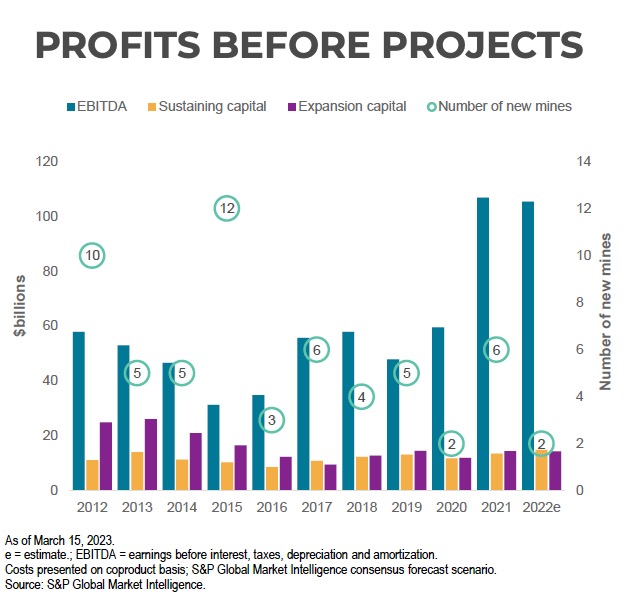

A recent presentation by S&P Global Market Intelligence mining and metals team featured a couple of graphs that crystalize the fundamental challenges facing copper mine supply.

Mitzi Sumangil, associate analyst at the US-based research firm, presented a graph showing the yawning gap between copper mining companies’ profits and capital spending.

Despite two consecutive years of bumper topline earnings north of $100 billion, expansion budgets haven’t budged, hovering in the early double digit billions. Barely more than 12% of ebitda, versus a long term average of more than double that.

Expansion capital is also focused on brownfield projects, with the number of new mines over the last four years adding up to 15 compared to 32 over the same period a decade ago when profits were below $60 and on a clear downward trend.

In 2015, when copper mining profits barely reached above $30 billion across the industry 12 mines went into production thanks to robust spending in the years preceding the bottom of the cycle.

Sumangil says miners have become more conservative when it comes to investing in new projects and the trend continues to hold true:

“Companies have been recently focusing on extending the life of mines, especially of those high-grade ones and already profitable projects because, let’s be honest, it takes a lot of time to develop something new and it takes a lot of administrative effort.”

On the last point, Sumangil showed another graph detailing the lead time from discovery to production for the average copper mine. Which is 16.2 years. Stumble upon a turquoise outcropping today and you’ll start seeing the money roll in in 2040.

Sumangil says even when accounting for concentrate capacity from uncommitted projects raw copper will still fall short of demand in scarcely two years:

“This is a very ominous broader view of copper supply, and we expect it to be only worsened by stunted major discoveries, tight copper exploration budgets and of course, time-consuming exploration work.”

As a result, S&P Global believes despite fairly substantial estimated surpluses for the next three years, the copper price will hold up well through 2026 before scaling $10,000 a tonne again in 2027 when market deficits begin to appear.

No comments:

Post a Comment